|

市场调查报告书

商品编码

1766289

兽医骨科植入物市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Veterinary Orthopedic Implants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

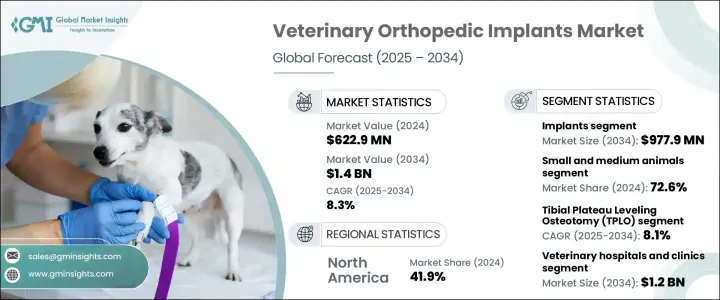

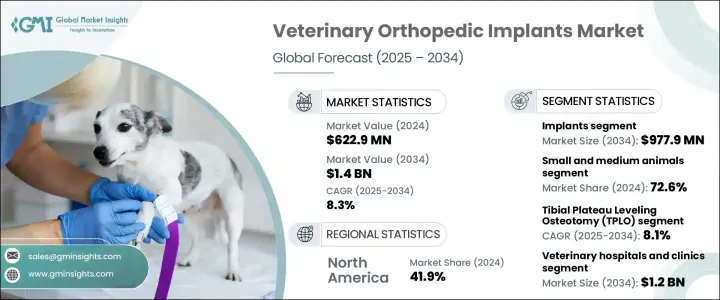

2024年,全球兽医骨科植入物市场价值为6.229亿美元,预计到2034年将以8.3%的复合年增长率成长,达到14亿美元。这一增长主要得益于全球宠物主人数量的增长,这持续推动了对骨科手术和骨骼整形等先进兽医服务的需求。兽医外科技术的进步,尤其是关节镜等微创技术,也有助于缩短復原时间,提升宠物主人的接受度。

此外,人们对现代动物外科植入物益处的认识不断提高,为产业参与者创造了新的机会。新兴经济体对动物保健基础设施的投资进一步促进了市场扩张。此外,正在进行的研发工作重点是开发经济高效且用户友好的植入物技术,预计将显着提高已开发市场和发展中市场的采用率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6.229亿美元 |

| 预测值 | 14亿美元 |

| 复合年增长率 | 8.3% |

兽医骨科手术在治疗伴侣动物的肌肉骨骼疾病方面需求尤其强劲。动物损伤和退化性疾病(尤其是关节和韧带损伤)的发生率持续上升,促使外科植入物的使用量增加。对生物可吸收植入材料的需求也不断增长,这些材料可在体内自然溶解,无需后续的移除手术。这些材料通常由聚乳酸和聚乙醇酸等聚合物製成,因其安全性、高效性和成本优势而日益普及。诸如嵌入感测器或药物释放涂层的智慧植入物等创新技术也日益受到重视。这些设备有助于监测癒合过程,减少术后感染,进而进一步改善治疗效果。

就产品类型而言,市场细分为植入物和器械。植入物类别进一步细分为骨板、关节植入物、骨螺丝和锚、骨针和金属丝以及其他相关组件。该细分市场在2024年占据市场主导地位,估值达4.42亿美元,预计2034年将成长至9.779亿美元。这种主导地位可归因于人们对宠物骨科护理的认识日益提高,以及先进植入技术的日益普及。

根据动物类型,市场分为小型动物、中型动物和大型动物。小型动物和中型动物细分市场(包括犬、猫和其他体型相似的动物)在2024年占据了72.6%的市场份额,预计到2034年将以8.5%的复合年增长率增长。此细分市场的成长主要得益于全球宠物数量的成长以及骨折和关节疾病等骨科疾病发病率的上升。此外,外科手术治疗的可近性提高以及宠物主人投资高品质照护的意愿增强,也进一步推动了细分市场的成长。

依应用分析,市场涵盖胫骨平台平整截骨术 (TPLO)、胫骨结节推进术 (TTA)、关节置换、创伤及其他用途。其中,TPLO 手术仍是主要应用,2024 年市场规模达 1.412 亿美元,预计到 2034 年将成长至 3.032 亿美元,复合年增长率为 8.1%。该手术尤其以恢復关节稳定性和促进韧带损伤动物更快康復而闻名。

