|

市场调查报告书

商品编码

1766356

旋回破碎机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Gyratory Crushers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

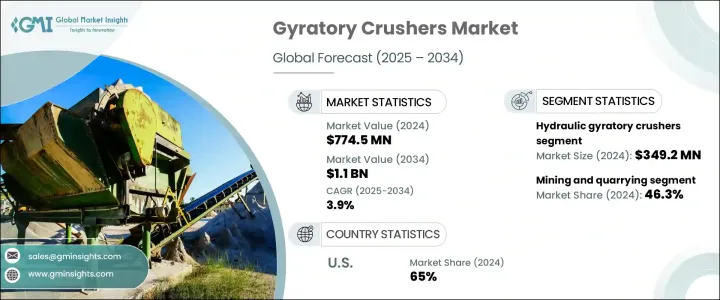

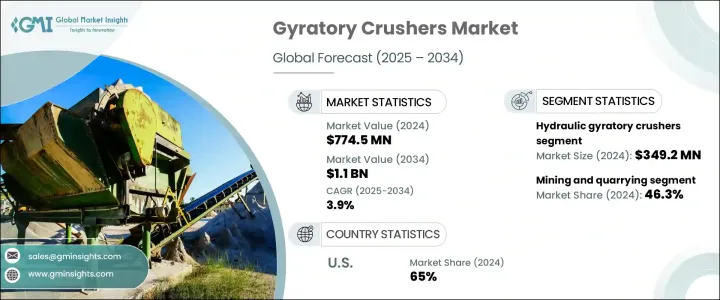

2024年,全球旋迴式破碎机市场规模达7.745亿美元,预估年复合成长率达3.9%,2034年将达11亿美元。尤其是在发展中国家,对矿物和骨材的需求不断增长,这推动矿业公司提高产量。旋迴式破碎机在这一扩张中发挥核心作用,因为它们拥有高产能的矿石处理能力。这些设备对于高效破碎大量原料至关重要,随着采矿技术的进步,其需求也日益增长。基础设施建设的成长和快速的城市化过程显着增加了对建筑骨材的需求。

随着桥樑、高速公路和商业开发等大型项目的逐步成型,能够从硬质岩石中生产骨材的破碎系统变得不可或缺。破碎机设计的创新,包括自动化、耐磨零件和节能係统,正在提升设备性能、安全性和整体营运产出。智慧功能的整合增强了可靠性,同时减少了计划外停机时间,满足了业界对可扩展且高效的材料加工不断变化的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.745亿美元 |

| 预测值 | 11亿美元 |

| 复合年增长率 | 3.9% |

2024年,液压旋回破碎机市场收入达3.492亿美元,这得益于其在重型物料加工方面提供的先进能力。这些系统广泛应用于需要大规模矿石还原的行业,例如铜和铁的开采,并设计用于处理花岗岩等极具磨蚀性的原料。配备液压系统后,这些系统简化了调整、维护和过载响应等关键功能。这不仅简化了使用,还提高了机器的安全性和正常运作时间。操作员可以轻鬆即时调整破碎机设置,以保持稳定的产量并优化吞吐量。液压系统还能快速清理破碎腔和更换零件,最大限度地减少中断并提高生产力,无需人工干预。

2024年,采矿和采石产业占据了46.3%的市场。由于处理物料的体积和硬度,旋迴式破碎机在该领域发挥显着优势。这些机器是铜、铁、石灰石和花岗岩等硬矿物初级破碎的首选。其坚固的结构和高吞吐量使其成为需要连续、大规模物料处理作业的理想选择。旋迴式破碎机能够有效率地缩小原矿的尺寸,并为下游工序提供稳定的给料。

2024年,美国旋迴式破碎机市场占据65%的市场份额,这主要得益于采矿和采石产业的扩张。这些设备凭藉其高产量和高可靠性,广泛应用于碎石、砾石和沙子等骨材的加工。整合自动化和液压控制的破碎机不断发展,在提高性能的同时降低了维护需求。这些进步对于延长设备使用寿命和降低营运成本至关重要。此外,道路和城市扩建等基础设施建设的日益推进,也推动了对能够满足重型骨材生产需求的大容量破碎机的需求。

