|

市场调查报告书

商品编码

1766245

急性冠状动脉症候群治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Acute Coronary Syndrome Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

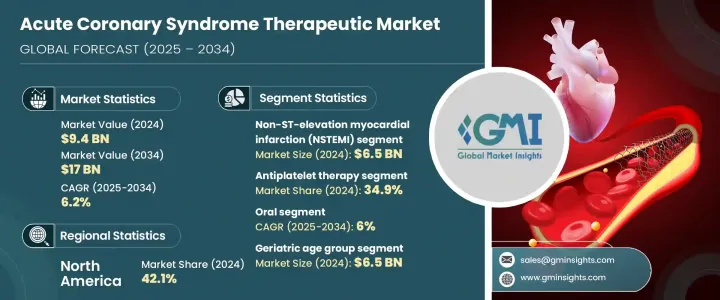

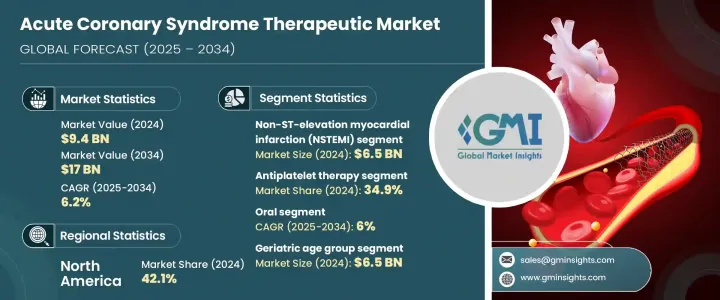

2024 年全球急性冠状动脉综合症治疗市场价值为 94 亿美元,预计到 2034 年将以 6.2% 的复合年增长率增长至 170 亿美元。市场扩张的主要原因是心血管疾病发生率的上升,特别是急性冠状动脉综合征,其包括 ST 段抬高型心肌梗塞 (STEMI)、非 ST 段抬高型心肌梗塞 (NSTEMI) 和不稳定型心绞痛等疾病。这些疾病是全球主要死亡原因之一,对先进疗法的需求庞大。药物传输系统的技术创新和下一代心血管药物的开发正在增强治疗选择。此外,ACS 个人化医疗的日益增长趋势使得可以根据个别患者情况制定更有针对性的治疗方案。

联合疗法和缓释製剂的兴起正在提高治疗急性冠状动脉综合症(ACS)的安全性和有效性。此外,在紧急情况下加强早期发现和快速诊断的努力,以及政府对心臟健康计画的支持,也促进了市场的成长。高度重视整合各种药物治疗,包括抗血小板药、抗凝血药和β受体阻断剂,有助于更有效控制病情。製药公司正致力于透过区域生产、合作和新药开发来扩大其覆盖范围,以满足已开发市场和新兴市场日益增长的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 94亿美元 |

| 预测值 | 170亿美元 |

| 复合年增长率 | 6.2% |

2024年,非ST段上升型心肌梗塞(NSTEMI)领域以65亿美元的估值领先市场,这得益于该疾病在全球范围内的日益增长的患病率。 NSTEMI是由冠状动脉部分阻塞引起的,需要立即进行医疗干预,其发生率高于STEMI,但对心臟的损害较小。生活方式相关的风险因素以及诊断工具(例如高灵敏度的肌钙蛋白检测和心臟成像)的进步等因素提高了NSTEMI的检出率,进一步推动了对该疾病靶向治疗的需求。

2024年,抗血小板治疗领域占34.9%的市占率。这些药物包括阿斯匹灵、氯吡格雷和替格瑞洛等,通常用于预防血小板聚集和血栓形成,而血栓是急性冠状动脉综合症(ACS)动脉阻塞的关键原因。由于临床指引推荐双重抗血小板治疗,尤其是针对高风险患者,抗血小板治疗的应用十分广泛。随着起效更快、更安全的抗血小板药物的持续开发,其在不同患者群体中的应用也不断扩大。

