|

市场调查报告书

商品编码

1773223

燃气房地产发电机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Gas Fired Real Estate Generator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

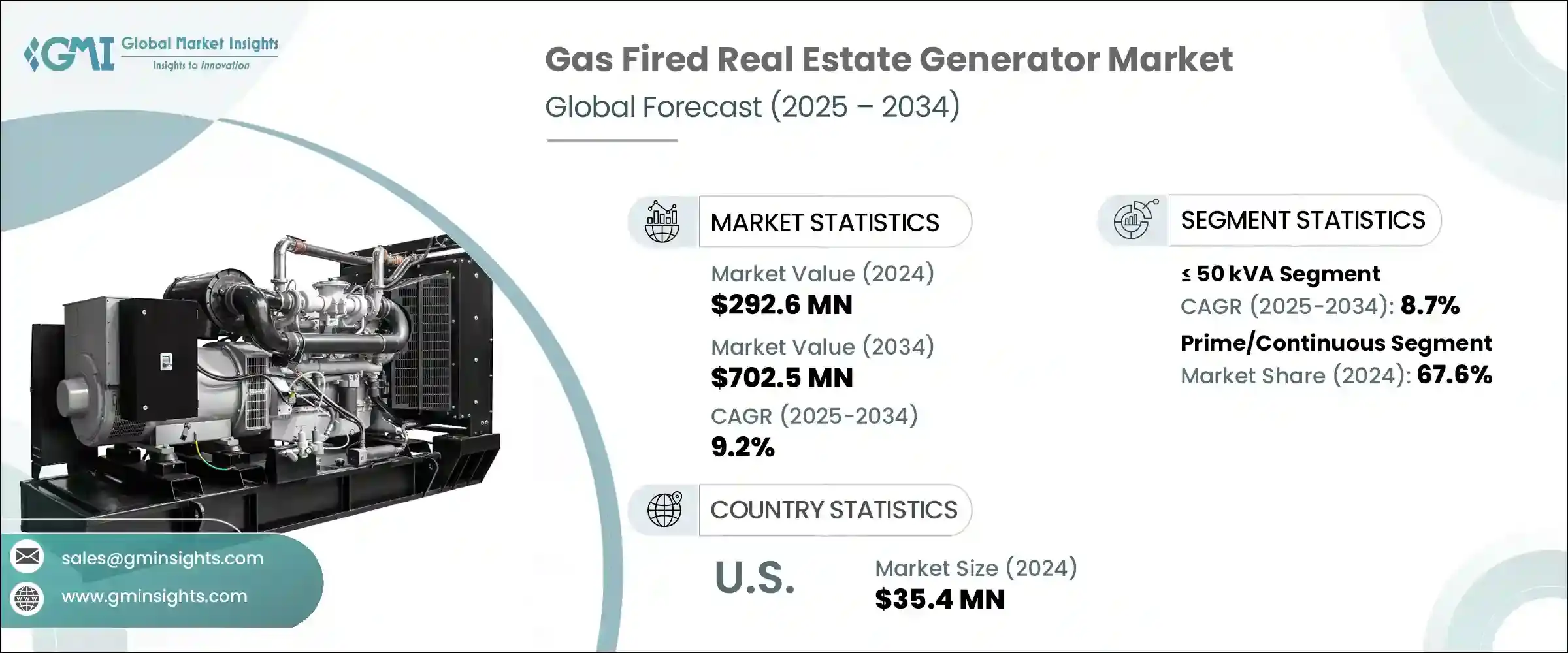

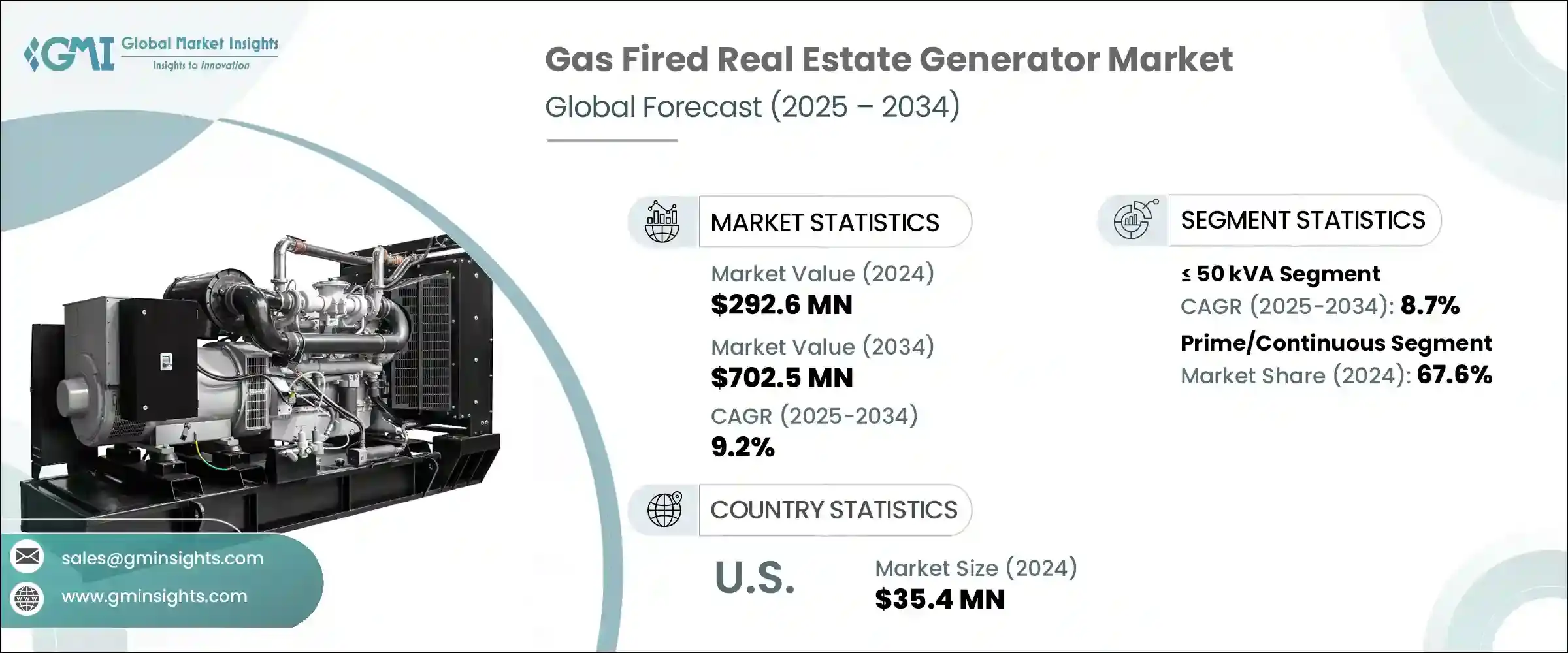

2024年,全球燃气房地产发电机市场规模达2.926亿美元,预计2034年将以9.2%的复合年增长率成长,达到7.025亿美元。城市发展步伐的加快,加上新兴经济体基础设施项目的不断扩张,正在推动整个产业的需求。住宅区和商业区频繁的停电和电网性能的不稳定,促使开发商部署燃气发电机组以确保持续供电。这些机组正被整合到混合微电网中,以便在缺乏稳定公共事业覆盖的地区提高可靠性。房地产开发案不仅在建设阶段受益于这些发电机组,而且在竣工后也作为可靠的备用系统,从而提升整体物业价值和营运稳定性。

