|

市场调查报告书

商品编码

1766319

太阳能光电支架系统市场机会、成长动力、产业趋势分析及2025-2034年预测Solar PV Mounting Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

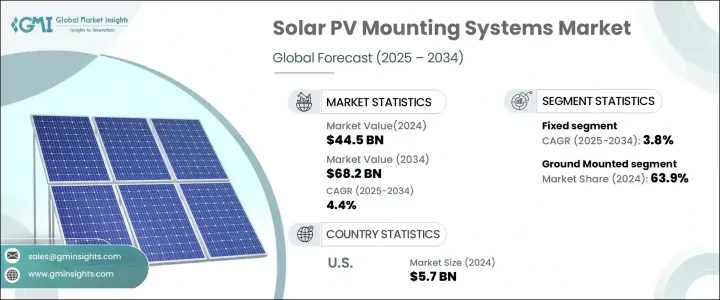

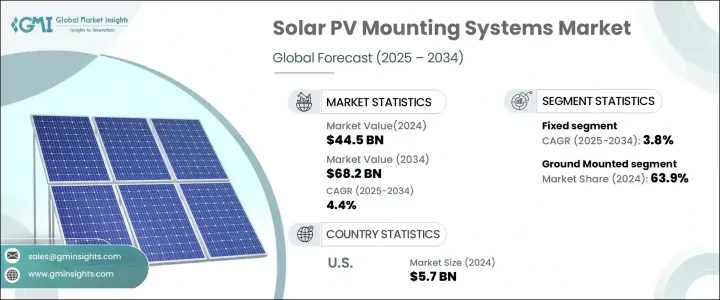

2024年,全球太阳能光电支架系统市场规模达445亿美元,预计到2034年将以4.4%的复合年增长率成长,达到682亿美元。对轻量化和预组装支架结构的需求日益增长,显着提升了产品的采用率,尤其是在製造商注重提高耐腐蚀性和确保模组化设计的情况下。这些创新使运输和安装更加高效,从而降低了人工成本,并提高了大规模太阳能部署的采用率。

可用土地日益紧缺,加之对加速实施进度的追求,推动了对高效节能、适应性强的安装解决方案的需求。脱碳和能源独立的强劲势头,尤其是在商业和公用事业领域,持续推动太阳能光电系统的结构整合。智慧基础设施和数位能源管理系统投资的增加,进一步加速了市场发展。在气候驱动的全球资金和有利的政策框架的支持下,漂浮式太阳能装置的发展势头也推动了对先进且高度专业化的安装技术日益增长的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 445亿美元 |

| 预测值 | 682亿美元 |

| 复合年增长率 | 4.4% |

随着越来越多的公用事业规模专案采用追踪系统来最大限度地利用太阳能并提高发电量,预计到2034年,追踪系统市场规模将达到168亿美元。追踪系统能够全天与太阳运行轨迹保持一致,从而显着提高发电量,远高于固定式光伏系统。先进的软体驱动控制系统以及日益增长的电网级设施整合度正在巩固其市场地位。

地面安装解决方案凭藉其可扩展性和易于维护的特点,在2024年占据了63.9%的市场份额。它们能够透过优化倾斜配置和减少遮光影响来提高能源性能,使其成为太阳能发电场和公用事业应用的首选方案。在未开发土地上扩展太阳能基础设施进一步支持了细分市场的扩张。

预计2025年至2034年间,亚太地区太阳能光电支架系统市场将实现5.1%的复合年增长率,城镇化进程加快、政府对再生能源应用的积极目标以及安装成本的下降将推动区域需求成长。私人企业越来越多地参与太阳能专案招标,加之支架组件在地化生产趋势的转变,将有助于简化部署流程,并促进更广泛的市场渗透。

活跃于全球太阳能光电支架系统市场的主要公司包括 FTC Solar、First Solar、GameChange Solar、Mounting Systems、晶科能源、天合光能、Arctech、Soltec、Clenergy、PV Hardware、SunPower Corporation、Valmont Industries、厦门格瑞斯太阳能新能源科技有限公司、Unirac、Schletter Group、杭州清洁市太阳能、Ideema、Kexk、Ideema、Kexcker)。太阳能光电支架系统产业的领导者正在采取多项策略倡议,以扩大市场覆盖范围并增强竞争优势。主要重点是技术创新——开发更轻、更模组化、耐腐蚀性更强且相容屋顶和浮动太阳能装置的系统。各公司正在投资提供即时监控、预测性维护和自动校准功能的数位平台,以优化能源生产。透过合作伙伴关係、合资企业和本地製造工厂进行区域扩张,使企业能够进入高成长市场。此外,企业也透过提供低碳、可回收的支架材料,与国家和国际永续发展目标保持一致。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率

