|

市场调查报告书

商品编码

1766314

实验室能力测试市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Laboratory Proficiency Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

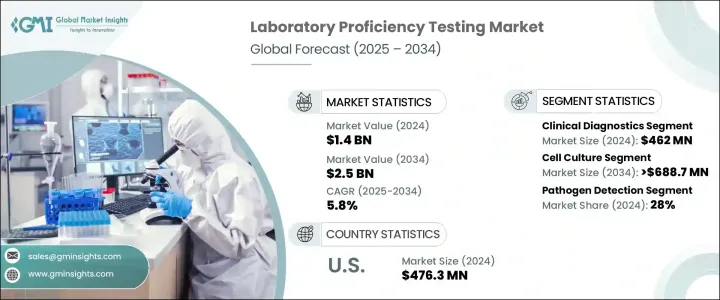

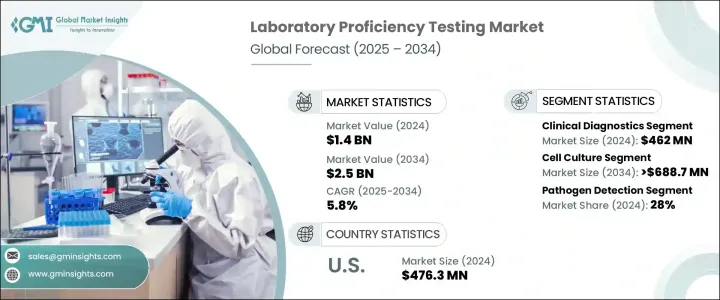

2024年,全球实验室能力验证市场规模达14亿美元,预计2034年将以5.8%的复合年增长率成长,达到25亿美元。推动这一成长的重要因素是实验室环境中对稳健品质控制的需求不断增长,以及各行各业对能力验证应用的不断增加。随着监管审查力度的加强以及越来越多的实验室寻求认证,市场参与度正在提升。临床诊断实验室的扩张以及对用于管理慢性病和传染病的精准检测的日益重视,进一步增强了市场发展势头。

随着慢性健康问题和传染病的持续激增,对精准诊断的依赖也显着增加。为了维护国际标准并降低误诊风险,能力验证计画正得到更广泛的应用。由于基因检测和分子检测等先进诊断技术的广泛应用,这些品质保证计画正变得至关重要。公共和私营部门的利益相关者都在投资加强实验室基础设施,以满足这些不断发展的标准。 CLIA、ISO 和 CAP 等组织的合规要求现在要求进行常规能力验证,以维持认证并满足全球品质基准。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 14亿美元 |

| 预测值 | 25亿美元 |

| 复合年增长率 | 5.8% |

临床诊断细分市场在2024年达到4.62亿美元,占市场最大份额。这种主导地位源于精准的诊断检测在管理患者健康结果方面发挥的关键作用。随着慢性病负担的加重,人们对诊断准确性的依赖程度也随之增加,这使得能力验证测试对于高容量实验室而言至关重要。在微生物学、分子检测和血液学领域进行广泛合作的机构正更加重视与ISO 15189等国际框架的接轨。随着先进诊断技术在医疗机构中的应用日益广泛,对严格的能力验证测试的需求也日益增长,以确保降低错误率并改善患者预后。

细胞培养检测市场预计将以5.3%的复合年增长率成长,到2034年将达到6.887亿美元。细胞培养是生物製剂、疫苗和各种细胞疗法生产的基础。为了保持一致性并防止污染,实验室必须定期通过能力验证来评估其技术和材料。按照GMP指南运作的实验室,尤其是生物製剂和再生医学领域的实验室,依赖这些评估来确保流程的可靠性和合规性。此外,随着干细胞治疗和组织工程等新疗法的发展,对标准化实验室实践和通过能力验证获得可靠结果的需求预计将持续增长。

2024年,美国实验室能力验证市场规模达4.763亿美元,预计2025年至2034年的复合年增长率为4.9%。凭藉强大的监管基础和完善的诊断基础设施,美国在全球市场处于领先地位。策略性资金投入计画进一步推动了实验室准确性的提升。总计17亿美元的投资用于提升检测能力,尤其是在传染病检测和分子诊断领域。联邦卫生计画也在推动更高水准的能力验证参与度,截至2024年,公共卫生实验室几乎实现全面覆盖,这将有力地支持该地区的市场成长。

