|

市场调查报告书

商品编码

1766201

汽车再生减震器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Regenerative Shock Absorbers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

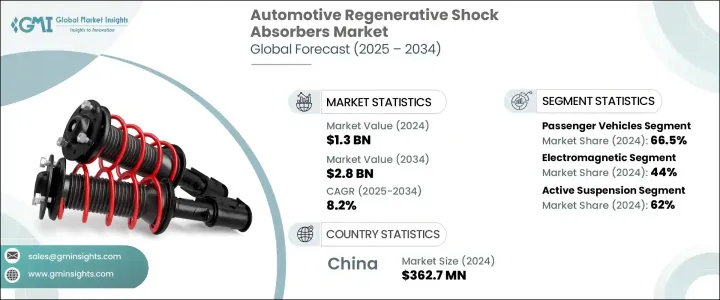

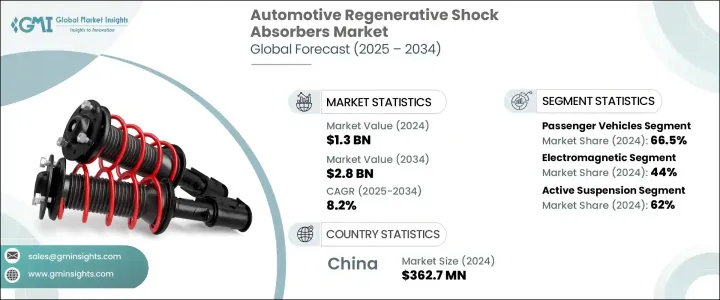

2024 年全球汽车再生避震器市场价值为 13 亿美元,预计到 2034 年将以 8.2% 的复合年增长率成长至 28 亿美元。对节能汽车系统和燃油性能的不断增长的需求继续推动再生减震器的应用。这些系统将悬吊运动和道路振动产生的动能转化为可用电能,有助于提高车辆整体效率。随着电气化趋势的加速和全球环境法规的收紧,汽车製造商正在将这些系统更广泛地整合到电动、混合动力和传统汽车中。汽车悬吊技术的进步正在扩大商用车和乘用车的应用范围,使再生解决方案更加可行。製造商正在转向能量收集技术来支援燃油经济性并满足排放标准,同时提高乘坐品质和系统响应能力。

汽车产业正转向能量回收解决方案,而再生减震器正成为实现营运效率的关键部件。这些系统将道路能量转化为电能,从而降低对传统能源的依赖。全球日益严格的减排和燃油经济法规正促使原始设备製造商将能量转换悬吊技术纳入其合规策略。在这一不断发展的格局中,再生减震系统在各种车型和用例中都日益受到重视。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 13亿美元 |

| 预测值 | 28亿美元 |

| 复合年增长率 | 8.2% |

2024年,乘用车以66.5%的市占率领先市场,预计到2034年将以8.5%的复合年增长率成长。全球乘用车的广泛生产和销售是推动这一趋势的主要力量。消费者越来越青睐那些行驶更平稳、操控性更佳、燃油效率更高的车款。因此,再生减震器正被应用于标准和高端乘用车。随着汽车製造商努力提升续航里程并减少对环境的影响,电动和混合式乘用车的快速成长进一步加速了这一趋势。原始设备製造商为实现永续发展目标所做的努力,正在推动电磁和机械减震器的整合。持续的研发投入和政府的支持性措施正在加速创新,并推动再生悬吊系统在该领域的应用。

电磁再生减震器在2024年占据最大的市场份额,达到44%,预计在2025-2034年期间的复合年增长率将达到8.3%。这些系统利用电磁感应技术,利用道路运动产生的能量,在发电的同时最大限度地减少机械阻力。其高效和灵敏的设计使其比传统的液压或机械系统更具优势。汽车製造商正在为高阶车型和电动车型采用电磁悬吊,以最大限度地提高性能并实现节能效益。随着全球消费者越来越倾向于智慧和高效的出行解决方案,这个细分市场正受到越来越多的关注并迅速扩张。

2024年,中国汽车再生避震器市场规模达3.627亿美元,占69%的市占率。电动车的快速普及,加上本土悬吊製造技术的进步,使中国成为重要的成长中心。更重的电动车电池设计推动了对先进减震解决方案的需求,这些解决方案旨在提升操控性和乘坐舒适度。中国强大的汽车製造生态系统,加上对国内创新和研发的大量投资,正在推动再生悬吊系统的普及。政府对电动车和产业转型的支持,进一步推动了轻量化和自适应技术的发展。中国对性能和燃油经济性的战略重点,使其成为全球市场扩张的重要贡献者。

