|

市场调查报告书

商品编码

1766261

聚合物微胶囊市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Polymeric Microcapsules Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

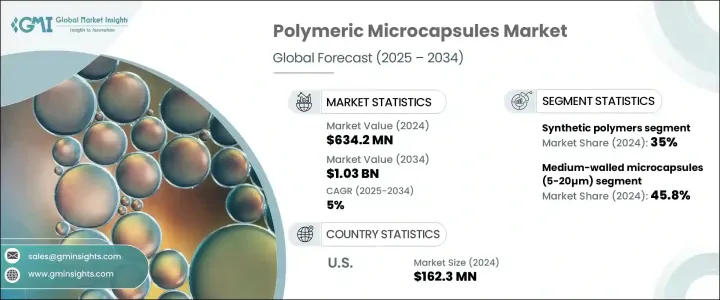

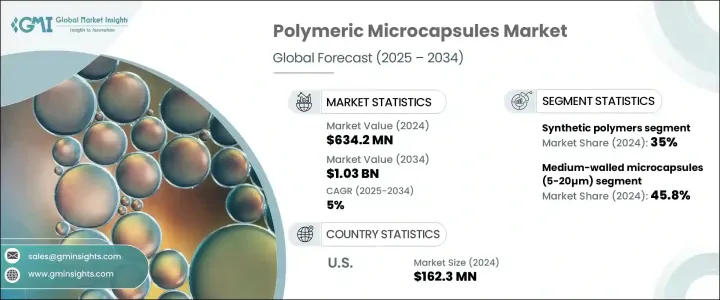

2024年,全球聚合物微胶囊市场规模达6.342亿美元,预计2034年将以5%的复合年增长率成长,达到10.3亿美元。各行各业对控释技术日益增长的需求是推动该市场成长的主要动力。微胶囊技术在製药和医疗保健领域尤其流行,因为控释技术对于提高药效、减少副作用和增强患者依从性至关重要。这些技术可确保活性成分在特定时间和特定位置释放,这对于慢性病管理和个人化医疗的发展至关重要。除了製药领域,聚合物微胶囊的应用也正在扩展到个人护理、纺织品和食品等领域。

例如,微胶囊技术在美容产品和个人护理产品中的应用日益广泛,它不仅能保护敏感成分,还能提升产品性能。在食品业,这些微胶囊还能保护发酵饮料等产品中的益生菌,进而延长保存期限。功能性食品和保健品中微胶囊技术的日益普及,进一步推动了市场的成长。随着消费者对更持久、更安全、更有效的产品的需求,聚合物微胶囊在各种应用中都变得至关重要,推动整个市场的创新。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6.342亿美元 |

| 预测值 | 10.3亿美元 |

| 复合年增长率 | 5% |

合成聚合物领域在2024年占据了35%的市场份额,这主要归功于其成本效益、多功能性以及与各种活性成分的兼容性。这些聚合物能够控制物质的释放,广泛应用于医药和农业化学物质。此外,由于其优异的阻隔性能、可调节的降解速率和高稳定性,它们在食品和化妆品领域也越来越受欢迎。合成聚合物的可扩展性,加上其易于生产的特性,使其比不太适合大规模生产的天然或混合替代品更受欢迎。

中壁微胶囊市场(尺寸介于5至20微米之间)在2024年的市占率为45.8%。这类微胶囊因其结构完整性和随时间有效释放活性成分的能力而备受青睐,使其成为药物输送系统、农业和食品领域的理想选择。其尺寸能够控制释放速率,这在精准时间和剂量至关重要的应用中至关重要。

2024年,美国聚合物微胶囊市场规模达1.623亿美元,反映美国在推动微胶囊技术创新方面发挥领导作用。美国完善的医疗体系和监管环境为控释技术的发展提供了稳定的基础。美国消费者对性能更佳、安全性更高、用户友好的产品的需求日益增长,而聚合物微胶囊则透过延长保质期、掩盖风味和控製成分释放等方式,满足了这些需求。

全球聚合物微胶囊市场的主要参与者,例如巴斯夫、赢创、奇华顿、IFF 和龙沙,持续致力于透过创新和产品开发扩大其市场份额。这些公司采取的策略包括投资研发以推进微胶囊技术、建立策略性合作伙伴关係以提高市场渗透率,以及扩展产品组合以满足食品、医疗保健和化妆品等行业日益增长的需求。透过提供可客製化的解决方案、提升产品性能并确保合规性,这些公司巩固了其在市场上的地位。此外,他们越来越注重提供能够提高永续性并满足消费者对更清洁、更安全产品需求的解决方案。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计(HS编码)

