|

市场调查报告书

商品编码

1766248

近防武器系统 (CIWS) 市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Close-In Weapon Systems (CIWS) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

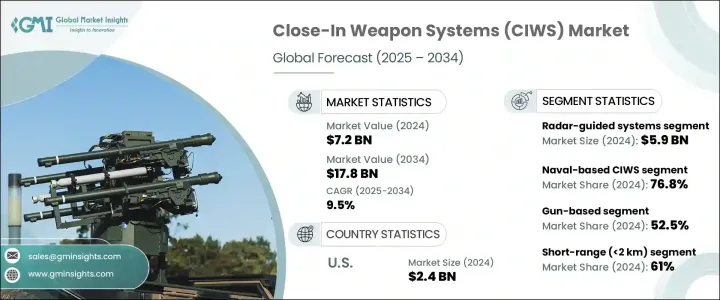

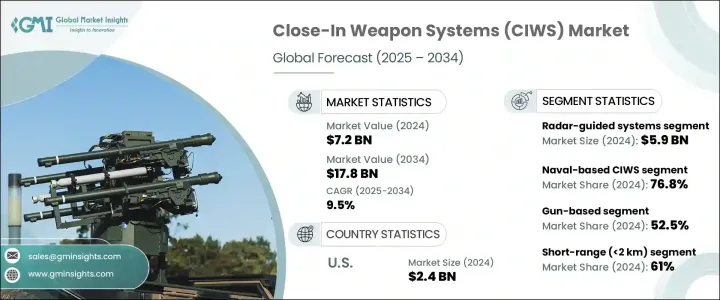

2024 年全球近防武器系统市场价值为 72 亿美元,预计到 2034 年将以 9.5% 的复合年增长率成长,达到 178 亿美元。这一增长主要得益于无人机和飞弹威胁的不断增加,以及全球国防开支的增加。近年来,近防武器市场面临挑战,包括美国政府征收关税的影响,提高了近防武器系统关键原料的价格,进而增加了生产成本。关税也导致供应链中断,合约执行延迟,并限制国防承包商进入国际市场。盟国的报復性贸易行动进一步使贸易格局复杂化,影响了美国国防公司在近防武器技术方面保持全球竞争力的能力,并对国内外买家的采购预算产生负面影响。

随着无人机和先进飞弹技术的威胁日益复杂,军方正将近防武器系统(CIWS)作为海军舰艇和关键基础设施的重要防线。这些系统能够快速回应,在极短距离内探测、追踪和消除来袭威胁,确保在恶劣环境中的生存。根据技术,近防武器市场可分为雷达导引系统和电光/红外线 (EO/IR) 导引系统,其中雷达导引系统因其在各种环境条件下追踪快速移动空中威胁的出色性能而占据主导地位。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 72亿美元 |

| 预测值 | 178亿美元 |

| 复合年增长率 | 9.5% |

2024年,枪基系统市场占了52.5%的份额。这种优势主要源自于其操作成熟度、成本效益和高射速,使其成为许多国防应用的首选。这些系统以其快速且精准的射击能力而闻名,这在分秒必争的近距离防御场景中至关重要。其相对低成本的交战能力使其能够更有效地消除威胁,而无需昂贵的弹药或资源。

就平台而言,海军近防系统(CIWS)占据主导地位,到2024年将占据76.8%的市场份额。这得归功于近防系统技术在驱逐舰、护卫舰和航空母舰等军舰上的广泛应用,这些军舰正在越来越多地整合这些系统,以应对日益增长的反舰飞弹和无人机群威胁。全球海军现代化计划和远洋海军的进步进一步增强了这一趋势。

由于对海军防御和反无人机能力的持续投资,美国近程武器系统 (CIWS) 市场在 2024 年达到 24 亿美元,成为全球最大市场。美国海军持续致力于透过整合定向能係统和人工智慧威胁侦测等先进技术来提升舰队的生存力,从而巩固其在 CIWS 领域的领先地位。