全球旋迴式破碎机市场的主要製造商包括蒂森克虏伯股份公司、塔克拉夫有限公司、威尔集团、上海山美矿山机械股份有限公司、美国史密斯公司、Earthtechnica公司、徐工集团、AGICO水泥机械有限公司、真库瑞集团、顺达矿业集团有限公司、特雷克斯公司、山特维克公司、美卓奥图库亚工业有限公司。产业领导者正透过策略性产品创新巩固其市场地位,重点关注自动化、能源效率和数位化整合。

製造商正在投资研发,以开发配备智慧控制系统的破碎机,从而实现即时效能监控和自适应处理。在新兴地区扩大产能,可以加快交货速度并提供在地化支援。企业也正在加强预测性维护和远端诊断等售后服务,以与客户建立长期合作关係。与矿业和建筑公司的合作有助于共同开发针对特定场地条件的客製化破碎解决方案。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 采矿和采石业的需求不断增长

- 基础建设发展

- 水泥和骨材产业的扩张

- 产业陷阱与挑战

- 资本和维护成本高

- 替代方案的可用性

- 机会

- 技术进步

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 标准破碎机

- 液压破碎机

- 颚式旋回破碎机

第六章:市场估计与预测:按产能,2021 年至 2034 年

- 主要趋势

- 高达 1000 TPH

- 1001–2000 吨/小时

- 2000吨/小时以上

第七章:市场估计与预测:按功率,2021 年至 2034 年

- 主要趋势

- 电的

- 杂交种

第八章:市场估计与预测:依移动性,2021 年至 2034 年

- 主要趋势

- 固定式

- 移动的

第九章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 聚合製造

- 采矿和采石业

- 回收利用

- 其他的

第十章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- AGICO Cement Machinery Co Ltd

- CITIC Heavy Industries Co., Ltd.

- Earthtechnicia

- FLSmidth & Co. A/S

- Metso Outotec

- Propel Industries

- Sandvik AB

- Shanghai SANME Mining Machinery Corp Ltd

- Shunda Mining Group Co Ltd

- TAKRAF GmbH

- Terex Corporation

- The Makuri Group

- ThyssenKrupp AG

- Weir Group

- XCMG

The Global Gyratory Crushers Market was valued at USD 774.5 million in 2024 and is estimated to grow at a CAGR of 3.9% to reach USD 1.1 billion by 2034. Rising demand for minerals and aggregates, particularly in developing countries, is driving mining firms to ramp up production. Gyratory crushers play a central role in this expansion, as they offer high-capacity ore processing capabilities. These machines are essential for crushing large volumes of raw material efficiently and are increasingly sought after with advancements in extraction technology. Infrastructure growth and rapid urbanization are significantly increasing the need for construction aggregates.

As large-scale projects such as bridges, highways, and commercial developments take shape, crushing systems capable of producing aggregates from hard rocks become indispensable. Innovations in crusher design, including automation, wear-resistant components, and energy-saving systems, are improving machine performance, safety, and overall operational output. The integration of smart features is enhancing reliability while reducing unplanned downtime, aligning with evolving industry needs for scalable and efficient material processing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $774.5 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 3.9% |

In 2024, the hydraulic gyratory crushers segment generated USD 349.2 million, driven by offering advanced capabilities in heavy-duty material processing. These systems are widely used in industries requiring large-scale ore reduction, such as copper and iron extraction, and are designed to handle extremely abrasive feedstocks like granite. Equipped with hydraulics, they streamline critical functions such as adjustment, maintenance, and overload response. This not only simplifies usage but also boosts machine safety and uptime. Operators can easily adjust crusher settings in real time to maintain consistent output and optimize throughput. Hydraulic systems also enable fast chamber clearing and part replacements, minimizing interruptions and enhancing productivity without the need for manual labor.