- 主要出口国

- 主要进口国。註:以上贸易统计仅提供主要国家

- 利润率分析

- 重要新闻和倡议

- 技术进步与创新

- 监管格局

- 全球的

- FDA 法规(美国)

- EMA法规(欧洲)

- CFDA法规(中国)

- 其他区域监管机构

- 环境法规

- 微塑胶法规

- 生物降解性标准

- 永续性要求

- 全球的

- 衝击力

- 成长动力

- 对控释技术的需求不断成长

- 封装技术的技术进步

- 製药和医疗保健领域的应用日益增多

- 越来越关注可持续和可生物降解的材料

- 产业陷阱与挑战

- 生产成本高、製造流程复杂

- 来自替代技术的竞争

- 与不可生物降解聚合物相关的环境问题

- 市场机会

- 自修復材料的新兴应用

- 对化妆品和个人护理产品的需求不断增长

- 农业应用扩展

- 功能性布料在纺织业的潜力

- 热能储存系统的机会

- 成长动力

- 原料分析

- 壳形成的关键原料

- 磁芯材质选择标准

- 原物料供应商格局

- 原物料价格趋势

- 未来趋势和新兴应用

- 技术进步

- 智慧型可程式释放系统

- 多功能微胶囊

- 奈米技术集成

- 绿色製造流程

- 材料创新

- 新型可生物降解聚合物

- 生物基和可持续材料

- 刺激响应材料

- 混合和复合材料

- 新兴应用

- 先进的药物传输系统

- 自修復材料

- 智慧纺织品

- 热能储存

- 3D列印应用

- 微生物组封装

- 产业融合机会

- 未来市场情景

- 长期成长前景

- 技术进步

- 成长潜力分析

- 2021-2034年价格分析(美元/吨)

- 影响定价的因素

- 原料成本

- 能源成本

- 生产规模

- 技术成熟度

- 市场竞争

- 石油基替代品定价

- 影响定价的因素

- 技术格局和製造流程

- 微胶囊技术

- 物理方法

- 喷雾干燥

- 流体化床包衣

- 离心挤压

- 冷冻干燥

- 化学方法

- 介面聚合

- 原位聚合

- 乳液聚合

- 物理化学方法

- 复合凝聚

- 简单凝聚

- 溶剂蒸发

- 先进技术

- 微流体技术

- 超临界流体技术

- 逐层组装

- 静电纺丝

- 技术创新与专利分析

- 最近的技术突破

- 研发趋势与未来技术方向

- 微胶囊技术

- 波特的分析

- PESTEL分析

- 价值链分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司热图分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

- Expansion

- Mergers & Acquisition

- Collaborations

- New Product Launches

- Research & Development

- 竞争格局

- 市场集中度分析

- 竞争定位和策略

- 合併、收购和策略伙伴关係

- 新产品发布和创新

- 行销和促销策略

- 主要参与者的最新发展和影响分析

- 公司分类

- 参与者概述

- 财务表现

- 来源基准测试

第五章:市场估计与预测:按聚合物类型,2021-2034 年

- 主要趋势

- 天然聚合物

- 多醣基聚合物

- 纤维素及其衍生物

- 淀粉及其衍生物

- 壳聚醣

- 海藻酸盐

- 树胶(阿拉伯胶、黄原胶等)

- 蛋白质基聚合物

- 明胶

- 白蛋白

- 胶原

- 其他蛋白质基聚合物

- 其他天然聚合物

- 多醣基聚合物

- 合成聚合物

- 可生物降解的合成聚合物

- 解放军

- 聚乳酸-羟基乙酸酯

- 聚己内酯

- 植物凝血酶原

- 其他可生物降解的合成聚合物

- 非生物分解的合成聚合物

- 聚氨酯/聚脲

- 聚甲基丙烯酸甲酯

- 聚乙烯

- 聚苯乙烯

- 其他不可生物降解的合成聚合物

- 可生物降解的合成聚合物

- 半合成聚合物

- 纤维素衍生物

- 改性淀粉

- 其他半合成聚合物

- 混合和复合聚合物

- 聚合物共混物

- 聚合物-无机杂化材料

- 多层聚合物体系

- 新兴高分子材料

- 智慧且刺激响应的聚合物

- 仿生聚合物材料

- 奈米复合聚合物

第六章:市场估计与预测:按壳厚度,2021-2034 年

- 主要趋势

- 薄壁微胶囊(1-5µm)

