|

市场调查报告书

商品编码

1766194

工业清洁产品市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Industrial Cleaning Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

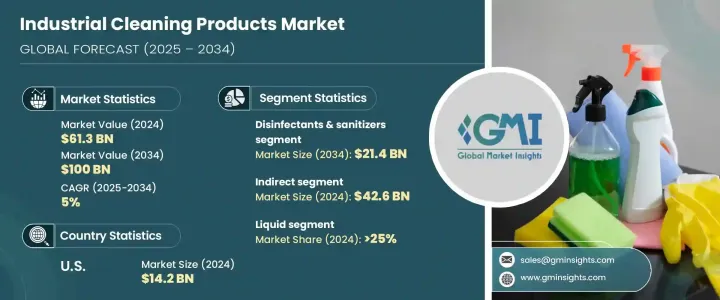

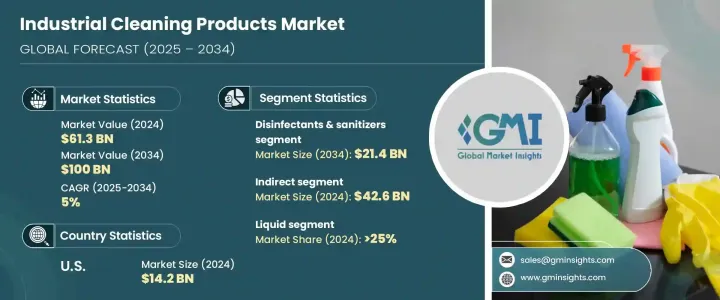

2024 年全球工业清洁产品市场价值为 613 亿美元,预计到 2034 年将以 5% 的复合年增长率成长,达到 1,000 亿美元。这一成长的一个重要驱动力是对工作场所卫生和个人卫生的日益重视,尤其是在食品加工、製药和医疗保健等卫生至关重要的行业。世界各国政府和监管机构实施的更严格的法规正在促使企业使用经过认证的工业清洁产品。因此,各行各业在满足卫生标准方面变得更加严格,以确保工人和最终用户的安全。亚洲和拉丁美洲等新兴经济体的持续工业化正在为各行各业的清洁解决方案创造额外的需求,从製造业的强力脱脂剂到商业场所的环保消毒剂。

已开发经济体和新兴经济体的工业基础快速成长,大大推动了全球对高效可靠清洁产品的需求。随着製造业、食品加工、製药和化学等产业的持续扩张,对专业清洁解决方案的需求也日益凸显,以维护安全、卫生和营运效率。随着工业化程度的提高,清洁任务的复杂性不断提升,需要更先进的清洁剂来处理油脂、化学残留物和颗粒物等重污染应用。自动化、先进製造技术的兴起以及向环保实践的转变进一步加剧了这一趋势,所有这些都给清洁产品製造商带来了额外的创新压力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 613亿美元 |

| 预测值 | 1000亿美元 |

| 复合年增长率 | 5% |

消毒剂和杀菌剂市场规模在2024年达到125亿美元,预计2034年将成长至214亿美元。这些产品在各行各业需求旺盛,尤其是在医疗保健、食品加工和製药领域,因为它们在保障卫生和预防感染传播方面发挥着重要作用。新冠疫情进一步凸显了消毒剂和杀菌剂的重要性,促使人们增加对这些解决方案的投资,以预防病原体的传播。表面清洁剂也占据了相当大的市场份额,广泛应用于商业和工业领域。

工业清洁产品市场的间接配销通路占了相当大的份额,2024 年价值达 426 亿美元,预计 2025 年至 2034 年的复合年增长率将达到 4.8%。该细分市场的蓬勃发展得益于完善的批发商、分销商和专业供应商网络,这些供应商提供深入的本地专业知识,并与客户保持长期合作关係。这些管道对于触达製造业、医疗保健业、食品加工业等各行各业的广泛终端用户至关重要。依赖这些中介机构可以实现高效的产品分销、及时交付和本地化支持,这对于满足工业运营的动态需求至关重要。

2024年,北美工业清洁产品市场规模达142亿美元,预计2034年将以5.3%的复合年增长率成长。美国市场的成长受到多种因素的推动,包括强调工作场所清洁的严格监管框架、频繁的工业活动以及先进的医疗保健基础设施。这些法规,例如美国职业安全与健康管理局(OSHA)制定的法规,创造了对工业清洁解决方案持续需求的环境。汽车、医疗保健、製药和食品加工等关键产业推动了这一需求,对符合产业标准的专业清洁产品的需求持续成长。

影响工业清洁产品市场的关键公司包括 3M、巴斯夫、科莱恩、泰华施、陶氏、杜邦、艺康、赢创工业、汉高、金佰利、宝洁、利洁时、索尔维、斯泰潘和高乐氏公司。为了巩固市场地位,工业清洁产品产业的公司正专注于产品创新并扩大产品组合。许多公司正在投资环保和永续的解决方案,以满足消费者对环保产品日益增长的需求。随着公司与其他行业参与者联手提供全面的解决方案并进入更广泛的分销网络,合作伙伴关係和协作变得非常常见。製造商也越来越注重法规合规性,以满足行业标准并提高产品可信度。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 监管格局

- 标准和合规要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 表面清洁剂

- 厕所清洁剂

- 玻璃和金属清洁剂

- 地板清洁剂

- 织物清洁剂

- 洗碗产品

- 消毒剂和杀菌剂

- 除油剂

- 除垢器

- 其他的

第六章:市场估计与预测:依形式类型,2021-2034

- 主要趋势

- 液体

- 粉末

- 凝胶

- 泡棉

- 气雾剂/喷雾

- 其他的

第七章:市场估计与预测:按最终用途产业,2021-2034 年

- 主要趋势

- 水和废水

- 石油和天然气

- 能源和电力

- 製药

- 化学品

- 汽车和航太

- 食品和饮料

- 金属与矿业

- 其他的

第八章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 直接的

- 间接

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十章:公司简介

- 3M

- BASF

- Clariant

- Diversey

- Dow

- DuPont

- Ecolab

- Evonik Industries

- Henkel

- Kimberly-Clark

- Procter & Gamble (P&G)

