|

市场调查报告书

商品编码

1766211

超高温陶瓷(UHTC)市场机会、成长动力、产业趋势分析及2025-2034年预测Ultra-High Temperature Ceramics (UHTCs) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

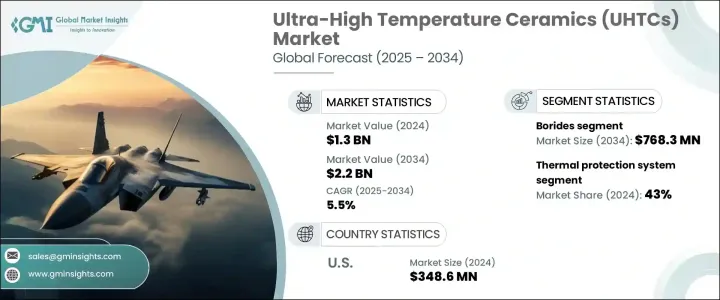

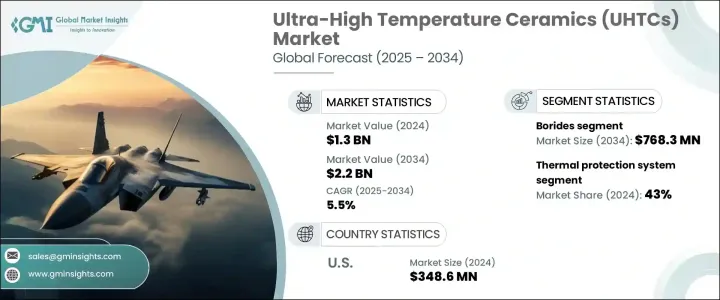

2024 年全球超高温陶瓷市场价值为 13 亿美元,预计到 2034 年将以 5.5% 的复合年增长率成长,达到 22 亿美元。该领域的成长主要得益于国防、航太、汽车和能源领域的技术进步,这些领域越来越需要能够在极端热和机械条件下工作的材料。 UHTC 的设计可承受超过 3000°C 的温度,这使其成为传统材料失效环境中的必需品。这些陶瓷目前在提高能源效率和实现高温系统的永续发展目标方面发挥关键作用。它们在先进推进系统、高速飞行系统和下一代热防护应用中的应用正在不断扩展。

随着各行各业转向注重性能和减排的创新,对超高温热塑材料 (UHTC) 的需求持续攀升。在不断突破技术界限、要求卓越耐久性的高性能领域,超高温热塑材料的重要性日益凸显。此外,全球军事战略的不断发展以及对太空探索的日益关注,也加速了对耐热材料的需求。随着各工业领域(尤其是在美国)投资的不断增加,超高温热塑材料在需要抗氧化、抗热衝击和抗机械应力的应用中变得不可或缺。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 13亿美元 |

| 预测值 | 22亿美元 |

| 复合年增长率 | 5.5% |

硼化物细分市场在2024年的营收为4.561亿美元,预计到2034年将成长至7.683亿美元。该类别凭藉其卓越的导热性、卓越的抗氧化性和超高的熔点,依然占据主导地位,是性能要求极高的应用的理想之选。在超高温热电材料(UHTC)中,硼化物因其能够承受的机械负荷和高温远超标准陶瓷,在极端环境下尤其重要。这些特性使其成为推进系统和隔热层(可靠性至关重要)的首选材料。

热防护系统领域占43%的份额,仍是领先的应用领域。对能够在极端恶劣环境下(例如高超音速飞行或太空任务)保持结构和热完整性的材料的需求日益增长,这推动了该领域对超高温热材料(UHTC)的需求。它们能够在持续的气动应力、强烈的摩擦热和快速的大气转变下保持性能,使其成为需要绝对热控制的系统不可或缺的材料。随着太空和国防技术创新的加速,对高耐热性和机械弹性材料的需求也激增。

2024年,美国超高温陶瓷 (UHTC) 市场规模达3.486亿美元。强劲成长源自于对先进国防系统、太空技术和能源应用的大量投资,这些领域高度依赖耐高温材料。美国积极推进军事能力和太空计画的现代化,加剧了对超耐高温材料的依赖。鑑于对下一代推进系统和国防战略的日益关注,美国超高温陶瓷市场预计将保持稳定成长动能。

为全球超高温陶瓷 (UTHC) 市场做出贡献的关键公司包括劳斯莱斯、精密陶瓷、洛克希德马丁公司、圣戈班和先进陶瓷製造公司。这些行业领导者正透过有针对性的研发投资来巩固其市场地位,旨在开发具有更高断裂韧性和更长使用寿命等增强性能的超高温陶瓷 (UTHC)。与航太和国防组织的策略合作,使其能够进行定製材料开发并将其整合到关键系统中。为了满足日益增长的需求,各公司也在扩大产能并追求先进的製造技术。透过实现应用多元化并确保严格的品质控制,这些公司正在为在这一不断发展的领域保持长期领先地位做好准备。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计资料(HS 编码)(註:仅提供主要国家的贸易统计数据

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场规模及预测:依材料类型,2021-2034

- 主要趋势

- 硼化物

- 二硼化锆(ZrB?)

