|

市场调查报告书

商品编码

1766266

料斗供料系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Hopper Feeding System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

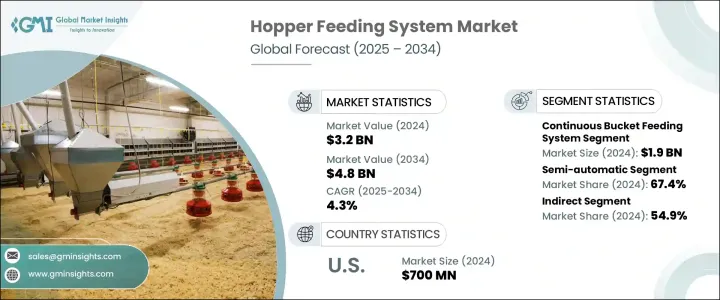

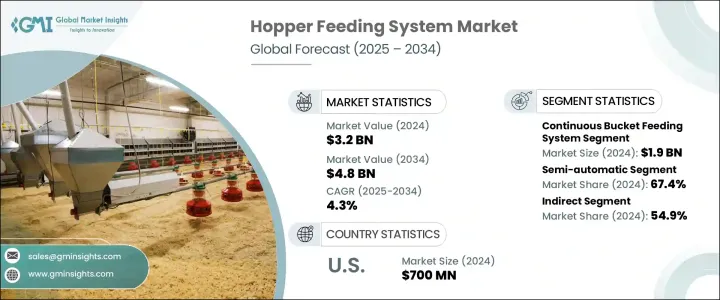

2024年,全球料斗供料系统市场规模达32亿美元,预计2034年将以4.3%的复合年增长率成长,达到48亿美元。随着工业自动化在各行业日益普及,高效物料搬运解决方案的需求也日益增长。料斗供料系统正成为这项转型的关键组成部分,它提供自动化、精简的机制,无需人工干预即可输送散装物料。随着对生产力和营运一致性的日益重视,各行各业正在将这些系统整合到生产线中,以最大限度地减少停机时间和人为错误。在那些需要维持高精度物料流以确保品质控制和营运连续性的产业中,这些系统尤其重要。

现代料斗供料系统配备感测器和电脑控制装置,可实现无缝物料计量,并与搅拌机、输送机和包装系统等自动化设备整合。透过实现不间断的物料输送和即时控制,这些系统可协助企业维持高营运效率并减少物料浪费。它们相容于各种製程自动化设置,对于注重优化产量和保持合规性的製造商而言,是一项极具吸引力的投资。随着劳动成本的上升和对稳定品质需求的不断增长,料斗供料系统正成为全球流程製造环境中的策略资产。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 32亿美元 |

| 预测值 | 48亿美元 |

| 复合年增长率 | 4.3% |

就产品类型而言,市场细分为连续式和间歇式料斗供料系统。其中,连续式料斗供料系统市场在2024年达到19亿美元,预估至2034年复合年增长率为4.7%。这些系统旨在以恆定的速率输送物料,非常适合依赖稳定输入的自动化操作,例如粉末、颗粒和丸粒的生产。它们能够保持不间断的物料流动,并满足大量生产的需求。此外,它们对智慧控制的适应性以及与数位化生产环境的完全集成,进一步增强了其对注重自动化和可扩展性的企业的吸引力。

依操作模式分类,市场分为半自动和全自动系统。 2024年,半自动系统以67.4%的市占率占据市场主导地位,预计在预测期内的复合年增长率为3.7%。这些系统在手动操作和自动化之间取得了平衡,为中小型企业提供了实用的解决方案。其价格实惠、易于使用,特别适合那些不需要完全自动化但仍希望提高流程一致性和减少劳动力依赖的操作。由于成本较低且维护要求较低,半自动料斗供料系统在预算有限、无法使用全自动技术的市场中被广泛采用。其日益普及与中小企业的全球扩张息息相关,而中小企业则构成了全球企业的大多数。