The mining and quarrying segment accounted for 46.3% market share in 2024. This segment benefits significantly from gyratory crushers due to the volume and hardness of the materials processed. These machines are the preferred choice for the primary crushing of hard minerals such as copper, iron, limestone, and granite. Their robust construction and high throughput capabilities make them ideal for operations that require continuous, large-scale material handling. Gyratory crushers ensure efficiency in reducing the size of raw ore, supporting downstream processes with consistent feedstock.

United States Gyratory Crushers Market held a 65% share in 2024, led by expansion in the mining and quarrying sectors. The machines are widely applied in processing aggregates like crushed stone, gravel, and sand due to their high output and reliability. Continuous development of crushers featuring integrated automation and hydraulic controls has enhanced performance while lowering maintenance demands. These advancements are crucial in improving the equipment lifecycle and reducing operational costs. Furthermore, the growing push for infrastructure development, including roads and urban expansion projects, is fueling the need for large-capacity crushers that meet the demands of heavy aggregate production.

Major manufacturers shaping the Global Gyratory Crushers Market include ThyssenKrupp AG, TAKRAF GmbH, Weir Group, Shanghai SANME Mining Machinery Corp Ltd, FLSmidth & Co. A/S, Earthtechnica, XCMG, AGICO Cement Machinery Co Ltd, The Makuri Group, Shunda Mining Group Co Ltd, Terex Corporation, Sandvik AB, Metso Outotec, CITIC Heavy Industries Co., Ltd., and Propel Industries. Industry leaders are strengthening their market position through strategic product innovation, focusing on automation, energy efficiency, and digital integration.

Manufacturers are investing in R&D to develop crushers with smart control systems, allowing real-time performance monitoring and adaptive processing. Expansion of production capacity in emerging regions enables faster delivery and localized support. Companies are also enhancing after-sales services such as predictive maintenance and remote diagnostics to build long-term relationships with clients. Partnerships with mining and construction firms help co-develop customized crushing solutions tailored to specific site conditions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Capacity

- 2.2.4 Power

- 2.2.5 Mobility

- 2.2.6 Application

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand in mining and quarrying

- 3.2.1.2 Infrastructure development

- 3.2.1.3 Expansion of cement and aggregate industries

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital and maintenance costs

- 3.2.2.2 Availability of alternatives

- 3.2.3 Opportunities

- 3.2.4 Technological advancements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Million) (Units)

- 5.1 Key trends

- 5.2 Standard Crushers

- 5.3 Hydraulic Crushers

- 5.4 Jaw Gyratory Crushers

Chapter 6 Market Estimates and Forecast, By Capacity, 2021 – 2034 (USD Million) (Units)

- 6.1 Key trends

- 6.2 Up to 1000 TPH

- 6.3 1001–2000 TPH

- 6.4 Above 2000 TPH

Chapter 7 Market Estimates and Forecast, By Power, 2021 – 2034 (USD Million) (Units)

- 7.1 Key trends

- 7.2 Electric

- 7.3 Hybrid

Chapter 8 Market Estimates and Forecast, By Mobility, 2021 – 2034 (USD Million) (Units)

- 8.1 Key trends

- 8.2 Stationary

- 8.3 Mobile

Chapter 9 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million) (Units)

- 9.1 Key trends

- 9.2 Aggregate Manufacturing

- 9.3 Mining and Quarrying

- 9.4 Recycling

- 9.5 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million) (Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AGICO Cement Machinery Co Ltd

- 11.2 CITIC Heavy Industries Co., Ltd.

- 11.3 Earthtechnicia

- 11.4 FLSmidth & Co. A/S

- 11.5 Metso Outotec

- 11.6 Propel Industries

- 11.7 Sandvik AB

- 11.8 Shanghai SANME Mining Machinery Corp Ltd

- 11.9 Shunda Mining Group Co Ltd

- 11.10 TAKRAF GmbH

- 11.11 Terex Corporation

- 11.12 The Makuri Group

- 11.13 ThyssenKrupp AG

- 11.14 Weir Group

- 11.15 XCMG