|

市场调查报告书

商品编码

1766210

支气管炎治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Bronchitis Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

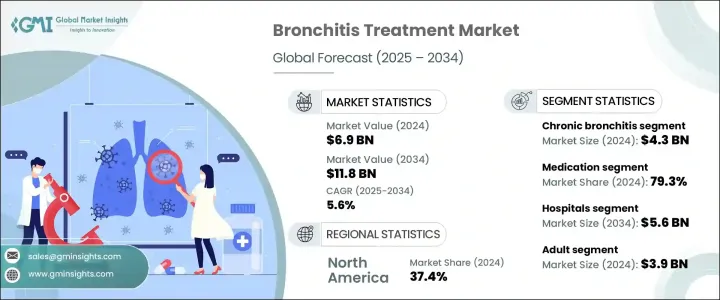

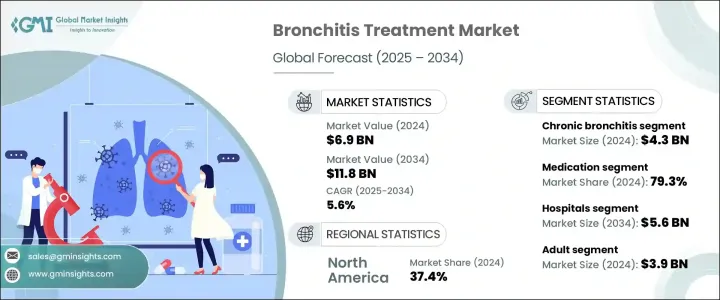

2024年,全球支气管炎治疗市场规模达69亿美元,预计2034年将以5.6%的复合年增长率成长,达到118亿美元。这一增长主要源于呼吸系统疾病负担的增加,主要原因是吸烟、接触环境污染物、职业危害以及反覆出现的病毒感染。急性支气管炎通常与流感和呼吸道合胞病毒等季节性病毒有关,如今发生率越来越高,尤其是在寒冷的月份。呼吸系统疾病的增加推高了对有效支气管炎疗法的需求,从而推动了市场表现的提升,并促进了全球治疗模式的创新。

全球人口老化显着增加了对支气管炎相关药物和疗法的需求。由于免疫力下降和肺功能减弱,老年人更容易罹患慢性呼吸系统疾病。随着65岁及以上老年人口的不断增长,支气管扩张剂、抗发炎药物和其他吸入治疗药物的消耗量也不断增加。支气管炎是指支气管的炎症,通常透过缓解呼吸道发炎、稀释粘液、止咳和改善呼吸功能来治疗。大多数患者需要药物治疗,例如支气管扩张剂、祛痰药和抗发炎药物。在病情较为严重的情况下,可以引入氧气治疗来帮助患者有效地控制呼吸。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 69亿美元 |

| 预测值 | 118亿美元 |

| 复合年增长率 | 5.6% |

2024年,慢性支气管炎细分市场收入达43亿美元。由于慢性支气管炎具有持续性和长期性,需要持续的医疗监督和复杂的治疗策略,该细分市场将继续成长。与急性支气管炎的短暂性不同,慢性支气管炎需要持续管理,并且经常与慢性阻塞性肺病 (COPD) 等疾病重迭,这进一步增加了对持续护理的需求。随着全球老化人口的增长,长期呼吸系统疾病的病例也在增加,这推动了对慢性支气管炎治疗的额外需求。

2024年,药物领域占了79.3%的主导份额。此类别包括广泛使用的药物,例如支气管扩张剂、止咳药、黏液活性剂和其他治疗药物。这些药物对于控制急性和慢性支气管炎症状至关重要。止咳药和祛痰药常用于控制持续性咳嗽并帮助排出呼吸道中多余的黏液-这是支气管炎患者最常见且最令人不适的两种症状。由于其在症状控制方面已被证实有效,以及药物输送系统的持续创新(包括长效製剂和吸入剂型),该领域持续蓬勃发展,从而提高了患者的依从性和治疗效果。