塑造全球汽车再生避震器市场的关键参与者包括采埃孚 (ZF Friedrichshafen)、萨克斯 (SACHS)、特瑞堡 (Trelleborg)、日立阿斯泰莫 (Hitachi Astemo)、凯迩必 (KYB)、万都 (Mando)、福克斯斯坦工厂 (Fox y虏)、科学科技耐力 (Curance Technologies)、福克斯斯坦工厂和京西重工集团 (BWI Group)。为了巩固其在汽车再生减震器市场的地位,领先公司正专注于创新、永续发展和策略合作。许多公司正在加大研发投入,以增强电磁和机械能回收系统,从而顺应电动车的转型。製造商正在与原始设备製造商 (OEM) 合作,将这些技术整合到下一代电动和混合动力汽车中。另一项重要策略是透过在地化生产单位向新兴电动车市场进行地理扩张。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 电动和混合动力汽车需求不断增长

- 汽车技术的进步

- 与先进驾驶辅助系统(ADAS) 集成

- 对舒适性和安全性的需求不断增长

- 延长车辆行驶里程的潜力

- 产业陷阱与挑战

- 原物料价格波动

- 激烈的竞争

- 市场机会

- 与电动车(EV)集成

- 自动驾驶汽车的普及率上升

- 高檔和豪华汽车销量不断成长

- 先进悬吊系统的研发资金

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 商用车

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第六章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 电磁

- 油压

- 机械的

- 其他的

第七章:市场估计与预测:依暂停分类,2021 - 2034 年

- 主要趋势

- 主动悬吊

- 半主动悬吊

第八章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第九章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 辅助系统电源

- 电池充电(电动车)

- 能量回收提高燃油效率

- 自动驾驶汽车系统

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- ADD Industry

- AL-KO Vehicle Technology Group

- BWI Group

- Endurance Technologies

- FOX Factory

- Gabriel India

- Hitachi Astemo

- KONI

- KYB

- Magneti Marelli

- Mando

- Multimatic

- Ohlins Racing

- Ride Control

- SACHS

- Showa Corporation

- Tenneco

- Thyssenkrupp Bilstein

- Trelleborg

- ZF Friedrichshafen

The Global Automotive Regenerative Shock Absorbers Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 8.2% to reach USD 2.8 billion by 2034. Increasing demand for energy-efficient vehicle systems and enhanced fuel performance continues to drive the adoption of regenerative shock absorbers. These systems convert kinetic energy, produced by suspension movement and road vibrations, into usable electricity, contributing to overall vehicle efficiency. As electrification trends accelerate and environmental regulations tighten worldwide, automakers are integrating these systems more broadly into electric, hybrid, and conventional vehicles. Advances in vehicle suspension technologies are expanding the application scope across both commercial and passenger vehicles, making regenerative solutions more viable. Manufacturers are turning to energy-harvesting technologies to support fuel economy and meet emissions standards while improving ride quality and system responsiveness.

The automotive sector is shifting toward energy recovery solutions, and regenerative shock absorbers are emerging as key components in achieving operational efficiency. These systems repurpose road energy into electrical output, lowering traditional energy dependency. Stricter global mandates for lower emissions and improved fuel economy are pushing OEMs to embrace energy-converting suspension technologies as part of their compliance strategies. In this evolving landscape, regenerative damping systems are gaining prominence across various vehicle classes and use cases.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $2.8 Billion |

| CAGR | 8.2% |

In 2024, passenger vehicles led the market with a 66.5% share and are forecast to grow at 8.5% CAGR through 2034. The widespread production and sales of passenger cars worldwide are a major force behind this trend. Consumers are increasingly favoring vehicles that offer smoother rides, superior handling, and better fuel efficiency. As a result, regenerative shock absorbers are being incorporated into both standard and high-end passenger vehicles. The rapid growth of electric and hybrid passenger models is further accelerating this trend, as automakers strive to enhance range and reduce environmental impact. Efforts by original equipment manufacturers to meet sustainability goals are encouraging the integration of electromagnetic and mechanical dampers. Continued R&D spending and supportive government initiatives are accelerating innovation and bolstering the adoption of regenerative suspension systems in this segment.