- 中壁微胶囊(5-20µm)

- 厚壁微胶囊(20-1000µm)

第七章:市场估计与预测:按核心材料,2021-2034 年

- 主要趋势

- 实心芯材料

- 扩散控制释放

- 单核(核壳)微胶囊

- 基质封装系统

- 多壁微胶囊

- 压力触发释放

- 单核(核壳)微胶囊

- 多核心微胶囊

- 酵素释放

- 单核(核壳)微胶囊

- 基质封装系统

- 扩散控制释放

- 液芯材料

- 溶解控制释放

- 单核(核壳)微胶囊

- 多壁微胶囊

- 温度响应释放

- 多壁微胶囊

- 基质封装系统

- 两面神和复杂形态

- p H反应性释放

- 单核(核壳)微胶囊

- 多壁微胶囊

- 溶解控制释放

- 气芯材料

- 压力触发释放

- 单核(核壳)微胶囊

- 两面神和复杂形态

- 其他刺激反应释放机制

- 多核心微胶囊

- 两面神和复杂形态

- 压力触发释放

- 多种核心材料

- 扩散控制释放

- 多核心微胶囊

- 多壁微胶囊

- 温度响应释放

- 两面神和复杂形态

- 基质封装系统

- pH响应释放

- 两面神和复杂形态

- 基质封装系统

- 其他刺激反应释放机制

- 两面神和复杂形态

- 扩散控制释放

第八章:市场估计与预测:依最终用途,2021-2034 年

- 主要趋势

- 製药和医疗保健

- 受管制药物传输系统

- 掩味

- 蛋白质和胜肽输送

- 标靶治疗

- 细胞封装

- 疫苗递送

- 其他药物应用

- 食品和饮料

- 风味封装

- 营养保存

- 益生菌封装

- 功能性食品配料

- 延长保存期限

- 其他食品和饮料应用

- 化妆品和个人护理

- 香料封装

- 活性成分输送

- 防紫外线

- 抗衰老配方

- 彩妆

- 其他化妆品应用

- 农业

- 控释肥料

- 农药和除草剂投放

- 种子包衣

- 土壤改良

- 其他农业应用

- 纺织品

- 散发香味的纺织品

- 抗菌纺织品

- 用于热调节的相变材料

- 防紫外线纺织品

- 其他纺织应用

- 建筑和建筑材料

- 自修復混凝土

- 热能储存

- 防腐蚀

- 阻燃系统

- 其他建筑应用

- 其他的

第九章:市场估计与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- Balchem Corporation

- BASF SE

- Calyxia

- Evonik Industries AG

- Givaudan SA

- IFF

- Lonza Group

- Microtek Laboratories

- Mikrocaps

- Milliken

- Tagra Biotechnologies

The Global Polymeric Microcapsules Market was valued at USD 634.2 million in 2024 and is estimated to grow at a CAGR of 5% to reach USD 1.03 billion by 2034. The increasing demand for controlled-release technologies across various industries is the main driver for this market growth. Microencapsulation techniques are particularly in demand in the pharmaceutical and healthcare sectors, where controlled release is essential for improving drug efficacy, minimizing side effects, and enhancing patient compliance. These technologies ensure precise timing and location for the release of active ingredients, which is vital for managing chronic conditions and advancing personalized medicine. In addition to pharmaceuticals, the use of polymeric microcapsules is expanding into sectors like personal care, textiles, and food products.

For instance, encapsulation is increasingly used in beauty products and self-care items, protecting sensitive ingredients and enhancing product performance. In the food industry, these microcapsules help improve shelf life by protecting probiotics in products like fermented beverages. The growing adoption of microencapsulation in functional foods and health supplements is further boosting market growth. As consumers demand longer-lasting, safer, and more effective products, polymeric microcapsules are becoming essential in a wide range of applications, fueling innovation across the market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $634.2 Million |

| Forecast Value | $1.03 Billion |

| CAGR | 5% |

The synthetic polymers segment held a 35% share in 2024, primarily due to their cost-effectiveness, versatility, and compatibility with various active ingredients. These polymers enable the controlled release of substances and are widely used in pharmaceutical and agrochemical products. Additionally, they are gaining traction in the food and cosmetics sectors, owing to their superior barrier properties, tunable degradation rates, and high stability. The scalability of synthetic polymers, coupled with the ease of their production, makes them more favorable than natural or hybrid alternatives, which are less suitable for mass production.

