|

市场调查报告书

商品编码

1766346

电子重合器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Electronic Recloser Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

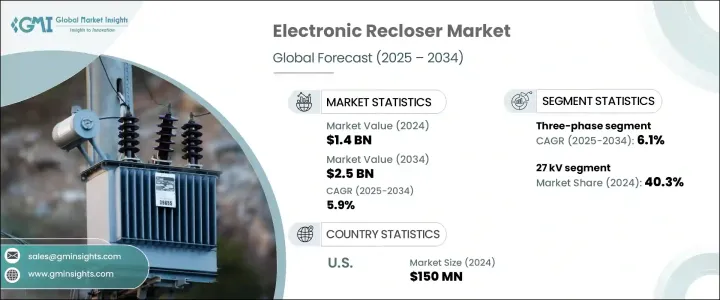

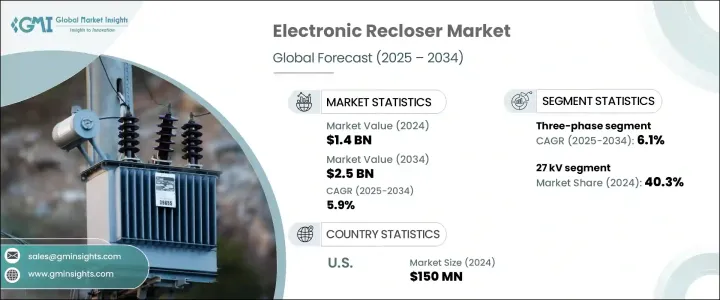

2024年,全球电子重合器市场规模达14亿美元,预计2034年将以5.9%的复合年增长率成长,达到25亿美元。这一成长主要源于对老化电网基础设施进行现代化改造、提高配电效率以及整合再生能源的需求。电子重合器在智慧电网中发挥着至关重要的作用,它能够实现故障的自动检测和恢復,从而减少停机时间并提高系统可靠性。技术进步推动了重合器的发展,这些重合器配备了增强型感测器、通讯能力以及与物联网 (IoT) 平台的集成,进一步推动了其应用。

此外,对可靠智慧电网系统日益增长的需求,加上政府的优惠激励措施和对电力基础设施现代化的大规模投资,持续推动电子重合器市场的成长。随着公用事业公司和电网营运商转向自动化和更智慧的能源管理,电子重合器正被整合到系统中,以支援快速故障检测,最大限度地减少电力中断,并增强整体系统弹性。随着分散式能源和再生能源併网的日益普及,电子重合器的作用变得更加关键,因为即时电网响应对于维持稳定性和服务连续性至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 14亿美元 |

| 预测值 | 25亿美元 |

| 复合年增长率 | 5.9% |

预计到2034年,三相电源市场的复合年增长率将达到6.1%,主要体现在高负载和关键任务配电网的安装。这些重合器为所有三相电源提供全面保护,非常适合大型商业和工业设施中的重型应用。它们能够隔离故障并自动恢復供电,无需人工干预,因此在需要最大限度减少停机时间的大容量电网中,它们不可或缺。

2024年,15千伏市场的估值达到5.355亿美元。此电压等级广泛应用于中压系统,并成为城乡配电网的标准规范。其受欢迎程度源自于其能够在住宅区、轻工业园区和公用事业变电站提供经济高效且可靠的故障管理,使公用事业公司能够在各种运作条件下保持不间断服务。

2024年,美国电子重合器市场规模达1.5亿美元,与前几年相比持续成长。这一成长趋势主要源自于美国致力于更换老化的电力基础设施和部署先进的电网技术。升级老旧系统对于满足当前的能源需求、确保电网稳定以及实现未来的永续发展目标至关重要。此外,为了满足监管机构制定的严格性能和可靠性标准,下一代重合器的应用也日益普及,这类重合器具备先进的诊断功能、远端操作能力以及与电网的无缝整合。

全球电子重合器市场的主要参与者包括 ABB、Arteche、Eaton、Ensto、Entec Electric & Electronic、G&W Electric、Hubbell、Hughes Power System、NOJA Power Switchgear Pty Ltd、Rockwell、S&C Electric Company、施耐德电气、Shinsung Industrial Electric、西门子和 Tavrida Electric。这些公司专注于产品创新、策略合作伙伴关係以及扩大市场占有率,以巩固其在竞争格局中的地位。为了巩固市场占有率,电子重合器产业的公司正在采取多项关键策略。他们正在投资研发以创新和改进产品,确保满足现代配电系统不断变化的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 策略倡议

