|

市场调查报告书

商品编码

1766226

血管通路设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Vascular Access Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

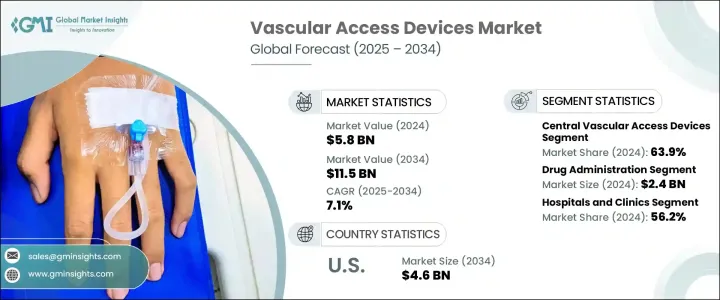

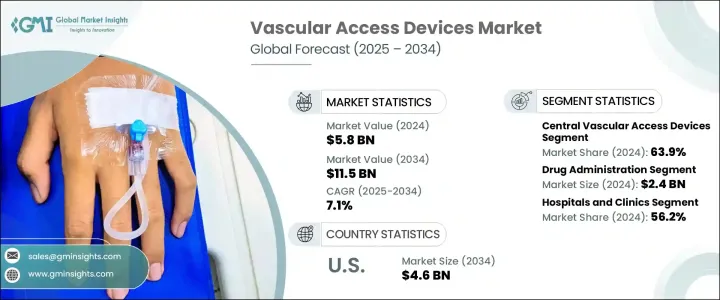

2024年,全球血管通路器械市场规模达58亿美元,预计2034年将以7.1%的复合年增长率成长,达到115亿美元。由于需要长期或反覆静脉注射治疗的慢性疾病负担日益加重,这些器械的需求也随之增长。在整个医疗保健领域,接受重症治疗的患者通常需要持续的药物传递、营养支持或液体管理,这需要可靠的血管通路解决方案。

在临床环境中,血管通路设备对于输送药物、抽血、输液以及执行其他关键操作至关重要。随着需要重症监护、外科手术和专科治疗的患者数量不断增加,其角色也变得更加重要。随着发展中国家医疗保健体系的扩展以及成熟市场的技术升级,无论是在急性护理环境中还是非急性护理环境中,对血管通路设备的需求都在持续增长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 58亿美元 |

| 预测值 | 115亿美元 |

| 复合年增长率 | 7.1% |

这些设备专为提供直接且高效的血流路径而设计,可用于多种治疗。它们广泛应用于外科手术等短期治疗,以及透析或化疗等长期治疗。随着医疗保健模式转向门诊和居家照护模式转变,这些设备在院外的使用也日益受到关注。设备材料和设计的创新有助于提高安全性,最大限度地减少感染和血栓等併发症,并提高医务人员的易用性。因此,血管通路设备已成为现代医疗保健服务不可或缺的一部分,确保病人安全和手术效率。

市场分为週边血管通路和中心血管通路。 2024年,中心血管通路占据主导地位,占市场总收入的63.9%。这些器械通常在需要持续或重复静脉治疗的情况下更受欢迎,尤其是在复杂的治疗方案中。它们能够长时间保持原位并将药物直接输送到大静脉,因此特别适合长期应用。在各种中心血管通路选择中,週边插入中心导管、隧道导管和植入式输液港等器械因其较低的插入频率和更高的患者舒适度而被广泛使用。

该领域的最新进展推动了血管器械的开发,其抗菌性能和抗凝血特性均有所提升。这些产品升级旨在最大限度地降低长期使用相关的风险,例如导管相关血流感染,并提高器械的可靠性。此外,影像技术与置入技术的融合使置入更加精准和安全,有助于提高治疗方案的整体效率。

从应用角度来看,药物管理占了最高的收入,到2024年将达到24亿美元。由于慢性病患者对持续输液治疗的需求日益增长,该领域将继续蓬勃发展。包括抗生素、生物製剂和免疫疗法在内的药物通常需要长时间的静脉通路,这使得血管通路设备不可或缺。随着医疗机构越来越多地支持家庭输液服务和门诊治疗以降低住院成本,血管通路工具在家庭护理环境中也变得越来越普遍。

