|

市场调查报告书

商品编码

1766349

兽医辅助生殖技术市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Veterinary Assistive Reproduction Technology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

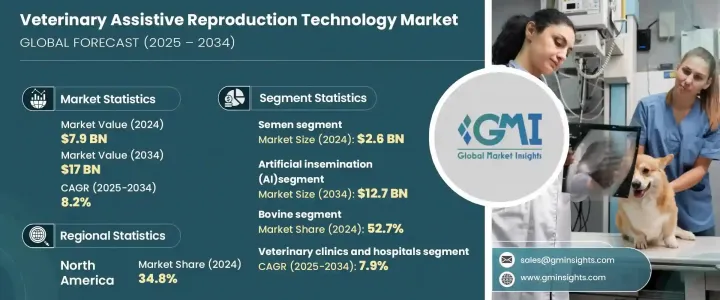

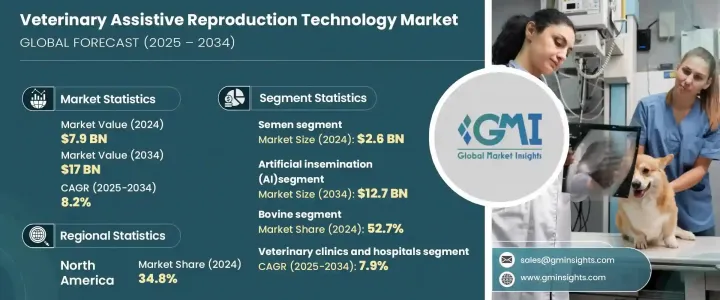

2024年,全球兽医辅助生殖技术市场规模达79亿美元,预计2034年将以8.2%的复合年增长率成长,达到170亿美元。这一增长主要源于牲畜存栏量的增加、肉类和乳製品需求的不断增长以及畜牧业投资的增加。随着牲畜育种和基因改良对满足全球粮食需求的重要性日益凸显,兽医辅助生殖技术(ART)正被用于提高繁殖效率、改善畜群遗传学和整体生产力。透过利用优良遗传材料并缩短育种週期,ART有助于提高牛奶和肉类的产量,从而促进全球消费的成长。

在许多国家,政府以补贴和畜牧业计画的形式提供支持,进一步推动了抗逆转录病毒疗法(ART)技术的采用。此外,包括冷冻保存、卵子提取(OPU)和精准育种在内的持续技术进步,也提高了抗逆转录病毒疗法的可及性,使小型诊所和大型农场都能从这些技术中受益。兽医抗逆转录病毒疗法在动物育种、濒危物种保护和牲畜健康改善方面发挥着至关重要的作用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 79亿美元 |

| 预测值 | 170亿美元 |

| 复合年增长率 | 8.2% |

2024年,精液市场价值达26亿美元。精液在人工授精(AI)中至关重要,由于其能够改善畜群遗传特性并避免与自然交配相关的疾病,已成为选择性育种计划中不可或缺的一部分。采用基于精液的辅助生殖技术(ART)策略,农民和育种者能够提高牲畜的生产力和获利能力。冷冻保存和精液性别鑑定技术的最新进展使得获得更好的育种效果成为可能,而精液品质检测和配送物流的创新则巩固了该领域的市场地位。此外,教育计画、财政激励措施以及兽医服务的日益普及也支持了基于精液的辅助生殖技术在该行业的广泛应用。

预计到2034年,人工授精 (AI) 市场规模将达到127亿美元。 AI广泛应用于各种动物,尤其是在畜牧业和乳製品行业,因为它能够更有效地安排配种时间,减少对多头雄性种畜的需求,并将基因优良雄性种畜的繁殖范围扩大到偏远地区。该技术增强了畜群遗传学,提高了生产力,增强了抗病能力,所有这些都使其得到了广泛的认可。与自然繁殖相比,AI也被认为更具成本效益和可靠性,并且受伤和疾病传播的风险更低,使其成为农民和育种者的首选。旨在提高畜牧业生产力的政府和非政府计画进一步加速了AI技术的普及。

