|

市场调查报告书

商品编码

1766188

生物活性玻璃市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Bioactive Glass Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

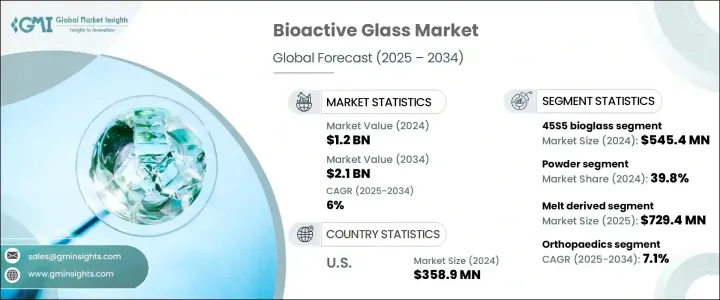

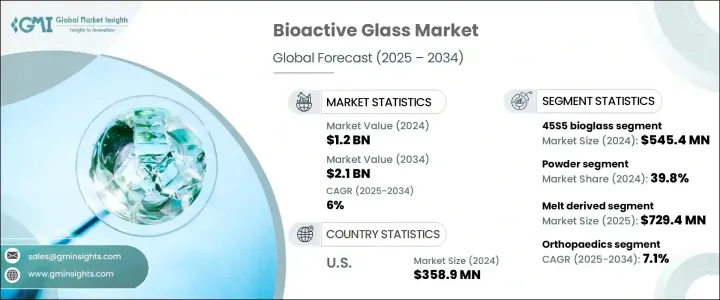

2024年,全球生物活性玻璃市场价值为12亿美元,预计到2034年将以6%的复合年增长率成长,达到21亿美元。这一增长主要得益于该材料独特的再生特性,尤其是在生物医学领域,生物活性玻璃与生物组织能够产生积极的相互作用。与传统的惰性材料不同,生物活性玻璃能够促进软组织和骨骼的主动再生,并具有成骨、血管生成和抗菌等优势。这些特性使其成为广泛临床应用中的关键材料。在骨科领域,生物活性玻璃因其能够刺激骨骼生长和整合,越来越多地应用于骨移植、脊椎融合和创伤修復。

在牙科领域,它被用于填充物、植入物和牙周治疗。此外,它在再生医学、药物传输系统和组织工程中的作用也不断扩大。溶胶-凝胶合成、熔融衍生技术和积层製造等新製造方法的发展,使得能够生产具有可客製化孔隙率、降解速率和离子释放曲线的客製化生物活性玻璃,从而进一步增强了其在医疗应用中的用途。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 12亿美元 |

| 预测值 | 21亿美元 |

| 复合年增长率 | 6% |

2024年,S53P4(BonAlive)生物活性玻璃板块的市值为3.871亿美元,预计到2034年将成长至7.281亿美元。 S53P4以其抗骨质疏鬆和骨骼刺激特性而闻名,使其在治疗骨感染和慢性骨髓炎方面非常有效。这种生物活性玻璃成分即使在存在细菌感染的情况下也能促进骨形成,常用于骨科手术,尤其是在感染风险较高的手术中。欧洲和北美对生物活性玻璃的日益普及促进了该板块的增长,尤其是作为骨骼替代品和抗菌剂。

预计到2034年,熔融法生物活性玻璃市场的复合年增长率将达到6.2%。这类生物活性玻璃透过熔融原料生产,其结构比传统生物医学玻璃更均匀緻密。熔融法生物活性玻璃在先进的组织工程领域尤其有用,它能够提供多孔结构,增强生物活性和表面积。这项特性非常适合增强表面反应性和涂层等应用,这些应用可以透过火焰喷涂合成等可扩展方法来实现,从而形成奈米级玻璃粉末。