市场也按最终用户细分,包括医院和诊所、门诊手术中心、家庭护理机构等。医院和诊所成为领先细分市场,2024 年的市占率为 56.2%。手术量的持续成长,以及急慢性病患者流量的增加,使得这些机构对血管器械的需求持续强劲。这些机构通常使用周边静脉输液进行常规手术,并使用中心静脉导管满足更复杂的治疗需求。感染预防和合规性是至关重要的考量,促使医院投资采用封闭系统设计和抗菌材料的先进通路器械。

从区域来看,北美市场占据主导地位,2024 年市场收入达 26 亿美元,预计未来十年复合年增长率将达到 7%。在北美地区,美国血管通路器械市场预计将从 2024 年的 23 亿美元成长至 2034 年的 46 亿美元。长期健康状况的日益增长,加上患者转向门诊治疗和居家治疗,推动了市场的持续扩张。在医疗服务提供者追求高品质治疗结果和以患者为中心的解决方案的推动下,对有效、耐用且更安全的血管通路方案的需求仍然旺盛。

市场竞争格局涵盖了专注于创新和产品性能的知名产业参与者。 2024年,像碧迪医疗、泰利福、贝朗、美敦力和费森尤斯医疗这样的公司共占据了全球约60%的市场。市场动态在很大程度上受到产品技术进步和成本考量的影响,尤其是在价格敏感的地区。跨国公司往往面临在价格承受能力和品质之间取得平衡的压力,而本土製造商则将自己定位为提供经济高效且合规的替代方案的供应商。在未来几年,这种创新与可近性之间的平衡仍将是血管通路器械市场的决定性特征。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 慢性病盛行率不断上升

- 微创手术日益受到青睐

- 技术进步

- 家庭医疗保健需求不断增长

- 产业陷阱与挑战

- 导管相关血流感染(CRBSI)风险高

- 先进血管通路设备成本高昂

- 成长动力

- 成长潜力分析

- 技术格局

- 定价分析

- 差距分析

- 未来市场趋势

- 监管格局

- 专利分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 週边血管通路装置

- 中央血管通路装置

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 药物管理

- 液体和营养管理

- 输血

- 诊断测试

- 其他应用

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院和诊所

- 门诊手术中心

- 居家照护环境

- 其他最终用途

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 日本

- 中国

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Access Vascular

- AngioDynamics

- B Braun

- Becton Dickinson and Company

- ConvaTec

- Cook Medical

- Fresenius Medical Care

- ICU Medical

- Medical Components

- Medtronic

- Nipro

- Penumbra

- Teleflex

- Terumo

- Vygon

The Global Vascular Access Devices Market was valued at USD 5.8 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 11.5 billion by 2034. Demand for these devices is being propelled by the rising burden of chronic health conditions that require long-term or repeated intravenous therapies. Across the healthcare spectrum, patients undergoing treatment for serious ailments often require sustained drug delivery, nutritional support, or fluid management, which calls for dependable vascular access solutions.

In clinical settings, vascular access devices are essential for delivering medications, drawing blood, administering fluids, and performing other critical procedures. Their role becomes even more vital with the growing number of patients needing intensive care, surgical procedures, and specialized treatments. As healthcare systems expand in developing countries and upgrade technologies in established markets, the need for vascular access equipment continues to grow in both acute and non-acute care environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.8 Billion |

| Forecast Value | $11.5 Billion |

| CAGR | 7.1% |

These devices are specifically designed to provide direct and efficient access to the bloodstream for a range of treatments. They are widely used in both short-term scenarios, such as surgical procedures, and for long-duration therapies like dialysis or chemotherapy. As the healthcare landscape shifts toward more outpatient and home-based care models, the use of these devices outside hospital settings is also gaining traction. Innovations in device materials and design have contributed to greater safety, minimizing complications like infections and blood clots, and improving ease of use for medical personnel. Vascular access equipment has thus become integral to modern healthcare delivery, ensuring both patient safety and procedural efficiency.

