|

市场调查报告书

商品编码

1766190

无菌填充和密封系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Aseptic Filling and Sealing Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

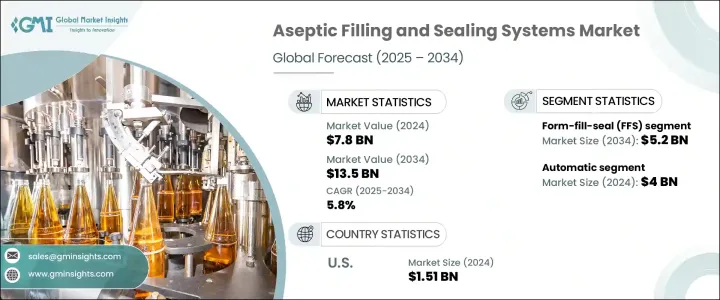

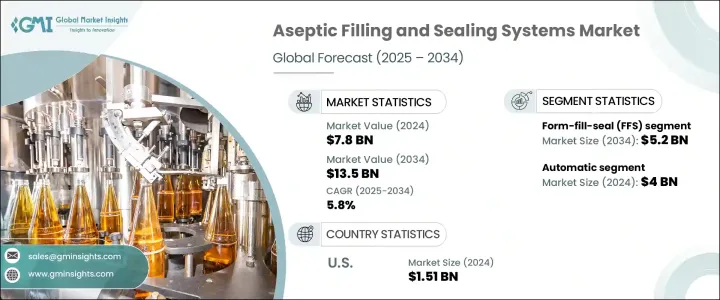

2024年,全球无菌填充和密封系统市场规模达78亿美元,预计2034年将以5.8%的复合年增长率成长,达到135亿美元。这一增长主要源于对复杂生物製剂、个人化医疗和无菌注射疗法日益增长的需求。与传统口服药物不同,单株抗体等生物製剂由于易受污染,需要高度无菌的环境。这些疗法通常透过注射给药,需要精确的填充量和安全的密封,而无菌系统在这些方面比传统包装方法具有明显的优势。

无污染加工的需求促使製药商采用全自动灌装-封口环境,包括基于隔离器和吹灌封 (BFS) 系统。这些先进的无菌解决方案有助于满足包括欧洲药品管理局 (EMA) 和美国食品药物管理局 (FDA) 在内的全球监管机构规定的严格无菌要求。为此,设备製造商正专注于模组化无菌系统,以满足大规模生产和小批量生产的需求。随着监管准则日益严格,尤其是在註射剂领域,该行业正转向整合无菌解决方案,以满足日益增长的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 78亿美元 |

| 预测值 | 135亿美元 |

| 复合年增长率 | 5.8% |

成型-填充-封口 (FFS) 细分市场在 2024 年的产值达到 28 亿美元,预计到 2034 年将达到 52 亿美元。 FFS 系统将成型、填充和封口工序整合在一个自动化单元中,从而降低了微生物污染的风险。 FFS 系统高速生产效率高,材料浪费少,是製药和乳製品应用的理想选择,同时也符合欧盟附件 1 和美国食品药物管理局 (FDA) 指南等严格的监管要求。

2024年,自动化领域以40亿美元的规模占据领先地位,占据51.1%的市场。自动化系统最大限度地减少了人工干预,这是减少无菌环境中污染的关键因素。这些系统提供稳定的循环时间、高速输出以及精准的计量和密封,使其成为大规模生产和日益增长的小批量生物製剂需求的关键。它们还整合了即时监控和先进的品质控制分析功能,进一步提升了其在市场上的吸引力。

2024年,美国无菌填充和密封系统市场规模达15.1亿美元,预计2025年至2034年的复合年增长率为4.2%。全自动无菌系统需求的成长是推动这一成长的关键趋势,製造商致力于满足美国食品药物管理局(FDA)21世纪CGMP计画设定的严格标准。该计划强调基于科学和风险的製造方法的重要性,并鼓励企业采用先进技术来增强无菌性并提高营运效率。自动化无菌系统减少了人为干预,而人为干预是无菌环境中重要的污染源。

