|

市场调查报告书

商品编码

1766323

年龄相关性黄斑部病变市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Age-related Macular Degeneration Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

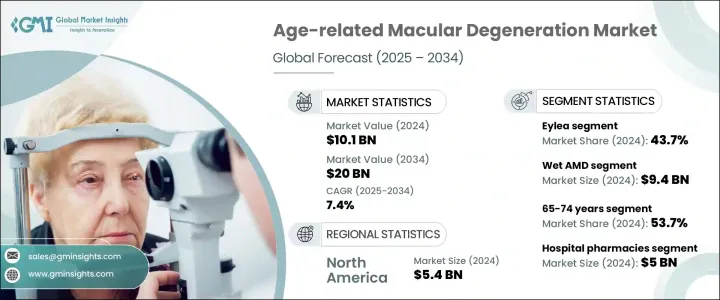

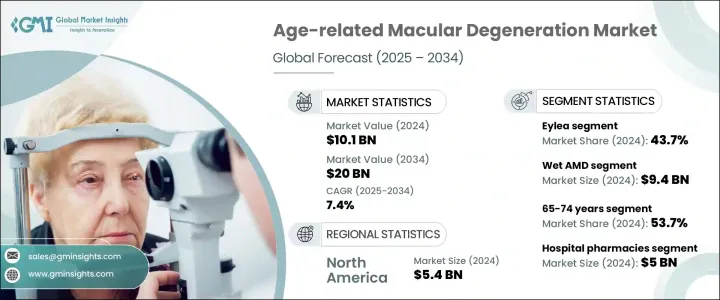

2024年,全球老年黄斑部病变市场规模达101亿美元,预计到2034年将以7.4%的复合年增长率成长,达到200亿美元。市场成长的驱动力包括:AMD盛行率的上升、全球人口老化、认知度的提高和早期诊断的提升,以及治疗方案的不断创新。 AMD是一种进行性眼部疾病,主要影响50岁以上族群,导致不可逆的中央视力丧失,并严重影响阅读、驾驶和脸部辨识等日常活动,最终影响整体生活品质。

随着病情进展,黄斑部(视网膜中负责清晰中央视力的部分)会受到损害,导致视野模糊或出现黑点,无法透过配戴眼镜或隐形眼镜矫正。这种独立性的丧失常常会导致焦虑、忧郁和社会孤立等心理问题,尤其是在老年人群体中。 AMD 日益加重的负担与全球老化趋势密切相关,65 岁以上族群的盛行率急剧上升。该疾病也与其他风险因素有关,例如吸烟、高血压、肥胖、遗传易感性和不良饮食习惯——这些因素在全球范围内变得越来越普遍。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 101亿美元 |

| 预测值 | 200亿美元 |

| 复合年增长率 | 7.4% |

按疾病类型划分,湿性AMD在2024年占据市场主导地位,市场规模达94亿美元,这得益于抗VEGF疗法的广泛应用。这些疗法已被证明能够有效阻止病情进展、最大程度减少视网膜积液并保护视功能。 Eylea、Lucentis和Beovu等药物的成功,使湿性AMD成为最有效的治疗类型。同时,干性AMD一直以来缺乏核准的药物干预,如今正重新受到临床关注。 Syfovre是首个获得FDA批准的地图样萎缩(一种严重的干性AMD)治疗药物,其上市以及一系列前景看好的补体通路抑制剂和基因疗法,标誌着该领域治疗的变革性转变。

抗VEGF疗法,例如Eylea、Lucentis和Vabysmo,已成为AMD治疗的基石。其中,Eylea凭藉其在延长注射间隔和维持视力方面的功效,占据了43.7%的市场。该药物的升级剂型Eylea HD透过提供延长的给药方案,提高了患者的依从性并减轻了治疗负担,正在获得进一步的关注。像Vabysmo这样的新进业者正透过双通路抑制(VEGF-A + Ang-2)迅速抢占市场份额,解决血管不稳定问题并提供更好的临床疗效。

