|

市场调查报告书

商品编码

1766169

神经导管、神经包覆及神经移植修復产品市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Nerve Conduit, Nerve Wrap, and Nerve Graft Repair Product Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

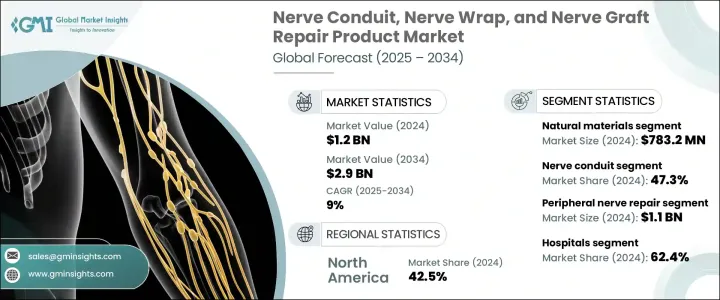

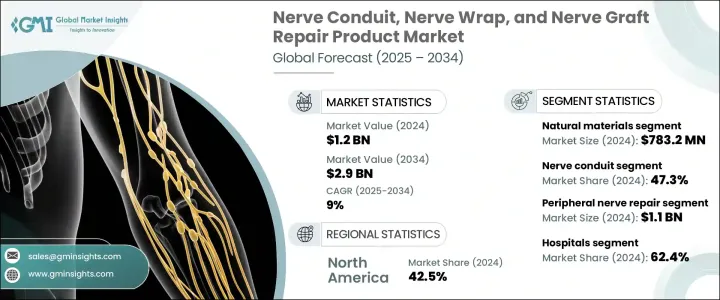

2024年,全球神经导管、神经包覆和神经移植修復产品市场价值为12亿美元,预计2034年将以9%的复合年增长率成长,达到29亿美元。推动此市场发展的因素包括:週边神经损伤病例的增加、生物材料的进步、对神经保留方案日益增长的偏好,以及对神经修復医疗器材的监管支持。由于事故、创伤、手术和人口老化等因素,发生在大脑和脊髓以外的周边神经损伤病例正在增加。这些损伤通常影响上肢,并且常常导致运动或感觉功能丧失、疼痛以及长期的社会心理影响。

道路交通事故、工伤、运动相关事故以及穿透性创伤的发生率日益上升,显着增加了对涉及神经导管、神经绷带和神经移植的外科手术的需求。这些损伤通常会导致周边神经大面积损伤,尤其是在四肢,由于神经缺口的大小或位置,直接缝合变得非常困难。在这种情况下,神经修復产品(例如神经导管、神经绷带和神经移植)是恢復功能和促进神经再生的重要解决方案。道路交通事故已成为週边神经损伤的主要原因,因为撞击力通常会导致关键神经通路受到严重损伤。同样,工伤,包括在工厂或建筑工地等高风险环境中的工伤,仍然是神经损伤的主要原因,尤其是在体力劳动者中。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 12亿美元 |

| 预测值 | 29亿美元 |

| 复合年增长率 | 9% |

2024年,神经导管领域占最大份额,达47.3%。神经导管因其易于使用且能够修復小至中等程度的神经缺损,在临床应用上备受青睐。这些装置提供了一种创伤较小、无张力的替代自体移植的方法,而自体移植更为复杂,且常常导致供体部位出现併发症。神经导管作为引导轴突穿过神经缺损的通道,确保神经正常再生。神经导管的应用日益广泛,尤其是在用于修復那些因缺损过小而无法进行移植的神经缺损时,这显着推动了市场扩张。

2024年,天然材料细分市场收入达7.832亿美元,这得益于其与生物系统卓越的兼容性以及增强组织整合的能力。这些材料在促进最佳神经再生方面发挥关键作用,因为它们与人体的自然结构高度相似,比合成材料更能促进癒合。胶原蛋白、去细胞细胞外基质 (ECM) 和经过处理的人体同种异体移植物等天然材料因其能够为轴突生长创造有利的微环境而受到青睐。

2024年,美国神经导管、神经包扎和神经移植修復产品市场规模达4.611亿美元,主要得益于创伤护理、整形重建手术、骨科手术以及道路交通事故导致的神经损伤高发生率。 FDA批准的神经移植、导管和神经包扎产品的普及,加上神经修復的优惠报销政策,推动了这些产品在全美各地医院和门诊的普及。

神经导管、神经包覆和神经移植修復产品市场的领先公司包括 Axogen、Axolotl Biologix、BioCircuit Technologies、Checkpoint Surgical、Collagen Matrix、Cook Group、Integra LifeSciences、KeriMedical、Medovent、Newrotex、Orthocell、Polyganics、Skerces、KeriMedical、Medovent、Newrotex、Orthocell、Polyganics、Skertry Corporation、Synovis 和 Tooboy's。为了巩固市场地位,神经导管、神经包裹和神经移植修復领域的公司正致力于扩大产品供应,并开发创新解决方案,以满足週边神经损伤患者不断变化的需求。许多公司正在投资研发,以改善神经修復产品的功能和性能,重点是增强组织整合和神经再生的生物材料。此外,与医院和医疗保健提供者的策略合作伙伴关係以及与学术机构的合作正在帮助公司提升其技术能力和临床知识。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 週边神经损伤发生率上升