全球无菌填充和密封系统市场的主要参与者包括 Syntegon、OPTIMA、Coesia Group、Tetra Pak 和 Serac Group 等公司。这些公司一直在采取策略来提升其市场地位,包括投资自动化和开发模组化无菌解决方案,以满足大量和小批量生产的需求。他们还注重遵守不断发展的监管标准,确保其係统能够满足严格的无菌和安全准则。此外,与合约开发和製造组织 (CDMO) 建立策略合作伙伴关係使这些公司能够扩大业务范围并在新兴市场站稳脚跟。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业影响力量

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 灌装机

- 线性填料

- 旋转灌装机

- 体积填料

- 重力填料

- 封口机

- 热封机

- 超音波封口机

- 感应封口机

- 其他(雷射封口机等)

- 整合填充和密封系统

第六章:市场估计与预测:依包装类型,2021 年至 2034 年

- 主要趋势

- 小瓶

- 玻璃小瓶

- 塑胶小瓶

- 预灭菌小瓶

- 注射器

- 预充式註射器

- 安全注射器

- 自动注射器

- 墨水匣

- 胰岛素笔芯

- 笔式註射器墨盒

- 特种药物药筒

- 安瓿

- 玻璃安瓿瓶

- 塑胶安瓿瓶

- 其他容器

第七章:市场估计与预测:依技术分类,2021 年至 2034 年

- 主要趋势

- 吹灌封(BFS)

- 成型-填充-密封(FFS)

- 灌装封口(FS)

- 其他的

第八章:市场估计与预测:依营运规模,2021 年至 2034 年

- 主要趋势

- 小规模系统

- 中型系统

- 大型系统

第九章:市场估计与预测:依自动化水平,2021 年至 2034 年

- 主要趋势

- 手动的

- 半自动

- 自动的

第 10 章:市场估计与预测:按最终用途产业,2021 年至 2034 年

- 主要趋势

- 製药和营养保健品产业

- 食品和饮料业

- 化妆品和个人护理

- 其他的

第 11 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直接的

- 间接

第 12 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十三章:公司简介

- AST, LLC

- Aseptic Systems Co., Ltd.

- Coesia Group

- Cytiva

- GEA Group AG

- Groninger Holding GmbH & Co. KG

- IMA Group

- KHS GmbH

- Krones AG

- OPTIMA

- PLUMAT

- Serac Group

- SIG Combibloc Group AG

- Syntegon Technology GmbH

- Tetra Pak International SA

The Global Aseptic Filling and Sealing Systems Market was valued at USD 7.8 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 13.5 billion by 2034. This growth is largely driven by the increasing demand for complex biologics, personalized medicine, and sterile injectable therapies. Unlike traditional oral medications, biologics such as monoclonal antibodies require highly sterile environments due to their sensitivity to contamination. These therapies, often delivered via injection, need precise fill volumes and secure sealing, areas where aseptic systems offer a distinct advantage over traditional packaging methods.

The demand for contamination-free processing has led pharmaceutical manufacturers to adopt fully automated fill-finish environments, including isolator-based and Blow-Fill-Seal (BFS) systems. These advanced aseptic solutions help meet the strict sterility requirements mandated by global regulatory bodies, including the European Medicines Agency (EMA) and the U.S. FDA. In response, equipment manufacturers are focusing on modular aseptic systems that can cater to both large-scale production and small-batch needs. With stricter regulatory guidelines, particularly around injectable drugs, the industry is shifting towards integrated aseptic solutions to accommodate growing demand.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.8 Billion |

| Forecast Value | $13.5 Billion |

| CAGR | 5.8% |

The form-fill-seal (FFS) segment generated USD 2.8 billion in 2024, expected to reach USD 5.2 billion by 2034. FFS systems combine the processes of forming, filling, and sealing within a single automated unit, reducing the risk of microbial contamination. Their efficiency in high-speed production with minimal material waste makes them ideal for pharmaceutical and dairy applications, while also aligning with stringent regulatory requirements such as EU Annex 1 and FDA guidelines.

The automatic segment was the leading market segment in 2024 with USD 4 billion, capturing a 51.1% share. Automated systems minimize human intervention, which is a key factor in reducing contamination in sterile environments. These systems provide consistent cycle times, high-speed output, and precision in dosing and sealing, making them essential for both large-scale production and the growing demand for small-batch biologics. They also incorporate real-time monitoring and advanced analytics for quality control, further boosting their appeal in the market.