Electromagnetic regenerative shock absorbers held the largest market share in 2024, accounting for 44%, and are projected to grow at a CAGR of 8.3% during 2025-2034. These systems harness energy from road-induced motion using electromagnetic induction, generating electricity while minimizing mechanical drag. Their high efficiency and responsive design give them an edge over traditional hydraulic or mechanical systems. OEMs are adopting electromagnetic suspension for premium and electric models to maximize performance while achieving energy-saving benefits. As global preferences shift toward intelligent and efficient mobility solutions, this segment is seeing heightened interest and rapid expansion.

China Automotive Regenerative Shock Absorbers Market generated USD 362.7 million in 2024 and held a 69% share. The rapid uptake of electric vehicles, coupled with advancements in local suspension manufacturing, has positioned China as a key growth hub. Heavier EV battery designs are driving the need for advanced shock absorption solutions that improve handling and ride quality. China's robust automotive manufacturing ecosystem, along with substantial investments in domestic innovation and R&D, is bolstering the adoption of regenerative suspension systems. Government backing for electric mobility and industry transformation is further encouraging the development of lightweight and adaptive technologies. The country's strategic focus on performance and fuel economy is making it a significant contributor to global market expansion.

Key players shaping the Global Automotive Regenerative Shock Absorbers Market include ZF Friedrichshafen, SACHS, Trelleborg, Hitachi Astemo, KYB, Mando, Fox Factory, Endurance Technologies, ThyssenKrupp Bilstein, and BWI Group. To solidify their position in the automotive regenerative shock absorbers market, leading companies are focusing on innovation, sustainability, and strategic collaborations. Many are ramping up R&D investments to enhance electromagnetic and mechanical energy recovery systems that align with the shift to electrified mobility. Manufacturers are partnering with OEMs to integrate these technologies into next-generation electric and hybrid vehicles. Another major strategy includes geographic expansion into emerging EV markets through localized production units.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Technology

- 2.2.4 Suspension

- 2.2.5 Sales channel

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for electric and hybrid vehicles

- 3.2.1.2 Advancements in automotive technology

- 3.2.1.3 Integration with advanced driver assistance systems (ADAS)

- 3.2.1.4 Rising demand for comfort and safety

- 3.2.1.5 Potential for extended vehicle range

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Volatility in raw material prices

- 3.2.2.2 Intense competition

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with electric vehicles (EVs)

- 3.2.3.2 The rise in adoption of autonomous vehicles

- 3.2.3.3 Growing premium and luxury vehicle sales

- 3.2.3.4 R&D funding in advanced suspension systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($ Billion, units)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchbacks

- 5.2.2 Sedans

- 5.2.3 SUVs

- 5.3 Commercial vehicles

- 5.3.1 Light commercial vehicles (LCV)

- 5.3.2 Medium commercial vehicles (MCV)

- 5.3.3 Heavy commercial vehicles (HCV)

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($ Billion, Units)

- 6.1 Key trends

- 6.2 Electromagnetic

- 6.3 Hydraulic

- 6.4 Mechanical

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Suspension, 2021 - 2034 ($ Billion, Units)

- 7.1 Key trends

- 7.2 Active suspension

- 7.3 Semi-active suspension

Chapter 8 Market Estimates & Forecast, By Sales channel, 2021 - 2034 ($ Billion, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($ Billion, Units)

- 9.1 Key trends

- 9.2 Power supply to auxiliary systems

- 9.3 Battery charging (EVs)

- 9.4 Energy recovery for fuel efficiency

- 9.5 Autonomous vehicle systems

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 ADD Industry

- 11.2 AL-KO Vehicle Technology Group

- 11.3 BWI Group

- 11.4 Endurance Technologies

- 11.5 FOX Factory

- 11.6 Gabriel India

- 11.7 Hitachi Astemo

- 11.8 KONI

- 11.9 KYB

- 11.10 Magneti Marelli

- 11.11 Mando

- 11.12 Multimatic

- 11.13 Ohlins Racing

- 11.14 Ride Control

- 11.15 SACHS

- 11.16 Showa Corporation

- 11.17 Tenneco

- 11.18 Thyssenkrupp Bilstein

- 11.19 Trelleborg

- 11.20 ZF Friedrichshafen