|

市场调查报告书

商品编码

1766253

快速换刀系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Quick-change Tooling System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

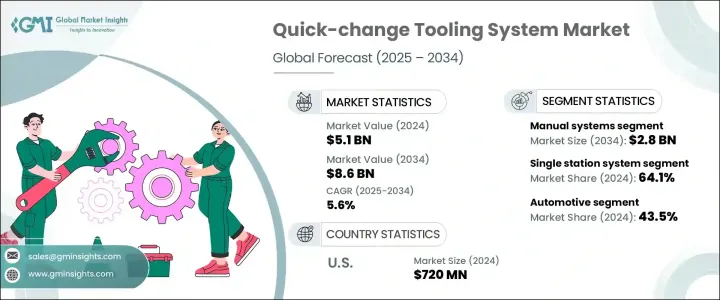

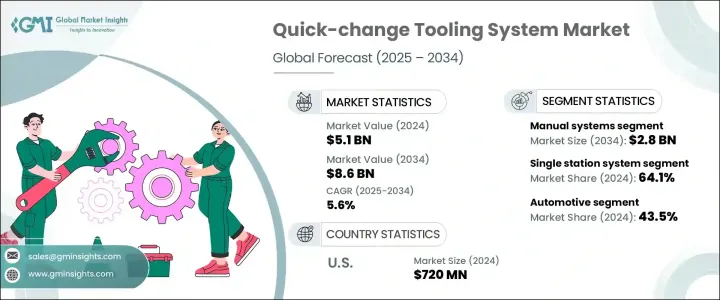

2024年,全球快速换刀系统市场规模达51亿美元,预计2034年将以5.6%的复合年增长率成长,达到86亿美元。对製造灵活性、营运速度、缩短设定时间和整体生产力的需求不断增长,正推动汽车、航太、电子和医疗器材产业的公司投资于速度更快、响应更快的工具解决方案。这些产业面临越来越大的压力,需要在精简营运、减少停机时间的同时,满足不断变化的生产目标。

快速换刀系统可以加快刀具更换速度,显着缩短换刀时间,有助于维持稳定的产量。它们广泛应用于数控中心、成型单元、冲压设备和其他精密驱动环境,彰显了其在智慧製造上的价值。随着工业4.0的蓬勃发展,下一代系统现已整合物联网和感测器技术,能够即时洞察刀具性能、磨损和换刀间隔,从而实现更具预测性和数据驱动性的营运。这种日益增长的自动化和即时监控趋势,为刀具基础设施的创新和持续改进奠定了基础。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 51亿美元 |

| 预测值 | 86亿美元 |

| 复合年增长率 | 5.6% |

2024年,手动快速更换系统以19亿美元的估值领先市场,预计2034年将达到28亿美元。其受欢迎程度源自于其易于与现有设备整合、成本效益高以及培训要求低等优势。对于不太依赖高速自动化的营运而言,这些系统仍然是理想之选,为中小型企业提供了切实可行的解决方案。此外,在木工、塑胶成型和金属製造等注重多功能性和简易性的领域,手动快速更换系统也备受青睐。在现代化进程较慢、基础设施投资有限的地区,手动快速更换系统能够在传统机器上有效运行,这进一步增强了其重要性。

2024年,单工位刀具系统市场占有64.1%的份额,预计到2034年将以5%的复合年增长率成长。这些系统在需要在固定位置换刀的应用中特别有效,例如单一CNC单元或车床。其价格实惠、设置简单、维护方便,非常适合製造业的中型企业。这些系统在製造、塑胶和精密金属加工等行业中应用广泛,这些产业受益于有针对性的独立工具机应用。

2024 年,美国快速换刀系统市值为 7.2 亿美元,预估 2025 年至 2034 年期间的复合年增长率为 6.1%。该地区强劲的汽车、航太和国防製造业是采用该技术的主要驱动力。随着製造商强调速度、客製化和精益生产方法,他们已显着转向自动化工具系统。美国受益于成熟的工业环境,这得益于熟练的劳动力、尖端的研发能力以及强劲的创新需求。这种结合支援快速週转和客製化的工具应用,增加了对手动和自动快速换刀解决方案的需求。

快速换刀系统产业的领先公司包括阿美特克公司 (AMETEK, Inc.)、那智不二越公司 (Nachi-Fujikoshi Corp.)、伊利诺伊工具厂公司 (Illinois Tool Works Inc.,简称 ITW)、THK 有限公司和肯纳金属公司 (Kennametal Inc.)。为了巩固市场地位,各公司正在投资创新,开发模组化、可扩展的工具系统,以提高与自动化机械的兼容性。许多公司正在与原始设备製造商 (OEM) 和机器製造商建立策略联盟,将其技术直接整合到新的生产设备中。各公司也正在透过支援物联网 (IoT) 的功能来增强产品线,以实现远端诊断和即时监控。持续的升级、对人体工学设计的关注以及向新兴经济体的扩张,正在帮助主要参与者保持竞争力,同时满足对快速、灵活和高效工具解决方案的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监理框架

- 标准和认证

- 环境法规

- 进出口法规

- 贸易统计数据

- 主要进口国

- 主要出口国

- 波特五力分析

- PESTEL分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 手动系统

- 自动系统

- 液压系统

- 其他的

第六章:市场估计与预测:按营运模式,2021 - 2034 年

- 主要趋势

- 单站系统

- 多站系统

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 射出成型

- 冲压和压印工具

- 机器人工具

- 焊接系统

- 组装线

- 包装机

- 其他的

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 汽车

- 航太和国防

- 消费性电子产品

- 医疗器材

- 包装

- 产业机械

- 塑胶和橡胶

- 其他的

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 直接的

- 间接

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 阿联酋

- 沙乌地阿拉伯

第 11 章:公司简介

- AMETEK, Inc.

