|

市场调查报告书

商品编码

1766312

一次性失禁产品市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Disposable Incontinence Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

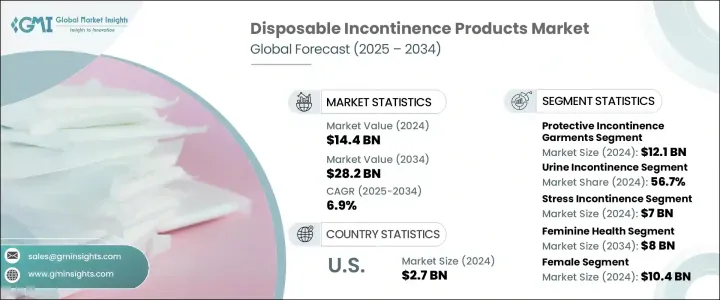

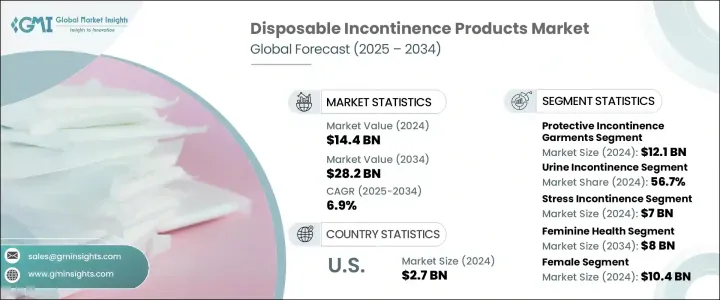

2024 年全球一次性失禁产品市场价值为 144 亿美元,预计到 2034 年将以 6.9% 的复合年增长率增长至 282 亿美元。

尿失禁患者人数的不断增长、人们对治疗和管理方案的认识不断提高,以及製造商不断改进产品,共同推动了市场的持续扩张。各公司正优先考虑创新材料,这些材料不仅具有高吸收性和亲肤性,而且可生物降解,既符合医疗保健功效,又能承担环境责任。此外,电子商务的发展简化了购买流程,使用户能够谨慎地购买产品。这种便利性、功能性和可近性的结合正在加速从医院到家庭等多种护理环境的需求,从而推动市场的整体成长轨迹。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 144亿美元 |

| 预测值 | 282亿美元 |

| 复合年增长率 | 6.9% |

一次性失禁解决方案旨在帮助个人透过吸收垫、成人内裤和防护衣等产品管理不自主的膀胱或肠道漏尿。这些产品可提升舒适度、尊严感和卫生水平,尤其适用于老年使用者、术后患者和慢性失禁患者。它们易于使用和处理,可满足临床和家庭护理需求,提供可靠的吸收能力,并最大程度地减少不适感。

防护性失禁衣凭藉其广泛的应用和便捷的使用,在2024年占据市场领先地位,其价值达121亿美元。这些服装因其可靠的性能和舒适的穿着体验,深受医院、长期护理中心和家庭的青睐。其吸水性强、卫生防漏的结构有助于使用者保持积极自信的生活方式。防护性失禁衣有多种款式可供选择,以应对不同程度的失禁,这增强了它们对患者和照护者的吸引力。

2024年,尿失禁市场占56.7%。尿失禁在老龄化人群中的高发性和持续性显着推动了产品需求。有效的解决方案对于长期漏尿至关重要,而一次性失禁产品则提供了实用且卫生的选择。越来越多的老年人面临此类健康问题,这进一步提升了该领域在市场上的突出地位。

2024年,美国一次性失禁产品市场规模达27亿美元。压力性尿失禁病例的增多,尤其是在老年女性族群中,正在推动产品需求的成长。更年期、肥胖和生育等因素都可能导致骨盆底併发症,促使女性寻求治疗。先进的医疗设施、日益增强的骨盆底健康意识以及优惠的报销制度,进一步支持了美国市场的扩张。

全球一次性失禁产品市场的主要参与者包括 Essity、BD、Coloplast、CardinalHealth、B Braun、Ontex、Attends、FUBURG、UROCARE、MEDLINE、Kimberly-Clark、convaTec、ABENA、unicharm 和 Hollister。一次性失禁产品领域的公司正透过专注于产品创新、永续性和分销扩张来提升其市场地位。许多公司正在投资研发环保材料、气味控制技术以及超薄、高吸收性产品,以提高使用者的舒适度和自由。为了满足老龄化人口不断变化的需求,参与者正在推出针对不同程度失禁严重程度的客製化产品线。与医疗保健提供者和护理人员的策略合作有助于促进早期采用。此外,公司正在扩大其线上业务,提供基于订阅的模式和谨慎的交付服务,这与现代消费者的偏好相呼应。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 全球失禁盛行率不断上升