- 二硼化铪(HfB?)

- 二硼化钽(TaB?)

- 二硼化钛(TiB?)

- 其他硼化物

- 碳化物

- 碳化锆(ZrC)

- 碳化铪(HfC)

- 碳化钽(TaC)

- 碳化钛(TiC)

- 碳化硅(SiC)

- 其他碳化物

- 氮化物

- 氮化铪(HfN)

- 氮化锆(ZrN)

- 氮化钽(TaN)

- 氮化硅(Si?N?)

- 其他氮化物

- 复合系统

- 硼化物基复合材料

- 碳化物基复合材料

- 氮化物基复合材料

- 其他复合系统

- 其他材料类型

第六章:市场规模及预测:依产品形式,2021-2034

- 主要趋势

- 粉末

- 散装组件

- 单体组件

- 复合组件

- 涂料

- 热障涂层

- 抗氧化涂层

- 耐腐蚀涂层

- 其他涂层类型

- 纤维和晶须

- 其他产品形式

第七章:市场规模及预测:依製造方法,2021-2034

- 主要趋势

- 热压

- 放电等离子烧结(SPS)

- 反应热压

- 无压烧结

- 化学气相沉积(CVD)

- 增材製造

- 其他製造方法

第 8 章:市场规模与预测:按应用,2021-2034 年

- 主要趋势

- 热保护系统

- 高超音速飞行器前缘

- 再入飞行器隔热板

- 火箭喷嘴喉口

- 燃烧室衬套

- 其他热保护应用

- 推进系统

- 火箭发动机部件

- 燃气涡轮机部件

- 超燃冲压发动机组件

- 其他推进应用

- 高温感测器和仪器

- 切削刀具及耐磨部件

- 炉元件和坩埚

- 核应用

- 其他应用

第九章:市场规模及预测:依最终用途产业,2021-2034

- 主要趋势

- 航太与国防

- 军事航太

- 民用航太

- 太空探索

- 飞弹系统

- 其他航太和国防应用

- 工业的

- 金属加工

- 玻璃製造

- 化学加工

- 其他工业应用

- 活力

- 核能

- 化石燃料发电

- 其他能源应用

- 电子和半导体

- 研究与学术

- 其他最终用途产业

第 10 章:市场规模与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 中东和非洲其他地区

第 11 章:公司简介

- Lockheed Martin Corporation

- Rolls-Royce

- Ultramet

- BAE Systems

- 3M Company

- CoorsTek

- Morgan Advanced Materials

- Kennametal

- Aremco Products

- Advanced Ceramics Manufacturing

- Precision Ceramics USA

- Kyocera Corporation

- Saint-Gobain

The Global Ultra-High Temperature Ceramics Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 2.2 billion by 2034. Growth in this sector is largely driven by technological advancements in defense, aerospace, automotive, and energy, which increasingly require materials capable of operating under extreme thermal and mechanical conditions. UHTCs are engineered to withstand temperatures exceeding 3000°C, making them essential in environments where conventional materials fail. These ceramics are now playing a pivotal role in enhancing energy efficiency and meeting sustainability goals in high-heat systems. Their use is expanding in advanced propulsion, high-speed flight systems, and next-gen thermal protection applications.

As industries shift towards performance-focused and emission-reducing innovations, demand for UHTCs continues to climb. Their importance is magnified in high-performance sectors pushing technological boundaries and requiring unmatched durability. In addition, evolving global military strategies and a greater focus on space exploration are accelerating the need for thermally resilient materials. With escalating investments across industrial verticals, particularly in the US, UHTCs are becoming indispensable in applications that demand resistance to oxidation, thermal shock, and mechanical stress.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $2.2 Billion |

| CAGR | 5.5% |

The Borides segment generated USD 456.1 million in 2024 and is expected to grow to USD 768.3 million by 2034. This category remains dominant due to its superior thermal conductivity, exceptional oxidation resistance, and ultra-high melting points, making it ideal for applications that demand the highest levels of performance. Among UHTCs, borides are specifically valued in extreme environments due to their capacity to endure mechanical loads and temperatures well beyond what standard ceramics can tolerate. These attributes make them the preferred material class in propulsion systems and thermal barriers where reliability is critical.

The thermal protection systems segment accounted for 43% share, remaining the leading application segment. The increasing need for materials that can maintain structural and thermal integrity in extremely harsh environments, such as during hypersonic travel or space-bound missions, is fueling demand for UHTCs in this segment. Their ability to perform under sustained aerodynamic stress, intense frictional heat, and rapid atmospheric transitions makes them indispensable for systems requiring absolute thermal control. As innovation accelerates in space and defense technologies, demand for materials with high heat tolerance and mechanical resilience is surging.

United States Ultra-High Temperature Ceramics (UHTCs) Market generated USD 348.6 million in 2024. This strong presence is driven by significant investments in advanced defense systems, space technology, and energy applications that rely heavily on materials capable of performing at elevated temperatures. The country's aggressive push to modernize military capabilities and space initiatives is increasing reliance on ultra-durable materials. Given the rising focus on next-generation propulsion and national defense strategies, the market for UHTCs in the US is expected to maintain steady momentum.