根据最终用途,市场细分为兽医医院和诊所以及其他兽医护理机构。 2024年,兽医院和诊所占据主导地位,市场价值为5.371亿美元,预计到2034年将达到12亿美元,复合年增长率为8.5%。设备齐全的诊所和医院的大量存在,加上对综合兽医护理日益增长的需求,推动了这一细分市场的发展。诊所和医院也是大多数宠物主人的首选咨询场所,使其成为整体市场收入的关键贡献者。

从地理分布来看,北美在2024年占据全球市场主导地位,市占率达41.9%。高宠物拥有率、不断增长的可支配收入以及对高级兽医护理的强劲需求是推动该地区成长的核心因素。此外,该地区还受益于多家大型兽医植入物製造商的布局、简化的监管途径以及大量的临床研究活动,所有这些都有助于该市场的持续扩张。

市场整合程度适中,主要参与者采取收购、合作、产品创新和研发投入等策略来维持竞争优势。排名前五的公司——DePuy Synthes(强生公司)、Movora(Vimian集团)、Veterinary Instrumentation、Arthrex Vet Systems 和 Rita Leibinger GmbH——合计占据了全球市场约 60% 的收入。这些公司持续专注于扩大产品组合併进入新市场,以满足全球日益增长的兽医骨科护理需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 狗狗骨科疾病发生率不断上升

- 兽医骨科技术的进步

- 扩大宠物保险覆盖范围

- 提高宠物主人对骨科问题的认识

- 产业陷阱与挑战

- 骨科手术和植入物费用高昂

- 熟练的兽医骨科外科医生数量有限

- 市场机会

- 加强植入物製造商和兽医医院之间的合作与伙伴关係

- 新兴市场的快速城市化和收入成长

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 技术格局

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 植入物

- 盘子

- TPLO板

- TTA板

- 创伤板

- 特种板材

- 其他板块

- 关节植入物

- 骨螺丝和锚

- 引脚和电线

- 其他植入物

- 盘子

- 仪器

第六章:市场估计与预测:依动物类型,2021 年至 2034 年

- 主要趋势

- 小型和中型动物

- 狗

- 猫

- 其他中小型动物

- 大型动物

第七章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 胫骨平台平整截骨术(TPLO)

- 胫骨结节推进术(TTA)

- 关节置换

- 髋关节置换术

- 膝关节置换术

- 手肘关节置换术

- 踝关节置换术

- 创伤

- 其他应用

第八章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 兽医医院和诊所

- 其他最终用途

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- AmerisourceBergen Corporation (Cencora, Inc.)

- Arthrex Vet Systems

- B. Braun

- BlueSAO

- DePuy Synthes (Johnson & Johnson)

- Fusion Implants

- GerVetUSA

- GPC Medical Ltd.

- Integra LifeSciences

- Movora (Vimian Group)

- Narang Medical Limited

- Ortho Max

- Orthomed

- Rita Leibinger

- Veterinary Instrumentation

The Global Veterinary Orthopedic Implants Market was valued at USD 622.9 million in 2024 and is estimated to grow at a CAGR of 8.3% to reach USD 1.4 billion by 2034. This growth is largely influenced by the rising number of pet owners worldwide, which continues to drive demand for advanced veterinary services such as orthopedic procedures and bone contouring. Technological advancements in veterinary surgery-especially minimally invasive techniques like arthroscopy-are also helping to accelerate recovery time, increasing acceptance among pet parents.

Furthermore, greater awareness about the benefits of modern surgical implants in animals has created new opportunities for industry participants. Investments in animal healthcare infrastructure in emerging economies have further reinforced market expansion. Additionally, ongoing R&D efforts are focused on developing cost-effective and user-friendly implant technologies, which are expected to significantly boost adoption rates across both developed and developing markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $622.9 Million |

| Forecast Value | $1.4 Billion |

| CAGR | 8.3% |

Veterinary orthopedic procedures are in particularly high demand for treating musculoskeletal conditions in companion animals. The prevalence of injuries and degenerative diseases in animals, especially those involving joints and ligaments, continues to rise, prompting increased use of surgical implants. Demand is also climbing for bioabsorbable implant materials that dissolve naturally in the body, eliminating the need for follow-up removal surgeries. These materials, often developed using polymers like polylactic acid and polyglycolic acid, are gaining popularity for their safety, efficiency, and cost advantages. Innovations such as smart implants embedded with sensors or drug-releasing coatings are also becoming more prominent. These devices help monitor healing processes and reduce post-operative infections, further enhancing treatment outcomes.

In terms of product type, the market is segmented into implants and instruments. The implants category is further broken down into plates, joint implants, bone screws and anchors, pins and wires, and other related components. This segment led the market in 2024, reaching a valuation of USD 442 million, and is expected to grow to USD 977.9 million by 2034. This dominance can be attributed to growing awareness around orthopedic care in pets and the increasing availability of sophisticated implant technologies.