- 政府的支持性报销政策

- 慢性病发生率上升,老龄人口增加

- 最近的技术进步和新产品开发

- 产业陷阱与挑战

- 新兴国家缺乏认知和产品供应

- 市场机会

- 扩大家庭医疗保健和电子商务分销管道

- 可持续发展的可生物降解和环保解决方案

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 世界其他地区

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 报销场景

- 报销政策对市场成长的影响

- 消费者行为分析

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 世界其他地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 保护性失禁服装

- 一次防护内衣

- 一次性成人尿布

- 成人布尿布

- 一次性护垫和衬垫

- 男警卫

- 膀胱控制垫

- 失禁衬垫

- 有腰带和不带腰带的内衣

- 免洗护垫

- 导尿管

- 留置导尿管

- 间歇导尿管

- 外导管

- 尿袋

- 腿尿袋

- 床边尿袋

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 尿失禁

- 大便失禁

- 双重失禁

第七章:市场估计与预测:按失禁类型,2021 年至 2034 年

- 主要趋势

- 压力

- 混合

- 敦促

- 其他失禁类型

第 8 章:市场估计与预测:按疾病,2021 年至 2034 年

- 主要趋势

- 女性健康

- 怀孕和分娩

- 停经

- 子宫切除术

- 其他女性健康疾病

- 慢性疾病

- 精神障碍

- 良性摄护腺增生

- 膀胱癌

- 其他疾病

第九章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 棉织物

- 超级吸收剂

- 塑胶

- 乳胶

- 其他材料

第十章:市场估计与预测:依性别,2021 年至 2034 年

- 主要趋势

- 女性

- 男性

第 11 章:市场估计与预测:按年龄组,2021 年至 2034 年

- 主要趋势

- 40至59岁

- 60至79岁

- 20至39岁

- 20岁以下

- 80多年

第 12 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 零售店

- 电子商务

第 13 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 护理设施

- 长期照护中心

- 门诊手术中心

- 其他最终用户

第 14 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十五章:公司简介

- ABENA

- Attends

- B Braun

- BD

- CardinalHealth

- Coloplast

- convaTec

- essity

- FUBURG

- Hollister

- Kimberly-Clark

- MEDLINE

- Ontex

- unicharm

- UROCARE

The Global Disposable Incontinence Products Market was valued at USD 14.4 billion in 2024 and is estimated to grow at a CAGR of 6.9% to reach USD 28.2 billion by 2034.

This consistent market expansion is fueled by the growing number of individuals experiencing urinary incontinence, rising awareness regarding treatment and management options, and continuous product advancements by manufacturers. Companies are prioritizing innovation in materials that are not only highly absorbent and skin-compatible but also biodegradable, aligning with both healthcare efficacy and environmental responsibility. In addition, the growth of e-commerce has simplified purchasing processes, enabling users to obtain products discreetly. This combination of convenience, functionality, and accessibility is accelerating demand across multiple care settings, from hospitals to home environments, contributing to the overall growth trajectory of the market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.4 Billion |

| Forecast Value | $28.2 Billion |

| CAGR | 6.9% |

Disposable incontinence solutions are designed to help individuals manage involuntary bladder or bowel leakage through products such as absorbent pads, adult briefs, and protective garments. These items enhance comfort, dignity, and hygiene, especially for elderly users, post-surgical patients, and people with chronic incontinence. Designed for easy use and disposal, they serve both clinical and home care needs, offering reliable absorption and minimal discomfort.

The protective incontinence garments segment led the market and was valued at USD 12.1 billion in 2024, owing to its wide adoption and ease of use. These garments are preferred across hospitals, long-term care centers, and homes due to their reliable performance and comfort. Their absorbent, hygienic, and leak-resistant structure helps users maintain an active and confident lifestyle. They are available in multiple formats to address varying severity levels of incontinence, which enhances their appeal to both patients and caregivers.

Urine incontinence segment held a 56.7% share in 2024. Its high prevalence and persistent nature across aging populations significantly contribute to product demand. Effective solutions are necessary to manage prolonged episodes of urine leakage, with disposable incontinence products offering a practical and hygienic option. The growing number of elderly individuals dealing with such health concerns continues to boost the segment's prominence in the market.

United States Disposable Incontinence Products Market was valued at USD 2.7 billion in 2024. Increasing cases of stress urinary incontinence, especially among aging women, are pushing product demand. Factors such as menopause, obesity, and childbirth have contributed to pelvic floor complications, prompting women to seek treatment. The availability of advanced healthcare facilities, greater pelvic health awareness, and favorable reimbursement systems are further supporting market expansion in the country.