实验室能力验证市场的知名产业参与者包括 Aashvi PT、BIO-RAD、LGC、美国能力验证研究所、美国病理学家学院、QACS LAB、FAPAS、FLUXANA、AOAC INTERNATIONAL、RANDOX、MERCK、Trilogy、WEQAS、Waters 和 ABSOLUTE STANDARDS。这包括透过扩展到分子生物学、微生物学和毒理学等专业测试领域来增强其服务组合。该公司还在投资数位平台,以简化能力验证结果提交并自动化资料分析。针对新兴诊断技术量身定制的 PT 方案已成为关注的焦点,而与监管机构的合作正在帮助这些公司与不断发展的全球品质标准保持一致。此外,策略合併、与诊断实验室的合作以及向新兴经济体的地理扩张有助于提高他们的竞争力并满足对认可测试服务日益增长的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 食品和药品的严格安全和品质法规

- 水质检测需求不断成长

- 能力验证是实验室卓越运作的必要前提

- 医用大麻合法化和大麻检测实验室数量的增加

- 产业陷阱与挑战

- 缺乏熟练的专业人员

- 需要大量资本投资来建造先进的测试设施

- 市场机会

- 测试产业的技术进步

- 越来越多地采用能力测试来防止食品掺假

- 成长动力

- 成长潜力分析

- 监管格局

- 我们

- 欧洲

- 技术格局

- 差距分析

- 波特的分析

- PESTEL分析

- 政策格局

- 未来市场趋势

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 按地区

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

- 关键进展

- 併购

- 伙伴关係和合作

- 新服务推出

- 扩张计划

第五章:市场估计与预测:按产业,2021 年至 2034 年

- 主要趋势

- 临床诊断

- 微生物学

- 製药

- 食品和饮料

- 生物製剂

- 其他行业

第六章:市场估计与预测:按技术,2021 年至 2034 年

- 主要趋势

- 细胞培养

- 免疫测定

- 聚合酶炼式反应

- 光谱法

- 色谱法

- 其他技术

第七章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 病原体检测

- 分子传染病检测

- 血液化学和血液学检查

- 无菌保证

- 内毒素和热原检测

- 残留溶剂和污染物分析

- 其他应用

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Aashvi PT

- ABSOLUTE STANDARDS

- American Proficiency Institute

- AOAC INTERNATIONAL

- BIO-RAD

- COLLEGE of AMERICAN PATHOLOGISTS

- FAPAS

- FLUXANA

- LGC

- MERCK

- QACS LAB

- RANDOX

- Trilogy

- Waters

- WEQAS

The Global Laboratory Proficiency Testing Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 2.5 billion by 2034. A significant driver behind this expansion is the rising demand for robust quality control in laboratory settings, as well as increased usage of proficiency testing across a range of sectors. With growing regulatory scrutiny and more laboratories seeking accreditation, the market is experiencing a boost in participation. The expansion of clinical diagnostics labs and heightened focus on precision testing to manage chronic and infectious diseases are further strengthening market momentum.

As chronic health issues and communicable diseases continue to surge, the reliance on accurate diagnostics has grown substantially. To uphold international standards and reduce the risk of misdiagnosis, proficiency testing programs are being adopted more widely. These quality assurance programs are becoming critical due to the broader application of advanced diagnostic technologies like genetic and molecular testing. Public and private stakeholders alike are investing in strengthening laboratory infrastructure to meet these evolving standards. Compliance requirements from organizations such as CLIA, ISO, and CAP now mandate routine proficiency evaluations to sustain certifications and meet global quality benchmarks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.5 Billion |

| CAGR | 5.8% |

The clinical diagnostics segment reached USD 462 million in 2024, accounting for the largest share in the market. This dominance stems from the critical role accurate diagnostic testing plays in managing patient health outcomes. With the growing burden of chronic illness, there is a higher dependency on diagnostic accuracy, which makes proficiency testing non-negotiable for high-volume labs. Facilities conducting extensive panels in microbiology, molecular testing, and hematology are placing an even greater emphasis on alignment with international frameworks like ISO 15189. As advanced diagnostics see greater adoption across medical institutions, the need for rigorous proficiency assessment continues to rise, ensuring reduced error rates and improved patient outcomes.

