|

市场调查报告书

商品编码

1766209

ELISpot 和 Fluorospot 检测市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测ELISpot and Fluorospot Assay Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

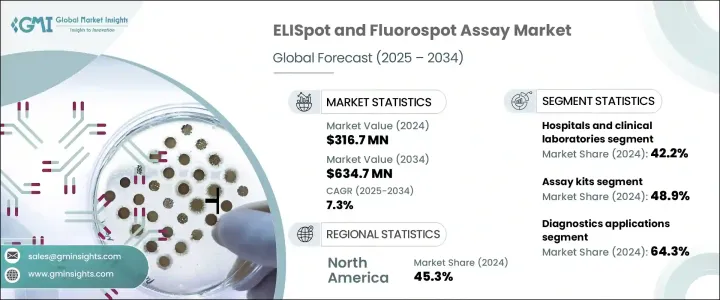

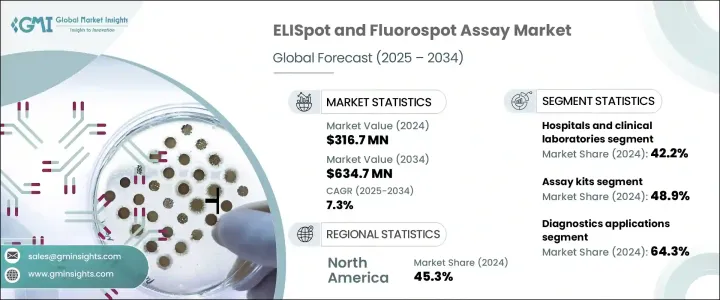

2024年,全球酵素连结免疫斑点 (ELISpot) 和萤光斑点 (Fluorospot) 检测市场规模达3.167亿美元,预计到2034年将以7.3%的复合年增长率成长,达到6.347亿美元。 ELISpot是目前最灵敏的技术之一,可用于检测细胞层面(尤其是T细胞或B细胞)的细胞激素或抗体分泌。萤光斑点检测是ELISpot的延伸,它使用萤光标记技术,可以同时检测单一细胞分泌的多种蛋白质。这两种检测方法都广泛用于临床研究、疫苗开发和临床研究中的免疫监测。传染病和免疫相关疾病的发生率不断上升,是这些检测需求成长的重要驱动因素。

这些检测在监测免疫反应中发挥着至关重要的作用,尤其是在针对传染病的疫苗接种工作、免疫疗法和疫苗研究中。结核病、癌症和新兴病毒感染等疾病的发生率不断上升,加剧了对先进免疫学检测的需求。 ELISpot 和 Fluorospot 系统以其高灵敏度、单细胞分辨率和多重分析能力而脱颖而出,使其成为临床和研究免疫学中不可或缺的工具。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3.167亿美元 |

| 预测值 | 6.347亿美元 |

| 复合年增长率 | 7.3% |

2024年,检测试剂盒领域占最大份额,达48.9%。这种优势可归因于标准化试剂盒的日益普及,这些试剂盒易于使用、可重复,且与细胞介导免疫研究框架相容。即用型试剂盒的便利性使其成为学术、临床和药物研究领域的首选。这些试剂盒因其在传染病、癌症免疫治疗和移植排斥监测中的作用而特别受欢迎。对细胞激素特异性检测的旺盛需求促进了这些检测方法的日益普及。此外,全球疾病负担的不断加重也持续推动对这些检测解决方案的需求。

诊断应用领域在2024年占最大份额,达64.3%。这主要归因于酶联免疫斑点(ELISpot)和萤光斑点(Fluorospot)检测在各种传染病(包括结核病、自体免疫疾病、癌症免疫疗法和其他发炎性疾病)诊断中的应用日益广泛。这些检测方法的高精度使其成为临床诊断中必不可少的工具,并使其成为精准医疗的关键工具。它们能够识别和监测免疫相关疾病的进展,进一步推动了市场成长。这一趋势凸显了这些检测方法在疾病诊断和管理中发挥的关键作用,巩固了它们在临床环境中的重要性。

亚太地区酵素连结免疫斑点 (ELISpot) 和萤光斑点 (Fluorospot) 检测市场预计将实现最高成长,2025 年至 2034 年的复合年增长率为 8%。推动这一增长的因素包括:医疗保健技术的日益普及、免疫学研究的大量投入,以及该地区结核病和病毒感染等传染病的日益普及。中国、印度和韩国等国家正迅速拥抱这些技术,这得益于其医疗保健意识的提升和完善的监管框架。生物製药产业的蓬勃发展和临床试验活动的增多,进一步推动了对 ELISpot 和萤光斑点检测等精准免疫监测工具的需求。

市场的主要参与者包括 Bio-Techne Corporation、BD、Mabtech、Oxford Immunotec、Bio-Connect、Cellular Technology、Abcam Limited、Stemcell Technologies、Autoimmun Diagnostika、Lophius Biosciences、GenScript Biotech、Merck、R&D Systems 和 U-CyTech。为了巩固市场地位,酶联免疫斑点 (ELISpot) 和萤光斑点 (Fluorospot) 检测市场的公司正致力于透过开发创新、灵敏度更高、准确度和分辨率更高的检测方法,扩大其产品范围。与学术机构、医疗保健提供者和製药公司的合作正成为推动这些检测方法广泛应用的关键策略。此外,该公司正在投资研发,以增强现有产品线并开发下一代检测方法。整合自动化、提高易用性和提供即用型试剂盒的努力,对于让更广泛的研究和临床使用者更容易获得这些检测方法也至关重要。此外,策略性的区域扩张,尤其是在亚太地区等新兴市场,使公司能够满足对先进诊断解决方案日益增长的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 慢性病和传染病发生率上升

