|

市场调查报告书

商品编码

1766166

包装与捆扎机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Wrapping and Bundling Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

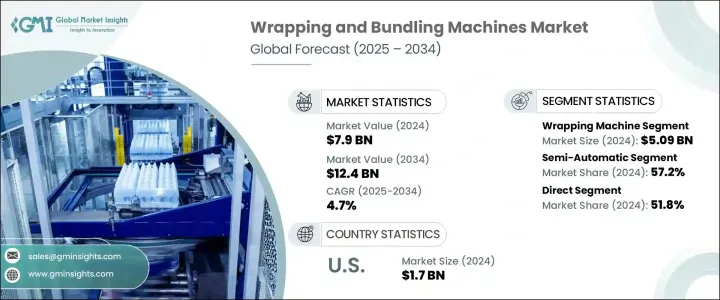

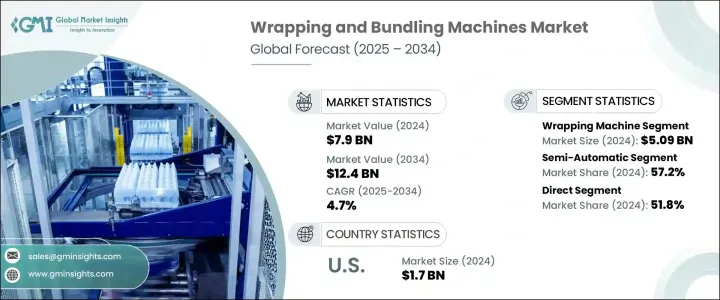

2024 年全球包装和捆扎机市场价值为 79 亿美元,预计到 2034 年将以 4.7% 的复合年增长率增长至 124 亿美元。各行各业对自动化的日益重视是推动该市场成长的主要动力之一。随着企业致力于提高营运效率、减少人力并确保包装一致性,对这些机器的需求持续成长。高产量产业越来越依赖自动化系统来简化营运、降低错误率并优化长期成本。这些机器不仅加快了包装过程,而且还最大限度地减少了停机时间,同时解决了劳动力短缺和工资压力问题。随着劳动力挑战的加剧以及对精简、无错误包装的需求,自动化成为维持生产力的关键策略。

现代包装和捆扎系统也整合了感测器、数据驱动监控以及与企业级软体相容等智慧技术。这些功能透过即时维护警报、精准控制和分析驱动的营运来提高效率。这种技术的应用正从已开发市场蔓延到发展中市场,这些市场的製造业升级与国家成长议程相符。随着製造商应对不断变化的合规性和卫生法规,先进的包装设备日益被视为一项策略性投资,以实现长期韧性和成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 79亿美元 |

| 预测值 | 124亿美元 |

| 复合年增长率 | 4.7% |

2024年,包装机市场规模达50.9亿美元,预计2025年至2034年的复合年增长率将达到5.4%。包装系统凭藉其灵活性、广泛的应用范围和易于自动化的特点,其受欢迎程度远远超过捆扎设备。这些机器对于维护产品状态至关重要,尤其对于运输过程中容易变质或损坏的物品。从小型设备到大型製造工厂,包装解决方案能够适应各种形状、尺寸和包装膜的产品,适用于各种生产环境。其可扩展性和适应性是支撑其市场主导地位的关键因素。

半自动机器占了57.2%的市场份额,预计到2034年将以5.8%的复合年增长率成长。这个细分市场吸引了那些寻求经济高效、可靠地从手动流程转型的企业。这些机器在经济实惠、功能强大和易用性之间实现了完美平衡。它们所需的资本投入更少,操作员培训也更少,同时比手动系统具有更高的一致性。由于半自动机器能够适应不断变化的产品线和中小批量生产,因此常用于处理多种包装形式的企业。它们在自动化需求适中的行业中广泛应用,使其成为迈向全面自动化的重要桥樑。

美国包装和捆扎机市场规模预计在2024年达到17亿美元,预计2025年至2034年的复合年增长率为6.1%。该地区的成长得益于包装作业向高效自动化系统的转变。随着企业寻求营运现代化,美国製造商正在投资升级的高速设备,以满足安全法规和智慧製造原则的要求。美国先进的基础设施和数位技术的整合进一步巩固了其在全球市场的领导地位。

