|

市场调查报告书

商品编码

1766237

医疗器材分销服务市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Medical Device Distribution Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

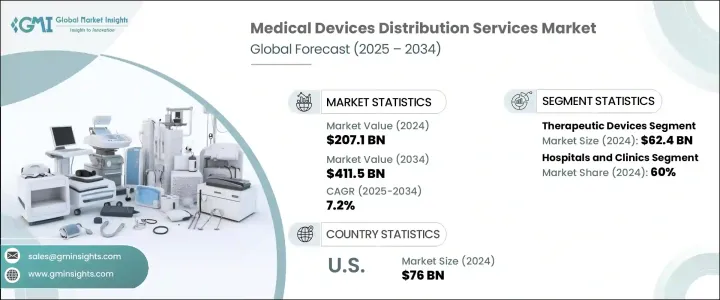

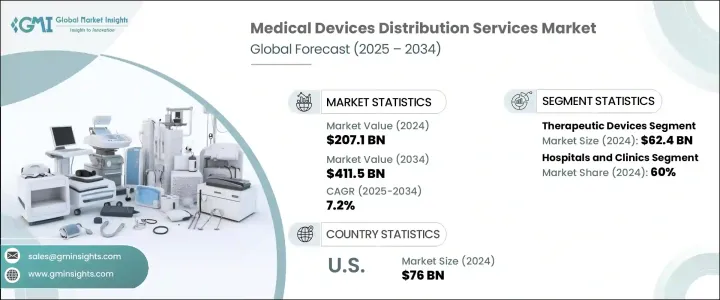

2024 年全球医疗器材分销服务市场规模为 2,071 亿美元,预计到 2034 年将以 7.2% 的复合年增长率成长,达到 4,115 亿美元。这一成长主要受到多种趋势融合的推动。越来越多的人被诊断出患有慢性疾病,导致对各种医疗器材的需求增加。除此之外,医疗领域的研发力道不断加大,带来了一波创新和监管审批浪潮,提高了产品的可用性和多样性。医疗技术也变得越来越先进,尤其是数位和远端监控功能的集成,这些功能在传统临床环境之外实现更高效的患者护理方面发挥着重要作用。随着患者越来越多地选择居家治疗和远端健康监控解决方案,分销商正在扩展其服务以满足这些不断变化的偏好。

此外,医疗器械开发持续吸引公共和私营部门的大量资金支持。创投持续成长,尤其是在维持生命和创新治疗解决方案领域,凸显了这些器械在增强全球医疗保健体系方面的重要作用。这种充满活力的环境促使老牌企业和新进业者加大对供应链效率和数位基础设施的投资,以确保器械安全、迅速地送达最终用户。随着医疗保健服务模式转向更加分散和以患者为中心的模式,对敏捷且响应迅速的分销网络的需求比以往任何时候都高。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2071亿美元 |

| 预测值 | 4115亿美元 |

| 复合年增长率 | 7.2% |

市场按产品类型细分为诊断设备、治疗设备、病患监护设备、家庭医疗保健解决方案和其他类别。其中,治疗设备领域在2024年成为收入最高的领域,价值达624亿美元。预计该领域在预测期内的复合年增长率将达到7.4%。该领域的强劲表现与全球对辅助治疗和管理慢性病设备的持续需求息息相关。从药物输送系统到植入物和助行器,此类设备在长期治疗方案中已变得越来越不可或缺。分销商正在优先考虑这一类别,以满足医疗保健领域不断增长的需求。

从终端用户的角度来看,2024年,医院和诊所占据了全球医疗器材分销服务市场60%的份额。这些医疗机构由于其处理的医疗案例范围广泛——从急性医疗干预到持续的慢性病护理——而始终处于采购的前沿。他们对多样化设备的需求推动了大规模的采购行为。为了避免中断并确保医疗服务的连续性,医院通常会大量采购医疗器材并保持充足的库存。医院和诊所的持续需求支撑着全球分销生态系统的重要组成部分。

