|

市场调查报告书

商品编码

1766361

汽车声学工程服务市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Acoustic Engineering Service Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

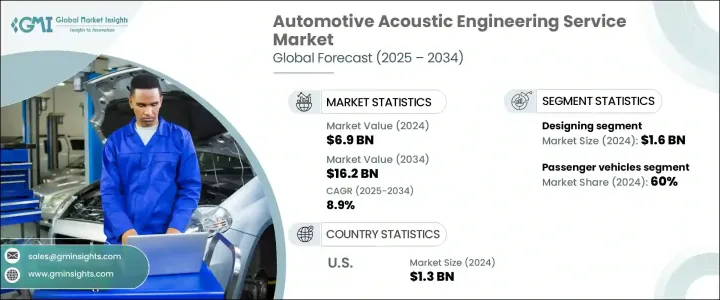

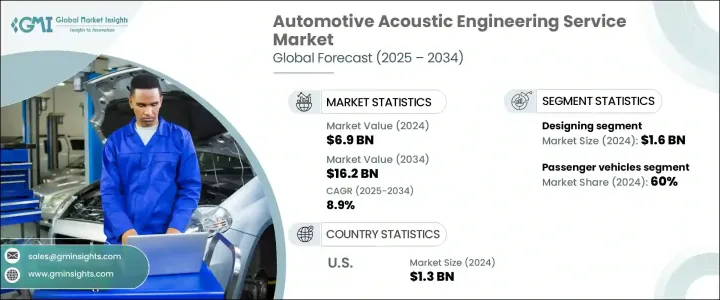

2024年,全球汽车声学工程服务市场规模达69亿美元,预计到2034年将以8.9%的复合年增长率成长,达到162亿美元。需求激增的主要原因是人们对更安静、更舒适驾驶体验的需求、更严格的全球噪音法规以及整个产业向电动车的转型。随着车辆结构和动力系统的变化,尤其是电动车引擎噪音的降低,汽车製造商和一级供应商开始重新关注噪音、振动和声振粗糙度(NVH)的改进。

领先的公司正在利用虚拟声学测试、数位模拟和声学材料优化等技术来塑造车辆的听觉特征,同时降低成本并缩短开发时间。欧洲和亚太地区的市场尤其活跃,製造商正在部署先进的软体平台和模拟环境,以管理各种车型的NVH性能。这些服务不仅有助于满足法规遵循性,还能在竞争日益激烈的汽车市场中脱颖而出。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 69亿美元 |

| 预测值 | 162亿美元 |

| 复合年增长率 | 8.9% |

2024年,设计阶段的收入达到16亿美元。此阶段在从开发初期塑造声学特性方面发挥关键作用。关键活动包括选择隔音材料、建造隔音套件以及使用3D工具和AI平台模拟声学环境。数位孪生和预测性声学建模的兴起使原始设备製造商能够跨车辆平台(从紧凑型电动车到大型SUV)定制NVH处理方案,从而在保持成本效益的同时提高产品品质。这些早期服务使製造商能够在开始实体原型製作之前微调声音特性。

2024年,乘用车占据了60%的市场份额,由于消费者更加重视座舱舒适度、隔音效果和精緻的声学体验,乘用车将继续占据主导地位。随着电动车消除引擎噪音,道路噪音和空调噪音等次要噪音变得更加明显。这种转变促使汽车製造商投资于更好的隔音材料、精准调校和先进的模拟软体,以提供更安静、更优质的车内体验。自动驾驶功能和互联资讯娱乐系统的日益普及,也增加了乘用车对良好声音环境管理的需求。

美国汽车声学工程服务市场在2024年创收13亿美元,预计2034年将以7.8%的复合年增长率成长。北美市场在声学工程服务市场的领先地位源于其强大的汽车製造基础、大量的研发投入以及对先进NVH技术的早期应用。特斯拉、福特汽车公司和通用汽车等汽车製造商正加大对声学设计和声音校准的投入,以提升用户体验并满足日益严格的噪音水平法规。密西根州和加州等地区的研究机构和创新中心为声学测试和产品验证提供了强大的生态系统,进一步巩固了美国在该地区的主导地位。