随着更严格的法规逐步淘汰高排放柴油发电机组,人们的兴趣正转向更干净的燃气动力替代品。在促进可持续基础设施建设的监管激励措施以及人们对环保建筑日益增长的兴趣的支持下,这些发电机正迅速受到青睐。从高层住宅到商业综合体,它们在现代房地产领域的部署正受到可靠、低排放电力需求的推动。政府强制要求,加上诸如降低噪音、提高燃油经济性和自动化负载管理等增强功能,正在加速发展中地区和发达地区的采用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.926亿美元 |

| 预测值 | 7.025亿美元 |

| 复合年增长率 | 9.2% |

2024年,50 kVA - 125 kVA发电机市场规模达7,090万美元。这些系统因其能够在电网不稳定的地区提供可靠的电力,同时满足最新的环保标准而备受青睐。持续改进的设计,例如更安静的运行和更高的燃油性能,预计将继续吸引投资。

预计到 2034 年,燃气房地产发电机市场中的备用部分将以 9% 的复合年增长率成长。这一增长受到不断发展的监管标准的支撑,这些标准侧重于减少排放,并透过自动负载优化等智慧功能更加重视能源效率。

预计到2034年,亚太地区燃气房地产发电机市场规模将达到2.6亿美元,这得益于快速的城市扩张和区域燃气配送基础设施的显着改善。城市发展项目明显转向使用清洁、稳定的能源,这加剧了该地区日益增长的建筑业对燃气发电机的需求。

燃气房地产发电机市场的主要参与者包括三菱重工、阿特拉斯·科普柯、卡特彼勒、劳斯莱斯、亚力克、阿肖克·利兰、康明斯、伊蒙妮莎、Generac 电力系统、马恆达 Powerol、JC Bamford 挖土机、PR Industrial、Rehlko、Kirloskar 和美国控股。领先的公司正致力于透过环保高效的发电机型号扩展其产品组合,以满足对低排放备用解决方案日益增长的需求。製造商正在整合自动负载平衡、即时监控和降噪系统等智慧技术,以增强用户体验并符合环境规范。许多公司正在加强其供应链和分销网络,以确保在城市化地区及时提供产品。与房地产开发商和政府支持的基础设施计划的合作正在成为获得长期合约的核心策略。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 战略仪表板

- 策略倡议

- 竞争基准测试

- 创新与永续发展格局

第五章:市场规模及预测:依功率等级,2021 - 2034 年

- 主要趋势

- ≤50千伏安

- > 50千伏安 - 125千伏安

- > 125 千伏安 - 200 千伏安

- > 200千伏安 - 350千伏安

- > 350千伏安 - 500千伏安

- > 500千伏安

第六章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 支援

- 主/连续

第七章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 俄罗斯

- 英国

- 德国

- 法国

- 西班牙

- 奥地利

- 义大利

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 印尼

- 马来西亚

- 泰国

- 越南

- 菲律宾

- 中东

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 土耳其

- 伊朗

- 阿曼

- 非洲

- 埃及

- 奈及利亚

- 阿尔及利亚

- 南非

- 安哥拉

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 智利

第八章:公司简介

- Aggreko

- Ashok Leyland

- Atlas Copco

- Caterpillar

- Cummins

- Generac Power Systems

- HIMOINSA

- JC Bamford Excavators

- Kirloskar

- Rehlko

- Mahindra Powerol

- Mitsubishi Heavy Industries

- PR Industrial

- Rolls-Royce

- Yanmar Holdings

The Global Gas Fired Real Estate Generator Market was valued at USD 292.6 million in 2024 and is estimated to grow at a CAGR of 9.2% to reach USD 702.5 million by 2034. The increasing pace of urban development, combined with expanding infrastructure projects across emerging economies, is boosting demand across the sector. Frequent power interruptions and unstable grid performance in residential and commercial zones are prompting developers to deploy gas-fired gensets to guarantee continuous electricity. These units are being integrated into hybrid microgrids for better reliability in regions lacking consistent utility coverage. Real estate developments benefit from these gensets not only during construction phases but also post-completion as reliable backup systems, thereby enhancing overall property value and operational stability.