Key players in the Global Disposable Incontinence Products Market include Essity, BD, Coloplast, CardinalHealth, B Braun, Ontex, Attends, FUBURG, UROCARE, MEDLINE, Kimberly-Clark, convaTec, ABENA, unicharm, and Hollister. Companies in the disposable incontinence products space are enhancing their market position by focusing on product innovation, sustainability, and distribution expansion. Many are investing in R&D to develop eco-friendly materials, odor-control technology, and ultra-thin, high-absorption products that increase user comfort and discretion. To meet the evolving needs of aging populations, players are launching tailored product lines catering to different levels of incontinence severity. Strategic collaborations with healthcare providers and caregivers help promote early adoption. Additionally, firms are expanding their online presence to offer subscription-based models and discreet delivery services, which resonate with modern consumer preferences.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 Incontinence type

- 2.2.5 Disease

- 2.2.6 Material

- 2.2.7 Gender

- 2.2.8 Age group

- 2.2.9 Distribution channel

- 2.2.10 End Use

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of incontinence across the globe

- 3.2.1.2 Supportive reimbursement policies by governments

- 3.2.1.3 Increasing incidence of chronic diseases coupled with rising elderly population

- 3.2.1.4 Recent technological advancements and new product developments

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of awareness and product availability in emerging countries

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of home healthcare and e-commerce distribution channels

- 3.2.3.2 Sustainability-driven biodegradable and eco-friendly solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Rest of the world

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Future market trends

- 3.8 Reimbursement scenario

- 3.8.1 Impact of reimbursement policies on market growth

- 3.9 Consumer behaviour analysis

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Rest of the world

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Protective incontinence garments

- 5.2.1 Disposable protective underwear

- 5.2.2 Disposable adult diaper

- 5.2.3 Cloth adult diaper

- 5.2.4 Disposable pads and liners

- 5.2.4.1 Male guards

- 5.2.4.2 Bladder control pads

- 5.2.4.3 Incontinence liners

- 5.2.4.3.1 Belted and beltless undergarments

- 5.2.4.3.2 Disposable under pads

- 5.3 Urinary catheter

- 5.3.1 Indwelling (foley) catheter

- 5.3.2 Intermittent catheter

- 5.3.3 External catheter

- 5.4 Urine bag

- 5.4.1 Leg urine bag

- 5.4.2 Bedside urine bag

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Urine incontinence

- 6.3 Fecal incontinence

- 6.4 Dual incontinence

Chapter 7 Market Estimates and Forecast, By Incontinence Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Stress

- 7.3 Mixed

- 7.4 Urge

- 7.5 Other incontinence types

Chapter 8 Market Estimates and Forecast, By Disease, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Feminine health

- 8.2.1 Pregnancy and childbirth

- 8.2.2 Menopause

- 8.2.3 Hysterectomy

- 8.2.4 Other feminine health diseases

- 8.3 Chronic disease

- 8.4 Mental disorders

- 8.5 Benign prostatic hyperplasia

- 8.6 Bladder cancer

- 8.7 Other diseases

Chapter 9 Market Estimates and Forecast, By Material, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Cotton fabrics

- 9.3 Super absorbents

- 9.4 Plastic

- 9.5 Latex

- 9.6 Other materials

Chapter 10 Market Estimates and Forecast, By Gender, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Female

- 10.3 Male

Chapter 11 Market Estimates and Forecast, By Age Group, 2021 – 2034 ($ Mn)

- 11.1 Key trends

- 11.2 40 to 59 years

- 11.3 60 to 79 years

- 11.4 20 to 39 years

- 11.5 Below 20 years

- 11.6 80+ years

Chapter 12 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 12.1 Key trends

- 12.2 Retail stores

- 12.3 E-commerce

Chapter 13 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 13.1 Key trends

- 13.2 Hospital

- 13.3 Nursing facilities

- 13.4 Long-term care centers

- 13.5 Ambulatory surgical centers

- 13.6 Other end users

Chapter 14 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 14.1 Key trends

- 14.2 North America

- 14.2.1 U.S.

- 14.2.2 Canada

- 14.3 Europe

- 14.3.1 Germany

- 14.3.2 UK

- 14.3.3 France

- 14.3.4 Spain

- 14.3.5 Italy

- 14.3.6 Netherlands

- 14.4 Asia Pacific

- 14.4.1 China

- 14.4.2 Japan

- 14.4.3 India

- 14.4.4 Australia

- 14.4.5 South Korea

- 14.5 Latin America

- 14.5.1 Brazil

- 14.5.2 Mexico

- 14.5.3 Argentina

- 14.6 Middle East and Africa

- 14.6.1 South Africa

- 14.6.2 Saudi Arabia

- 14.6.3 UAE

Chapter 15 Company Profiles

- 15.1 ABENA

- 15.2 Attends

- 15.3 B Braun

- 15.4 BD

- 15.5 CardinalHealth

- 15.6 Coloplast

- 15.7 convaTec

- 15.8 essity

- 15.9 FUBURG

- 15.10 Hollister

- 15.11 Kimberly-Clark

- 15.12 MEDLINE

- 15.13 Ontex

- 15.14 unicharm

- 15.15 UROCARE