2024年,美国支气管炎治疗市场规模达23亿美元,成为全球成长的关键贡献者。人口对呼吸系统疾病的易感性日益增加是主要的成长动力。随着人口稠密的城市地区越来越多的人接触过敏原和污染,支气管炎的诊断数量持续攀升。此外,美国拥有强大的医疗基础设施、更广泛的保险覆盖范围以及强化的公共卫生运动,所有这些都提高了治疗的可及性。美国成熟的製药业务以及持续的产品开发,进一步巩固了其在全球支气管炎治疗领域的地位。

全球支气管炎治疗市场的主要参与者包括 Sunovion Pharma、Glenmark、Lupin、3M Pharmaceuticals、辉瑞、赛诺菲、利洁时、雷迪博士实验室、勃林格殷格翰、强生、Teva Pharmaceuticals、葛兰素史克、Aurobindo Pharmauticals 和默克。在支气管炎治疗市场运作的公司正在采取多管齐下的方法来提升市场占有率。主要参与者正在大力投资研发缓释製剂、吸入疗法和药物组合,以改善患者预后和依从性。正在寻求战略合作伙伴关係和许可协议,以扩大产品线和地理覆盖范围。鑑于老龄人口的成长,许多公司正在加大对慢性支气管炎解决方案的关注。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 增加医疗服务

- 呼吸系统疾病盛行率不断上升

- 药物开发和治疗方案的进步

- 产业陷阱与挑战

- 药物依从性问题

- 替代药物的可用性

- 市场机会

- 空气污染和吸烟率上升

- 非处方药供应不断扩大,自我药疗趋势日益增强

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 未来市场趋势

- 管道分析

- 定价分析

- 消费者行为分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

第五章:市场估计与预测:按疾病类型,2021 - 2034 年

- 主要趋势

- 急性支气管炎

- 慢性支气管炎

第六章:市场估计与预测:依治疗方式,2021 - 2034 年

- 主要趋势

- 药物

- 依药物类型

- 止咳药

- 支气管扩张剂

- 黏液活性剂

- 其他药物

- 按类型

- 处方

- 场外交易(OTC)

- 依给药途径

- 口服

- 鼻腔

- 注射剂

- 依药物类型

- 氧气治疗

第七章:市场估计与预测:按年龄组,2021 - 2034 年

- 主要趋势

- 儿科

- 成人

- 老年

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 诊所

- 居家照护环境

- 其他最终用途

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- 3M pharmaceuticals

- Aurobindo Pharma

- Boehringer Ingelheim

- Dr. Reddy's Laboratories

- GlaxoSmithKline

- Glenmark

- Johnson & Johnson

- Lupin

- Merck

- Macleods Pharmaceuticals

- Pfizer

- Reckitt Benckiser

- Sunovion Pharma

- Sanofi

- Teva Pharmaceuticals

The Global Bronchitis Treatment Market was valued at USD 6.9 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 11.8 billion by 2034. This growth is being driven by an increasing burden of respiratory conditions, mainly due to smoking, exposure to environmental pollutants, occupational hazards, and recurring viral infections. Acute bronchitis, typically linked with seasonal viruses like influenza and RSV, is becoming more frequent, especially during colder months. This rise in respiratory illnesses is pushing up demand for effective bronchitis therapies, leading to stronger market performance and innovation in treatment modalities worldwide.

An aging global population is significantly boosting demand for bronchitis-related medications and therapies. Older adults are more likely to develop chronic respiratory conditions because of weakened immunity and diminished lung function. As the demographic aged 65 and over continues to expand, so does the consumption of bronchodilators, anti-inflammatory drugs, and other inhaled treatments. Bronchitis, defined as inflammation of the bronchial tubes, is typically treated by relieving airway inflammation, loosening mucus, calming cough, and improving breathing capacity. Most patients require drug-based therapies like bronchodilators, expectorants, and anti-inflammatories. In more severe cases, oxygen therapy is introduced to help patients manage their breathing effectively.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.9 Billion |

| Forecast Value | $11.8 Billion |

| CAGR | 5.6% |

In 2024, chronic bronchitis segment generated USD 4.3 billion. This segment continues to grow due to the persistent and long-term nature of chronic bronchitis, which requires consistent medical supervision and complex therapeutic strategies. Unlike the short-lived nature of acute bronchitis, chronic bronchitis demands ongoing management and frequently overlaps with conditions such as chronic obstructive pulmonary disease (COPD), further escalating the need for continuous care. As older populations rise globally, cases of long-term respiratory disease are also on the rise, driving additional demand for chronic bronchitis treatment.