With stricter regulations phasing out high-emission diesel gensets, interest is shifting toward cleaner gas-powered alternatives. Backed by regulatory incentives promoting sustainable infrastructure and growing interest in eco-friendly buildings, these generators are gaining rapid traction. Their deployment in modern real estate-from residential high-rises to commercial complexes-is being driven by demands for reliable, low-emission power. Government mandates, coupled with enhanced features such as reduced noise, better fuel economy, and automated load management, are accelerating adoption across both developing and developed regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $292.6 Million |

| Forecast Value | $702.5 Million |

| CAGR | 9.2% |

In 2024, the > 50 kVA - 125 kVA generator segment accounted for USD 70.9 million. These systems are preferred for their ability to deliver reliable power in areas with grid instability while meeting updated environmental standards. Ongoing enhancements in design, such as quieter operations and improved fuel performance, are expected to continue drawing investment.

The standby segment within the gas-fired real estate generator market is forecast to grow at a CAGR of 9% through 2034. This growth is underpinned by evolving regulatory standards focused on cutting emissions and an increased emphasis on energy efficiency through smart features like automatic load optimization.

Asia Pacific Gas Fired Real Estate Generator Market is expected to reach USD 260 million by 2034, supported by fast-paced urban expansion and significant improvements in regional gas distribution infrastructure. A marked shift toward clean, stable energy for urban development projects is reinforcing the need for gas-based generators across the region's growing construction sector.

Major players operating in the Gas Fired Real Estate Generator Market include Mitsubishi Heavy Industries, Atlas Copco, Caterpillar, Rolls-Royce, Aggreko, Ashok Leyland, Cummins, HIMOINSA, Generac Power Systems, Mahindra Powerol, J.C. Bamford Excavators, PR Industrial, Rehlko, Kirloskar, and Yanmar Holdings. Leading companies are focusing on expanding their portfolios with eco-friendly and high-efficiency generator models to address the growing demand for low-emission backup solutions. Manufacturers are integrating smart technologies such as automated load balancing, real-time monitoring, and noise-reduction systems to enhance user experience and compliance with environmental norms. Many firms are strengthening their supply chain and distribution networks to ensure timely product availability across urbanizing regions. Partnerships with real estate developers and government-backed infrastructure initiatives are becoming a core strategy to secure long-term contracts.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Rating, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 ≤ 50 kVA

- 5.3 > 50 kVA - 125 kVA

- 5.4 > 125 kVA - 200 kVA

- 5.5 > 200 kVA - 350 kVA

- 5.6 > 350 kVA - 500 kVA

- 5.7 > 500 kVA

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Standby

- 6.3 Prime/continuous

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Russia

- 7.3.2 UK

- 7.3.3 Germany

- 7.3.4 France

- 7.3.5 Spain

- 7.3.6 Austria

- 7.3.7 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.4.6 Indonesia

- 7.4.7 Malaysia

- 7.4.8 Thailand

- 7.4.9 Vietnam

- 7.4.10 Philippines

- 7.5 Middle East

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Turkey

- 7.5.5 Iran

- 7.5.6 Oman

- 7.6 Africa

- 7.6.1 Egypt

- 7.6.2 Nigeria

- 7.6.3 Algeria

- 7.6.4 South Africa

- 7.6.5 Angola

- 7.7 Latin America

- 7.7.1 Brazil

- 7.7.2 Mexico

- 7.7.3 Argentina

- 7.7.4 Chile

Chapter 8 Company Profiles

- 8.1 Aggreko

- 8.2 Ashok Leyland

- 8.3 Atlas Copco

- 8.4 Caterpillar

- 8.5 Cummins

- 8.6 Generac Power Systems

- 8.7 HIMOINSA

- 8.8 J.C. Bamford Excavators

- 8.9 Kirloskar

- 8.10 Rehlko

- 8.11 Mahindra Powerol

- 8.12 Mitsubishi Heavy Industries

- 8.13 PR Industrial

- 8.14 Rolls-Royce

- 8.15 Yanmar Holdings