2024年,美国生物活性玻璃市场规模达3.589亿美元。由于医疗和牙科应用对生物活性玻璃的需求不断增长,尤其是在骨再生和矫正植体涂层领域,美国生物活性玻璃市场正在快速成长。生物活性玻璃因其与骨组织的优异相容性及其抗菌特性,在骨科、牙科和伤口癒合领域至关重要。骨质疏鬆症、骨折和牙科疾病的发生率不断上升,进一步推动了市场的成长。此外,患者和医疗专业人员对微创治疗益处的认识不断提高,也推动了生物活性玻璃的普及。

全球生物活性玻璃市场的知名企业包括 Mo-Sci Corporation、Stryker Corporation(及其子公司 Ortho Vita, Inc.)、肖特股份公司、DePuy Synthes(强生公司)和 NovaBone Products, LLC。生物活性玻璃市场中的企业为巩固其市场地位而实施的关键策略包括投资研发,以开发创新和客製化的生物活性玻璃配方。这些进步使企业能够提供具有特定特性(例如可控离子释放、增强生物活性和可调节降解速率)的客製化产品。

企业也致力于扩大产品组合,以满足新兴市场和医疗需求旺盛地区日益增长的需求。此外,与学术机构、医疗保健提供者和其他行业领导者建立策略合作伙伴关係,有助于企业提升市场影响力。此外,企业正在加大对行销和教育活动的投入,以提高大众对生物活性玻璃优势的认识,这有望推动其在各个医疗领域的应用。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- Pestel 分析

- 价格趋势

- 按地区

- 按成分

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利格局

- 贸易统计数据(HS 代码)(註:仅提供主要国家的贸易统计数据

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依构成,2021 - 2034 年

- 主要趋势

- 45S5生物玻璃

- S53p4(活着)

- 13-93生物活性玻璃

- 58S生物活性玻璃

- 70S30c生物活性玻璃

- 磷酸盐基生物活性玻璃

- 硼酸盐基生物活性玻璃

- 其他作品

第六章:市场估计与预测:依形式 2021 - 2034

- 主要趋势

- 粉末

- 颗粒和微粒

- 支架和多孔结构

- 涂料

- 纤维和网状物

- 复合材料

- 其他形式

第七章:市场估计与预测:依方法,2021 - 2034 年

- 主要趋势

- 熔融衍生

- 溶胶-凝胶

- 火焰喷涂合成

- 微波处理

- 3D列印/积层製造

- 其他加工方法

第八章:市场估计与预测:按应用 2021 - 2034

- 主要趋势

- 骨科

- 骨移植和骨替代物

- 骨空隙填充物

- 脊椎融合

- 创伤修復

- 其他骨科应用

- 牙科

- 牙齿填充物

- 牙种植体

- 牙周治疗

- 牙髓科材料

- 其他牙科应用

- 组织工程与再生医学

- 骨组织工程

- 软组织工程

- 药物输送系统

- 其他组织工程应用

- 伤口癒合

- 化妆品和个人护理

- 其他应用

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 医院和诊所

- 牙医诊所

- 门诊手术中心(ascs)

- 研究与学术机构

- 医疗器材製造商

- 製药和生物技术公司

- 其他最终用途

第十章:市场估计与预测:按物业类型,2021 - 2034 年

- 主要趋势

- 骨传导性

- 抗菌活性

- 血管生成特性

- 生物降解性

- 其他属性

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- MEA 其余地区

第十二章:公司简介

- 3M Company

- Artoss, Inc.

- Berkeley Advanced Biomaterials Inc.

- Biomatlante

- Biomin Technologies Ltd.

- Biovision GmbH

- BonAlive Biomaterials Ltd.

- Cambioceramics BV

- Cerapedics, Inc.

- Curasan AG

- Dentsply Sirona Inc.

- DePuy Synthes (Johnson & Johnson)

- Ferro Corporation

- GC Corporation

- Matexcel

- Medtronic plc

- Mo-Sci Corporation

- Nippon Electric Glass Co., Ltd.