- 早期疾病诊断意识不断增强

- 增加医疗支出和政府支持

- 产业陷阱与挑战

- 缺乏熟练的人员

- 严格的监管要求

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

- 专利分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 检测试剂盒

- 分析器

- 配套产品

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 研究应用

- 诊断应用程式

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院和临床实验室

- 学术和研究机构

- 生物製药公司

- 其他最终用途

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- BD

- Abcam Limited

- Autoimmun Diagnostika

- Bio-Connect

- Bio-Techne Corporation

- Cellular Technology

- GenScript Biotech

- Lophius Biosciences

- Mabtech

- Merck

- Oxford Immunotec

- R&D Systems

- Stemcell Technologies

- U-CyTech

The Global ELISpot and Fluorospot Assay Market was valued at USD 316.7 million in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 634.7 million by 2034. ELISpot is one of the most sensitive techniques available to detect cytokine or antibody secretion at the cellular level, specifically from T or B cells. The Fluorospot assay, an extension of the ELISpot, allows for the simultaneous detection of multiple proteins secreted from a single cell using fluorescent labeling. Both assays are widely used for immune monitoring in clinical research, vaccine development, and clinical studies. The rising prevalence of infectious and immune-related diseases is a significant driver for the increased demand for these assays.

These assays play a crucial role in monitoring immune responses, especially in vaccination efforts targeting infectious diseases, immunotherapies, and vaccine research. The growing incidence of diseases like tuberculosis, cancer, and emerging viral infections has intensified the need for advanced immunological assays. ELISpot and Fluorospot systems stand out for their high sensitivity, single-cell resolution, and multiplexing abilities, which make them invaluable tools in clinical and research immunology.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $316.7 Million |

| Forecast Value | $634.7 Million |

| CAGR | 7.3% |

In 2024, the assay kits segment held the largest share of 48.9%. This dominance can be attributed to the growing adoption of standardized kits that are easy to use, reproducible, and compatible with cell-mediated immunity research frameworks. The convenience of ready-to-use kits makes them a preferred choice in academic, clinical, and pharmaceutical research settings. These kits are particularly popular for their role in infectious disease, cancer immunotherapy, and transplant rejection monitoring. The high demand for cytokine-specific detection has contributed to the growing adoption of these assays. Furthermore, the increasing global burden of diseases continues to drive the need for these assay solutions.

The diagnostics application segment held the largest share 64.3% in 2024. This is primarily due to the increasing use of ELISpot and Fluorospot assays in the diagnosis of various infectious diseases, including tuberculosis, autoimmune disorders, cancer immunotherapy, and other inflammatory conditions. The assays' high accuracy makes them essential in clinical diagnostics, positioning them as key tools in precision medicine. Their ability to identify and monitor the progression of immune-related disorders further propels market growth. This trend highlights the critical role these assays play in both the diagnosis and management of diseases, cementing their importance in clinical settings.

Asia Pacific ELISpot and Fluorospot Assay Market is expected to witness the highest growth, with a CAGR of 8% from 2025 to 2034. The growth is driven by the rising adoption of healthcare technologies, significant investments in immunological research, and the increasing prevalence of infectious diseases such as tuberculosis and viral infections in the region. Countries like China, India, and South Korea are rapidly embracing these technologies, aided by heightened healthcare awareness and favorable regulatory frameworks. The growing biopharmaceutical industry and an increase in clinical trial activity are further contributing to the demand for precise immune surveillance tools like ELISpot and Fluorospot assays.

The market features major participants including Bio-Techne Corporation, BD, Mabtech, Oxford Immunotec, Bio-Connect, Cellular Technology, Abcam Limited, Stemcell Technologies, Autoimmun Diagnostika, Lophius Biosciences, GenScript Biotech, Merck, R&D Systems, U-CyTech. To strengthen their market position, companies in the ELISpot and Fluorospot assay market are focusing on expanding their product offerings by developing innovative and more sensitive assays that provide higher accuracy and resolution. Partnerships and collaborations with academic institutions, healthcare providers, and pharmaceutical companies are becoming a key strategy to promote the widespread adoption of these assays. Additionally, companies are investing in research and development to enhance their existing product lines and create next-generation assays. Efforts to integrate automation, improve ease of use, and offer ready-to-use kits are also crucial in making these assays more accessible to a wider range of research and clinical users. Moreover, strategic regional expansion, particularly in emerging markets like Asia Pacific, is enabling companies to tap into the growing demand for advanced diagnostic solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of chronic and infectious diseases

- 3.2.1.2 Growing awareness of early disease diagnosis

- 3.2.1.3 Increasing healthcare spending and government support

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of skilled personnel

- 3.2.2.2 Stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Patent Analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Assay kits

- 5.3 Analyzers

- 5.4 Ancillary products

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Research applications

- 6.3 Diagnostics applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals and clinical laboratories

- 7.3 Academic and research institutions

- 7.4 Biopharmaceutical companies

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 BD

- 9.2 Abcam Limited

- 9.3 Autoimmun Diagnostika

- 9.4 Bio-Connect

- 9.5 Bio-Techne Corporation

- 9.6 Cellular Technology

- 9.7 GenScript Biotech

- 9.8 Lophius Biosciences

- 9.9 Mabtech

- 9.10 Merck

- 9.11 Oxford Immunotec

- 9.12 R&D Systems

- 9.13 Stemcell Technologies

- 9.14 U-CyTech