2025-2034年,北美老年性黄斑部病变市场将以7%的复合年增长率成长,这得益于强大的医疗基础设施、创新疗法的早期应用以及支持性监管框架。 OCT等先进影像技术的广泛普及以及对预防性眼科护理的日益重视,进一步支撑了较高的诊断率。近期,美国食品药物管理局(FDA)批准了用于治疗干性老年性黄斑部病变的光生物调节等新型非侵入性疗法,凸显了该地区正朝着更便捷的治疗方式转变,这些方式更符合患者的偏好,并能提高患者的长期依从性。

为了巩固其在老年黄斑部病变市场的地位,Xbrane Biopharma AB、辉瑞公司、Formycon AG、Celltrion, Inc.、诺华公司、安进公司、山德士集团、Apellis Pharmaceuticals, Inc.、STADA Arzneimittel AG、F. Hoffmann-La Rocheics Ltd.、Biocon Biologics Limited、再生元製药公司、拜耳公司和百健公司等公司正在采取策略性倡议,包括研发投资、生物相似药开发和长效製剂。再生元推出的Eylea HD和罗氏推出的Vabysmo体现了创新驱动的竞争。各公司也透过与合约研究组织(CRO)合作进行临床试验并利用数位工具进行真实世界资料收集来扩大规模。全球市场领导者专注于基因疗法、双通路抑制剂和补体标靶药物,以实现产品组合多元化。此外,定价策略、策略许可和监管合作可以加快市场准入速度。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 老年黄斑部病变(AMD)盛行率上升

- 老龄人口成长

- 治疗方案的进步

- 提高认识和早期诊断

- 产业陷阱与挑战

- 治疗费用高昂

- 玻璃体内注射併发症的风险

- 成长动力

- 成长潜力分析

- 监管格局

- 我们

- 欧洲(不包括英国)

- 英国

- 印度

- 巴西

- 中国

- 技术格局

- 核心技术

- 邻近技术

- 未来市场趋势

- 专利分析

- 管道分析

- 临床试验概况

- 已获批准的疗法

- 正在临床试验中的新兴生物相似药

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 竞争市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 艾莉娅

- 乐康

- 贝奥武

- 瓦比斯莫

- 赛福弗尔

- 阿瓦斯汀

- 其他产品

第六章:市场估计与预测:依疾病类型,2021 年至 2034 年

- 主要趋势

- 湿性AMD

- 干性AMD

第七章:市场估计与预测:依年龄组,2021 年至 2034 年

- 主要趋势

- 50–64岁

- 65–74岁

- 75岁以上

第八章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 医院药房

- 专业药局和零售药局

- 电子商务

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 日本

- 中国

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Amgen

- Apellis Pharmaceuticals

- Bayer

- Biocon Biologics

- Biogen

- Celltrion

- F. Hoffmann-La Roche

- Formycon

- Novartis

- Pfizer

- Regeneron Pharmaceuticals

- Sandoz Group

- STADA Arzneimittel

- Xbrane Biopharma

The Global Age-related Macular Degeneration Market was valued at USD 10.1 billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 20 billion by 2034. The market growth is driven by a rising prevalence of AMD, an aging global population, increased awareness and early diagnosis, and ongoing innovations in treatment options. AMD is a progressive eye condition affecting individuals aged 50 and above, leading to central vision loss and significantly impacting quality of life. AMD is a progressive eye condition that primarily affects individuals aged 50 and above, leading to irreversible central vision loss and significantly impairing daily activities such as reading, driving, and recognizing faces, ultimately impacting the overall quality of life.

As the disease advances, it compromises the macula-the part of the retina responsible for sharp, central vision-resulting in blurred or dark spots in the visual field that cannot be corrected with glasses or contact lenses. This loss of independence often contributes to psychological effects such as anxiety, depression, and social isolation, especially among older adults. The growing burden of AMD is closely tied to the global aging trend, with its prevalence sharply increasing in populations over 65. The disease is also associated with other risk factors such as smoking, hypertension, obesity, genetic predisposition, and poor dietary habits-factors that are becoming more prevalent globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.1 Billion |

| Forecast Value | $20 Billion |

| CAGR | 7.4% |

By disease type, wet AMD dominated the market with USD 9.4 billion in 2024, driven by the widespread adoption of anti-VEGF therapies, which have proven effective in halting disease progression, minimizing retinal fluid accumulation, and preserving visual function. The success of agents like Eylea, Lucentis, and Beovu has positioned wet AMD as the most actively treated form of the disease. Meanwhile, dry AMD, historically lacking approved pharmacologic interventions, is now seeing renewed clinical focus. The launch of Syfovre, the first FDA-approved treatment for geographic atrophy (a severe form of dry AMD), along with a promising pipeline of complement pathway inhibitors and gene therapies, signals a transformative shift in managing this segment.