Medium-walled microcapsules segment, which measure between 5 and 20 micrometers, accounted for 45.8% share in 2024. These microcapsules are favored for their structural integrity and ability to release active ingredients efficiently over time, making them ideal for use in drug delivery systems, agriculture, and food products. Their size offers the necessary control over the release rate, which is essential in applications where precise timing and dosage are critical. The

U.S. Polymeric Microcapsules Market was valued at USD 162.3 million in 2024, reflecting the country's leading role in driving innovation in microencapsulation technologies. The well-established healthcare system and regulatory environment in the U.S. provide a stable foundation for the growth of controlled-release technologies. U.S. consumers are increasingly demanding products that offer enhanced performance, safety, and user-friendly features, which polymeric microcapsules help deliver by improving shelf life, flavor masking, and controlled ingredient delivery.

Key players in the Global Polymeric Microcapsules Market, such as BASF, Evonik, Givaudan, IFF, and Lonza, continue to focus on expanding their market presence through innovations and product development. These companies adopt strategies that include investing in R&D to advance microencapsulation technologies, forming strategic partnerships to improve market penetration, and expanding their portfolios to meet the growing demand from industries like food, healthcare, and cosmetics. By offering customizable solutions, enhancing product performance, and ensuring regulatory compliance, these companies strengthen their foothold in the market. Additionally, they are increasingly focusing on offering solutions that improve sustainability and address consumer demands for cleaner, safer products.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries. Note: the above trade statistics will be provided for key countries only

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Technological advancements and innovations

- 3.7 Regulatory landscape

- 3.7.1 Global

- 3.7.1.1 FDA regulations (U.S.)

- 3.7.1.2 EMA regulations (Europe)

- 3.7.1.3 CFDA regulations (China)

- 3.7.1.4 Other regional regulatory bodies

- 3.7.2 Environmental regulations

- 3.7.2.1 Microplastics regulations

- 3.7.2.2 Biodegradability standards

- 3.7.2.3 Sustainability requirements

- 3.7.1 Global

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Growing demand for controlled release technologies

- 3.8.1.2 Technological advancements in encapsulation techniques

- 3.8.1.3 Increasing applications in pharmaceutical and healthcare sectors

- 3.8.1.4 Growing focus on sustainable and biodegradable materials

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High production costs and complex manufacturing processes