Key companies contributing to the Global Ultra-High Temperature Ceramics (UTHCs) Market include Rolls-Royce, Precision Ceramics, Lockheed Martin Corporation, Saint-Gobain, and Advanced Ceramics Manufacturing. These industry leaders are strengthening their market positions through targeted investments in R&D, aiming to develop UHTCs with enhanced properties such as higher fracture toughness and longer service life. Strategic collaborations with aerospace and defense organizations allow for customized material development and integration into critical systems. Firms are also scaling production capacities and pursuing advanced manufacturing techniques to meet growing demand. By diversifying applications and ensuring stringent quality control, these companies are positioning themselves for long-term leadership in this evolving field.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material type

- 2.2.3 Product form

- 2.2.4 Manufacturing method

- 2.2.5 Application

- 2.2.6 End use Industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Size and Forecast, By Material Type, 2021-2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 Borides

- 5.2.1 Zirconium diboride (ZrB?)

- 5.2.2 Hafnium diboride (HfB?)

- 5.2.3 Tantalum diboride (TaB?)

- 5.2.4 Titanium diboride (TiB?)

- 5.2.5 Other borides

- 5.3 Carbides

- 5.3.1 Zirconium carbide (ZrC)

- 5.3.2 Hafnium carbide (HfC)

- 5.3.3 Tantalum carbide (TaC)

- 5.3.4 Titanium carbide (TiC)

- 5.3.5 Silicon carbide (SiC)

- 5.3.6 Other carbides

- 5.4 Nitrides

- 5.4.1 Hafnium nitride (HfN)

- 5.4.2 Zirconium nitride (ZrN)

- 5.4.3 Tantalum nitride (TaN)

- 5.4.4 Silicon nitride (Si?N?)

- 5.4.5 Other nitrides

- 5.5 Composite systems

- 5.5.1 Boride-based composites

- 5.5.2 Carbide-based composites

- 5.5.3 Nitride-based composites

- 5.5.4 Other composite systems

- 5.6 Other material types

Chapter 6 Market Size and Forecast, By Product Form, 2021-2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Powders

- 6.3 Bulk components

- 6.3.1 Monolithic components

- 6.3.2 Composite components

- 6.4 Coatings

- 6.4.1 Thermal barrier coatings

- 6.4.2 Oxidation-resistant coatings

- 6.4.3 Erosion-resistant coatings

- 6.4.4 Other coating types

- 6.5 Fibers & whiskers

- 6.6 Other product forms

Chapter 7 Market Size and Forecast, By Manufacturing Method, 2021-2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Hot pressing

- 7.3 Spark plasma sintering (SPS)

- 7.4 Reactive hot pressing

- 7.5 Pressureless sintering

- 7.6 Chemical vapor deposition (CVD)

- 7.7 Additive manufacturing

- 7.8 Other manufacturing methods

Chapter 8 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.2 Thermal protection systems

- 8.2.1 Hypersonic vehicle leading edges

- 8.2.2 Reentry vehicle heat shields

- 8.2.3 Rocket nozzle throats

- 8.2.4 Combustion chamber liners

- 8.2.5 Other thermal protection applications

- 8.3 Propulsion systems

- 8.3.1 Rocket engine components

- 8.3.2 Gas turbine components

- 8.3.3 Scramjet components

- 8.3.4 Other propulsion applications

- 8.4 High-temperature sensors & instrumentation

- 8.5 Cutting tools & wear-resistant components

- 8.6 Furnace elements & crucibles

- 8.7 Nuclear applications

- 8.8 Other applications

Chapter 9 Market Size and Forecast, By End Use Industry, 2021-2034 (USD Billion) (Tons)

- 9.1 Key trends

- 9.2 Aerospace & defense

- 9.2.1 Military aerospace

- 9.2.2 Civil aerospace

- 9.2.3 Space exploration

- 9.2.4 Missile systems

- 9.2.5 Other aerospace & defense applications

- 9.3 Industrial

- 9.3.1 Metal processing

- 9.3.2 Glass manufacturing

- 9.3.3 Chemical processing

- 9.3.4 Other industrial applications

- 9.4 Energy

- 9.4.1 Nuclear energy

- 9.4.2 Fossil fuel power generation

- 9.4.3 Other energy applications

- 9.5 Electronics & semiconductor

- 9.6 Research & academia

- 9.7 Other end use industries

Chapter 10 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Rest of Middle East & Africa

Chapter 11 Company Profiles

- 11.1 Lockheed Martin Corporation

- 11.2 Rolls-Royce

- 11.3 Ultramet

- 11.4 BAE Systems

- 11.5 3M Company

- 11.6 CoorsTek

- 11.7 Morgan Advanced Materials

- 11.8 Kennametal

- 11.9 Aremco Products

- 11.10 Advanced Ceramics Manufacturing

- 11.11 Precision Ceramics USA

- 11.12 Kyocera Corporation

- 11.13 Saint-Gobain