|

市场调查报告书

商品编码

1766310

商用电锅炉市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Commercial Electric Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

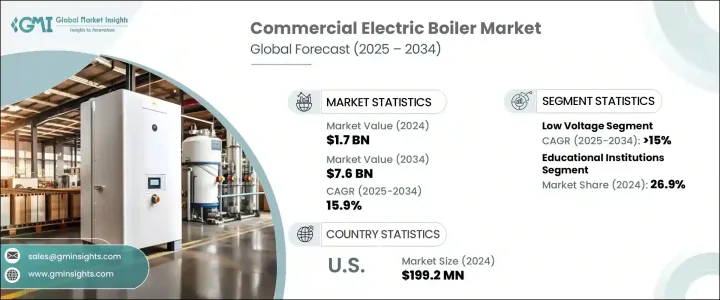

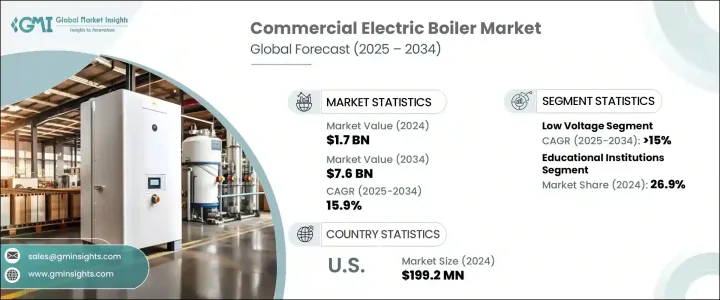

2024年,全球商用电锅炉市场规模达17亿美元,预计2034年将以15.9%的复合年增长率成长,达到76亿美元。这一成长主要源自于商业设施对节能供暖解决方案日益增长的需求。受环境永续意识增强以及化石能源成本上升的推动,企业正逐步从传统的化石燃料加热系统过渡到电锅炉。此外,政府透过财政奖励措施和政策框架推动清洁能源使用的措施也进一步加速了这项转变。

随着商业机构优先考虑减排策略,电锅炉正成为能源管理计画中的关键要素。它们能够以最低的排放提供稳定的供暖性能,这与脱碳目标相符,尤其是在环境严格规范的地区。电网基础设施的改善和再生能源系统的整合也支持了这一转变,使电锅炉在技术和经济上都更具可行性。值得注意的是,这些系统能够利用剩余的可再生电力、储存能源并按需供暖,从而提高了其运作效率,使其成为现代商业基础设施的理想选择。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 17亿美元 |

| 预测值 | 76亿美元 |

| 复合年增长率 | 15.9% |

按额定电压细分,商用电锅炉市场包括中压和低压系统。预计到2034年,低压市场的复合年增长率将超过15%。这项需求受到旨在减少碳足迹和在商业环境中推广清洁技术的支持性监管政策和激励措施的推动。低压电锅炉设计紧凑,维护需求低,对中小型营运尤其具有吸引力。这些系统也更容易与现有基础设施进行改造,这对于老建筑的现代化至关重要。随着人们越来越重视减少对燃气或燃油设备的依赖,低压电锅炉预计将在未来几年获得可观的市场份额。

按应用领域划分,教育机构在2024年占据了最大的市场份额,占26.9%。该领域对电锅炉的青睐源自于学校、学院和大学普遍致力于暖气系统现代化。各机构正在投资更换老旧设备,以节省成本并符合新的能源效率标准。由于教育机构通常预算固定,电加热解决方案的长期成本优势在采用过程中发挥重要作用。此外,低噪音、零现场排放和易于安装的特性使电锅炉成为此类环境的理想选择。

从地区来看,美国近年来电加热技术的应用显着成长,市场估值从2022年的1.599亿美元成长至2024年的1.992亿美元。全国范围内减少温室气体排放的倡议,以及建筑规范向电加热而非燃气加热的转变,进一步强化了这一趋势。随着企业将营运与永续发展目标结合,美国商用电锅炉的需求持续成长。随着办公大楼、医院和零售场所对电加热的偏好日益增长,美国可望继续成为全球市场中重要的收入来源。