By animal type, the market is categorized into small and medium animals and large animals. The small and medium animals segment-which includes dogs, cats, and other similarly sized animals-accounted for 72.6% of the market share in 2024 and is projected to expand at a CAGR of 8.5% through 2034. Growth in this segment is driven by the rising global pet population and the increasing frequency of orthopedic issues, such as fractures and joint disorders. Additionally, enhanced accessibility to surgical treatments and a greater willingness among pet owners to invest in high-quality care are further propelling segment growth.

When analyzed by application, the market includes procedures such as Tibial Plateau Leveling Osteotomy (TPLO), Tibial Tuberosity Advancement (TTA), joint replacement, trauma, and other uses. Among these, TPLO surgery remains a primary application, accounting for USD 141.2 million in 2024, and is projected to grow to USD 303.2 million by 2034, with a CAGR of 8.1%. This procedure is particularly known for restoring joint stability and promoting faster recovery in animals suffering from ligament injuries.

On the basis of end use, the market is segmented into veterinary hospitals and clinics and other veterinary care facilities. In 2024, veterinary hospitals and clinics dominated with a market value of USD 537.1 million, expected to reach USD 1.2 billion by 2034 at a CAGR of 8.5%. The robust presence of well-equipped clinics and hospitals, paired with the growing demand for comprehensive veterinary care, has been instrumental in driving this segment forward. Clinics and hospitals also serve as the initial point of consultation for most pet owners, making them key contributors to overall market revenue.

Geographically, North America led the global market in 2024, holding a share of 41.9%. High levels of pet ownership, rising disposable incomes, and strong demand for advanced veterinary care are core factors fueling regional growth. The region also benefits from the presence of several major veterinary implant manufacturers, streamlined regulatory pathways, and substantial clinical research activities, all of which contribute to the continued expansion of this market.

The market is moderately consolidated, with key players adopting strategies such as acquisitions, partnerships, product innovation, and R&D investments to maintain their competitive edge. The top five companies- DePuy Synthes (Johnson & Johnson), Movora (Vimian Group), Veterinary Instrumentation, Arthrex Vet Systems, and Rita Leibinger GmbH-collectively accounted for approximately 60% of global market revenue. These firms continue to focus on expanding their portfolios and entering new markets to address the growing global need for veterinary orthopedic care.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Animal type

- 2.2.4 Application

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing incidence of orthopedic conditions in dogs

- 3.2.1.2 Advancement in veterinary orthopedic technology

- 3.2.1.3 Expansion of pet insurance coverage

- 3.2.1.4 Increasing awareness among pet owners about orthopedic problems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of orthopedic procedures and implants

- 3.2.2.2 Limited availability of skilled veterinary orthopedic surgeons

- 3.2.3 Market opportunities

- 3.2.3.1 Increasing collaboration and partnership between implant manufacturers and veterinary hospitals

- 3.2.3.2 Rapid urbanization and income growth in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Implants

- 5.2.1 Plates

- 5.2.1.1 TPLO plates

- 5.2.1.2 TTA plates

- 5.2.1.3 Trauma plates

- 5.2.1.4 Specialty plates

- 5.2.1.5 Other plates

- 5.2.2 Joint implants

- 5.2.3 Bone screws and anchors

- 5.2.4 Pins and Wires

- 5.2.5 Other implants

- 5.2.1 Plates

- 5.3 Instruments

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Small and medium animals

- 6.2.1 Dogs

- 6.2.2 Cats

- 6.2.3 Other small and medium animals

- 6.3 Large animals

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Tibial Plateau Leveling Osteotomy (TPLO)

- 7.3 Tibial Tuberosity Advancement (TTA)

- 7.4 Joint replacement

- 7.4.1 Hip replacement

- 7.4.2 Knee replacement

- 7.4.3 Elbow replacement

- 7.4.4 Ankle replacement

- 7.5 Trauma

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospitals and clinics

- 8.3 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AmerisourceBergen Corporation (Cencora, Inc.)

- 10.2 Arthrex Vet Systems

- 10.3 B. Braun

- 10.4 BlueSAO

- 10.5 DePuy Synthes (Johnson & Johnson)

- 10.6 Fusion Implants

- 10.7 GerVetUSA

- 10.8 GPC Medical Ltd.

- 10.9 Integra LifeSciences

- 10.10 Movora (Vimian Group)

- 10.11 Narang Medical Limited

- 10.12 Ortho Max

- 10.13 Orthomed

- 10.14 Rita Leibinger

- 10.15 Veterinary Instrumentation