2024年,美国急性冠状动脉症候群(ACS)治疗市场规模达36亿美元。美国ACS的盛行率不断上升,推动了对先进治疗方案的需求。旨在应对高血压、肥胖症和糖尿病等风险因素的公共卫生倡议,以及医疗基础设施的改善,正在推动市场成长。此外,指南导向的药物治疗的广泛应用,有助于改善患者预后,并降低与心臟护理相关的医疗成本。

全球急性冠状动脉综合症治疗市场的主要参与者包括默克、辉瑞、阿斯特捷利康、百时美施贵宝、礼来、基因泰克(罗氏)、赛诺菲、杨森製药和勃林格殷格翰等。急性冠状动脉综合症治疗市场的公司正在透过对新药研发的策略性投资来巩固其地位,尤其是那些提供更快起效和更高安全性的药物。许多製药公司正在透过联合疗法和个人化治疗方案来扩展其产品组合,以满足患者的独特需求。与医疗保健提供者和政府计划的合作也是其策略的重要组成部分,使他们能够进入服务不足的市场。此外,该公司正在利用数位健康技术来改善患者监测和治疗依从性。扩大区域製造能力和获得新疗法的监管批准也是在已开发市场和新兴市场保持竞争优势的关键策略。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 心血管疾病发生率上升

- ACS 药物治疗的进展

- 更重视早期诊断和紧急护理

- 人口老化加剧和復发事件

- 产业陷阱与挑战

- 治疗费用高且难以取得

- 临床实务和依从性的差异

- 市场机会

- 心血管负担较重的新兴市场

- 公私医疗合作

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 未来市场趋势

- 定价分析

- 管道分析

- 消费者行为分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

第五章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 非 ST 段上升型心肌梗塞 (NSTEMI)

- ST 段上升型心肌梗塞 (STEMI)

- 不稳定型心绞痛

第六章:市场估计与预测:依药物类别,2021 年至 2034 年

- 主要趋势

- 抗血小板治疗

- 抗凝血剂

- β受体阻断剂

- 硝酸盐

- 血栓溶解剂

- 其他药物

第七章:市场估计与预测:依管理路线,2021 年至 2034 年

- 主要趋势

- 口服

- 注射剂

第八章:市场估计与预测:按年龄组,2021 年至 2034 年

- 主要趋势

- 成人

- 老年

第九章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 心臟病诊所

- 门诊手术中心

- 其他最终用途

第十章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- AstraZeneca

- Azurity Pharmaceuticals

- Baxter Healthcare

- Boehringer Ingelheim

- Bristol Myers Squibb

- Cipla

- Eli Lilly

- Genentech (Roche)

- Intas Pharmaceuticals

- Janssen Pharmaceuticals

- Merck

- Novartis

- Pfizer

- Ranbaxy Laboratories

- Sanofi

The Global Acute Coronary Syndrome Therapeutics Market was valued at USD 9.4 billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 17 billion by 2034. The market expansion is primarily driven by the rising incidence of cardiovascular diseases, particularly acute coronary syndrome, which encompasses conditions such as ST-elevation myocardial infarction (STEMI), non-ST-elevation myocardial infarction (NSTEMI), and unstable angina. These conditions are among the leading causes of death worldwide, creating significant demand for advanced therapies. Technological innovations in drug delivery systems and the development of next-generation cardiovascular drugs are enhancing treatment options. Additionally, the growing trend of personalized medicine for ACS allows for more targeted treatments tailored to individual patient profiles.

The rise of combination therapies and extended-release formulations is improving both safety and effectiveness in treating ACS. Furthermore, efforts to enhance early detection and rapid diagnosis in emergency settings, along with government support for heart health initiatives, are also contributing to market growth. A strong emphasis on integrating various pharmacological treatments, including antiplatelets, anticoagulants, and beta-blockers, is helping to manage the condition more effectively. Pharmaceutical companies are focusing on expanding their reach through regional production, collaborations, and new drug development to meet the growing demand across both developed and emerging markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.4 Billion |

| Forecast Value | $17 Billion |

| CAGR | 6.2% |

The NSTEMI segment led the market in 2024 with a valuation of USD 6.5 billion, driven by the growing prevalence of this condition globally. NSTEMI, which results from partial blockage of coronary arteries, demands immediate medical intervention and is more common than STEMI, though it causes less damage to the heart. Factors like lifestyle-related risk factors and advancements in diagnostic tools, such as sensitive troponin assays and cardiac imaging, have increased the detection rates of NSTEMI, further driving the demand for targeted therapeutics for the condition.