市场也按配销通路细分为直接销售和间接销售。间接分销在2024年占据主导地位,占总收入的54.9%,预计在2025年至2034年期间的复合年增长率为4.8%。授权经销商、经销商和系统整合商等间接通路在拓展更广泛的客户群方面发挥着至关重要的作用。这些中间商通常对当地市场动态、技术要求和监管环境有着深入的了解,这使得他们能够提供客製化的解决方案和卓越的支援。他们建立的网路可以帮助製造商在无需大量投资直接销售基础设施的情况下扩大业务范围,从而使间接销售成为一种高效的市场进入策略。

从地区来看,美国在北美料斗供料系统市场占有重要份额,2024 年估值达 7 亿美元。由于先进的工业基础设施和自动化技术的日益普及,美国的需求正在稳步增长。围绕生产效率和工作场所安全的监管标准也推动着各行各业向料斗供料系统等自动化解决方案迈进。随着企业寻求提高精度并减少营运中断,智慧工厂框架和数位化生产系统的日益普及进一步支撑了市场成长。凭藉着坚实的工业基础和积极向智慧自动化转型,美国继续引领该地区的料斗供料系统市场。

塑造全球料斗供料系统市场格局的关键参与者包括 Eriez Manufacturing、Coperion、Festo、GEA Group、Hapman、Gericke、K-Tron、Novatec、Piab、Movacolor、Schenck Process、Spiroflow、Thayer Scale-Hyer Systems、Simatek Bulk 和 Volkmann。这些公司专注于创新、产品开发和策略性分销合作伙伴关係,以扩大市场份额并满足不断变化的行业需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 工业自动化的成长

- 对精确和连续进料的需求不断增加

- 食品和製药业的扩张

- 客製化和模组化设计需求

- 产业陷阱与挑战

- 与现有系统的复杂集成

- 初期投资成本高

- 机会

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 贸易统计数据

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东非洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 连续铲斗供料系统

- 间歇式料斗供料系统

第六章:市场估计与预测:依营运模式,2021 年至 2034 年

- 主要趋势

- 半自动

- 全自动

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 农业

- 食品工业

- 化学工业

- 其他的

第八章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直接的

- 间接

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十章:公司简介

- Coperion

- Eriez Manufacturing

- Festo

- GEA Group

- Gericke

- Hapman

- K-Tron

- Movacolor

- Novatec

- Piab

- Schenck Process

- Simatek Bulk Systems

- Spiroflow

- Thayer Scale-Hyer Industries

- Volkmann

The Global Hopper Feeding System Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 4.8 billion by 2034. As industrial automation becomes increasingly widespread across sectors, the demand for efficient material handling solutions is growing rapidly. Hopper feeding systems are emerging as key components in this transformation, offering automated and streamlined mechanisms for feeding bulk materials without manual intervention. With growing emphasis on productivity and operational consistency, industries are integrating these systems into their production lines to minimize downtime and human error. These systems have become especially important in sectors where maintaining material flow with high precision is essential for quality control and operational continuity.

Modern hopper feeding systems, equipped with sensors and computer controls, enable seamless material dosing and integration with automated equipment such as mixers, conveyors, and packaging systems. By facilitating uninterrupted material transfer and offering real-time control, these systems help companies maintain a high level of operational efficiency and reduce material waste. Their compatibility with various process automation setups makes them an attractive investment for manufacturers focusing on optimizing throughput and maintaining regulatory compliance. With rising labor costs and increasing demand for consistent quality, hopper feeding systems are becoming a strategic asset in process manufacturing environments globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $4.8 Billion |

| CAGR | 4.3% |

In terms of product type, the market is segmented into continuous and intermittent bucket feeding systems. Among these, the continuous bucket feeding system segment accounted for USD 1.9 billion in 2024 and is projected to register a CAGR of 4.7% through 2034. These systems are designed to deliver material at a constant rate, making them ideal for automated operations that rely on steady input, such as in the production of powders, granules, and pellets. Their ability to maintain uninterrupted flow aligns with the needs of high-volume manufacturing setups. Moreover, their adaptability to intelligent controls and full integration into digital production environments further enhance their appeal for companies prioritizing automation and scalability.