The market is categorized into peripheral and central vascular access devices. In 2024, central vascular access devices held the dominant position, generating 63.9% of the total market revenue. These devices are frequently preferred in situations requiring consistent or repeated intravenous treatments, especially in complex therapeutic regimens. Their ability to remain in place for extended durations and deliver drugs directly into large veins makes them particularly suitable for long-term applications. Among the various central access options, devices such as peripherally inserted central catheters, tunneled catheters, and implantable ports are widely used due to their lower insertion frequency and enhanced patient comfort.

Recent advancements in this segment have led to the development of vascular devices with improved antimicrobial properties and anti-clotting features. These product upgrades are designed to minimize risks associated with prolonged usage, such as catheter-related bloodstream infections, and enhance device reliability. Additionally, the integration of imaging technologies in insertion techniques has made placements more accurate and safer, contributing to the overall efficiency of treatment protocols.

From an application standpoint, drug administration accounted for the highest revenue, reaching USD 2.4 billion in 2024. This segment continues to thrive due to the growing need for continuous infusion therapies in patients with chronic illnesses. Medications, including antibiotics, biologics, and immunotherapies, often require prolonged intravenous access, which makes vascular access devices indispensable. As medical practices increasingly support home infusion services and outpatient therapy to reduce hospitalization costs, vascular access tools are becoming more common in homecare environments as well.

The market is also segmented by end users, including hospitals and clinics, ambulatory surgical centers, homecare settings, and others. Hospitals and clinics emerged as the leading segment, with a market share of 56.2% in 2024. The consistent rise in surgical volumes, along with a higher patient inflow for both acute and chronic care, sustains a strong demand for vascular devices in these facilities. These settings frequently utilize both peripheral IVs for routine procedures and central lines for more complex treatment needs. Infection prevention and compliance with regulatory standards are critical concerns, prompting hospitals to invest in advanced access devices that incorporate closed-system designs and antimicrobial materials.

Regionally, North America led the market, generating USD 2.6 billion in revenue in 2024 and is forecasted to grow at a CAGR of 7% over the next decade. Within this region, the United States is expected to see its vascular access device market grow from USD 2.3 billion in 2024 to USD 4.6 billion by 2034. The increasing prevalence of long-term health conditions, combined with a shift toward outpatient care and at-home treatment programs, supports continued market expansion. The demand for effective, durable, and safer vascular access options remains high, driven by healthcare providers striving for quality outcomes and patient-centered solutions.

The competitive landscape of the market includes prominent industry players that focus on innovation and product performance. Companies such as Becton Dickinson and Company, Teleflex, B. Braun, Medtronic, and Fresenius Medical Care collectively captured approximately 60% of the global market share in 2024. Market dynamics are heavily influenced by advancements in product technology and cost considerations, particularly in price-sensitive regions. Multinational corporations often face pressure to balance affordability with quality, while local manufacturers position themselves as providers of cost-effective yet compliant alternatives. This balance between innovation and accessibility will remain a defining feature of the vascular access devices market in the years ahead.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic diseases

- 3.2.1.2 Growing preference for minimally invasive procedures

- 3.2.1.3 Technological advancements

- 3.2.1.4 Rising demand for home healthcare

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High risk of catheter-related bloodstream infections (CRBSIs)

- 3.2.2.2 High cost of advanced vascular access devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.5 Pricing analysis

- 3.6 Gap analysis

- 3.7 Future market trends

- 3.8 Regulatory landscape

- 3.9 Patent analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Peripheral vascular access devices

- 5.3 Central vascular access devices

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Drug administration

- 6.3 Fluid and nutrition administration

- 6.4 Blood transfusion

- 6.5 Diagnostic testing

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals and clinics

- 7.3 Ambulatory surgical centers

- 7.4 Homecare settings

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Mexico

- 8.5.2 Brazil

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Access Vascular

- 9.2 AngioDynamics

- 9.3 B Braun

- 9.4 Becton Dickinson and Company

- 9.5 ConvaTec

- 9.6 Cook Medical

- 9.7 Fresenius Medical Care

- 9.8 ICU Medical

- 9.9 Medical Components

- 9.10 Medtronic

- 9.11 Nipro

- 9.12 Penumbra

- 9.13 Teleflex

- 9.14 Terumo

- 9.15 Vygon