The cell culture testing segment is set to grow at a CAGR of 5.3%, reaching USD 688.7 million by 2034. Cell culture is foundational to the production of biologics, vaccines, and various cell-based therapeutics. To maintain consistency and prevent contamination, laboratories must regularly assess their techniques and materials through proficiency testing. Labs operating under GMP guidelines, particularly those in biologics and regenerative medicine, depend on these evaluations to ensure process reliability and regulatory compliance. Furthermore, as new therapies like stem cell treatments and tissue engineering gain momentum, demand for standardized lab practices and reliable results through proficiency testing is expected to escalate.

United States Laboratory Proficiency Testing Market was valued at USD 476.3 million in 2024 and is forecast to grow at a CAGR of 4.9% from 2025 to 2034. The country leads the global market due to its strong regulatory foundation and robust diagnostics infrastructure. Strategic funding initiatives have further fueled progress in lab accuracy. Investments totaling USD 1.7 billion were dedicated to expanding testing capacity, particularly in the areas of infectious disease detection and molecular diagnostics. Federal health programs are also pushing for higher participation in proficiency evaluations, with nearly full coverage of public health labs as of 2024, which significantly supports market growth in the region.

Prominent industry players in the Laboratory Proficiency Testing Market include Aashvi PT, BIO-RAD, LGC, American Proficiency Institute, COLLEGE of AMERICAN PATHOLOGISTS, QACS LAB, FAPAS, FLUXANA, AOAC INTERNATIONAL, RANDOX, MERCK, Trilogy, WEQAS, Waters, and ABSOLUTE STANDARDS. This include strengthening their service portfolios through expansion into specialized testing areas such as molecular biology, microbiology, and toxicology. Firms are also investing in digital platforms to streamline proficiency test result submissions and automate data analysis. Custom-designed PT schemes tailored to emerging diagnostic technologies have become a central focus, while partnerships with regulatory bodies are helping these companies align with evolving global quality standards. Additionally, strategic mergers, collaborations with diagnostic laboratories, and geographic expansion into emerging economies help increase their competitive footprint and meet the growing demand for accredited testing services.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Industry trends

- 2.2.3 Technology trends

- 2.2.4 Application trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Stringent safety and quality regulations for food and pharmaceuticals products

- 3.2.1.2 Increasing demand for water testing

- 3.2.1.3 Proficiency testing is a necessary pre-requisite for laboratory's operational excellence

- 3.2.1.4 Legalization of medical cannabis and increasing number of cannabis testing laboratories

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Dearth of skilled professionals

- 3.2.2.2 Requirement of high-capital investments for advance testing facilities

- 3.2.3 Market opportunities

- 3.2.3.1 Technological advancements in testing industry

- 3.2.3.2 Increasing adoption of proficiency tests to prevent food adulteration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Policy landscape

- 3.10 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 By Region

- 4.3.1.1 North America

- 4.3.1.2 Europe

- 4.3.1.3 Asia Pacific

- 4.3.1 By Region

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New services launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Industry, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Clinical diagnostics

- 5.3 Microbiology

- 5.4 Pharmaceuticals

- 5.5 Food and beverages

- 5.6 Biologics

- 5.7 Other industries

Chapter 6 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cell culture

- 6.3 Immunoassays

- 6.4 Polymerase chain reaction

- 6.5 Spectrometry

- 6.6 Chromatography

- 6.7 Other technologies

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pathogen detection

- 7.3 Molecular infectious disease testing

- 7.4 Blood chemistry and hematology panels

- 7.5 Sterility assurance

- 7.6 Endotoxin and pyrogen testing

- 7.7 Residual solvent and contaminant analysis

- 7.8 Other applications

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Aashvi PT

- 9.2 ABSOLUTE STANDARDS

- 9.3 American Proficiency Institute

- 9.4 AOAC INTERNATIONAL

- 9.5 BIO-RAD

- 9.6 COLLEGE of AMERICAN PATHOLOGISTS

- 9.7 FAPAS

- 9.8 FLUXANA

- 9.9 LGC

- 9.10 MERCK

- 9.11 QACS LAB

- 9.12 RANDOX

- 9.13 Trilogy

- 9.14 Waters

- 9.15 WEQAS