|

市场调查报告书

商品编码

1766369

癫痫治疗药物市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Epilepsy Treatment Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

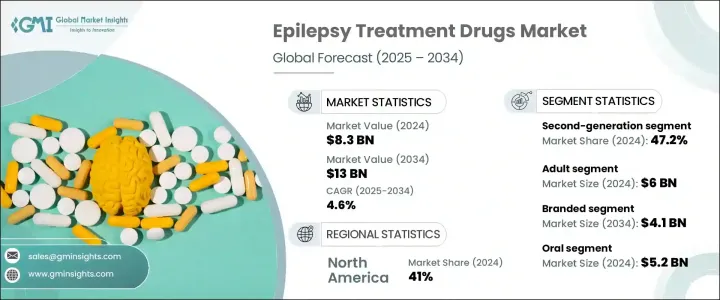

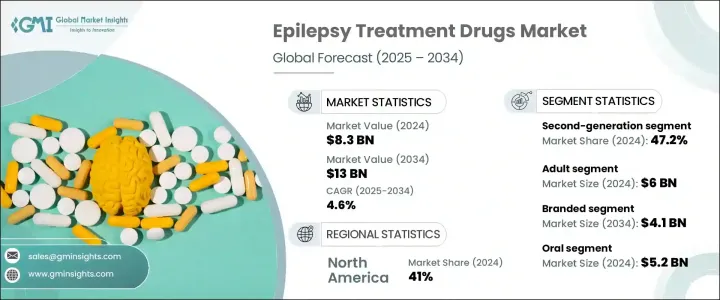

2024年,全球癫痫治疗药物市场规模达83亿美元,预计到2034年将以4.6%的复合年增长率成长,达到130亿美元。全球癫痫诊断数量的稳定成长是推动人们对更有效、更便捷治疗方案需求的关键因素之一。药物创新、副作用较少的新一代抗癫痫药物的研发以及治疗顺从性的提高,都支撑着这一上升趋势。政府和私人部门对神经病学相关研究的投入不断增加,以及认知度和筛检率的提高,都促进了市场的扩张。

全球老龄人口的不断增长——更容易患上神经系统疾病——预计也将进一步提升对癫痫药物的需求。药物开发商正在优先考虑耐受性更好、缓释性更强、患者依从性更高的疗法。这种转变,加上发展中国家医疗基础设施的改善以及主要市场监管途径的简化,正在为创新和产品应用创造有利的环境。此外,朝向更个人化的医疗策略(尤其是针对抗药性癫痫)的转变,正在改善治疗效果,并推动市场的长期成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 83亿美元 |

| 预测值 | 130亿美元 |

| 复合年增长率 | 4.6% |

抗癫痫药物 (AED),也称为抗惊厥药,透过稳定大脑中不规则的电讯号发挥作用,有助于预防癫痫发作并控制癫痫的整体症状。根据药物类别,市场分为第一代、第二代和第三代药物。 2024 年,第二代 AED 占据最大收入份额,为全球市场贡献了 47.2%。预计该细分市场在 2025 年至 2034 年期间的复合年增长率将达到 4.6%。与老一代疗法相比,第二代 AED 被更广泛地接受,这归因于其药物交互作用发生率更低、副作用更少以及患者依从性更高。

就产品类型而言,市场分为品牌药和仿製药。 2024年,品牌药的销售额为26亿美元,预计到2034年将达到41亿美元。製药公司越来越注重生产具有更优药物动力学、更少不良反应和更大疗效的品牌药物。对新型疗法的需求日益增长,尤其是在对传统疗法无反应的患者群体中,这也推动了对品牌抗癫痫药物的需求。

依给药途径分析,口服製剂在2024年占最大份额,达52亿美元。预计该细分市场在预测期内的复合年增长率将达到4.9%。口服药物因其便捷易用以及缓释剂型的推出而受到青睐,缓释剂型可以改善给药方案并提高患者依从性。多样化口服製剂的出现也加速了其在已开发市场和新兴市场的普及。

根据患者人口统计数据,市场细分为成人和儿童族群。成人群体占据主导地位,2024 年市场价值达 60 亿美元,预计到 2034 年将以 4.5% 的复合年增长率成长。成人癫痫发生率的上升与中风、脑损伤和退化性疾病等与年龄相关的神经系统疾病有关。因此,对可靠且有针对性的治疗方法的需求日益增长,多重药物联合治疗方案和长期治疗也越来越受到重视,以改善癫痫发作的控制。