- BIG DAISHOWA

- Destaco

- Diebold Goldring-Werkzeugfabrik

- Erowa AG

- Illinois Tool Works Inc. (ITW)

- Jergens Inc.

- Kennametal Inc. Co., Ltd

- LANG Technik GmbH

- Mate Precision Technologies

- Nachi-Fujikoshi Corp

- Rohm GmbH

- SCHUNK GmbH & Co. KG

- SMW Autoblok

- THK Co., Ltd.

The Global Quick-change Tooling System Market was valued at USD 5.1 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 8.6 billion by 2034. The rise in demand for manufacturing flexibility, operational speed, reduced setup times, and overall productivity is pushing companies across the automotive, aerospace, electronics, and medical device sectors to invest in quicker, more responsive tooling solutions. These industries face increasing pressure to streamline operations and reduce downtime while meeting evolving production goals.

Quick-change tooling systems allow faster tool replacements and significantly cut changeover durations, helping maintain consistent output levels. Their widespread use in CNC centers, molding units, stamping facilities, and other precision-driven environments underscores their value in smart manufacturing. As Industry 4.0 gains momentum, next-generation systems now integrate IoT and sensor technologies to enable real-time insights into tool performance, wear, and change intervals, allowing more predictive and data-driven operations. This growing shift toward automation and real-time monitoring is setting the stage for innovation and continuous improvement in tooling infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.1 Billion |

| Forecast Value | $8.6 Billion |

| CAGR | 5.6% |

Manual quick-change systems led the market in 2024 with a valuation of USD 1.9 billion and are projected to hit USD 2.8 billion by 2034. Their popularity stems from easy integration with existing machinery, cost efficiency, and minimal training requirements. These systems remain ideal for operations that do not depend heavily on high-speed automation, offering a practical solution for small and medium businesses. They're also favored in segments like woodworking, plastic molding, and metal fabrication, where versatility and simplicity matter. The ability to function effectively in legacy machines further enhances their relevance in regions where modernization is slower and infrastructure investments are limited.

In 2024, the single-station tooling systems segment held a 64.1% share and is forecasted to grow at a CAGR of 5% through 2034. These systems are especially effective in applications requiring tool changes at fixed points, such as with individual CNC units or lathes. Their affordability, minimal setup complexity, and easy maintenance make them well-suited for mid-sized enterprises across manufacturing sectors. The use of these systems is prominent in industries like fabrication, plastics, and precision metalwork, which benefit from targeted and standalone machine applications.

United States Quick-change Tooling System Market was valued at USD 720 million in 2024 and is anticipated to grow at a CAGR of 6.1% between 2025 and 2034. The region's robust automotive, aerospace, and defense manufacturing sectors are major drivers of adoption. As manufacturers emphasize speed, customization, and lean production methods, there has been a notable shift toward automation-ready tooling systems. The U.S. benefits from a sophisticated industrial environment supported by skilled labor, cutting-edge R&D capabilities, and a strong demand for innovation. This combination supports rapid turnaround and tailored tooling applications, increasing demand for both manual and automated quick-change solutions.

Leading companies in the Quick-change Tooling System Industry include AMETEK, Inc., Nachi-Fujikoshi Corp, Illinois Tool Works Inc. (ITW), THK Co., Ltd., and Kennametal Inc. To reinforce their market positions, companies are investing in innovation by developing modular and scalable tooling systems that offer greater compatibility with automated machinery. Many are forming strategic alliances with OEMs and machine manufacturers to integrate their technologies directly into new production equipment. Firms are also enhancing product lines with IoT-enabled features for remote diagnostics and real-time monitoring. Continuous upgrades, focus on ergonomic designs and expansion into emerging economies are helping key players stay competitive while meeting demand for fast, flexible, and efficient tooling solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Operation mode

- 2.2.4 Application

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Manual systems

- 5.3 Automatic systems

- 5.4 Hydraulic systems

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Operation mode, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Single-station systems

- 6.3 Multi-station systems

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Injection molding

- 7.3 Stamping & press tools

- 7.4 Robotic tooling

- 7.5 Welding systems

- 7.6 Assembly lines

- 7.7 Packaging machines

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Aerospace and defense

- 8.4 Consumer electronics

- 8.5 Medical devices

- 8.6 Packaging

- 8.7 Industrial machinery

- 8.8 Plastics and rubber

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 UAE

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 AMETEK, Inc.

- 11.2 BIG DAISHOWA

- 11.3 Destaco

- 11.4 Diebold Goldring-Werkzeugfabrik

- 11.5 Erowa AG

- 11.6 Illinois Tool Works Inc. (ITW)

- 11.7 Jergens Inc.

- 11.8 Kennametal Inc. Co., Ltd

- 11.9 LANG Technik GmbH

- 11.10 Mate Precision Technologies

- 11.11 Nachi-Fujikoshi Corp

- 11.12 Rohm GmbH

- 11.13 SCHUNK GmbH & Co. KG

- 11.14 SMW Autoblok

- 11.15 THK Co., Ltd.