|

市场调查报告书

商品编码

1766370

兽医分子诊断市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Veterinary Molecular Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

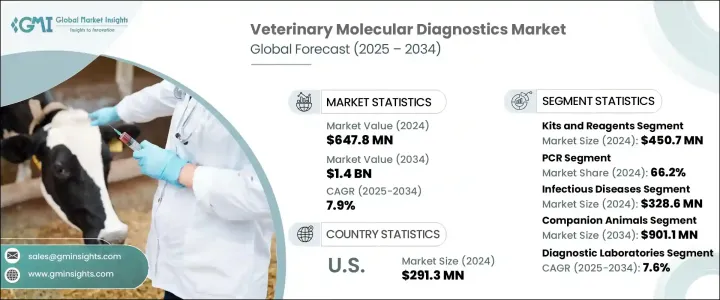

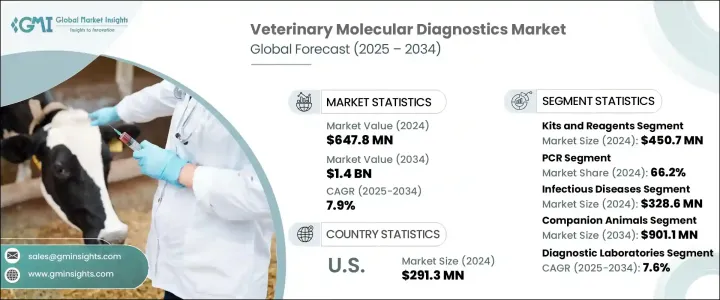

2024年,全球兽医分子诊断市场规模达6.478亿美元,预计2034年将以7.9%的复合年增长率成长至14亿美元。动物传染病发病率的不断上升推动了这个市场的稳定成长,也增加了对更准确、更及时诊断方法的需求。随着全球尤其是城市地区宠物拥有量的持续成长,对早期疾病检测的重视程度也日益加深。宠物照护文化的这种转变正鼓励人们投资于能够提供快速、可靠和非侵入性解决方案的分子诊断工具。兽医医疗基础设施的改善,例如现代化诊断实验室和技术先进的设施的出现,正在进一步加速市场成长。此外,宠物保险的作用日益增强,使得更广泛的宠物主人群体能够更容易获得复杂的诊断程序。

推动这一市场发展的另一个主要因素是全球对预防人畜共患疾病传播的重视程度不断提高,尤其是在伴侣动物和牲畜疫情爆发风险日益增加的情况下。多个国家的监管机构正在实施更严格的动物健康和疾病监测政策,这为兽医分子诊断的应用创造了更有利的环境。政府主导的旨在改善食品安全和动物健康的健康计画进一步加强了控制疾病传播的力度,从而刺激了对精准诊断工具的需求。包括先进分子检测平台在内的兽医技术创新正在重新定义动物疾病管理策略方面发挥关键作用。将这些工具整合到常规兽医实践中,不仅可以提高诊断的准确性,还可以加快治疗决策,从而改善整体疗效。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6.478亿美元 |

| 预测值 | 14亿美元 |

| 复合年增长率 | 7.9% |

依产品细分,市场可分为试剂盒、试剂和仪器。试剂盒和试剂占据主导地位,2024 年的估值为 4.507 亿美元。与仪器不同,这些耗材用于每项检测,因此其需求会随着兽医检测总量的增长而不断增长。它们在诊断工作流程中的持续使用确保了製造商和供应商稳定的收入来源,使其成为整个市场的最大贡献者。

就技术而言,市场包括DNA定序、PCR、微阵列和等温核酸扩增技术 (INAAT) 试剂盒。 PCR 细分市场在 2024 年占据了最大的收入份额,占整个市场的 66.2%。 PCR 检测因其速度快、准确度高、灵敏度高,能够检测多种病原体而备受青睐。这些检测能够在早期阶段识别传染病,这对于疾病的预防和控制至关重要。即时 PCR 和多重 PCR 等创新技术使得在一次检测中即可检测多种病原体,从而简化了诊断流程并提高了实验室效率。

根据应用,该市场涵盖传染病、遗传性疾病和其他用途。传染病细分市场收入最高,2024年达3.286亿美元,预计到2034年复合年增长率将达8.3%。全球动物族群的高疾病负担使得传染病诊断成为一个主要关注领域,尤其是在人们对疾病传播和跨物种感染的认识不断提高的情况下。

依动物类型,市场分为伴侣动物和家畜。伴侣动物市场占据主导地位,2024年收入达4.163亿美元,预计2034年将达到9.011亿美元。此细分市场的强劲成长与宠物拥有量的激增和动物照护支出的增加息息相关。可支配收入的增加以及对宠物情感依附的加深,推动了对高端医疗服务的需求,包括早期精准的诊断。