根据癫痫发作类型,市场细分为局部癫痫、全身性癫痫和混合性癫痫。全身性癫痫发作市场在2024年创收25亿美元,预计2034年将达到40亿美元。全身性癫痫病例(包括强直阵挛性癫痫和失神性癫痫)的不断增加,促使人们需要更有效的治疗方案。政府加强对神经病学研究的投入、扩大保险覆盖范围以及旨在提高癫痫治疗可及性的政策倡议,都为这一趋势提供了支持。

就分销管道而言,医院药房、零售药房和线上药房是主要细分市场。零售药局在2024年的收入为23亿美元,预计预测期内的复合年增长率为4.9%。在零售环境中,尤其是在中低收入国家,高性价比仿製药的供应日益增多,有助于患者以更经济的方式管理癫痫。此外,保险覆盖和补贴计划也使患者更容易透过零售店获得必需药物。

从区域来看,北美在2024年以41%的市占率引领全球癫痫治疗药物市场。仅美国一国就贡献了31亿美元的收入,这得益于其较高的认知度、完善的医疗保健体係以及持续改善患者获得先进神经系统治疗途径的努力。美国市场呈现逐年稳定成长,从2021年的28亿美元成长至2023年的30亿美元,并在2024年达到31亿美元。该地区癫痫盛行率的不断上升,加上有利的监管条件和全球製药巨头的参与,将继续推动市场发展。

主要行业参与者正在积极投资先进的配方和联合疗法,旨在改善患者的治疗效果并减轻癫痫对医疗保健系统的整体负担。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 癫痫盛行率上升

- 增加对研发活动的投资

- 对新型癫痫治疗方法的需求日益增长

- 提高认识和早期诊断

- 产业陷阱与挑战

- 与抗癫痫药物相关的不良反应

- 专利到期

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 美国[食品药物管理局(FDA)]

- 加拿大(加拿大卫生部法规)

- 欧洲

- 亚太地区

- 日本(PMDA)

- 中国(国家药品监督管理局)

- 印度(CDSCO)

- 澳洲(TGA)

- 北美洲

- 管道分析

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按药物类别,2021 - 2034 年

- 主要趋势

- 第一代

- 第二代

- 第三代

第六章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 品牌

- 泛型

第七章:市场估计与预测:按管理路线,2021 - 2034 年

- 主要趋势

- 口服

- 鼻腔

- 注射剂

- 直肠

第八章:市场估计与预测:按年龄组,2021 - 2034 年

- 主要趋势

- 儿科

- 成人

第九章:市场估计与预测:按扣押类型,2021 - 2034 年

- 主要趋势

- 局部性癫痫

- 全身性癫痫

- 合併癫痫

第 10 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 医院药房

- 零售药局

- 网路药局

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- AbbVie

- Bausch Health Companies

- Dr. Reddy's Laboratories

- Eisai

- GSK

- Jazz Pharmaceuticals

- Lupin Pharmaceuticals

- Neurelis

- Novartis

- Pfizer

- Sanofi

- SK Biopharmaceuticals

- Sumitomo Pharma

- Sun Pharmaceutical Industries

- UCB

The Global Epilepsy Treatment Drugs Market was valued at USD 8.3 billion in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 13 billion by 2034. The steady rise in epilepsy diagnoses globally is one of the key factors driving demand for more effective and accessible treatment options. Pharmaceutical innovations, the development of new-age anti-epileptic drugs with fewer side effects, and enhanced treatment adherence are all supporting this upward trend. Growing government and private investments in neurology-related research, alongside increasing awareness and screening rates, are contributing to the expanding market.

The rising global aging population-more vulnerable to neurological disorders-is also expected to further elevate the demand for epilepsy medications. Drug developers are prioritizing therapies that offer better tolerability, sustained release, and improved patient compliance. This shift, paired with improved healthcare infrastructure in developing nations and streamlined regulatory pathways in key markets, is creating a favorable environment for innovation and product adoption. Moreover, the transition toward more personalized medicine strategies, particularly for drug-resistant epilepsy, is improving treatment outcomes and driving long-term market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.3 Billion |

| Forecast Value | $13 Billion |

| CAGR | 4.6% |

Anti-epileptic drugs (AEDs), also referred to as anticonvulsants, work by stabilizing irregular electrical signals in the brain, helping to prevent seizures and manage the overall symptoms of epilepsy. Based on drug class, the market is divided into first-generation, second-generation, and third-generation drugs. In 2024, second-generation AEDs accounted for the largest revenue share, contributing 47.2% to the global market. This segment is forecasted to expand at a CAGR of 4.6% from 2025 to 2034. Their broader acceptance is attributed to lower incidences of drug interactions, improved side effect profiles, and better patient adherence compared to older-generation therapies.