When categorized by mode of operation, the market is divided into semi-automatic and fully automatic systems. In 2024, the semi-automatic segment led the market with a 67.4% share and is expected to grow at a CAGR of 3.7% during the forecast period. These systems strike a balance between manual effort and automation, offering a practical solution for small and medium-sized enterprises. Their affordability and ease of use make them particularly suitable for operations that don't require full automation but still seek to improve process consistency and reduce labor dependency. Due to their lower cost and reduced maintenance requirements, semi-automatic hopper feeding systems are widely adopted in markets where budget constraints limit access to fully automated technology. Their growing popularity can be linked to the global expansion of SMEs, which make up the majority of businesses worldwide.

The market is also segmented by distribution channel into direct and indirect sales. The indirect distribution segment dominated in 2024, accounting for 54.9% of total revenue, and is anticipated to grow at a CAGR of 4.8% between 2025 and 2034. Indirect channels such as authorized distributors, resellers, and system integrators play a vital role in reaching a broader customer base. These intermediaries often possess deep knowledge of local market dynamics, technical requirements, and regulatory environments, enabling them to provide tailored solutions and superior support. Their established networks help manufacturers expand their reach without significant investment in direct sales infrastructure, making indirect sales a highly effective go-to-market strategy.

Regionally, the United States held a significant share in the North American hopper feeding system market, with a valuation of USD 700 million in 2024. The country is witnessing steady growth in demand due to its advanced industrial infrastructure and rising adoption of automation technologies. Regulatory standards around manufacturing efficiency and workplace safety are also pushing industries toward automated solutions like hopper feeding systems. The increasing adoption of smart factory frameworks and digitalized production systems further supports market growth, as companies look to improve precision and reduce operational disruptions. With a solid industrial base and a proactive shift toward intelligent automation, the U.S. continues to lead the region's market for hopper feeding systems.

Key players shaping the global hopper feeding system market landscape include Eriez Manufacturing, Coperion, Festo, GEA Group, Hapman, Gericke, K-Tron, Novatec, Piab, Movacolor, Schenck Process, Spiroflow, Thayer Scale-Hyer Industries, Simatek Bulk Systems, and Volkmann. These companies are focused on innovation, product development, and strategic distribution partnerships to expand their market presence and cater to evolving industry demands.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Mode of operation

- 2.2.4 End use

- 2.2.5 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth in industrial automation

- 3.2.1.2 Increasing demand for accurate and continuous feeding

- 3.2.1.3 Expansion of food and pharmaceutical sectors

- 3.2.1.4 Customization and modular design demand

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Complex integration with existing systems

- 3.2.2.2 High initial investment costs

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation Landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 – 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Continuous bucket feeding systems

- 5.3 Intermittent bucket feeding systems

Chapter 6 Market Estimates & Forecast, By Mode of Operation, 2021 – 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Semi-automatic

- 6.3 Fully automatic

Chapter 7 Market Estimates & Forecast, By End Use, 2021 – 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Agriculture

- 7.3 Food industrial

- 7.4 Chemical industrial

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Coperion

- 10.2 Eriez Manufacturing

- 10.3 Festo

- 10.4 GEA Group

- 10.5 Gericke

- 10.6 Hapman

- 10.7 K-Tron

- 10.8 Movacolor

- 10.9 Novatec

- 10.10 Piab

- 10.11 Schenck Process

- 10.12 Simatek Bulk Systems

- 10.13 Spiroflow

- 10.14 Thayer Scale-Hyer Industries

- 10.15 Volkmann