- 3.8.2.2 Competition from alternative technologies

- 3.8.2.3 Environmental concerns related to non-biodegradable polymers

- 3.8.3 Market opportunities

- 3.8.3.1 Emerging applications in self-healing materials

- 3.8.3.2 Growing demand in cosmetics and personal care

- 3.8.3.3 Expansion in agricultural applications

- 3.8.3.4 Potential in textile industry for functional fabrics

- 3.8.3.5 Opportunities in thermal energy storage systems

- 3.8.1 Growth drivers

- 3.9 Raw materials analysis

- 3.9.1 Key raw materials for shell formation

- 3.9.2 Core material selection criteria

- 3.9.3 Raw material suppliers landscape

- 3.9.4 Raw material price trends

- 3.10 Future trends and emerging applications

- 3.10.1 Technological advancements

- 3.10.1.1 Smart and programmable release systems

- 3.10.1.2 Multi-functional microcapsules

- 3.10.1.3 Nanotechnology integration

- 3.10.1.4 Green manufacturing processes

- 3.10.2 Material innovations

- 3.10.2.1 Novel biodegradable polymers

- 3.10.2.2 Bio-based and sustainable materials

- 3.10.2.3 Stimuli-responsive materials

- 3.10.2.4 Hybrid and composite materials

- 3.10.3 Emerging applications

- 3.10.3.1 Advanced drug delivery systems

- 3.10.3.2 Self-healing materials

- 3.10.3.3 Smart textiles

- 3.10.3.4 Thermal energy storage

- 3.10.3.5 3d printing applications

- 3.10.3.6 Microbiome encapsulation

- 3.10.4 Industry convergence opportunities

- 3.10.5 Future market scenarios

- 3.10.6 Long-term growth prospects

- 3.10.1 Technological advancements

- 3.11 Growth potential analysis

- 3.12 Pricing analysis (USD/Tons) 2021-2034

- 3.12.1 Factors affecting pricing

- 3.12.1.1 Raw material costs

- 3.12.1.2 Energy costs

- 3.12.1.3 Production scale

- 3.12.1.4 Technology maturity

- 3.12.1.5 Market competition

- 3.12.1.6 Petroleum-based alternatives pricing

- 3.12.1 Factors affecting pricing

- 3.13 Technology landscape and manufacturing processes

- 3.13.1 Microencapsulation techniques

- 3.13.1.1 Physical methods

- 3.13.1.2 Spray drying

- 3.13.1.3 Fluid bed coating

- 3.13.1.4 Centrifugal extrusion

- 3.13.1.5 Freeze drying

- 3.13.2 Chemical methods

- 3.13.2.1 Interfacial polymerization

- 3.13.2.2 In-situ polymerization

- 3.13.2.3 Emulsion polymerization

- 3.13.3 Physicochemical methods

- 3.13.3.1 Complex coacervation

- 3.13.3.2 Simple coacervation

- 3.13.3.3 Solvent evaporation

- 3.13.4 Advanced technologies

- 3.13.4.1 Microfluidic techniques

- 3.13.4.2 Supercritical fluid technology

- 3.13.4.3 Layer-by-layer assembly

- 3.13.4.4 Electrospinning

- 3.13.5 Technological innovations and patent analysis

- 3.13.5.1 Recent technological breakthroughs

- 3.13.5.2 R&D trends and future technological directions

- 3.13.1 Microencapsulation techniques

- 3.14 Porter's analysis

- 3.15 PESTEL analysis

- 3.16 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Company heat map analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.6.1 Expansion

- 4.6.2 Mergers & Acquisition

- 4.6.3 Collaborations

- 4.6.4 New Product Launches

- 4.6.5 Research & Development

- 4.7 Competitive landscape

- 4.7.1 Market concentration analysis

- 4.7.2 Competitive positioning and strategies

- 4.7.3 Mergers, acquisitions, and strategic partnerships

- 4.7.4 New product launches and innovations

- 4.7.5 Marketing and promotional strategies

- 4.8 Recent developments & impact analysis by key players

- 4.8.1 Company categorization

- 4.8.2 Participant’s overview

- 4.8.3 Financial performance

- 4.9 Source benchmarking

Chapter 5 Market Estimates and Forecast, By Polymer Type, 2021–2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Natural polymers

- 5.2.1 Polysaccharide-based polymers

- 5.2.1.1 Cellulose and derivatives

- 5.2.1.2 Starch and derivatives

- 5.2.1.3 Chitosan

- 5.2.1.4 Alginate

- 5.2.1.5 Gums (arabic, xanthan, etc.)

- 5.2.2 Protein-based polymers

- 5.2.2.1 Gelatin

- 5.2.2.2 Albumin

- 5.2.2.3 Collagen

- 5.2.2.4 Other protein-based polymers

- 5.2.3 Other natural polymers

- 5.2.1 Polysaccharide-based polymers

- 5.3 Synthetic polymers

- 5.3.1 Biodegradable synthetic polymers

- 5.3.1.1 PLA

- 5.3.1.2 PLGA

- 5.3.1.3 PCL

- 5.3.1.4 PHA

- 5.3.1.5 Other biodegradable synthetic polymers

- 5.3.2 Non-biodegradable synthetic polymers

- 5.3.2.1 Polyurethane/polyurea

- 5.3.2.2 PMMA

- 5.3.2.3 Polyethylene

- 5.3.2.4 Polystyrene

- 5.3.2.5 Other non-biodegradable synthetic polymers

- 5.3.1 Biodegradable synthetic polymers

- 5.4 Semi-synthetic polymers

- 5.4.1 Cellulose derivatives

- 5.4.2 Modified starches

- 5.4.3 Other semi-synthetic polymers

- 5.5 Hybrid and composite polymers

- 5.5.1 Polymer blends

- 5.5.2 Polymer-inorganic hybrids

- 5.5.3 Multi-layer polymer systems

- 5.6 Emerging polymer materials

- 5.6.1 Smart and stimuli-responsive polymers

- 5.6.2 Bio-inspired polymeric materials

- 5.6.3 Nanocomposite polymers

Chapter 6 Market Estimates and Forecast, By Shell Thickness, 2021–2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Thin-walled microcapsules (1-5µm)

- 6.3 Medium- walled microcapsules (5-20µm)

- 6.4 Thick- walled microcapsules (20-1000µm)

Chapter 7 Market Estimates and Forecast, By Core Material, 2021–2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Solid core materials