The antiplatelet therapies segment held a 34.9% share in 2024. These therapies, including drugs like aspirin, clopidogrel, and ticagrelor, are commonly used to prevent platelet aggregation and thrombus formation, which are key causes of artery blockage in ACS. Their use is widespread due to clinical guidelines recommending dual antiplatelet therapy, especially for high-risk patients. The ongoing development of faster-acting and safer antiplatelet medications continues to expand their use across diverse patient populations.

U.S. Acute Coronary Syndrome Therapeutics Market was valued at USD 3.6 billion in 2024. The growing prevalence of ACS in the U.S. is driving demand for advanced treatment options. Public health initiatives addressing risk factors such as hypertension, obesity, and diabetes, as well as improving healthcare infrastructure, are contributing to market growth. Additionally, the widespread adoption of guideline-directed medical therapy is helping improve patient outcomes and reduce healthcare costs related to cardiac care.

Key players in the Global Acute Coronary Syndrome Therapeutics Market include Merck, Pfizer, AstraZeneca, Bristol Myers Squibb, Eli Lilly, Genentech (Roche), Sanofi, Janssen Pharmaceuticals, and Boehringer Ingelheim, among others. Companies in the acute coronary syndrome therapeutics market are strengthening their position through strategic investments in research and development of new drugs, especially those offering faster action and improved safety profiles. Many pharmaceutical firms are expanding their portfolios with combination therapies and personalized treatment options to address the unique needs of patients. Collaborations with healthcare providers and government initiatives are also a significant part of their strategy, enabling them to reach underserved markets. Additionally, companies are leveraging digital health technologies to improve patient monitoring and treatment adherence. Expanding regional manufacturing capabilities and securing regulatory approvals for novel therapies are also key strategies to maintain competitive advantage in both developed and emerging markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Drug class

- 2.2.4 Route of administration

- 2.2.5 Age group

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of cardiovascular diseases

- 3.2.1.2 Advancements in pharmacological treatments for ACS

- 3.2.1.3 Increasing emphasis on early diagnosis and emergency care

- 3.2.1.4 Growing aging population and recurrent events

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High treatment costs and accessibility issues

- 3.2.2.2 Variability in clinical practice and adherence

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging markets with high cardiovascular burden

- 3.2.3.2 Public-private healthcare collaborations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Future market trends

- 3.6 Pricing analysis

- 3.7 Pipeline analysis

- 3.8 Consumer behaviour analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Non-ST-elevation myocardial infarction (NSTEMI)

- 5.3 ST-elevation MI (STEMI)

- 5.4 Unstable angina

Chapter 6 Market Estimates and Forecast, By Drug Class, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Antiplatelet therapy

- 6.3 Anticoagulants

- 6.4 Beta blockers

- 6.5 Nitrates

- 6.6 Thrombolytics

- 6.7 Other medications

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Injectables

Chapter 8 Market Estimates and Forecast, By Age Group, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Adult

- 8.3 Geriatric

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Cardiology clinics

- 9.4 Ambulatory surgical centers

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AstraZeneca

- 11.2 Azurity Pharmaceuticals

- 11.3 Baxter Healthcare

- 11.4 Boehringer Ingelheim

- 11.5 Bristol Myers Squibb

- 11.6 Cipla

- 11.7 Eli Lilly

- 11.8 Genentech (Roche)

- 11.9 Intas Pharmaceuticals

- 11.10 Janssen Pharmaceuticals

- 11.11 Merck

- 11.12 Novartis

- 11.13 Pfizer

- 11.14 Ranbaxy Laboratories

- 11.15 Sanofi