从最终用途来看,诊断实验室预计将实现强劲成长,预计2025年至2034年的复合年增长率为7.6%。这些实验室凭藉其完善的基础设施、高技能的员工队伍以及处理大量高精度检测的能力,成为兽医诊断生态系统中不可或缺的参与者。它们通常是复杂分子检测的首选,并可作为缺乏内部检测能力的小型诊所和兽医诊所的中央检测设施。

从区域来看,北美引领全球兽医分子诊断市场,2024年市场规模达3.19亿美元,预计2034年将达到6.857亿美元。这一增长得益于该地区宠物饲养的普及、动物健康意识的提升以及强大的医疗基础设施。 2024年,美国在该区域市场的份额达到2.913亿美元,凸显了其在全球市场的主导地位。

市场仍然保持中等程度的分散,领先的製药和生物技术公司透过创新和策略扩张来保持竞争优势。硕腾、爱德士实验室、凯杰和纽勤等主要参与者合计占全球市场收入的48%-50%。这些公司正在不断改进其诊断平台,以提供更先进、更具成本效益的解决方案。同时,许多区域性公司透过提供经济实惠的产品并透过併购和产品创新进行扩张,加剧了竞争。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 伴侣动物的收养率不断上升

- 人畜共通传染病高发

- 兽医分子诊断技术的进展

- 宠物保险的普及率不断提高

- 产业陷阱与挑战

- 动物试验成本高

- 缺乏熟练的人员

- 机会

- 技术进步和即时诊断分子工具

- 畜牧业的扩张和对食品安全的需求

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 当前的技术趋势

- 新兴技术

- 2024年各国兽医数量

- 定价分析

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 试剂盒和试剂

- 仪器

第六章:市场估计与预测:按技术,2021 年至 2034 年

- 主要趋势

- 聚合酶连锁反应

- 实时PCR

- 其他PCR

- DNA定序

- 微阵列

- INAAT 试剂盒

第七章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 传染病

- 细菌性传染病

- 病毒性传染病

- 寄生虫感染疾病

- 其他传染病

- 遗传疾病

- 其他应用

第八章:市场估计与预测:依动物类型,2021 年至 2034 年

- 主要趋势

- 伴侣动物

- 狗

- 猫

- 马匹

- 其他伴侣动物

- 牲畜

- 牛

- 猪

- 家禽

- 其他牲畜

第九章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 诊断实验室

- 兽医诊所

- 兽医院

- 其他最终用途

第十章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Agrolabo

- bioMerieux

- BIONOTE

- Bioneer Corporation

- Bio-Rad Laboratories

- GZ MED

- Heska Corporation

- Idexx Laboratories

- INDICAL BIOSCIENCE

- Innovative Diagnostics

- Neogen Corporation

- QIAGEN

- Thermo Fisher Scientific

- Veterinary Molecular Diagnostics

- Zoetis

The Global Veterinary Molecular Diagnostics Market was valued at USD 647.8 million in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 1.4 billion by 2034. This steady expansion is being driven by a growing incidence of infectious diseases in animals, which has heightened the demand for more accurate and timely diagnostic methods. As pet ownership continues to rise globally, especially in urban regions, the emphasis on early disease detection is also increasing. This shift in pet care culture is encouraging investment in molecular diagnostic tools that offer fast, reliable, and non-invasive solutions. Improvements in veterinary healthcare infrastructure, such as the presence of modern diagnostic labs and technologically advanced facilities, are further accelerating market growth. In addition, the growing role of pet insurance is making sophisticated diagnostic procedures more accessible to a broader base of pet owners.

Another major factor fueling this market is the heightened global focus on preventing zoonotic disease transmission, particularly with the increasing risk of outbreaks affecting both companion and livestock animals. Regulatory authorities across several countries are enforcing stricter policies on animal health and disease surveillance, which has created a more supportive environment for the adoption of veterinary molecular diagnostics. Government-led wellness programs aimed at improving food safety and animal health have further intensified efforts to control disease spread, boosting demand for precise diagnostic tools. Technological innovations in veterinary medicine, including advanced molecular testing platforms, are playing a key role in redefining disease management strategies for animals. The integration of these tools into routine veterinary practices not only improves the accuracy of diagnostics but also enables faster treatment decisions, improving overall outcomes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $647.8 Million |

| Forecast Value | $1.4 Billion |

| CAGR | 7.9% |

By product, the market is segmented into kits and reagents and instruments. Kits and reagents dominated the product landscape with a valuation of USD 450.7 million in 2024. Unlike instruments, these consumables are used in every test, creating recurring demand that scales with the overall volume of veterinary testing. Their consistent usage in diagnostic workflows ensures a stable revenue stream for manufacturers and suppliers, making them the largest contributor to the overall market.

