|

市场调查报告书

商品编码

1766191

OTC 连续血糖监测市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测OTC Continuous Glucose Monitoring Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

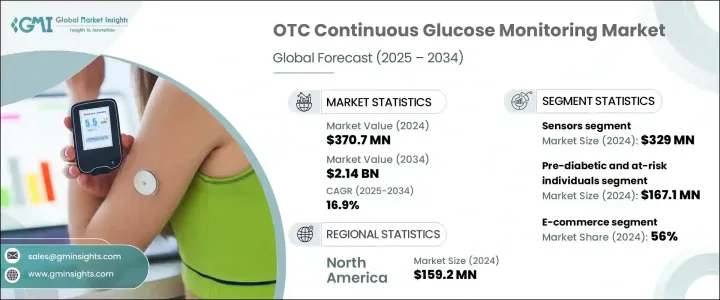

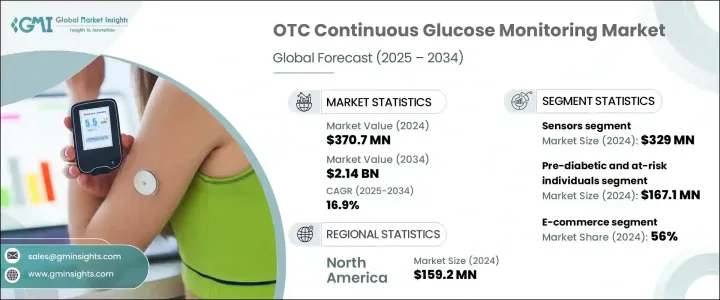

2024 年全球非处方连续血糖监测市场规模为 3.707 亿美元,预计到 2034 年将以 16.9% 的复合年增长率成长,达到 21.4 亿美元。非处方连续血糖监测 (OTC CGM) 无需处方即可购买,不仅在糖尿病管理中发挥越来越重要的作用,而且在更广泛的健康监测应用中也发挥着越来越重要的作用。这些设备使消费者能够即时追踪血糖水平,从而帮助他们就饮食、运动和整体健康状况做出明智的决定。随着对个人健康资讯的需求不断增长,这些系统正被用于预防性医疗保健和个人化营养。随着感测器技术、紧凑设计、更长的可穿戴性以及与智慧型手机和人工智慧平台的无缝整合的进步,OTC CGM 正变得更加用户友好,并被更广泛的受众所接受。

製造商和数位平台正日益携手合作,以提升消费者的整体产品体验。透过整合高级分析技术并提供个人化的生活方式指导,这些合作正在为用户创造更具吸引力、更注重价值的体验。消费者现在可以即时获得健康洞察,了解日常饮食习惯如何影响血糖水平和整体健康状况。这种个人化回馈不仅限于监测血糖水平,还扩展到製定切实可行的健康目标,例如优化饮食、运动和睡眠模式。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3.707亿美元 |

| 预测值 | 21.4亿美元 |

| 复合年增长率 | 16.9% |

感测器领域占最大份额,2024 年价值 3.29 亿美元。人们对紧凑、舒适、易用的可穿戴设备的日益青睐,推动了更多创新感测器的开发。这些感测器如今采用了石墨烯、柔性聚合物和可拉伸电子元件等先进材料,以提高舒适度和测量精度。这些感测器与穿戴式装置和智慧型手机的集成,实现了即时连接和资料传输,从而提升了用户体验,并拓宽了连续血糖监测 (CGM) 的使用范围。

2024年,电商领域占了56%的市场。这一成长源自于消费者行为的转变,注重健康的消费者更倾向于在线上购买健康设备,从而绕过传统的零售和临床管道。电商平台让消费者能够直接购买非处方动态血糖监测(OTC CGM),从而在数位化健康旅程中拥有更大的自主权。这种直接面向消费者的方式也使品牌能够更有效地与客户互动,透过线上管道提供个人化的教育和支援。

预计到 2034 年,美国非处方连续血糖监测市场规模将达到 11 亿美元。人们对预防性保健的兴趣日益浓厚,尤其是在非糖尿病族群中,这推动了这项需求。人们越来越多地使用 CGM 来优化饮食、运动和代谢性能。美国食品药物管理局 (FDA) 的监管进展,包括对非处方连续血糖监测 (OTC CGM) 的批准,进一步促进了这些设备的广泛应用。连续血糖监测 (CGM) 与智慧型手机和健康应用程式的整合也增强了消费者对自我管理的信心,使用户能够无缝监测血糖水平并获得个人化的健康建议。这一趋势得益于美国数位健康工具的广泛采用,消费者越来越多地寻求个人化的健康资料。

OTC 连续血糖监测市场的主要参与者包括雅培实验室、Dexcom、January AI、Levels Health、Limbo (Vitals in View)、Nutrisense、三诺生物、Ultrahuman Healthcare、Veri 和 Zoe。为了加强在 OTC 连续血糖监测市场的地位,各公司采取了多种策略。首先,他们专注于增强感测器背后的技术,整合柔性聚合物和可拉伸电子产品等尖端材料,以提高舒适度和准确性。许多公司也与数位健康平台建立策略合作伙伴关係,为消费者提供附加服务,例如人工智慧分析和个人化指导。此外,许多製造商正在接受向电子商务的转变,这使他们能够直接透过线上管道接触更广泛的消费者群体。透过投资使用者友善的设计、提供教育资源和简化购买流程,这些公司旨在提高产品采用率并建立强大的客户忠诚度。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 消费者对代谢健康和保健的兴趣日益浓厚

- 直接面向消费者 (DTC) 和订阅模式的扩展

- 技术进步和人工智慧驱动的洞察力

- 预防性医疗保健和长寿趋势的转变

- 产业陷阱与挑战

- 成本高且保险范围有限

- 监管和资料隐私问题

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

- 2024 年按消费者类型分類的销售量

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 透过感测器

- 按平台/应用

- 公司市场排名(按地区)