2024年,美国兽医辅助生殖技术市场规模达25亿美元。由于其完善的兽医医疗基础设施和先进生殖技术的广泛应用,美国在全球兽医辅助生殖技术市场中占据重要地位。美国的兽医诊所配备了最先进的设施,可执行人工授精、胚胎移植和体外受精等辅助生殖技术(ART)程序。商业化育种机构越来越多地利用ART技术来改善遗传品质和控制疾病,从而改善畜群健康状况。此外,美国强大的供应商和服务提供者网路提高了ART产品和服务的可近性,从而推动了市场成长。

全球兽医辅助生殖技术市场的主要参与者包括 Minitube Group、IMV Technologies、Genus Plc、CRV Holdings、Bovine Elite、Select Sires、STgenetics、SEMEX、Swine Genetics International、Geno SA、VikingGenetics 和 URUS Group。在策略方面,兽医辅助生殖技术市场中的公司专注于扩大产品组合併增强服务内容,以巩固其市场地位。关键策略包括开发创新解决方案,例如先进的精液冷冻保存技术、胚胎移植技术和精准育种工具。与研究机构和兽医诊所的合作也在提高辅助生殖技术服务的可及性和有效性方面发挥着重要作用,尤其是在新兴市场。公司也大力投资教育项目,为兽医专业人员提供培训计划,以提高这些技术的整体应用率。此外,一些公司专注于地理扩张,瞄准牲畜数量不断增长、肉类和乳製品需求不断增长的地区,例如亚太地区和拉丁美洲。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 动物养殖需求不断成长

- 兽医学的进步

- 注重基因保存

- 兽医保健支出增加

- 产业陷阱与挑战

- 先进生殖技术相关的高昂初始设定成本

- 手术失败和併发症的风险

- 市场机会

- 基因组选择与精准育种的整合

- 保护和濒危物种繁殖的需求不断增长

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 当前的技术趋势

- 新兴技术

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 服务

- 精液

- 正常精液

- 性控精液

- 仪器

- 套件和耗材

第六章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 人工授精(AI)

- 体外受精(IVF)

- 胚胎移植(MOET)

- 其他技术

第七章:市场估计与预测:按动物类型,2021 - 2034 年

- 主要趋势

- 牛

- 猪

- 绵羊

- 山羊

- 马

- 其他动物类型

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 兽医诊所和医院

- 动物养殖中心

- 科学研究院所及大学

- 其他最终用途

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 波兰

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Bovine Elite

- CRV Holdings

- Geno SA

- Genus Plc

- IMV Technologies

- Minitube Group

- SEMEX

- Select Sires

- Swine Genetics International

- STgenetics

- URUS Group

- VikingGenetics

The Global Veterinary Assistive Reproduction Technology Market was valued at USD 7.9 billion in 2024 and is estimated to grow at a CAGR of 8.2% to reach USD 17 billion by 2034. This growth is primarily driven by the rising livestock population, an increasing demand for meat and dairy products, and greater investments in the livestock sector. As breeding and genetic improvement in livestock animals become more critical to meeting global food demand, veterinary ART technologies are being adopted to improve reproductive efficiency, herd genetics, and overall productivity. By leveraging superior genetic materials and enhancing breeding cycles, ART helps to boost yields of milk and meat, which in turn supports rising global consumption.

In many countries, governmental support in the form of subsidies and livestock programs further drives the adoption of ART technologies. Additionally, ongoing technological advancements, including cryopreservation, ovum pick-up (OPU), and precision breeding, are improving accessibility to ART, enabling small clinics and large farms alike to benefit from these technologies. Veterinary ART plays an essential role in animal breeding, the conservation of endangered species, and the improvement of livestock health.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.9 Billion |

| Forecast Value | $17 Billion |

| CAGR | 8.2% |

The semen segment was valued at USD 2.6 billion in 2024. Semen is crucial in artificial insemination (AI) and has become an integral part of selective breeding programs due to its ability to improve herd genetics and avoid diseases associated with natural mating. The adoption of semen-based ART strategies enables farmers and breeders to enhance livestock productivity and profitability. Recent advancements in cryopreservation and semen sexing technologies have made it possible to achieve better breeding results, and innovations in semen quality testing and distribution logistics have bolstered the segment's market position. Furthermore, educational programs, financial incentives, and the growing availability of veterinary services are also supporting the widespread use of semen-based ART in the industry.