- 竞争基准测试

- 战略仪表板

- 创新与技术格局

第五章:市场规模及预测:依阶段,2021 - 2034

- 主要趋势

- 单相

- 三相

第六章:市场规模及预测:按中断,2021 - 2034

- 主要趋势

- 油

- 真空

第七章:市场规模及预测:依电压等级,2021 - 2034

- 主要趋势

- 15千伏

- 27千伏

- 38千伏

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 义大利

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

第九章:公司简介

- ABB

- ARTECHE

- Eaton

- ENSTO

- ENTEC Electric & Electronic

- G&W Electric

- Hubbell

- Hughes Power System

- NOJA Power Switchgear Pty Ltd

- Rockwill

- S&C Electric Company

- Schneider Electric

- Shinsung Industrial Electric

- Siemens

- Tavrida Electric

The Global Electronic Recloser Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 2.5 billion by 2034. This growth is driven by the need to modernize aging grid infrastructure, enhance power distribution efficiency, and integrate renewable energy sources. Electronic reclosers play a crucial role in smart grids by enabling automated fault detection and restoration, thereby reducing downtime and improving system reliability. Technological advancements have led to the development of reclosers with enhanced sensors, communication capabilities, and integration with Internet of Things (IoT) platforms, further boosting their adoption.

Additionally, the rising demand for dependable and intelligent grid systems, alongside favorable government incentives and large-scale investments in electrical infrastructure modernization, continues to fuel growth in the electronic recloser market. As utilities and grid operators shift toward automation and smarter energy management, electronic reclosers are being integrated to support rapid fault detection, minimize power interruptions, and enhance overall system resilience. Their role becomes even more critical with the growing deployment of distributed energy resources and renewable energy integration, where real-time grid responsiveness is essential for maintaining stability and service continuity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.5 Billion |

| CAGR | 5.9% |

The three-phase segment is anticipated to grow at a CAGR of 6.1% through 2034, reflecting installations in high-load and mission-critical distribution networks. These reclosers provide comprehensive protection across all three phases of power, making them well-suited for heavy-duty applications in large-scale commercial and industrial facilities. Their ability to isolate faults and automatically restore power without manual intervention makes them indispensable in high-capacity grids where downtime must be minimized.

In 2024, the 15kV segment reached a market valuation of USD 535.5 million. This voltage class is widely deployed in medium-voltage systems and serves as a standard specification for both urban and rural distribution networks. Its popularity stems from its ability to deliver cost-effective and reliable fault management in residential zones, light industrial parks, and utility substations, enabling utilities to maintain uninterrupted service in diverse operating conditions.

United States Electronic Recloser Market was valued at USD 150 million in 2024, reflecting consistent growth over the previous years. This upward trend is largely driven by the nation's focus on replacing aging power infrastructure and deploying advanced grid technologies. Upgrades to outdated systems are essential for addressing current energy demands, ensuring grid stability, and achieving future sustainability goals. Additionally, compliance with strict performance and reliability standards set by regulatory bodies has increased the adoption of next-generation reclosers, which offer advanced diagnostics, remote operation capabilities, and seamless grid integration.

Key players operating in the Global Electronic Recloser Market include ABB, Arteche, Eaton, Ensto, Entec Electric & Electronic, G&W Electric, Hubbell, Hughes Power System, NOJA Power Switchgear Pty Ltd, Rockwell, S&C Electric Company, Schneider Electric, Shinsung Industrial Electric, Siemens, and Tavrida Electric. These companies are focusing on product innovation, strategic partnerships, and expanding their market presence to strengthen their positions in the competitive landscape. To strengthen their market presence, companies in the electronic recloser industry are adopting several key strategies. They are investing in research and development to innovate and improve product offerings, ensuring they meet the evolving needs of modern power distribution systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic initiative

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Phase, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Single phase

- 5.3 Three phase

Chapter 6 Market Size and Forecast, By Interruption, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Oil

- 6.3 Vacuum

Chapter 7 Market Size and Forecast, By Voltage Rating, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 15 kV

- 7.3 27 kV

- 7.4 38 kV

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Russia

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Chile

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 ARTECHE

- 9.3 Eaton

- 9.4 ENSTO

- 9.5 ENTEC Electric & Electronic

- 9.6 G&W Electric

- 9.7 Hubbell

- 9.8 Hughes Power System

- 9.9 NOJA Power Switchgear Pty Ltd

- 9.10 Rockwill

- 9.11 S&C Electric Company

- 9.12 Schneider Electric

- 9.13 Shinsung Industrial Electric

- 9.14 Siemens

- 9.15 Tavrida Electric