- 7.2.1 Diffusion-controlled release

- 7.2.1.1 Mononuclear (core-shell) microcapsules

- 7.2.1.2 Matrix encapsulation systems

- 7.2.1.3 Multi-wall microcapsules

- 7.2.2 Pressure-triggered release

- 7.2.2.1 Mononuclear (core-shell) microcapsules

- 7.2.2.2 Polynuclear microcapsules

- 7.2.3 Enzyme-triggered release

- 7.2.3.1 Mononuclear (core-shell) microcapsules

- 7.2.3.2 Matrix encapsulation systems

- 7.2.1 Diffusion-controlled release

- 7.3 Liquid core materials

- 7.3.1 Dissolution-controlled release

- 7.3.1.1 Mononuclear (core-shell) microcapsules

- 7.3.1.2 Multi-wall microcapsules

- 7.3.1.3 Temperature-responsive release

- 7.3.2 Multi-wall microcapsules

- 7.3.2.1 Matrix encapsulation systems

- 7.3.2.2 Janus and complex morphologies

- 7.3.3 p H-responsive release

- 7.3.3.1 Mononuclear (core-shell) microcapsules

- 7.3.3.2 Multi-wall microcapsules

- 7.3.1 Dissolution-controlled release

- 7.4 Gas core materials

- 7.4.1 Pressure-triggered release

- 7.4.1.1 Mononuclear (core-shell) microcapsules

- 7.4.1.2 Janus and complex morphologies

- 7.4.2 Other stimuli-responsive release mechanisms

- 7.4.2.1 Polynuclear microcapsules

- 7.4.2.2 Janus and complex morphologies

- 7.4.1 Pressure-triggered release

- 7.5 Multiple core materials

- 7.5.1 Diffusion-controlled release

- 7.5.1.1 Polynuclear microcapsules

- 7.5.1.2 Multi-wall microcapsules

- 7.5.2 Temperature-responsive release

- 7.5.2.1 Janus and complex morphologies

- 7.5.2.2 Matrix encapsulation systems

- 7.5.3 pH-responsive release

- 7.5.3.1 Janus and complex morphologies

- 7.5.3.2 Matrix encapsulation systems

- 7.5.4 Other stimuli-responsive release mechanisms

- 7.5.4.1 Janus and complex morphologies

- 7.5.1 Diffusion-controlled release

Chapter 8 Market Estimates and Forecast, By End Use, 2021–2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Pharmaceutical and healthcare

- 8.2.1 Controlled drug delivery systems

- 8.2.2 Taste masking

- 8.2.3 Protein and peptide delivery

- 8.2.4 Targeted therapy

- 8.2.5 Cell encapsulation

- 8.2.6 Vaccine delivery

- 8.2.7 Other pharmaceutical applications

- 8.3 Food and beverage

- 8.3.1 Flavor encapsulation

- 8.3.2 Nutrient preservation

- 8.3.3 Probiotics encapsulation

- 8.3.4 Functional food ingredients

- 8.3.5 Shelf-life extension

- 8.3.6 Other food and beverage applications

- 8.4 Cosmetics and personal care

- 8.4.1 Fragrance encapsulation

- 8.4.2 Active ingredient delivery

- 8.4.3 UV protection

- 8.4.4 Anti-aging formulations

- 8.4.5 Color cosmetics

- 8.4.6 Other cosmetic applications

- 8.5 Agriculture

- 8.5.1 Controlled release fertilizers

- 8.5.2 Pesticide and herbicide delivery

- 8.5.3 Seed coating

- 8.5.4 Soil enhancement

- 8.5.5 Other agricultural applications

- 8.6 Textile

- 8.6.1 Fragrance-releasing textiles

- 8.6.2 Antimicrobial textiles

- 8.6.3 Phase change materials for thermal regulation

- 8.6.4 UV-protective textiles

- 8.6.5 Other textile applications

- 8.7 Construction and building materials

- 8.7.1 Self-healing concrete

- 8.7.2 Thermal energy storage

- 8.7.3 Corrosion protection

- 8.7.4 Fire retardant systems

- 8.7.5 Other construction applications

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021–2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Balchem Corporation

- 10.2 BASF SE

- 10.3 Calyxia

- 10.4 Evonik Industries AG

- 10.5 Givaudan SA

- 10.6 IFF

- 10.7 Lonza Group

- 10.8 Microtek Laboratories

- 10.9 Mikrocaps

- 10.10 Milliken

- 10.11 Tagra Biotechnologies