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按组成部分,2021 年至 2034 年

- 主要趋势

- 感应器

- 平台/应用程式

第六章:市场估计与预测:依消费者类型,2021 年至 2034 年

- 主要趋势

- 非糖尿病健康爱好者

- 糖尿病前期及高危险群

- 其他消费者类型

第七章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 医院药房

- 零售药局

- 电子商务

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 日本

- 中国

- 印度

- 澳洲

- 韩国

- 世界其他地区

第九章:公司简介

- Abbott Laboratories

- Dexcom

- January AI

- Levels Health

- Limbo (Vitals in View)

- Nutrisense

- Sinocare

- Ultrahuman Healthcare

- Veri

- Zoe

The Global OTC Continuous Glucose Monitoring Market was valued at USD 370.7 million in 2024 and is estimated to grow at a CAGR of 16.9% to reach USD 2.14 billion by 2034. OTC CGMs, which are available for purchase without a prescription, are playing an increasingly significant role not only in managing diabetes but also in broader health monitoring applications. These devices allow consumers to track their glucose levels in real-time, which empowers them to make informed decisions about their diet, exercise, and overall wellness. As the demand for personal health information grows, these systems are being embraced for preventive healthcare and personalized nutrition. With advancements in sensor technology, compact design, longer wearability, and seamless integration with smartphones and AI platforms, OTC CGMs are becoming more user-friendly and accessible to a wider audience.

Manufacturers and digital platforms are increasingly joining forces to improve the overall product experience for consumers. By integrating advanced analytics and offering personalized lifestyle coaching, these collaborations are creating a more engaging and value-driven experience for users. Consumers now have access to insights about their health in real-time, helping them understand how their daily choices impact their glucose levels and overall well-being. This personalized feedback is not just limited to monitoring glucose levels but extends to creating actionable health goals, such as optimizing diet, exercise, and sleep patterns.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $370.7 Million |

| Forecast Value | $2.14 Billion |

| CAGR | 16.9% |

The sensor segment holds the largest share valued at USD 329 million in 2024. The increasing preference for compact, comfortable, and easy-to-use wearables is fueling the development of more innovative sensors. These sensors now incorporate advanced materials such as graphene, flexible polymers, and stretchable electronics to improve comfort and measurement accuracy. The integration of these sensors with wearables and smartphones allows real-time connectivity and data transfer, enhancing the user experience and broadening the scope of CGM usage.

The e-commerce segment held 56% share in 2024. This growth is driven by a shift in consumer behavior, where health-conscious individuals prefer purchasing wellness devices online, bypassing traditional retail and clinical settings. E-commerce platforms offer consumers direct access to OTC CGMs, providing greater autonomy over their digital health journey. This direct-to-consumer approach also enables brands to engage with customers more effectively, offering personalized education and support through online channels.

United States OTC Continuous Glucose Monitoring Market is projected to reach USD 1.1 billion by 2034. The rising interest in preventive health, particularly among non-diabetic individuals, is driving this demand. People are increasingly using CGMs to optimize their diet, exercise, and metabolic performance. Regulatory advancements by the FDA, including approvals for OTC CGMs, are further facilitating the widespread adoption of these devices. The integration of CGMs with smartphones and health apps is also boosting consumer confidence in self-management, enabling users to monitor their glucose levels seamlessly and gain personalized health insights. This trend is supported by the high adoption of digital health tools in the U.S., with consumers increasingly seeking personalized health data.

Key players in the OTC Continuous Glucose Monitoring Market include Abbott Laboratories, Dexcom, January AI, Levels Health, Limbo (Vitals in View), Nutrisense, Sinocare, Ultrahuman Healthcare, Veri, and Zoe. To strengthen their presence in the OTC continuous glucose monitoring market, companies have adopted several strategies. First, they are focusing on enhancing the technology behind their sensors, integrating cutting-edge materials like flexible polymers and stretchable electronics to improve comfort and accuracy. Many companies are also entering strategic partnerships with digital health platforms to provide consumers with additional services, such as AI-powered analytics and personalized coaching. Furthermore, the shift towards e-commerce is being embraced by many manufacturers, allowing them to reach a broader consumer base directly through online channels. By investing in user-friendly designs, providing educational resources, and streamlining the purchase process, these companies aim to increase product adoption and build strong customer loyalty.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising consumer interest in metabolic health and wellness

- 3.2.1.2 Expansion of direct-to-consumer (DTC) and subscription models

- 3.2.1.3 Technological advancements and AI-powered insights

- 3.2.1.4 Shifts in preventive healthcare and longevity trends

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs and limited insurance coverage

- 3.2.2.2 Regulatory and data privacy concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Rest of the World

- 3.5 Volume by consumer type, 2024

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By sensor

- 4.2.2 By platform/app

- 4.3 Company market ranking, by region

- 4.4 Company matrix analysis

- 4.5 Competitive analysis of major market players

- 4.6 Competitive positioning matrix

- 4.7 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Component, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Sensors

- 5.3 Platforms/Apps

Chapter 6 Market Estimates and Forecast, By Consumer Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Non-diabetic health enthusiasts

- 6.3 Pre-diabetic and at-risk individuals

- 6.4 Other consumer types

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital pharmacies

- 7.3 Retail pharmacies

- 7.4 E-commerce

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Rest of the World

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Dexcom

- 9.3 January AI

- 9.4 Levels Health

- 9.5 Limbo (Vitals in View)

- 9.6 Nutrisense

- 9.7 Sinocare

- 9.8 Ultrahuman Healthcare

- 9.9 Veri

- 9.10 Zoe