近程武器系统 (CIWS) 市场的领导者包括泰雷兹集团、洛克希德·马丁公司、莱茵金属股份公司和 RTX 公司。为了巩固其在 CIWS 市场的地位,各公司正专注于技术创新,包括整合定向能和人工智慧驱动系统,以缩短威胁侦测和回应时间。透过大力投资研发,这些公司旨在领先新兴威胁,例如先进的无人机和飞弹。与国防承包商和政府建立战略合作伙伴关係有助于改善市场准入,而与其他产业参与者的合作则可以共享技术和专业知识。此外,製造商正在扩大生产能力,以满足对 CIWS 解决方案日益增长的需求,使系统更加经济实惠,并可供更广泛的全球客户使用。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 无人机和飞弹威胁日益加剧

- 陆基近防武器系统在基地防御方面的需求不断成长

- 对多层防御系统的需求不断增长

- 新兴经济体国防预算增加

- 海军舰队现代化计划

- 产业陷阱与挑战

- 采购和维护成本高

- 复杂的整合挑战

- 市场机会

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 新兴商业模式

- 合规性要求

- 国防预算分析

- 全球国防开支趋势

- 区域国防预算分配

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 重点国防现代化项目

- 预算预测(2025-2034)

- 对产业成长的影响

- 各国国防预算

- 国防预算按部门分配

- 人员

- 营运和维护

- 采购

- 研究、开发、测试和评估

- 基础设施和建筑

- 科技与创新

- 供应链弹性

- 地缘政治分析

- 劳动力分析

- 数位转型

- 合併、收购和策略伙伴关係格局

- 风险评估与管理

- 主要合约授予(2021-2024)

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 市场集中度分析

- 按地区

- 关键参与者的竞争基准

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理位置比较

- 全球足迹分析

- 服务网路覆盖

- 各地区市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係和合作

- 技术进步

- 扩张和投资策略

- 数位转型倡议

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:依武器类型,2021-2034

- 主要趋势

- 枪基系统

- 飞弹系统

- 基于雷射的系统

- 混合系统

第六章:市场估计与预测:依技术,2021-2034 年

- 主要趋势

- 雷达导引系统

- 电光/红外线(EO/IR)导引系统

第七章:市场估计与预测:依平台,2021-2034

- 主要趋势

- 海军近防系统

- 陆基近防系统

第八章:市场估计与预测:依范围,2021-2034

- 主要趋势

- 短距离(<2公里)

- 中程(2-10公里)

- 扩展范围(>10 公里)

第九章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 海军部队(海军)

- 陆军

第十章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- ASELSAN

- BAE Systems

- General Dynamics

- KBP Instrument Design Bureau

- Larsen & Toubro Limited

- Leonardo SpA

- Lockheed Martin Corporation

- MBDA

- Nexter Systems

- PIT-RADWAR SA

- RAFAEL Advanced Defense Systems Ltd.

- Rheinmetall AG

- RTX Corporation

- Saab AB

- Thales Group

The Global Close-In Weapon Systems Market was valued at USD 7.2 billion in 2024 and is estimated to grow at a CAGR of 9.5% to reach USD 17.8 billion by 2034. This growth is primarily driven by rising threats from unmanned aerial vehicles (UAVs) and missiles, along with increasing global defense spending. The CIWS market has faced challenges in recent years, including the impact of tariffs imposed by the U.S. administration, which raised the price of critical raw materials for CIWS systems and, in turn, increased production costs. The tariffs also led to disruptions in supply chains, delaying the execution of contracts and limiting access to international markets for defense contractors. Retaliatory trade actions from allied countries further complicated the trade landscape, affecting the ability of U.S. defense companies to remain globally competitive in CIWS technology and negatively impacting the procurement budgets of both domestic and foreign buyers.

As threats from UAVs and advanced missile technologies become more sophisticated, militaries are turning to CIWS as an essential line of defense for naval vessels and critical infrastructure. These systems offer a rapid-response capability to detect, track, and neutralize incoming threats at extremely short ranges, ensuring survival in hostile environments. The market is categorized by technology into radar-guided and electro-optical/infrared (EO/IR)-guided systems, with radar-guided systems being the dominant segment due to their excellent performance in tracking fast-moving aerial threats across various environmental conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.2 billion |

| Forecast Value | $17.8 billion |

| CAGR | 9.5% |

Gun-based systems segment held a 52.5% share in 2024. This dominance is largely due to their operational maturity, cost-efficiency, and high rate of fire, making them the preferred choice for many defense applications. These systems are known for their ability to deliver rapid and accurate fire, which is essential in close-in defense scenarios where every second counts. Their relatively low-cost engagement capability allows for more effective neutralization of threats without the need for expensive ammunition or resources.