影响全球汽车声学工程服务市场的关键参与者包括西门子、Gentex、舍弗勒工程、FEV 集团、EDAG 工程、佛吉亚、Catalyst Acoustics、大陆集团、Autoneum 和 Bertrandt。汽车声学工程服务市场的公司正在透过投资数位模拟平台、AI 整合声学建模和即时 NVH 分析来提升其市场占有率。与 OEM 建立的协同开发策略合作伙伴关係正在帮助工程公司共同设计用于电动车和混合动力平台的客製化声学解决方案。公司还将服务范围扩展到使用智慧感测器和基于数据的调整的早期设计咨询和后期生产验证。透过全球创新中心增强研发能力和收购利基科技公司可以加快产品推出速度。重视永续和轻质声学材料符合环境法规,同时满足性能标准。市场领导者也将服务扩展到汽车需求不断增长的发展中市场,支援在地化工作,并建立长期客户关係。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 车辆增强功能的需求不断增加

- 政府对车辆噪音的严格规定

- 高级汽车销量成长

- 声学工程技术的进步

- 产业陷阱与挑战

- 实施成本高

- 多材料和轻量化设计的复杂性

- 市场机会

- 电动车和自动驾驶汽车市场的成长

- 采用人工智慧驱动的 NVH 分析

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 生产统计

- 生产中心

- 消费中心

- 汇出和汇入

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按工艺,2021 - 2034 年

- 主要趋势

- 设计

- 发展

- 测试

第六章:市场估计与预测:按供应量,2021 - 2034 年

- 主要趋势

- 身体的

- 虚拟的

第七章:市场估计与预测:按解决方案,2021 - 2034 年

- 主要趋势

- 校准

- 振动

- 模拟

- 其他的

第八章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 轿车

- 掀背车

- 越野车

- 商用车

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第九章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 内部的

- 车身与结构

- 动力传动系统

- 传动系统

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙乌地阿拉伯

- 南非

- 阿联酋

第 11 章:公司简介

- Adler Pelzer

- Autoneum

- AVL List

- Bertrandt

- Catalyst Acoustics

- Continental

- DESIGNA

- EDAG Engineering

- Faurecia SA

- FEV Group

- Gentex

- HEAD

- Horiba

- IAV GmbH

- Roechling

- Schaeffler

- Siemens

- Spectris

- STS Group

- Vibroacoustic

The Global Automotive Acoustic Engineering Service Market was valued at USD 6.9 billion in 2024 and is estimated to grow at a CAGR of 8.9% to reach USD 16.2 billion by 2034. The surge in demand is largely influenced by the need for quieter and more comfortable driving experiences, stricter global noise regulations, and the industry-wide transition toward electric mobility. As the structure and powertrains of vehicles change, particularly with the reduced engine noise in EVs, automakers and Tier 1 suppliers are placing renewed focus on noise, vibration, and harshness (NVH) refinement.

Leading companies are leveraging technologies such as virtual acoustic testing, digital simulation, and sound material optimization to shape the auditory signature of vehicles while cutting costs and development time. The market is particularly dynamic in Europe and Asia-Pacific, where manufacturers are deploying advanced software platforms and simulation environments to manage NVH performance across vehicle types. These services not only help meet regulatory compliance but also support differentiation in an increasingly competitive automotive landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.9 Billion |

| Forecast Value | $16.2 Billion |

| CAGR | 8.9% |

The design phase segment generated USD 1.6 billion in 2024. This segment plays a critical role in shaping acoustic profiles from the earliest phases of development. Key activities include selecting sound-insulating materials, building sound packages, and simulating acoustic environments using 3D tools and AI-powered platforms. The rise of digital twins and predictive acoustic modeling allows OEMs to customize NVH treatments across vehicle platforms-from compact EVs to large SUVs-improving product quality while maintaining cost efficiency. These early-stage services enable manufacturers to fine-tune sound characteristics before physical prototyping begins.