- Noraker

- NovaBone Products, LLC

- Orthovita, Inc. (Stryker)

- Pulpdent Corporation

- SCHOTT AG

- Septodont

- Stryker Corporation

- Synergy Biomedical, LLC

- TheraMetrics AG

- Wuxi Jinxin Science & Technology Co., Ltd.

- Zimmer Biomet Holdings, Inc.

The Global Bioactive Glass Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 2.1 billion by 2034. This expansion is largely driven by the material's unique regenerative properties, particularly in the biomedical field, where bioactive glass interacts positively with biological tissues. Unlike traditional inert materials, bioactive glass promotes active regeneration of soft tissues and bones, offering benefits such as osteogenesis, angiogenesis, and antimicrobial activity. These qualities make it a key material in a wide range of clinical applications. In orthopedics, bioactive glass is increasingly used in bone grafts, spinal fusions, and trauma repair due to its ability to stimulate bone growth and integration.

In dentistry, it is employed in fillings, implants, and periodontal treatments. Moreover, its role in regenerative medicine, drug delivery systems, and tissue engineering continues to expand. The development of new manufacturing methods, such as sol-gel synthesis, melt-derived techniques, and additive manufacturing, has enabled the production of tailored bioactive glasses with customizable porosity, degradation rates, and ion release profiles, further enhancing their use in medical applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.1 Billion |

| CAGR | 6% |

In 2024, the bioactive glass segment from the S53P4 (BonAlive) segment was valued at USD 387.1 million and is expected to grow to USD 728.1 million by 2034. S53P4 is known for its osteoporosis and osteostimulative properties, making it highly effective in treating bone infections and chronic osteomyelitis. This bioactive glass composition assists in bone formation, even in the presence of pre-existing bacterial infections, and is commonly used in orthopedic surgeries, particularly where infection risks are high. The increasing adoption of bioactive glasses in Europe and North America has contributed to the segment's growth, especially as a bone substitute and antimicrobial agent.

The melt-derived bioactive glass segment is expected to grow at a CAGR of 6.2% through 2034. This type of bioactive glass is produced by melting raw materials, resulting in a more homogeneous and dense structure than conventional biomedicine glass. Melt-derived bioactive glass is especially useful in advanced tissue engineering, offering porous structures with enhanced bioactivity and surface area. This property is ideal for applications such as surface reactivity enhancement and coating applications, which can be achieved through scalable methods like flame spray synthesis, allowing the formation of nano-sized glass powders.

U.S. Bioactive Glass Market generated USD 358.9 million in 2024. The market in the U.S. is growing rapidly due to the rising demand for bioactive glass in medical and dental applications, particularly in bone regeneration and orthodontic implant coatings. Bioactive glass is essential in orthopedics, dentistry, and wound healing due to its excellent compatibility with bone tissue and its antibacterial properties. The increasing prevalence of osteoporosis, bone fractures, and dental disorders is further fueling market growth. Additionally, the growing awareness of patients and medical professionals about the benefits of less invasive treatments is driving adoption.

Prominent players in the Global Bioactive Glass Market include Mo-Sci Corporation, Stryker Corporation (and its subsidiary Ortho Vita, Inc.), SCHOTT AG, DePuy Synthes (Johnson & Johnson), and NovaBone Products, LLC. Key strategies implemented by companies in the bioactive glass market to strengthen their position include investing in R&D to develop innovative and customized bioactive glass formulations. These advancements allow companies to offer tailored products with specific properties like controlled ion release, enhanced bioactivity, and adjustable degradation rates.