- 生物材料的进展

- 临床越来越倾向于选择保留神经的替代方案

- 支持性监管批准

- 产业陷阱与挑战

- 产品成本高

- 缺乏长期疗效的临床证据

- 市场机会

- 下一代生物工程移植物的成长

- 癌症切除和牙科手术的增加

- 成长动力

- 成长潜力分析

- 专利分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 定价分析

- 依产品类型

- 按地区

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 神经导管

- 神经包裹

- 神经移植

第六章:市场估计与预测:按材料,2021 - 2034 年

- 主要趋势

- 天然材质

- 合成材料

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 週边神经修復

- 牙科应用

- 中枢神经修復

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 学术研究机构

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Axogen

- Axolotl Biologix

- BioCircuit Technologies

- Checkpoint Surgical

- Collagen Matrix

- Cook Group

- Integra LifeSciences

- KeriMedical

- Medovent

- Newrotex

- Orthocell

- Polyganics

- Stryker Corporation

- Synovis

- Toyobo

The Global Nerve Conduit, Nerve Wrap, and Nerve Graft Repair Product Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 9% to reach USD 2.9 billion by 2034. This market is driven by a growing number of peripheral nerve injuries, advances in biomaterials, an increasing preference for nerve-sparing solutions, and regulatory support for medical devices used in nerve repair. Peripheral nerve injuries, which occur outside of the brain and spinal cord, are on the rise due to factors such as accidents, trauma, surgeries, and an aging population. These injuries commonly affect the upper limbs and often lead to loss of motor or sensory function, pain, and long-term psychosocial impacts.

The growing frequency of road traffic accidents, workplace injuries, sports-related accidents, and penetrating trauma has significantly amplified the demand for surgical interventions involving nerve conduits, wraps, and grafts. These injuries often result in extensive damage to peripheral nerves, particularly in the limbs, where direct suturing becomes challenging due to the size or location of the nerve gap. In such cases, nerve repair products like conduits, wraps, and grafts offer an essential solution for restoring functionality and promoting nerve regeneration. Road traffic accidents have become a major contributor to peripheral nerve injuries, as the force of impact often leads to severe trauma in critical nerve pathways. Similarly, workplace injuries, including those in high-risk environments such as factories or construction sites, continue to be a leading cause of nerve damage, especially among manual laborers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.9 Billion |

| CAGR | 9% |

The nerve conduit segment held the largest share of 47.3% in 2024. Conduits are favored in clinical settings for their ease of use and ability to repair small to moderate nerve gaps. These devices provide a less invasive, tension-free alternative to autografts, which are more complex and often lead to complications at the donor site. Nerve conduits serve as channels that guide axons through nerve gaps, ensuring proper nerve regeneration. The growing adoption of conduits, especially for nerve gaps that are too small for grafts, has significantly driven market expansion.

The natural materials segment generated USD 783.2 million in 2024, driven by their superior compatibility with biological systems and their ability to enhance tissue integration. These materials play a critical role in facilitating optimal nerve regeneration, as they closely mimic the body's natural structure, promoting more effective healing than synthetic alternatives. Natural materials like collagen, decellularized extracellular matrices (ECM), and processed human allografts are preferred for their ability to create a conducive microenvironment for axonal growth.

U.S. Nerve Conduit, Nerve Wrap, and Nerve Graft Repair Product Market was valued at USD 461.1 million in 2024, driven by the high incidence of nerve injuries resulting from trauma care, plastic and reconstructive surgeries, orthopedic procedures, and road traffic accidents. The availability of FDA-approved nerve grafts, conduits, and wraps, coupled with favorable reimbursement policies for nerve repair, has helped drive the adoption of these products in hospitals and outpatient clinics across the country.

Leading companies in the Nerve Conduit, Nerve Wrap, and Nerve Graft Repair Product Market include Axogen, Axolotl Biologix, BioCircuit Technologies, Checkpoint Surgical, Collagen Matrix, Cook Group, Integra LifeSciences, KeriMedical, Medovent, Newrotex, Orthocell, Polyganics, Stryker Corporation, Synovis, and Toyobo. To strengthen their market position, companies in the nerve conduit, nerve wrap, and nerve graft repair sectors are focusing on expanding their product offerings and developing innovative solutions that cater to the evolving needs of patients with peripheral nerve injuries. Many companies are investing in research and development to improve the functionality and performance of nerve repair products, with an emphasis on biomaterials that enhance tissue integration and nerve regeneration. Additionally, strategic partnerships with hospitals and healthcare providers, along with collaborations with academic institutions, are helping companies advance their technological capabilities and clinical knowledge.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Treatment

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of peripheral nerve injuries

- 3.2.1.2 Advancements in biomaterials

- 3.2.1.3 Growing clinical preference for nerve-sparing alternatives

- 3.2.1.4 Supportive regulatory approvals

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of product

- 3.2.2.2 Lack of clinical evidence for long term outcomes

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in next-generation bioengineered grafts

- 3.2.3.2 Rise in post-cancer resection and dental surgery

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Technology and innovation landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Pricing analysis

- 3.7.1 By Product type

- 3.7.2 By Region

- 3.8 Future market trends

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Nerve conduit

- 5.3 Nerve wrap

- 5.4 Nerve grafts

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Natural materials

- 6.3 Synthetic materials

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Peripheral nerve repair

- 7.3 Dental applications

- 7.4 Central nerve repair

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Academic research institutions

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Axogen

- 10.2 Axolotl Biologix

- 10.3 BioCircuit Technologies

- 10.4 Checkpoint Surgical

- 10.5 Collagen Matrix

- 10.6 Cook Group

- 10.7 Integra LifeSciences

- 10.8 KeriMedical

- 10.9 Medovent

- 10.10 Newrotex

- 10.11 Orthocell

- 10.12 Polyganics

- 10.13 Stryker Corporation

- 10.14 Synovis

- 10.15 Toyobo