纵观整个地区,预计到2034年,北美地区的复合年增长率将超过18%。对环保目标的坚定承诺,加上对清洁建筑技术投资的不断增加,正在推动对高效电力加热系统的需求。随着各市政府实施低排放发展策略,美国和加拿大的城市中心在这项转型中特别活跃。商业空间的基础设施升级,尤其是老旧建筑的现代化改造,也促进了区域成长。

商用电锅炉市场的领先公司包括 ACV、Bosch Industriekessel、Acme Engineering Products、Chromalox、Cochrane Engineering、Cleaver-Brooks、Danstoker、Flexiheat UK、Ecotherm Austria、Fulton、Klopper-Therm、Hi-Therm Boilers、SPELARS Heating Systems、OvELASd、AulAii、FLA1 Boilers、Thermon、Thermona 和 Vattenfall。这些公司专注于创新、产品效率和系统集成,以满足商用供暖行业不断变化的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 战略仪表板

- 策略倡议

- 竞争基准测试

- 创新与永续发展格局

第五章:市场规模及预测:依电压等级,2021 - 2034 年

- 主要趋势

- 低电压

- 中压

第六章:市场规模及预测:依产能,2021 - 2034 年

- 主要趋势

- ≤ 0.3 - 2.5 百万英热单位/小时

- > 2.5 - 10 百万英热单位/小时

- > 10 - 50 百万英热单位/小时

- > 50 - 100 百万英热单位/小时

- > 100 - 250 百万英热单位/小时

第七章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 办公室

- 医疗保健设施

- 教育机构

- 住宿

- 零售店

- 其他的

第八章:市场规模及预测:依产品,2021 - 2034

- 主要趋势

- 热水

- 蒸气

第九章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 法国

- 英国

- 波兰

- 义大利

- 西班牙

- 德国

- 俄罗斯

- 奥地利

- 瑞典

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 印尼

- 菲律宾

- 中东和非洲

- 沙乌地阿拉伯

- 伊朗

- 阿联酋

- 埃及

- 奈及利亚

- 肯亚

- 摩洛哥

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 智利

第十章:公司简介

- Acme Engineering Products

- ACV

- Bosch Industriekessel

- Chromalox

- Cleaver-Brooks

- Cochrane Engineering

- Danstoker

- Ecotherm Austria

- Flexiheat UK

- Fulton

- Hi-Therm Boilers

- Klopper

- KOSPEL Spolka

- LAARS Heating Systems

- Lochinvar

- Precision Boilers

- SAS Lacaze Energies

- Thermon

- Thermona

- Vattenfall

The Global Commercial Electric Boiler Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 15.9% to reach USD 7.6 billion by 2034. This growth is largely attributed to the increasing demand for energy-efficient heating solutions across commercial facilities. Businesses are gradually transitioning from conventional heating systems powered by fossil fuels to electric boilers, driven by heightened awareness around environmental sustainability and the rising cost of fossil-based energy sources. Additionally, government initiatives promoting clean energy usage through financial incentives and policy frameworks are further accelerating this transition.

As commercial establishments prioritize emission reduction strategies, electric boilers are becoming a key element in energy management plans. Their ability to deliver consistent heating performance with minimal emissions aligns with decarbonization targets, especially in regions with stringent environmental norms. Improved grid infrastructure and the integration of renewable energy systems are also supporting the shift, making electric boilers more viable both technically and economically. Notably, the capability of these systems to utilize surplus renewable electricity, store energy, and provide heating on demand enhances their operational efficiency, making them a desirable option for modern commercial infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $7.6 Billion |

| CAGR | 15.9% |

Segmented by voltage rating, the commercial electric boiler market includes medium voltage and low voltage systems. The low voltage segment is anticipated to grow at a CAGR exceeding 15% through 2034. This demand is driven by supportive regulatory policies and incentives aimed at reducing carbon footprints and promoting cleaner technologies in commercial settings. The compact design and reduced maintenance needs of low voltage electric boilers make them particularly attractive for small- to medium-scale operations. These systems are also easier to retrofit into existing infrastructure, which is a key advantage as older buildings move toward modernization. With increasing attention on minimizing reliance on gas or oil-fired units, low voltage electric boilers are positioned to gain substantial market share over the coming years.

