|

市场调查报告书

商品编码

1766202

光疗设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Phototherapy Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

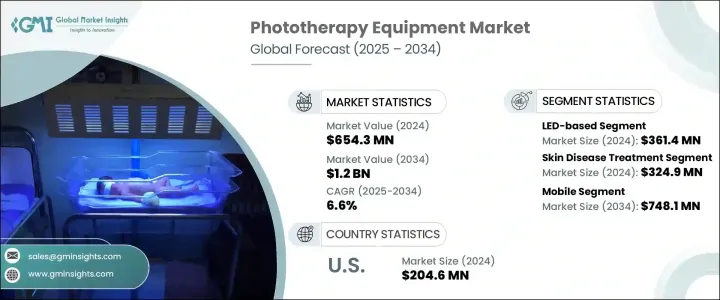

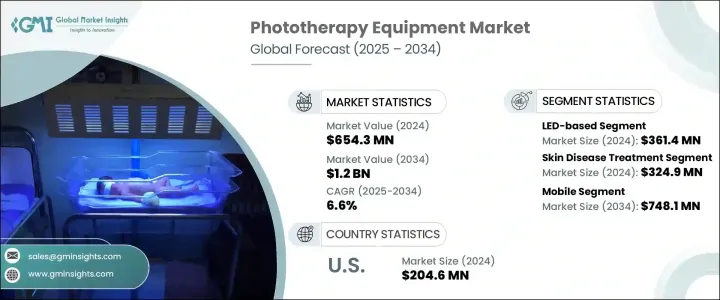

2024 年全球光疗设备市场价值为 6.543 亿美元,预计到 2034 年将以 6.6% 的复合年增长率成长,达到 12 亿美元。这一上升趋势主要受皮肤病患病率上升、新生儿黄疸发病率上升以及光疗技术的快速创新所推动。白斑症、牛皮癣、痤疮和湿疹等疾病越来越常见,增加了对光疗作为一种非侵入性治疗方法的依赖。医疗保健基础设施的不断发展,优先考虑改善新生儿和皮肤病的治疗,这促进了这些设备的广泛采用。光疗系统的进步,包括基于 LED 的技术、可穿戴解决方案和精确的波长传输,使这些治疗更安全、更有效,特别是透过最大限度地减少热暴露和提高用户舒适度。

使用特定波段(例如紫外线、红光或蓝光)的设备已显示出显着的治疗效果,它们能够触发靶向生物反应,例如分解新生儿的胆红素或减少慢性皮肤病的发炎。这些波长经过精心挑选,能够穿透皮肤的不同深度,从而在不损伤周围组织的情况下精准治疗特定疾病。紫外线尤其适用于治疗牛皮癣等自体免疫性皮肤病,因为它可以减缓皮肤细胞过度生长。红光以其抗炎特性而闻名,有助于组织修復并减少刺激,因此对湿疹和伤口癒合非常有用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6.543亿美元 |

| 预测值 | 12亿美元 |

| 复合年增长率 | 6.6% |

2024年,LED系统以3.614亿美元的估值领先市场。这些设备因其节能、低发热量和长使用寿命而备受青睐,尤其对新生儿安全。 LED系统在临床和家庭环境中的应用日益广泛,这主要归功于其便携性以及在治疗白斑、牛皮癣和痤疮等皮肤病方面取得的显着疗效。 LED解决方案能够提供可控、精准、均匀的光疗,且副作用极小,使其成为医疗保健提供者的首选。

预计到2034年,行动光疗设备市场规模将达到7.481亿美元。这些行动系统易于使用、操作灵活,并且相容于医疗机构和家庭治疗环境。它们在治疗新生儿黄疸方面具有显着的实用性,尤其是因为移动性可以提高治疗的可及性和效率。在皮肤科领域,这些便携式设备是门诊的理想选择,无需固定安装即可提供更有针对性的护理。随着越来越多的患者选择居家护理解决方案,由于成本节约和便利性,对行动光疗设备的需求持续成长。