从区域来看,北美在2024年以37.4%的市占率领先全球市场。该地区的主导地位可以归因于人口老化以及糖尿病、心血管疾病等慢性病的高发生率。这些健康趋势给现有的医疗基础设施带来了巨大压力,并加速了对支援长期患者护理的设备进行高效分销的需求。医疗保健需求的复杂性和规模日益增长,促使分销商提升营运能力,利用传统物流和数位工具来确保关键设备的及时交付。

在美国,该市场持续呈现上升势头,估值从2021年的634亿美元增长至2022年的673亿美元,预计在2024年达到760亿美元。该市场的稳定成长反映了美国持续推动医疗体系现代化,以应对日益加重的生活方式相关疾病负担的努力。随着医院、护理机构和患者对各种设备的依赖程度日益加深,分销管道也日益完善,以确保产品在需要时随时随地可用。

竞争环境由少数几家主要参与者主导,他们总共控制约45%的市场份额。这些全球分销商凭藉完善的物流网络、丰富的产品组合以及与医院和医疗保健提供者等关键买家的牢固关係,保持着竞争优势。他们的策略重点包括对库存管理、数位平台、法规合规性和即时供应链可视性的投资。另一方面,规模较小的区域性公司则利用本地市场知识以及与政府资助的医疗保健项目的密切联繫,开拓利基市场。大型经销商透过全球覆盖范围不断扩张,而规模较小的公司则透过提供针对特定区域需求的灵活个人化服务蓬勃发展。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 慢性病盛行率不断上升

- 研发投入激增,医疗器材审批数量增加

- 家庭医疗保健和远端监控的需求不断增长

- 医疗器材技术的进步

- 产业陷阱与挑战

- 需要较高的初始资本支出

- 遵守严格的监管规定

- 市场机会

- 线上分销服务和数位订购系统的成长

- 加强公私合作,强化供应链

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 未来市场趋势

- 差距分析

- 定价分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 诊断设备

- 治疗设备

- 病人监护设备

- 家庭医疗保健设备

- 其他产品类型

第六章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院和诊所

- 诊断中心

- 门诊手术中心(ASC)

- 长期照护机构

- 居家照护环境

第七章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- Alfresa Holdings

- B. Braun Melsungen

- Cardinal Health

- Henry Schein

- McKesson Corporation

- Medline Industries

- Meditek

- Medtronic

- Nipro

- Owens & Minor

- Patterson Companies

- Soquelec

- Southmedic

- Stat Medical

- The Stevens Company

The Global Medical Device Distribution Services Market was valued at USD 207.1 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 411.5 billion by 2034. This growth is primarily being fueled by several converging trends. A rising number of individuals are being diagnosed with chronic conditions, leading to higher demand for a variety of medical devices. Alongside this, the push for research and development in the medical field has intensified, bringing a wave of innovations and regulatory approvals that enhance product availability and variety. Medical technologies are also becoming more advanced, especially with the integration of digital and remote monitoring capabilities, which are playing a significant role in enabling more efficient patient care outside of conventional clinical environments. As patients increasingly opt for home-based treatment and remote health monitoring solutions, distributors are expanding their services to cater to these evolving preferences.

Additionally, medical device development continues to attract substantial financial backing from both the public and private sectors. Venture capital investment has grown, particularly in life-sustaining and innovative therapeutic solutions, underscoring the essential role of these devices in enhancing the global healthcare system. This dynamic environment is prompting both established players and new entrants to boost investment in supply chain efficiency and digital infrastructure, ensuring that devices reach end-users safely and swiftly. With healthcare delivery models shifting to more decentralized and patient-centered care, the demand for agile and responsive distribution networks is higher than ever.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $207.1 Billion |

| Forecast Value | $411.5 Billion |

| CAGR | 7.2% |

The market is segmented by product type into diagnostic devices, therapeutic devices, patient monitoring equipment, home healthcare solutions, and other categories. Among these, the therapeutic devices segment emerged as the highest revenue generator in 2024, valued at USD 62.4 billion. It is expected to expand at a CAGR of 7.4% over the forecast period. The strong performance of this segment can be linked to the consistent global demand for equipment that aids in treating and managing chronic illnesses. From drug delivery systems to implants and mobility aids, the use of such devices has become increasingly indispensable in long-term treatment protocols. Distributors are prioritizing this category to meet the surging demand across healthcare settings.