The medication segment held a commanding 79.3% share in 2024. This category includes widely used drugs such as bronchodilators, cough suppressants, mucoactive agents, and other therapeutic drugs. These treatments are essential for managing both acute and chronic bronchitis symptoms. Cough suppressants and expectorants are prescribed frequently to manage persistent coughing and help expel excess mucus from the airways-two of the most common and discomforting symptoms for bronchitis patients. The segment continues to thrive due to its proven effectiveness in symptom control and ongoing innovations in drug delivery systems, including long-acting formulations and inhalable formats, which improve patient adherence and therapeutic outcomes.

United States Bronchitis Treatment Market reached USD 2.3 billion in 2024, making it a key contributor to global growth. The increasing susceptibility of the population to respiratory illnesses is a primary growth driver. With more people exposed to allergens and pollution in dense urban areas, the number of bronchitis diagnoses continues to climb. Additionally, the country benefits from strong healthcare infrastructure, wider insurance coverage, and enhanced public health campaigns, all of which improve access to treatment. A well-established pharmaceutical presence, along with continual product development, is further solidifying the US market's position in the global bronchitis treatment landscape.

Major players in the Global Bronchitis Treatment Market include Sunovion Pharma, Glenmark, Lupin, 3M Pharmaceuticals, Pfizer, Sanofi, Reckitt Benckiser, Dr. Reddy's Laboratories, Boehringer Ingelheim, Johnson & Johnson, Teva Pharmaceuticals, GlaxoSmithKline, Aurobindo Pharma, Macleods Pharmaceuticals, and Merck. Companies operating in the bronchitis treatment market are adopting a multi-pronged approach to enhance market presence. Key players are heavily investing in R&D to develop extended-release formulations, inhalable therapies, and drug combinations that improve patient outcomes and compliance. Strategic partnerships and licensing agreements are being pursued to expand product pipelines and geographic reach. Many firms are increasing their focus on chronic bronchitis solutions, given the growing elderly population.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Disease type

- 2.2.3 Treatment

- 2.2.4 Age group

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increased health access

- 3.2.1.2 Increasing prevalence of respiratory diseases

- 3.2.1.3 Advancement in drug developments and treatment options

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Drug compliance issues

- 3.2.2.2 Availability of alternative medicines

- 3.2.3 Market opportunities

- 3.2.3.1 Increase in air pollution and smoking rates

- 3.2.3.2 Expanding over-the-counter availability and increasing trend of self-medications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Future market trends

- 3.6 Pipeline analysis

- 3.7 Pricing analysis

- 3.8 Consumer behaviour analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnership and collaborations

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Disease Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Acute bronchitis

- 5.3 Chronic bronchitis

Chapter 6 Market Estimates and Forecast, By Treatment, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Medication

- 6.2.1 By drug type

- 6.2.1.1 Cough suppressants

- 6.2.1.2 Bronchodilators

- 6.2.1.3 Mucoactive agents

- 6.2.1.4 Other drugs

- 6.2.2 By type

- 6.2.2.1 Prescription

- 6.2.2.2 Over-the-counter (OTC)

- 6.2.3 By route of administration

- 6.2.3.1 Oral

- 6.2.3.2 Nasal

- 6.2.3.3 Injectable

- 6.2.1 By drug type

- 6.3 Oxygen therapy

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pediatric

- 7.3 Adult

- 7.4 Geriatric

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Clinics

- 8.4 Homecare settings

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 3M pharmaceuticals

- 10.2 Aurobindo Pharma

- 10.3 Boehringer Ingelheim

- 10.4 Dr. Reddy’s Laboratories

- 10.5 GlaxoSmithKline

- 10.6 Glenmark

- 10.7 Johnson & Johnson

- 10.8 Lupin

- 10.9 Merck

- 10.10 Macleods Pharmaceuticals

- 10.11 Pfizer

- 10.12 Reckitt Benckiser

- 10.13 Sunovion Pharma

- 10.14 Sanofi

- 10.15 Teva Pharmaceuticals