- Reckitt Benckiser

- Solvay

- Stepan

- The Clorox Company

The Global Industrial Cleaning Products Market was valued at USD 61.3 billion in 2024 and is estimated to grow at a CAGR of 5% to reach USD 100 billion by 2034. A significant driver of this growth is the increasing focus on workplace sanitation and hygiene, especially in sectors like food processing, pharmaceuticals, and healthcare, where hygiene is crucial. Stricter regulations imposed by governments and regulatory bodies worldwide are pushing businesses to use certified industrial cleaning products. As a result, industries have become more diligent in meeting hygiene standards to ensure the safety of workers and end-users. The ongoing industrialization in emerging economies, such as those in Asia and Latin America, is creating additional demand for cleaning solutions across a variety of sectors, from heavy-duty degreasers in manufacturing to eco-friendly disinfectants in commercial spaces.

The rapidly growing industrial base across both developed and emerging economies is significantly driving the demand for effective and reliable cleaning products worldwide. As industries such as manufacturing, food processing, pharmaceuticals, and chemicals continue to expand, the need for specialized cleaning solutions to maintain safety, hygiene, and operational efficiency has become more pronounced. With increased industrialization, the complexity of cleaning tasks has escalated, requiring more advanced cleaning agents to tackle heavy-duty applications such as grease, chemical residues, and particulate matter. This trend is further amplified by the rise of automation, advanced manufacturing techniques, and the shift towards eco-friendly practices, all of which place additional pressure on cleaning product manufacturers to innovate.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $61.3 Billion |

| Forecast Value | $100 Billion |

| CAGR | 5% |

The disinfectants and sanitizers segment, valued at USD 12.5 billion in 2024, is expected to grow to USD 21.4 billion by 2034. These products are in high demand across industries, particularly in healthcare, food processing, and pharmaceuticals, due to their role in ensuring hygiene and preventing the spread of infections. The COVID-19 pandemic further highlighted the importance of disinfectants and sanitizers, leading to even greater investments in these solutions to prevent the spread of pathogens. Surface cleaners also maintain a significant market share, with widespread applications in both commercial and industrial settings.

The indirect distribution channel in the industrial cleaning products market held a significant share, valued at USD 42.6 billion in 2024, and is forecasted to grow at a CAGR of 4.8% from 2025 to 2034. This segment thrives due to a well-established network of wholesalers, distributors, and specialized suppliers that provide in-depth local expertise and maintain long-term relationships with their customers. These channels are instrumental in reaching a broad array of end-users across industries, including manufacturing, healthcare, food processing, and more. The reliance on these intermediaries allows for efficient product distribution, timely delivery, and localized support, which are critical in meeting the dynamic needs of industrial operations.

North America Industrial Cleaning Products Market was valued at USD 14.2 billion in 2024 and is projected to grow at a CAGR of 5.3% by 2034. The growth of the U.S. market is driven by a combination of factors, including rigorous regulatory frameworks that emphasize workplace cleanliness, high industrial activity, and advanced healthcare infrastructure. These regulations, such as those set by OSHA (Occupational Safety and Health Administration), create an environment where industrial cleaning solutions are in constant demand. Key sectors such as automotive, healthcare, pharmaceuticals, and food processing fuel this demand, with a continued need for specialized cleaning products that meet industry standards.

Key companies shaping the Industrial Cleaning Products Market include 3M, BASF, Clariant, Diversey, Dow, DuPont, Ecolab, Evonik Industries, Henkel, Kimberly-Clark, Procter & Gamble (P&G), Reckitt Benckiser, Solvay, Stepan, and The Clorox Company. To strengthen their position in the market, companies in the industrial cleaning products sector are focusing on product innovation and expanding their product portfolios. Many are investing in environmentally friendly and sustainable solutions to align with growing consumer demand for eco-conscious products. Partnerships and collaborations are common, as companies team up with other industry players to offer comprehensive solutions and access wider distribution networks. Manufacturers are also increasing their focus on regulatory compliance to meet industry standards and improve product credibility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Form type

- 2.2.4 End use industry

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Surface cleaners

- 5.3 Toilet cleaners

- 5.4 Glass & metal cleaners

- 5.5 Floor cleaners

- 5.6 Fabric cleaners

- 5.7 Dishwashing products

- 5.8 Disinfectants & sanitizers

- 5.9 Degreasers

- 5.10 Descalers

- 5.11 Others

Chapter 6 Market Estimates & Forecast, By Form Type, 2021-2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Liquid

- 6.3 Powder

- 6.4 Gel

- 6.5 Foam

- 6.6 Aerosol/spray

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021-2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Water and wastewater

- 7.3 Oil and gas

- 7.4 Energy and power

- 7.5 Pharmaceuticals

- 7.6 Chemicals

- 7.7 Automotive & aerospace

- 7.8 Food & beverage

- 7.9 Metals & mining

- 7.10 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034, ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 3M

- 10.2 BASF

- 10.3 Clariant

- 10.4 Diversey

- 10.5 Dow

- 10.6 DuPont

- 10.7 Ecolab

- 10.8 Evonik Industries

- 10.9 Henkel

- 10.10 Kimberly-Clark

- 10.11 Procter & Gamble (P&G)

- 10.12 Reckitt Benckiser

- 10.13 Solvay

- 10.14 Stepan

- 10.15 The Clorox Company