In terms of technology, the market includes DNA sequencing, PCR, microarrays, and isothermal nucleic acid amplification technology (INAAT) kits. The PCR segment held the largest revenue share in 2024, accounting for 66.2% of the total market. PCR testing is preferred due to its speed, accuracy, and sensitivity in detecting a wide range of pathogens. These tests are capable of identifying infectious diseases in their earliest stages, which is essential for disease prevention and control. Innovations such as real-time PCR and multiplex PCR allow multiple pathogens to be detected in a single test, which streamlines the diagnostic process and improves laboratory efficiency.

Based on application, the market covers infectious diseases, genetic disorders, and other uses. The infectious diseases segment recorded the highest revenue, reaching USD 328.6 million in 2024, and is projected to grow at a CAGR of 8.3% through 2034. The high disease burden across animal populations globally has made infectious disease diagnostics a major focus area, especially with increasing awareness of disease transmission and cross-species infections.

On the basis of animal type, the market is divided into companion animals and livestock animals. Companion animals led the market with revenue of USD 416.3 million in 2024 and are expected to reach USD 901.1 million by 2034. The strong growth of this segment is linked to the surge in pet ownership and increased spending on animal care. Rising disposable income and greater emotional attachment to pets are pushing demand for premium healthcare services, including early and accurate diagnostics.

By end use, diagnostic laboratories are poised for strong growth, with an expected CAGR of 7.6% between 2025 and 2034. These labs are essential players in the veterinary diagnostics ecosystem due to their infrastructure, skilled workforce, and ability to handle high volumes of testing with exceptional precision. They are often the preferred choice for complex molecular testing and serve as central testing facilities for smaller clinics and veterinary practices that lack in-house capabilities.

Regionally, North America leads the global veterinary molecular diagnostics market, with a market size of USD 319 million in 2024 and a projected value of USD 685.7 million by 2034. This growth is supported by widespread pet ownership, increased awareness about animal health, and strong healthcare infrastructure across the region. The U.S. accounted for USD 291.3 million of the regional market in 2024, underscoring its dominant position in the global landscape.

The market remains moderately fragmented, with leading pharmaceutical and biotech firms holding a competitive edge through innovations and strategic expansions. Key players such as Zoetis, IDEXX Laboratories, Qiagen, and Neogen Corporation collectively account for 48%-50% of global revenue. These companies are consistently enhancing their diagnostic platforms to offer more advanced and cost-effective solutions. At the same time, numerous regional firms are intensifying competition by offering budget-friendly products and expanding through mergers, acquisitions, and product innovation.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Technology

- 2.2.4 Application

- 2.2.5 Animal type

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of companion animals

- 3.2.1.2 High prevalence of zoonotic diseases

- 3.2.1.3 Advancements in veterinary molecular diagnostics technologies

- 3.2.1.4 Increasing adoption of pet insurance

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with animal tests

- 3.2.2.2 Lack of skilled personnel

- 3.2.3 Opportunities

- 3.2.3.1 Technological advancements and point-of-care molecular tools

- 3.2.3.2 Expanding livestock industry and demand for food safety

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Number of veterinarians, by country, 2024

- 3.7 Pricing analysis

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Kits and reagents

- 5.3 Instruments

Chapter 6 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 PCR

- 6.2.1 Real time PCR

- 6.2.2 Other PCR

- 6.3 DNA sequencing

- 6.4 Microarray

- 6.5 INAAT kits

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Infectious diseases

- 7.2.1 Bacterial infectious diseases

- 7.2.2 Viral infectious diseases

- 7.2.3 Parasitic infectious diseases

- 7.2.4 Other infectious diseases

- 7.3 Genetic diseases

- 7.4 Other applications

Chapter 8 Market Estimates and Forecast, By Animal Type, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Companion animals

- 8.2.1 Dogs

- 8.2.2 Cats

- 8.2.3 Horses

- 8.2.4 Other companion animals

- 8.3 Livestock animals

- 8.3.1 Cattle

- 8.3.2 Swine

- 8.3.3 Poultry

- 8.3.4 Other livestock animals

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Diagnostic laboratories

- 9.3 Veterinary clinics

- 9.4 Veterinary hospitals

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Agrolabo

- 11.2 bioMerieux

- 11.3 BIONOTE

- 11.4 Bioneer Corporation

- 11.5 Bio-Rad Laboratories

- 11.6 GZ MED

- 11.7 Heska Corporation

- 11.8 Idexx Laboratories

- 11.9 INDICAL BIOSCIENCE

- 11.10 Innovative Diagnostics

- 11.11 Neogen Corporation

- 11.12 QIAGEN

- 11.13 Thermo Fisher Scientific

- 11.14 Veterinary Molecular Diagnostics

- 11.15 Zoetis