Artificial insemination (AI) segment is expected to reach USD 12.7 billion by 2034. AI is widely used in various animal species, particularly in livestock and dairy sectors, for its ability to schedule breeding more effectively, reduce the need for multiple male breeding animals, and extend the reach of genetically superior males to remote locations. The technology has enhanced herd genetics, improved productivity, and increased disease resistance, all of which have led to its widespread acceptance. AI is also considered more cost-effective, and reliable, and carries a lower risk of injury and disease transmission compared to natural breeding, making it a preferred option for farmers and breeders. Government and non-governmental programs designed to boost livestock productivity further accelerate the adoption of AI technologies.

U.S. Veterinary Assistive Reproduction Technology Market was valued at USD 2.5 billion in 2024. The country is a key player in the global veterinary assistive reproduction technology market, driven by a sophisticated veterinary healthcare infrastructure and high adoption of advanced reproductive technologies. Veterinary clinics in the U.S. are equipped with state-of-the-art facilities to perform ART procedures such as AI, embryo transfer, and in vitro fertilization. Commercial breeding operations are increasingly utilizing ART to improve genetic quality and control diseases, leading to better herd health. Additionally, a strong network of suppliers and service providers in the U.S. increases accessibility to ART products and services, propelling market growth.

Key players in the Global Veterinary Assistive Reproduction Technology Market include Minitube Group, IMV Technologies, Genus Plc, CRV Holdings, Bovine Elite, Select Sires, STgenetics, SEMEX, Swine Genetics International, Geno SA, VikingGenetics, and URUS Group. In terms of strategies, companies in the veterinary assistive reproduction technology market focus on expanding their product portfolios and enhancing service offerings to strengthen their market position. Key strategies include developing innovative solutions such as advanced semen cryopreservation techniques, embryo transfer technologies, and precision breeding tools. Partnerships with research institutions and veterinary clinics also play a significant role in increasing the accessibility and effectiveness of ART services, especially in emerging markets. Companies are also investing heavily in educational initiatives, providing training programs for veterinary professionals to improve the overall adoption of these technologies. Furthermore, some companies are focusing on geographical expansion by targeting regions with growing livestock populations and rising demand for meat and dairy products, such as Asia-Pacific and Latin America.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Technology

- 2.2.4 Animal type

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for animal breeding

- 3.2.1.2 Advancements in veterinary medicine

- 3.2.1.3 Focus on genetic preservation

- 3.2.1.4 Increasing veterinary healthcare expenditure

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial setup costs associated with advanced reproductive technologies

- 3.2.2.2 Risk of procedural failures and complications

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of genomic selection and precision breeding

- 3.2.3.2 Rising demand for conservation and endangered species breeding

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Services

- 5.3 Semen

- 5.3.1 Normal semen

- 5.3.2 Sexed semen

- 5.4 Instruments

- 5.5 Kits and consumables

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Artificial insemination (AI)

- 6.3 In vitro fertilization (IVF)

- 6.4 Embryo transfer (MOET)

- 6.5 Other technologies

Chapter 7 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Bovine

- 7.3 Swine

- 7.4 Ovine

- 7.5 Caprine

- 7.6 Equine

- 7.7 Other animal types

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary clinics and hospitals

- 8.3 Animal breeding centers

- 8.4 Research institutes and universities

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Poland

- 9.3.7 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Bovine Elite

- 10.2 CRV Holdings

- 10.3 Geno SA

- 10.4 Genus Plc

- 10.5 IMV Technologies

- 10.6 Minitube Group

- 10.7 SEMEX

- 10.8 Select Sires

- 10.9 Swine Genetics International

- 10.10 STgenetics

- 10.11 URUS Group

- 10.12 VikingGenetics