2024年,美国光疗设备市场规模达2.046亿美元。美国凭藉其完善的医疗基础设施、高发生率的皮肤病发病率以及对新生儿治疗方案的持续关注,在光疗领域占据着稳固的地位。随着非侵入性治疗的偏好和认知度的提升,光纤系统和先进的LED灯等设备在医院和家庭护理中的应用日益广泛。因此,持续的医疗进步以及对患者舒适度和经济承受能力的日益重视,推动了美国光疗设备的需求。

积极影响光疗设备市场的关键参与者包括 SolRx、Ibis Medical、Natus、Neotech、PHOENIX、GE HealthCare、DAVID、UVBioTek、ATOM MEDICAL、MEDI WAVES、OKUMAN、Phothera、NARANG MEDICAL LIMITED 和 PHILIPS。为了提升影响力,光疗设备市场的公司正在大力投资产品创新,专注于 LED 技术、穿戴式光疗和提供个人化波长控制的系统。一些参与者正在扩大其全球分销网络,并与医院和诊所建立策略合作伙伴关係,以扩大客户群。此外,许多公司正在将物联网和数位监控功能整合到设备中,以支援远端护理并改善患者预后。行销工作强调非侵入性益处和临床成功,以吸引医疗服务提供者和最终用户。该公司也专注于紧凑型和家用型号,以满足对便利且经济高效的治疗解决方案日益增长的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 新生儿黄疸盛行率上升

- 日益严重的皮肤病

- 光疗设备的技术进步

- 政府对新生儿护理的支持倡议

- 产业陷阱与挑战

- 替代疗法的可用性

- 产品成本高,欠发达地区取得管道有限

- 机会

- 家庭医疗保健的兴起趋势

- 采用智慧光疗设备

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 按产品分類的价格趋势

- 未来市场趋势

- 报销场景

- 报销政策对市场成长的影响

- 消费者行为分析

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 世界其他地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 基于LED

- 传统的

- 光纤

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 皮肤病治疗

- 新生儿黄疸管理

- 其他应用

第七章:市场估计与预测:按模式,2021 年至 2034 年

- 主要趋势

- 移动的

- 固定的

- 穿戴

第八章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院和诊所

- 居家护理

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- ATOM MEDICAL

- DAVID

- GE HealthCare

- Ibis Medical

- MEDI WAVES

- NARANG MEDICAl LIMITED

- natus

- Neotech

- OKUMAN

- PHILIPS

- PHOENIX

- Phothera

- SolRx

- UVBioTek

The Global Phototherapy Equipment Market was valued at USD 654.3 million in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 1.2 billion by 2034. This upward trend is primarily driven by the increasing prevalence of skin-related ailments, rising incidences of neonatal jaundice, and rapid innovation in phototherapy technologies. Conditions like vitiligo, psoriasis, acne, and eczema are becoming more common, increasing the reliance on phototherapy as a non-invasive treatment method. The widespread adoption of these devices is reinforced by the growing healthcare infrastructure that prioritizes improved treatment for newborns and dermatological conditions. Advancements in phototherapy systems, including LED-based technology, wearable solutions, and precision wavelength delivery, have made these treatments safer and more effective, particularly by minimizing heat exposure and enhancing user comfort.

Devices using specific bands of light, such as UV, red, or blue, have shown significant therapeutic effects by triggering targeted biological responses, such as bilirubin breakdown in newborns or inflammation reduction in chronic skin diseases. These wavelengths are carefully selected to penetrate the skin at varying depths, allowing for precise treatment of specific conditions without damaging surrounding tissue. UV light is particularly effective in managing autoimmune skin disorders like psoriasis by slowing down excessive skin cell growth. Red light, known for its anti-inflammatory properties, supports tissue repair and reduces irritation, making it useful for eczema and wound healing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $654.3 Million |

| Forecast Value | $1.2 Billion |

| CAGR | 6.6% |

In 2024, LED-based systems led the market with a valuation of USD 361.4 million. These devices are favored for their energy efficiency, low heat output, and extended operational life, making them particularly safe for neonates. Their growing use in both clinical and home settings is largely due to their portability and proven outcomes in treating dermatological disorders like vitiligo, psoriasis, and acne. The ability to deliver controlled, precise, and uniform light therapy with minimal side effects is positioning LED-based solutions as a preferred choice among healthcare providers.