- 战略仪表板

- 策略倡议

- 竞争基准测试

- 创新与永续发展格局

第五章:市场规模及预测:依技术分类,2021 年至 2034 年

- 主要趋势

- 固定的

- 追踪

第六章:市场规模及预测:依产品,2021 年至 2034 年

- 主要趋势

- 地面安装

- 屋顶

第七章:市场规模及预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 住宅

- 商业和工业

- 公用事业

第八章:市场规模及预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 奥地利

- 挪威

- 丹麦

- 芬兰

- 法国

- 德国

- 义大利

- 瑞士

- 西班牙

- 瑞典

- 英国

- 荷兰

- 波兰

- 比利时

- 爱尔兰

- 波罗的海国家

- 葡萄牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 泰国

- 菲律宾

- 越南

- 马来西亚

- 新加坡

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿联酋

- 约旦

- 阿曼

- 科威特

- 土耳其

- 非洲

- 南非

- 埃及

- 阿尔及利亚

- 奈及利亚

- 摩洛哥

- 拉丁美洲

- 巴西

- 智利

- 阿根廷

- 秘鲁

第九章:公司简介

- Arctech

- Array Technologies

- Clenergy

- First Solar

- FTC Solar

- GameChange Solar

- Ideematec

- Jinko Solar

- K2 Systems

- Mounting Systems

- Nextracker

- PV Hardware

- Schletter Group

- Soltec

- SunPower Corporation

- Trina Tracker

- Unirac

- Valmont Industries

- Versolsolar Hangzhou

- Xiamen Grace Solar New Energy Technology

The Global Solar PV Mounting Systems Market was valued at USD 44.5 billion in 2024 and is estimated to grow at a CAGR of 4.4% to reach USD 68.2 billion by 2034. The growing demand for lightweight and pre-assembled mounting structures is significantly enhancing product adoption, especially as manufacturers focus on improving corrosion resistance and ensuring modular design. These innovations make transportation and installation more efficient, thereby reducing labor costs and increasing adoption across large-scale solar deployments.

Rising limitations in available land and the push for faster implementation timelines are fueling the need for space-efficient, adaptable mounting solutions. Strong momentum around decarbonization and energy independence, especially in commercial and utility sectors, continues to drive structural integration of solar PV systems. Increased investments in intelligent infrastructure and digital energy management systems are further accelerating market development. The momentum behind floating solar installations, supported by climate-driven global funding and favorable policy frameworks, is also contributing to the growing need for advanced and highly specialized mounting technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $44.5 Billion |

| Forecast Value | $68.2 Billion |

| CAGR | 4.4% |

The tracking systems segment is anticipated to reach USD 16.8 billion by 2034 as more utility-scale projects adopt these systems to maximize solar exposure and improve output. Their ability to align with the sun's path throughout the day results in significantly higher energy generation compared to fixed alternatives. Advanced software-driven control systems and growing integration across grid-scale installations are solidifying their market position.

Ground-mounted solutions captured a 63.9% share in 2024 due to their scalability and ease of maintenance. Their ability to deliver improved energy performance through optimal tilt configurations and reduced shading influence has made them a preferred option for solar farms and utility applications. Expanding solar infrastructure across undeveloped land further supports segmental expansion.

Asia Pacific Solar PV Mounting Systems Market is forecasted to register a CAGR of 5.1% between 2025 and 2034, with growing urbanization, favorable government targets for renewable energy adoption, and declining installation costs driving regional demand. Increasing involvement from private firms in solar project tenders, coupled with a shift toward local production of mounting components, will help streamline deployment and promote broader market penetration.

Key companies active in the Global Solar PV Mounting Systems Market include FTC Solar, First Solar, GameChange Solar, Mounting Systems, Jinko Solar, Trina Tracker, Arctech, Soltec, Clenergy, PV Hardware, SunPower Corporation, Valmont Industries, Xiamen Grace Solar New Energy Technology, Unirac, Schletter Group, Versolsolar Hangzhou, Ideematec, K2 Systems, Array Technologies, and Nextracker. Leading players in the solar PV mounting systems industry are adopting several strategic initiatives to expand market reach and strengthen their competitive edge. A primary focus is on technological innovation-developing lighter, more modular systems with higher corrosion resistance and compatibility with both rooftop and floating solar installations. Companies are investing in digital platforms that provide real-time monitoring, predictive maintenance, and automated alignment to optimize energy generation. Regional expansion through partnerships, joint ventures, and local manufacturing facilities is enabling access to high-growth markets. Additionally, players are aligning with national and international sustainability goals by offering low-carbon, recyclable mounting materials.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Fixed

- 5.3 Tracking

Chapter 6 Market Size and Forecast, By Product, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Ground mounted

- 6.3 Rooftop

Chapter 7 Market Size and Forecast, By End Use, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial & industrial

- 7.4 Utility

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Austria

- 8.3.2 Norway

- 8.3.3 Denmark

- 8.3.4 Finland

- 8.3.5 France

- 8.3.6 Germany

- 8.3.7 Italy

- 8.3.8 Switzerland

- 8.3.9 Spain

- 8.3.10 Sweden

- 8.3.11 UK

- 8.3.12 Netherlands

- 8.3.13 Poland

- 8.3.14 Belgium

- 8.3.15 Ireland

- 8.3.16 Baltics

- 8.3.17 Portugal

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.4.6 Thailand

- 8.4.7 Philippines

- 8.4.8 Vietnam

- 8.4.9 Malaysia

- 8.4.10 Singapore

- 8.5 Middle East

- 8.5.1 Israel

- 8.5.2 Saudi Arabia

- 8.5.3 UAE

- 8.5.4 Jordan

- 8.5.5 Oman

- 8.5.6 Kuwait

- 8.5.7 Turkey

- 8.6 Africa

- 8.6.1 South Africa

- 8.6.2 Egypt

- 8.6.3 Algeria

- 8.6.4 Nigeria

- 8.6.5 Morocco

- 8.7 Latin America

- 8.7.1 Brazil

- 8.7.2 Chile

- 8.7.3 Argentina

- 8.7.4 Peru

Chapter 9 Company Profiles

- 9.1 Arctech

- 9.2 Array Technologies

- 9.3 Clenergy

- 9.4 First Solar

- 9.5 FTC Solar

- 9.6 GameChange Solar

- 9.7 Ideematec

- 9.8 Jinko Solar

- 9.9 K2 Systems

- 9.10 Mounting Systems

- 9.11 Nextracker

- 9.12 PV Hardware

- 9.13 Schletter Group

- 9.14 Soltec

- 9.15 SunPower Corporation

- 9.16 Trina Tracker

- 9.17 Unirac

- 9.18 Valmont Industries

- 9.19 Versolsolar Hangzhou

- 9.20 Xiamen Grace Solar New Energy Technology