By application, educational institutions held the largest market share in 2024, accounting for 26.9%. The preference for electric boilers in this segment is supported by widespread efforts to modernize heating systems in schools, colleges, and universities. Institutions are investing in the replacement of outdated units to achieve cost savings and comply with new efficiency standards. As educational facilities often operate on fixed budgets, the long-term cost advantages of electric heating solutions play a significant role in adoption. Additionally, the low noise, zero on-site emissions, and ease of installation make electric boilers an ideal fit for these settings.

Regionally, the United States has witnessed significant adoption in recent years, with market valuations rising from USD 159.9 million in 2022 to USD 199.2 million by 2024. This trend is reinforced by a national push toward reducing greenhouse gas emissions and the shift in building codes favoring electric over gas-based heating. As businesses align their operations with sustainability targets, demand for commercial electric boilers in the U.S. continues to gain traction. With a growing preference for electrified heating in office buildings, hospitals, and retail spaces, the country is poised to remain a prominent revenue generator in the global market.

Across the broader region, North America is expected to exhibit a CAGR of more than 18% through 2034. A strong commitment to environmental goals, coupled with rising investments in clean building technologies, is fueling the demand for efficient electric heating systems. Urban centers across the U.S. and Canada are especially active in this transition as municipalities implement low-emission development strategies. Infrastructure upgrades in commercial spaces, particularly in older buildings being brought up to modern standards, are also contributing to regional growth.

Leading companies in the commercial electric boiler market include ACV, Bosch Industriekessel, Acme Engineering Products, Chromalox, Cochrane Engineering, Cleaver-Brooks, Danstoker, Flexiheat UK, Ecotherm Austria, Fulton, Klopper-Therm, Hi-Therm Boilers, LAARS Heating Systems, KOSPEL Spolka, Lochinvar, S.A.S Lacaze Energies, Precision Boilers, Thermon, Thermona, and Vattenfall. These players are focusing on innovation, product efficiency, and system integration to meet the evolving needs of the commercial heating industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Voltage Rating, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Low voltage

- 5.3 Medium voltage

Chapter 6 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 ≤ 0.3 - 2.5 MMBTU/hr

- 6.3 > 2.5 - 10 MMBTU/hr

- 6.4 > 10 - 50 MMBTU/hr

- 6.5 > 50 - 100 MMBTU/hr

- 6.6 > 100 - 250 MMBTU/hr

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Offices

- 7.3 Healthcare facilities

- 7.4 Educational institutions

- 7.5 Lodgings

- 7.6 Retail stores

- 7.7 Others

Chapter 8 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Hot water

- 8.3 Steam

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 France

- 9.3.2 UK

- 9.3.3 Poland

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Germany

- 9.3.7 Russia

- 9.3.8 Austria

- 9.3.9 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Indonesia

- 9.4.7 Philippines

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 Iran

- 9.5.3 UAE

- 9.5.4 Egypt

- 9.5.5 Nigeria

- 9.5.6 Kenya

- 9.5.7 Morocco

- 9.5.8 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

- 9.6.3 Colombia

- 9.6.4 Chile

Chapter 10 Company Profiles

- 10.1 Acme Engineering Products

- 10.2 ACV

- 10.3 Bosch Industriekessel

- 10.4 Chromalox

- 10.5 Cleaver-Brooks

- 10.6 Cochrane Engineering

- 10.7 Danstoker

- 10.8 Ecotherm Austria

- 10.9 Flexiheat UK

- 10.10 Fulton

- 10.11 Hi-Therm Boilers

- 10.12 Klopper

- 10.13 KOSPEL Spolka

- 10.14 LAARS Heating Systems

- 10.15 Lochinvar

- 10.16 Precision Boilers

- 10.17 S.A.S Lacaze Energies

- 10.18 Thermon

- 10.19 Thermona

- 10.20 Vattenfall