Anti-VEGF therapies such as Eylea, Lucentis, and Vabysmo have become the cornerstone of AMD treatment. Among these, the Eylea segment held 43.7% share owing to its efficacy in extending injection intervals and maintaining visual acuity. The drug's updated formulation, Eylea HD, is gaining further traction by offering extended dosing schedules that improve patient adherence and reduce treatment burden. New entrants like Vabysmo are rapidly gaining market share through dual-pathway inhibition (VEGF-A + Ang-2), addressing vascular instability and offering enhanced clinical outcomes.

North America Age-related Macular Degeneration Market will grow at a CAGR of 7% during 2025-2034, driven by robust healthcare infrastructure, early adoption of innovative therapies, and supportive regulatory frameworks. High diagnosis rates are further supported by widespread access to advanced imaging technologies such as OCT and an increasing focus on preventative eye care. Recent FDA approvals of novel, non-invasive therapies such as photobiomodulation for dry AMD underscore a regional shift toward less burdensome treatment modalities, aligning with patient preferences and improving long-term adherence.

To strengthen their position in the Age-related Macular Degeneration Market, companies like Xbrane Biopharma AB, Pfizer Inc., Formycon AG, Celltrion, Inc., Novartis AG, Amgen Inc., Sandoz Group AG, Apellis Pharmaceuticals, Inc., STADA Arzneimittel AG, F. Hoffmann-La Roche Ltd., Biocon Biologics Limited, Regeneron Pharmaceuticals Inc., Bayer AG, Biogen, Inc. are adopting strategic initiatives including R&D investments, biosimilar development, and long-acting formulations. Regeneron's launch of Eylea HD and Roche's introduction of Vabysmo demonstrate innovation-driven competition. Companies are also expanding through partnerships with CROs for clinical trials and leveraging digital tools for real-world data collection. Global market leaders focus on gene therapies, dual-pathway inhibitors, and complement-targeting drugs to diversify their portfolios. Additionally, pricing strategies, strategic licensing, and regulatory collaborations enable faster market access.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Market size estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.5 Forecast model

- 1.6 Data mining sources

- 1.6.1 Global

- 1.6.2 Regional/Country

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 End Use

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of age-related macular degeneration (AMD)

- 3.2.1.2 Growth in aging population

- 3.2.1.3 Advancements in treatment options

- 3.2.1.4 Increased awareness and early diagnosis

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of treatment

- 3.2.2.2 Risk of complications from intravitreal injections

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe (excluding UK)

- 3.4.3 UK

- 3.4.4 India

- 3.4.5 Brazil

- 3.4.6 China

- 3.5 Technology landscape

- 3.5.1 Core technologies

- 3.5.2 Adjacent technologies

- 3.6 Future market trends

- 3.7 Patent analysis

- 3.8 Pipeline analysis

- 3.9 Clinical trial landscape

- 3.9.1 Approved therapies

- 3.9.2 Emerging biosimilars under clinical trials

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Eylea

- 5.3 Lucentis

- 5.4 Beovu

- 5.5 Vabysmo

- 5.6 Syfovre

- 5.7 Avastin

- 5.8 Other products

Chapter 6 Market Estimates and Forecast, By Disease Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Wet AMD

- 6.3 Dry AMD

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 50–64 years

- 7.3 65–74 years

- 7.4 75 and above

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Specialty and retail pharmacies

- 8.4 E-commerce

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 Japan

- 9.4.2 China

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.4 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amgen

- 10.2 Apellis Pharmaceuticals

- 10.3 Bayer

- 10.4 Biocon Biologics

- 10.5 Biogen

- 10.6 Celltrion

- 10.7 F. Hoffmann-La Roche

- 10.8 Formycon

- 10.9 Novartis

- 10.10 Pfizer

- 10.11 Regeneron Pharmaceuticals

- 10.12 Sandoz Group

- 10.13 STADA Arzneimittel

- 10.14 Xbrane Biopharma