Companies are also focusing on expanding their product portfolios to meet the growing demand in emerging markets and regions with high medical needs. Additionally, strategic partnerships and collaborations with academic institutions, healthcare providers, and other industry leaders are helping companies enhance their market presence. Furthermore, players are increasing their investments in marketing and educational campaigns to raise awareness about the advantages of bioactive glass, which is expected to drive adoption across various medical fields.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Composition

- 2.2.3 Form

- 2.2.4 Method

- 2.2.5 Application

- 2.2.6 End use

- 2.2.7 Property

- 2.3 Tam analysis, 2025-2034

- 2.4 Cxo perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By composition

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (hs code) (note: the trade statistics will be provided for key countries only

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Composition, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 45S5 bioglass

- 5.3 S53p4 (bonalive)

- 5.4 13-93 bioactive glass

- 5.5 58S bioactive glass

- 5.6 70S30c bioactive glass

- 5.7 Phosphate-based bioactive glass

- 5.8 Borate-based bioactive glass

- 5.9 Other compositions

Chapter 6 Market Estimates and Forecast, By Form 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Powder

- 6.3 Granules & particles

- 6.4 Scaffolds & porous structures

- 6.5 Coatings

- 6.6 Fibers & meshes

- 6.7 Composites

- 6.8 Other forms

Chapter 7 Market Estimates and Forecast, By Method, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Melt-derived

- 7.3 Sol-gel

- 7.4 Flame spray synthesis

- 7.5 Microwave processing

- 7.6 3d printing/additive manufacturing

- 7.7 Other processing methods

Chapter 8 Market Estimates and Forecast, By Application 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Orthopedics

- 8.2.1 Bone grafts & substitutes

- 8.2.2 Bone void fillers

- 8.2.3 Spinal fusion

- 8.2.4 Trauma repair

- 8.2.5 Other orthopedic applications

- 8.3 Dentistry

- 8.3.1 Dental fillings

- 8.3.2 Dental implants

- 8.3.3 Periodontal treatment

- 8.3.4 Endodontic materials

- 8.3.5 Other dental applications

- 8.4 Tissue engineering & regenerative medicine

- 8.4.1 Bone tissue engineering

- 8.4.2 Soft tissue engineering

- 8.4.3 Drug delivery systems

- 8.4.4 Other tissue engineering applications

- 8.5 Wound healing

- 8.6 Cosmetics & personal care

- 8.7 Other applications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Hospitals & clinics

- 9.2 Dental clinics

- 9.3 Ambulatory surgical centers (ascs)

- 9.4 Research & academic institutions

- 9.5 Medical device manufacturers

- 9.6 Pharmaceutical & biotechnology companies

- 9.7 Other end use

Chapter 10 Market Estimates and Forecast, By Property, 2021 - 2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 Osteoconductivity

- 10.3 Antimicrobial activity

- 10.4 Angiogenic properties

- 10.5 Biodegradability

- 10.6 Other properties

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Rest of Latin America

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

- 11.6.4 Rest of MEA

Chapter 12 Company Profiles

- 12.1 3M Company

- 12.2 Artoss, Inc.

- 12.3 Berkeley Advanced Biomaterials Inc.

- 12.4 Biomatlante

- 12.5 Biomin Technologies Ltd.

- 12.6 Biovision GmbH

- 12.7 BonAlive Biomaterials Ltd.

- 12.8 Cambioceramics B.V.

- 12.9 Cerapedics, Inc.

- 12.10 Curasan AG

- 12.11 Dentsply Sirona Inc.

- 12.12 DePuy Synthes (Johnson & Johnson)

- 12.13 Ferro Corporation

- 12.14 GC Corporation

- 12.15 Matexcel

- 12.16 Medtronic plc

- 12.17 Mo-Sci Corporation

- 12.18 Nippon Electric Glass Co., Ltd.

- 12.19 Noraker

- 12.20 NovaBone Products, LLC

- 12.21 Orthovita, Inc. (Stryker)

- 12.22 Pulpdent Corporation

- 12.23 SCHOTT AG

- 12.24 Septodont

- 12.25 Stryker Corporation

- 12.26 Synergy Biomedical, LLC

- 12.27 TheraMetrics AG

- 12.28 Wuxi Jinxin Science & Technology Co., Ltd.

- 12.29 Zimmer Biomet Holdings, Inc.