Passenger vehicles represented a 60% share in 2024, continuing to dominate due to heightened consumer focus on cabin comfort, noise isolation, and refined acoustic experiences. With EVs eliminating engine noise, secondary sounds like road and HVAC noise have become more noticeable. This shift is prompting carmakers to invest in better soundproofing materials, precision tuning, and advanced simulation software to deliver a quieter, more premium in-vehicle experience. The expanding presence of autonomous features and connected infotainment systems also increases the need for well-managed soundscapes in passenger vehicles.

U.S. Automotive Acoustic Engineering Service Market generated USD 1.3 billion in 2024 and is forecasted to grow at a CAGR of 7.8% through 2034. This leadership in North America stems from a strong automotive manufacturing base, significant R&D investment, and early adoption of advanced NVH technologies. OEMs like Tesla, Ford Motor Company, and General Motors are increasing their focus on acoustic design and sound calibration to enhance user experience and meet tightening noise-level regulations. Research institutions and innovation hubs across regions such as Michigan and California provide a robust ecosystem for acoustic testing and product validation, further reinforcing the U.S.'s regional dominance.

Key players shaping the Global Automotive Acoustic Engineering Service Market include Siemens, Gentex, Schaeffler Engineering, FEV Group, EDAG Engineering, Faurecia, Catalyst Acoustics, Continental, Autoneum, and Bertrandt. Companies in the automotive acoustic engineering service market are enhancing their market presence through investment in digital simulation platforms, AI-integrated acoustic modeling, and real-time NVH analytics. Strategic partnerships with OEMs for collaborative development are helping engineering firms co-design tailored acoustic solutions for EVs and hybrid platforms. Firms are also expanding service offerings into early-phase design consultation and post-production validation using smart sensors and data-based tuning. Enhancing R&D capabilities through global innovation centers and acquiring niche tech firms are enabling faster product rollout. Emphasis on sustainable and lightweight acoustic materials aligns with environmental regulations while meeting performance standards. Market leaders are also extending services to developing markets with growing automotive demand, supporting localization efforts, and building long-term client relationships.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Process

- 2.2.3 Offering

- 2.2.4 Solution

- 2.2.5 Vehicle

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for enhanced features in vehicle

- 3.2.1.2 Stringent government regulations on vehicle noise

- 3.2.1.3 Rise in sales of premium vehicles

- 3.2.1.4 Advancements in acoustic engineering technology

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation costs

- 3.2.2.2 Complexity in multi-material and lightweight designs

- 3.2.3 Market opportunities

- 3.2.3.1 Growth of EV and autonomous vehicle markets

- 3.2.3.2 Adoption of AI-driven NVH analytics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Process, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Designing

- 5.3 Development

- 5.4 Testing

Chapter 6 Market Estimates & Forecast, By Offering, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Physical

- 6.3 Virtual

Chapter 7 Market Estimates & Forecast, By Solution, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Calibration

- 7.3 Vibration

- 7.4 Simulation

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Passenger cars

- 8.2.1 Sedans

- 8.2.2 Hatchbacks

- 8.2.3 SUV

- 8.3 Commercial vehicles

- 8.3.1 Light Commercial Vehicles (LCV)

- 8.3.2 Medium Commercial Vehicles (MCV)

- 8.3.3 Heavy Commercial Vehicles (HCV)

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 Interior

- 9.3 Body & structure

- 9.4 Powertrain

- 9.5 Drivetrain

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Adler Pelzer

- 11.2 Autoneum

- 11.3 AVL List

- 11.4 Bertrandt

- 11.5 Catalyst Acoustics

- 11.6 Continental

- 11.7 DESIGNA

- 11.8 EDAG Engineering

- 11.9 Faurecia SA

- 11.10 FEV Group

- 11.11 Gentex

- 11.12 HEAD

- 11.13 Horiba

- 11.14 IAV GmbH

- 11.15 Roechling

- 11.16 Schaeffler

- 11.17 Siemens

- 11.18 Spectris

- 11.19 STS Group

- 11.20 Vibroacoustic