In terms of platform, naval-based CIWS systems are the leading segment, accounting for 76.8% of the market in 2024. This is driven by the high proliferation of CIWS technology on warships like destroyers, frigates, and aircraft carriers, which are increasingly integrating these systems to counter the growing threat of anti-ship missiles and swarming drones. Global naval modernization programs and advancements in blue-water navies further bolster this trend.

United States Close-In Weapon Systems (CIWS) Market reached USD 2.4 billion in 2024 was the largest due to continued investments in naval defense and counter-UAV capabilities. The U.S. Navy's ongoing efforts to enhance fleet survivability through the integration of advanced technologies, including directed energy systems and AI-powered threat detection, reinforce the country's leadership in the CIWS space.

Leading players in the Close-In Weapon Systems (CIWS) Market include Thales Group, Lockheed Martin Corporation, Rheinmetall AG, and RTX Corporation. To strengthen their position in the CIWS market, companies are focusing on technological innovation, including the integration of directed energy and AI-driven systems to improve threat detection and response times. By investing heavily in research and development, these companies aim to stay ahead of emerging threats, such as advanced UAVs and missiles. Strategic partnerships with defense contractors and governments help improve market access, while collaboration with other industry players allows for the sharing of technology and expertise. Additionally, manufacturers are expanding their production capacities to meet the increasing demand for CIWS solutions, making the systems more affordable and accessible to a broader range of global customers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Weapon type trends

- 2.2.2 Technology trends

- 2.2.3 Platform trends

- 2.2.4 Range trends

- 2.2.5 End use trends

- 2.2.6 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Million)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising threats from UAVs and missiles

- 3.2.1.2 Rising demand for land-based CIWS for base defense

- 3.2.1.3 Growing demand for multi-layered defense systems

- 3.2.1.4 Increasing defense budgets in emerging economies

- 3.2.1.5 Naval fleet modernization programs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High procurement and maintenance costs

- 3.2.2.2 Complex integration challenges

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Defense budget analysis

- 3.11 Global defense spending trends

- 3.12 Regional defense budget allocation

- 3.12.1 North America

- 3.12.2 Europe

- 3.12.3 Asia Pacific

- 3.12.4 Middle East and Africa

- 3.12.5 Latin America

- 3.13 Key defense modernization programs

- 3.14 Budget forecast (2025-2034)

- 3.14.1 Impact on industry growth

- 3.14.2 Defense budgets by country

- 3.14.3 Defense budget allocation by segment

- 3.14.3.1 Personnel

- 3.14.3.2 Operations and maintenance

- 3.14.3.3 Procurement

- 3.14.3.4 Research, development, test and evaluation

- 3.14.3.5 Infrastructure and construction

- 3.14.3.6 Technology and innovation

- 3.15 Supply chain resilience

- 3.16 Geopolitical analysis

- 3.17 Workforce analysis

- 3.18 Digital transformation

- 3.19 Mergers, acquisitions, and strategic partnerships landscape

- 3.20 Risk assessment and management

- 3.21 Major contract awards (2021-2024)

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Weapon Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Gun-based systems

- 5.3 Missile-based systems

- 5.4 Laser-based systems

- 5.5 Hybrid systems

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Radar-guided systems

- 6.3 Electro-optical/infrared (EO/IR)-guided systems

Chapter 7 Market Estimates & Forecast, By Platform, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Naval-based CIWS

- 7.3 Land-based CIWS

Chapter 8 Market Estimates & Forecast, By Range, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Short-range (<2 km)

- 8.3 Medium-range (2–10 km)

- 8.4 Extended range (>10 km)

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 Naval forces (Navy)

- 9.3 Ground forces

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 ASELSAN

- 11.2 BAE Systems

- 11.3 General Dynamics

- 11.4 KBP Instrument Design Bureau

- 11.5 Larsen & Toubro Limited

- 11.6 Leonardo S.p.A.

- 11.7 Lockheed Martin Corporation

- 11.8 MBDA

- 11.9 Nexter Systems

- 11.10 PIT-RADWAR S.A.

- 11.11 RAFAEL Advanced Defense Systems Ltd.

- 11.12 Rheinmetall AG

- 11.13 RTX Corporation

- 11.14 Saab AB

- 11.15 Thales Group