塑造这一市场的顶尖公司包括利乐拉伐集团 (Tetra Laval Group)、阿德尔菲集团 (Adelphi Group)、罗博帕克 (Robopac)、星德科科技 (Syntegon Technology)、石田 (Ishida)、伍尔夫泰克国际 (Wulftec International)、大森机械 (Omori Machine)、克朗斯 (Kignron) 工业集团Group)、Coesia、Lantech、Multivac、Optima 包装集团 (Optima Packaging Group)、nVenia 和 Nichrome 包装解决方案 (Nichrome Packaging Solutions)。为了巩固市场地位,製造商正专注于技术创新和智慧自动化。他们正在开发具有物联网功能、模组化设计以及与数位工厂系统相容的机器,以提升客户价值。许多公司正在实现本地化生产,以降低供应链风险并改善服务交付。产品多样化和针对特定行业的客製化解决方案也在推动长期合作伙伴关係的建立。策略性併购正在帮助企业扩大地域覆盖范围和产品组合。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 包装自动化需求不断成长

- 电子商务和物流的成长

- 食品饮料和製药业的成长

- 永续性和环保包装趋势

- 技术进步

- 产业陷阱与挑战

- 初期投资高

- 维护复杂且停机风险

- 机会

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 透过机器

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 贸易统计(HS编码842240)

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- Industry structure and concentration

- Competitive intensity assessment

- 公司市占率分析

- 竞争定位矩阵

- 产品定位

- 性价比定位

- 地理分布

- 创新能力

- 战略仪表板

- Competitive benchmarking

- Strategic initiatives assessment

- SWOT analysis of key players

- 未来竞争前景

第五章:市场估计与预测:按机器类型,2021 - 2034 年

- 主要趋势

- 包装机

- 拉伸包装

- 收缩包装

- 其他机器

- 捆扎机

- 收缩捆扎机

- 薄膜捆扎机

- 捆扎机

- 袖套捆扎机

第六章:市场估计与预测:依营运模式,2021 年至 2034 年

- 主要趋势

- 自动的

- 半自动

第七章:市场估计与预测:依资料,2021 - 2034 年

- 主要趋势

- 塑胶薄膜

- 可生物降解薄膜

- 纸质包装

- 瓦楞纸板

第八章:市场估计与预测:依包装类型,2021 - 2034 年

- 主要趋势

- 初级包装

- 二次包装

- 三级包装

第九章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 食品和饮料

- 製药

- 个人护理和化妆品

- 消费性电子产品

- 纺织品

- 物流与仓储

- 化学品

- 工业品

- 其他的

第 10 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直接的

- 间接

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十二章:公司简介

- Adelphi Group

- Coesia

- Ishida

- Krones

- Lantech

- Multivac

- Nichrome Packaging Solutions

- nVenia

- Omori Machinery

- Optima Packaging Group

- Robopac

- Signode Industrial Group

- Syntegon Technology

- Tetra Laval Group

- Wulftec International

The Global Wrapping and Bundling Machines Market was valued at USD 7.9 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 12.4 billion by 2034. The rising focus on automation across various industries is one of the major drivers behind this market growth. As companies aim to boost operational efficiency, cut back on manual labor, and ensure packaging consistency, demand for these machines continues to grow. Industries dealing with high production volumes increasingly rely on automated systems to streamline operations, reduce error rates, and optimize long-term costs. These machines not only speed up the packaging process but also minimize downtime while addressing workforce shortages and wage pressures. With rising labor challenges and the need for streamlined, error-free packaging, automation becomes a key strategy for sustained productivity.

Modern wrapping and bundling systems are also integrating intelligent technologies such as sensors, data-driven monitoring, and compatibility with enterprise-level software. These features improve efficiency through real-time maintenance alerts, precision control, and analytics-driven operations. Adoption is spreading from developed to developing markets, where manufacturing upgrades are aligning with national growth agendas. As manufacturers deal with evolving compliance and hygiene regulations, advanced packaging equipment is increasingly seen as a strategic investment for long-term resilience and growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.9 Billion |

| Forecast Value | $12.4 Billion |

| CAGR | 4.7% |

The wrapping machine segment generated USD 5.09 billion in 2024 and is anticipated to grow at a CAGR of 5.4% from 2025 to 2034. Wrapping systems are outperforming bundling units in popularity due to their flexibility, broad application range, and ease of automation. These machines are essential for maintaining product condition, especially for items prone to spoilage or damage during transport. From small setups to large manufacturing plants, wrapping solutions can accommodate diverse product shapes, sizes, and packaging films, making them suitable for a wide array of production environments. Their scalability and adaptability are key factors supporting their market dominance.