When viewed from an end-use perspective, hospitals and clinics held a commanding 60% share of the global medical device distribution services market in 2024. These healthcare institutions remain at the forefront of procurement due to the wide range of medical cases they handle-from acute medical interventions to ongoing chronic care. Their need for a diverse set of devices drives large-scale purchasing behavior. To avoid disruptions and ensure continuity of care, hospitals typically purchase medical devices in bulk and maintain robust inventories. This consistent demand from hospitals and clinics sustains a critical portion of the global distribution ecosystem.

Regionally, North America led the global market with a 37.4% share in 2024. The region's dominance can be attributed to a combination of an aging population and the high incidence of chronic diseases like diabetes and cardiovascular conditions. These health trends are straining existing medical infrastructure and accelerating the need for efficient distribution of devices that support long-term patient care. The growing complexity and volume of healthcare needs are prompting distributors to enhance their operational capacity, leveraging both traditional logistics and digital tools to ensure timely delivery of critical devices.

In the United States, the market has shown consistent upward momentum, with valuations increasing from USD 63.4 billion in 2021 to USD 67.3 billion in 2022, and reaching USD 76 billion in 2024. The market's steady rise reflects the nation's ongoing efforts to modernize its healthcare system and respond to the escalating burden of lifestyle-related illnesses. As hospitals, care facilities, and patients increasingly rely on a diverse range of devices, distribution channels are becoming more sophisticated, ensuring that products are available where and when they are needed.

The competitive environment is shaped by a handful of major players that collectively control around 45% of the market. These global distributors maintain a competitive edge through well-established logistics networks, wide product portfolios, and strong relationships with key buyers like hospitals and healthcare providers. Their strategic focus includes investments in inventory management, digital platforms, regulatory compliance, and real-time supply chain visibility. On the other hand, smaller regional firms are carving out niches by leveraging local market knowledge and close ties with government-funded healthcare programs. While large distributors scale up with global reach, smaller firms are thriving by offering agile and personalized services tailored to specific regional demands.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of chronic diseases

- 3.2.1.2 Surge in investments for research and growth in medical device approvals

- 3.2.1.3 Rising demand for home healthcare and remote monitoring

- 3.2.1.4 Advancements in medical device technology

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Requirement for high initial capital expenditure

- 3.2.2.2 Presence of stringent regulatory compliance

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in online distribution services and digital ordering systems

- 3.2.3.2 Increasing public-private partnership to strengthen supply chains

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Pricing analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Diagnostic devices

- 5.3 Therapeutic devices

- 5.4 Patient monitoring devices

- 5.5 Home healthcare devices

- 5.6 Other product types

Chapter 6 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals and clinics

- 6.3 Diagnostic centers

- 6.4 Ambulatory surgical centers (ASCs)

- 6.5 Long-term care facilities

- 6.6 Homecare settings

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Alfresa Holdings

- 8.2 B. Braun Melsungen

- 8.3 Cardinal Health

- 8.4 Henry Schein

- 8.5 McKesson Corporation

- 8.6 Medline Industries

- 8.7 Meditek

- 8.8 Medtronic

- 8.9 Nipro

- 8.10 Owens & Minor

- 8.11 Patterson Companies

- 8.12 Soquelec

- 8.13 Southmedic

- 8.14 Stat Medical

- 8.15 The Stevens Company