U.S. Aseptic Filling and Sealing Systems Market was valued at USD 1.51 billion in 2024, and it is projected to grow at a CAGR of 4.2% from 2025 to 2034. The rise in demand for fully automated aseptic systems is a key trend driving this growth, with manufacturers focusing on meeting the rigorous standards set by the FDA's 21st Century CGMP initiative. This initiative emphasizes the importance of science- and risk-based approaches to manufacturing, encouraging companies to adopt advanced technologies that enhance sterility and improve operational efficiency. Automated aseptic systems reduce human intervention, which is a significant source of contamination in sterile environments.

Key players in the Global Aseptic Filling and Sealing Systems Market include companies like Syntegon, OPTIMA, Coesia Group, Tetra Pak, and Serac Group. These firms have been adopting strategies to enhance their market position by investing in automation and developing modular aseptic solutions that cater to both high-volume and small-batch production. They are also focusing on compliance with evolving regulatory standards, ensuring their systems are capable of meeting strict sterility and safety guidelines. Additionally, strategic partnerships with contract development and manufacturing organizations (CDMOs) have enabled these companies to expand their reach and gain a foothold in emerging markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Packaging type

- 2.2.4 Technology

- 2.2.5 Scale of operation

- 2.2.6 Automation level

- 2.2.7 End use industry

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 – 2034 (USD Billion) (Units)

- 5.1 Key trends

- 5.2 Filling machines

- 5.2.1 Linear fillers

- 5.2.2 Rotary fillers

- 5.2.3 Volumetric fillers

- 5.2.4 Gravity fillers

- 5.3 Sealing machines

- 5.3.1 Heat sealers

- 5.3.2 Ultrasonic sealers

- 5.3.3 Induction sealers

- 5.3.4 Others (Laser Sealers, etc.)

- 5.4 Integrated filling & sealing systems

Chapter 6 Market Estimates & Forecast, By Packaging Type, 2021 – 2034 (USD Billion) (Units)

- 6.1 Key trends

- 6.2 Vials

- 6.2.1 Glass vials

- 6.2.2 Plastic vials

- 6.2.3 Pre-sterilized vials

- 6.3 Syringes

- 6.3.1 Prefilled syringes

- 6.3.2 Safety syringes

- 6.3.3 Auto-injectors

- 6.4 Cartridges

- 6.4.1 Insulin cartridges

- 6.4.2 Pen injector cartridges

- 6.4.3 Specialty drug cartridges

- 6.5 Ampoules

- 6.5.1 Glass ampoules

- 6.5.2 Plastic ampoules

- 6.6 Other containers

Chapter 7 Market Estimates & Forecast, By Technology, 2021 – 2034 (USD Billion) (Units)

- 7.1 Key trends

- 7.2 Blow-fill-seal (BFS)

- 7.3 Form-fill-seal (FFS)

- 7.4 Fill-seal (FS)

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Scale of Operation, 2021 – 2034, (USD Billion) (Units)

- 8.1 Key trends

- 8.2 Small-scale systems

- 8.3 Medium-scale systems

- 8.4 Large-scale systems

Chapter 9 Market Estimates & Forecast, By Automation Level, 2021 – 2034, (USD Billion) (Units)

- 9.1 Key trends

- 9.2 Manual

- 9.3 Semi-automatic

- 9.4 Automatic

Chapter 10 Market Estimates & Forecast, By End Use Industry, 2021 – 2034, (USD Billion) (Units)

- 10.1 Key trends

- 10.2 Pharmaceutical & nutraceuticals industry

- 10.3 Food & beverage industry

- 10.4 Cosmetics & personal care

- 10.5 Others

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion) (Units)

- 11.1 Key trends

- 11.2 Direct

- 11.3 Indirect

Chapter 12 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 U.K.

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 UAE

- 12.6.2 Saudi Arabia

- 12.6.3 South Africa

Chapter 13 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 13.1 AST, LLC

- 13.2 Aseptic Systems Co., Ltd.

- 13.3 Coesia Group

- 13.4 Cytiva

- 13.5 GEA Group AG

- 13.6 Groninger Holding GmbH & Co. KG

- 13.7 IMA Group

- 13.8 KHS GmbH

- 13.9 Krones AG

- 13.10 OPTIMA

- 13.11 PLUMAT

- 13.12 Serac Group

- 13.13 SIG Combibloc Group AG

- 13.14 Syntegon Technology GmbH

- 13.15 Tetra Pak International S.A.