In terms of product type, the market is categorized into branded and generic drugs. Branded drugs generated USD 2.6 billion in 2024 and are projected to reach USD 4.1 billion by 2034. Pharmaceutical firms are increasingly focusing on producing branded treatments with improved pharmacokinetics, fewer adverse reactions, and greater therapeutic benefits. The rising need for novel treatments, especially among individuals who do not respond to conventional therapies, is also driving the demand for branded anti-epileptic medications.

When analyzing the route of administration, oral formulations held the largest share in 2024, accounting for USD 5.2 billion. This segment is projected to grow at a CAGR of 4.9% over the forecast period. Oral medications are preferred due to their convenience, ease of use, and the introduction of extended-release versions that improve dosage scheduling and patient adherence. The availability of diverse oral formulations is also accelerating adoption in both developed and emerging markets.

Based on patient demographics, the market is segmented into adult and pediatric populations. The adult segment led with a market value of USD 6 billion in 2024 and is expected to expand at a CAGR of 4.5% through 2034. The increasing incidence of epilepsy among adults is linked to age-related neurological conditions such as strokes, brain injuries, and degenerative disorders. As a result, the demand for reliable and targeted treatment approaches is rising, with a growing emphasis on multi-drug regimens and long-term therapy for improved seizure control.

According to seizure type, the market is segmented into focal seizures, generalized seizures, and combined seizures. The generalized seizure segment generated USD 2.5 billion in 2024 and is estimated to reach USD 4 billion by 2034. A rising number of generalized seizure cases, including tonic-clonic and absence seizures, is prompting the need for more robust therapeutic solutions. This trend is being supported by greater government funding for neurological research, insurance coverage expansions, and policy initiatives aimed at enhancing access to epilepsy care.

In terms of distribution channels, hospital pharmacies, retail pharmacies, and online pharmacies are the major segments. Retail pharmacies captured USD 2.3 billion in revenue in 2024 and are expected to register a CAGR of 4.9% during the forecast period. The growing availability of cost-effective generic drugs in retail settings, especially in low- and middle-income countries, is helping patients manage epilepsy more affordably. Additionally, insurance coverage and subsidy programs are making it easier for patients to access essential medications via retail outlets.

Regionally, North America led the global epilepsy treatment drugs market with a 41% share in 2024. The U.S. alone contributed USD 3.1 billion in revenue that year, driven by high awareness, well-developed healthcare systems, and consistent efforts to improve patient access to advanced neurological treatments. The U.S. market has shown steady year-on-year growth, moving from USD 2.8 billion in 2021 to USD 3 billion in 2023 and reaching USD 3.1 billion in 2024. The increasing prevalence of epilepsy in the region, coupled with favorable regulatory conditions and the presence of global pharmaceutical leaders, continues to push market development.

Major industry players are actively investing in advanced formulations and combination therapies, aiming to enhance patient outcomes and reduce the overall burden of epilepsy on healthcare systems.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Drug class

- 2.2.2 Type

- 2.2.3 Route of administration

- 2.2.4 Age group

- 2.2.5 Seizure type

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of epilepsy

- 3.2.1.2 Increasing investments in research and development activities

- 3.2.1.3 Increasing demand for novel treatment for epilepsy

- 3.2.1.4 Growing awareness and early diagnosis

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adverse effects associated with the antiepileptic drugs

- 3.2.2.2 Patent expiration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S. [Food and Drug Administration (FDA)]

- 3.4.1.2 Canada (Health Canada Regulation)

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.3.1 Japan (PMDA)

- 3.4.3.2 China (NMPA)

- 3.4.3.3 India (CDSCO)

- 3.4.3.4 Australia (TGA)

- 3.4.1 North America

- 3.5 Pipeline analysis

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 First-generation

- 5.3 Second-generation

- 5.4 Third-generation

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Branded

- 6.3 Generics

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Nasal

- 7.4 Injectable

- 7.5 Rectal

Chapter 8 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pediatric

- 8.3 Adult

Chapter 9 Market Estimates and Forecast, By Seizure Type, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Focal seizure

- 9.3 Generalized seizure

- 9.4 Combined seizure

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Hospital pharmacies

- 10.3 Retail pharmacies

- 10.4 Online pharmacies

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AbbVie

- 12.2 Bausch Health Companies

- 12.3 Dr. Reddy’s Laboratories

- 12.4 Eisai

- 12.5 GSK

- 12.6 Jazz Pharmaceuticals

- 12.7 Lupin Pharmaceuticals

- 12.8 Neurelis

- 12.9 Novartis

- 12.10 Pfizer

- 12.11 Sanofi

- 12.12 SK Biopharmaceuticals

- 12.13 Sumitomo Pharma

- 12.14 Sun Pharmaceutical Industries

- 12.15 UCB