The mobile phototherapy device segment is projected to reach USD 748.1 million by 2034. These mobile systems offer ease of use, operational flexibility, and compatibility with both healthcare facilities and at-home treatment environments. Their utility in treating neonatal jaundice is significant, particularly because mobility enhances treatment accessibility and efficiency. In the field of dermatology, these portable units are ideal for outpatient clinics, enabling more targeted care without requiring fixed installations. As more patients opt for home-based care solutions, the demand for mobile phototherapy equipment continues to climb due to cost savings and convenience.

U.S. Phototherapy Equipment Market accounted for USD 204.6 million in 2024. The country maintains a strong foothold in the phototherapy space due to its well-developed healthcare infrastructure, high prevalence of skin conditions, and continued focus on neonatal treatment solutions. Devices such as fiber optic systems and advanced LED units are increasingly utilized in both hospital settings and home care, supported by a rise in non-invasive treatment preferences and heightened awareness. As a result, demand in the U.S. is fueled by consistent medical advancements and the growing emphasis on patient comfort and affordability.

Key players actively shaping the Phototherapy Equipment Market include SolRx, Ibis Medical, Natus, Neotech, PHOENIX, GE HealthCare, DAVID, UVBioTek, ATOM MEDICAL, MEDI WAVES, OKUMAN, Phothera, NARANG MEDICAL LIMITED, and PHILIPS. To enhance their presence, companies in the phototherapy equipment market are investing heavily in product innovation, focusing on LED technology, wearable light therapy, and systems offering personalized wavelength control. Several players are expanding their global distribution networks and entering strategic partnerships with hospitals and clinics to broaden their customer base. Additionally, many are integrating IoT and digital monitoring capabilities into devices to support remote care and improve patient outcomes. Marketing efforts emphasize non-invasive benefits and clinical success to attract both healthcare providers and end-users. Companies are also focusing on compact and home-use models to cater to the increasing demand for convenient and cost-effective therapy solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.2.4 Modality

- 2.2.5 End Use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of neonatal jaundice

- 3.2.1.2 Growing skin disorders

- 3.2.1.3 Technological advancements in phototherapy devices

- 3.2.1.4 Supportive government initiatives for newborn care

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Availability of alternative treatments

- 3.2.2.2 High product cost and limited accessibility in underdeveloped regions

- 3.2.3 Opportunities

- 3.2.3.1 Rising trend of home healthcare

- 3.2.3.2 Adoption of smart phototherapy devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends, by product

- 3.7 Future market trends

- 3.8 Reimbursement scenario

- 3.8.1 Impact of reimbursement policies on market growth

- 3.9 Consumer behaviour analysis

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Rest of the world

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 LED-based

- 5.3 Conventional

- 5.4 Fiberoptic

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Skin disease treatment

- 6.3 Neonatal jaundice management

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By Modality, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Mobile

- 7.3 Fixed

- 7.4 Wearable

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals and clinics

- 8.3 Homecare

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ATOM MEDICAL

- 10.2 DAVID

- 10.3 GE HealthCare

- 10.4 Ibis Medical

- 10.5 MEDI WAVES

- 10.6 NARANG MEDICAl LIMITED

- 10.7 natus

- 10.8 Neotech

- 10.9 OKUMAN

- 10.10 PHILIPS

- 10.11 PHOENIX

- 10.12 Phothera

- 10.13 SolRx

- 10.14 UVBioTek