The semi-automatic machines segment held a 57.2% share and are projected to grow at a CAGR of 5.8% through 2034. This segment appeals to businesses looking for a cost-effective, reliable transition from manual processes. These machines strike a perfect balance between affordability, functionality, and ease of use. They require less capital investment and minimal operator training while offering improved consistency over manual systems. Because of their adaptability to changing product lines and small-to-medium batch sizes, semi-automatic machines are commonly used in companies handling multiple packaging formats. Their widespread use in sectors with moderate automation needs makes them a vital bridge toward full automation adoption.

United States Wrapping and Bundling Machines Market with USD 1.7 billion in 2024 and is projected to grow at a CAGR of 6.1% from 2025 to 2034. Growth in this region is fueled by the shift toward high-efficiency automated systems across packaging operations. As businesses look to modernize operations, U.S.-based manufacturers are investing in upgraded, high-speed equipment aligned with safety regulations and smart manufacturing principles. The country's advanced infrastructure and integration of digital technologies further enhance its leadership position in the global landscape.

Top companies shaping this market include Tetra Laval Group, Adelphi Group, Robopac, Syntegon Technology, Ishida, Wulftec International, Omori Machinery, Krones, Signode Industrial Group, Coesia, Lantech, Multivac, Optima Packaging Group, nVenia, and Nichrome Packaging Solutions. To strengthen their market position, manufacturers are focusing on technological innovation and smart automation. They are developing machines with IoT capabilities, modular designs, and compatibility with digital factory systems to increase customer value. Many firms are localizing production to reduce supply chain risks and improve service delivery. Product diversification and customized solutions for specific industries are also driving long-term partnerships. Strategic mergers and acquisitions are helping companies expand their geographic reach and portfolio offerings.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Machine

- 2.2.3 Mode of operation

- 2.2.4 Material

- 2.2.5 Packaging type

- 2.2.6 End use industry

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for automation in packaging

- 3.2.1.2 Growth in e-commerce and logistics

- 3.2.1.3 Food & beverage and pharma industry growth

- 3.2.1.4 Sustainability and eco-friendly packaging trends

- 3.2.1.5 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment

- 3.2.2.2 Complex maintenance and downtime risk

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Machine

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code 842240)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.1.1 Industry structure and concentration

- 4.1.2 Competitive intensity assessment

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.3.1 Product positioning

- 4.3.2 Price-performance positioning

- 4.3.3 Geographic presence

- 4.3.4 Innovation capabilities

- 4.4 Strategic dashboard

- 4.4.1 Competitive benchmarking

- 4.4.1.1 Manufacturing capabilities

- 4.4.1.2 Product portfolio strength

- 4.4.1.3 Distribution network

- 4.4.1.4 R&D investments

- 4.4.2 Strategic initiatives assessment

- 4.4.3 SWOT analysis of key players

- 4.4.1 Competitive benchmarking

- 4.5 Future competitive outlook

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021 - 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Wrapping machine

- 5.2.1 Stretch wrapping

- 5.2.2 Shrink wrapping

- 5.2.3 Other machines

- 5.3 Bundling machine

- 5.3.1 Shrink bundling machines

- 5.3.2 Film bundling machines

- 5.3.3 Strap bundling machines

- 5.3.4 Sleeve bundling machines

Chapter 6 Market Estimates & Forecast, By Mode of operation, 2021 - 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Automatic

- 6.3 Semi-automatic

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Plastic films

- 7.3 Biodegradable films

- 7.4 Paper-based wraps

- 7.5 Corrugated cardboard

Chapter 8 Market Estimates & Forecast, By Packaging Type, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Primary packaging

- 8.3 Secondary packaging

- 8.4 Tertiary packaging

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Food & beverage

- 9.3 Pharmaceuticals

- 9.4 Personal care & cosmetics

- 9.5 Consumer electronics

- 9.6 Textiles

- 9.7 Logistics & warehousing

- 9.8 Chemicals

- 9.9 Industrial goods

- 9.10 Others

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Adelphi Group

- 12.2 Coesia

- 12.3 Ishida

- 12.4 Krones

- 12.5 Lantech

- 12.6 Multivac

- 12.7 Nichrome Packaging Solutions

- 12.8 nVenia

- 12.9 Omori Machinery

- 12.10 Optima Packaging Group

- 12.11 Robopac

- 12.12 Signode Industrial Group

- 12.13 Syntegon Technology

- 12.14 Tetra Laval Group

- 12.15 Wulftec International