|

市场调查报告书

商品编码

1773232

婴儿配方奶粉市场机会、成长动力、产业趋势分析及2025-2034年预测Infant Formula Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

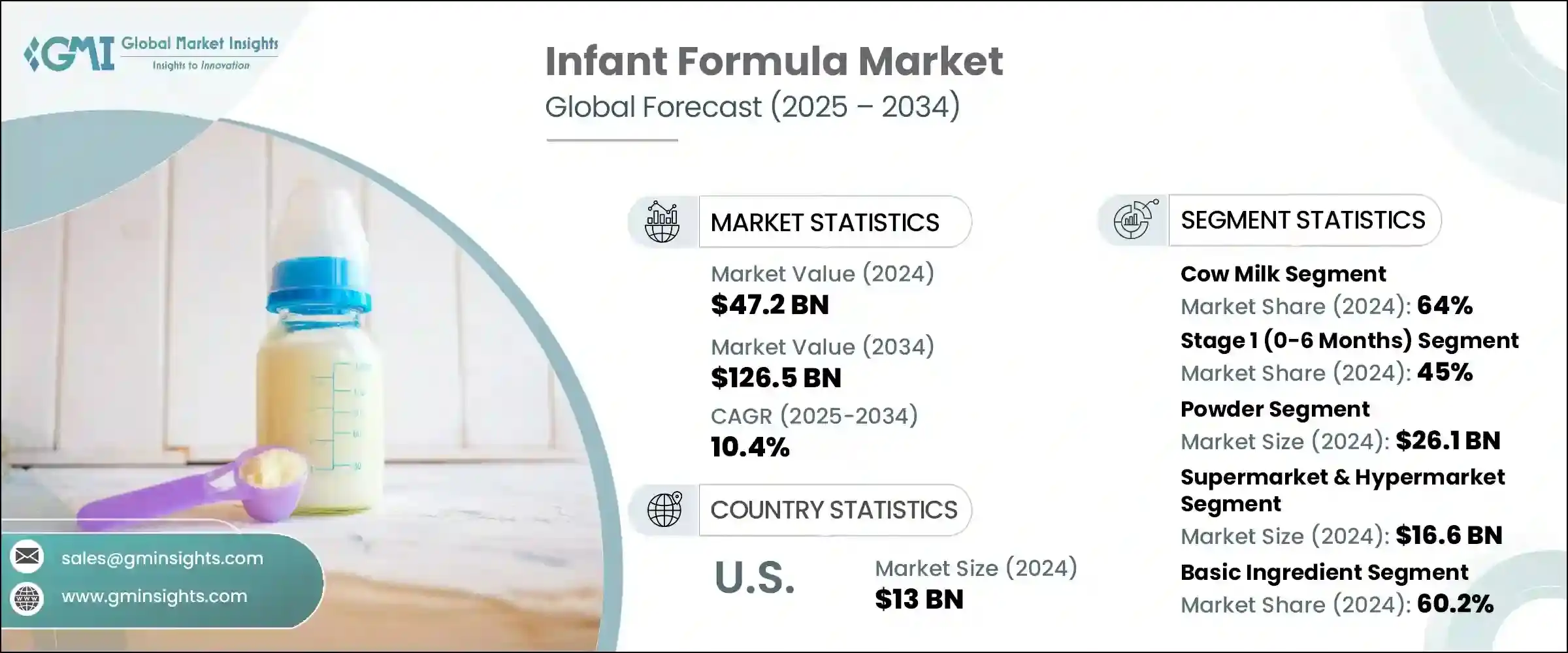

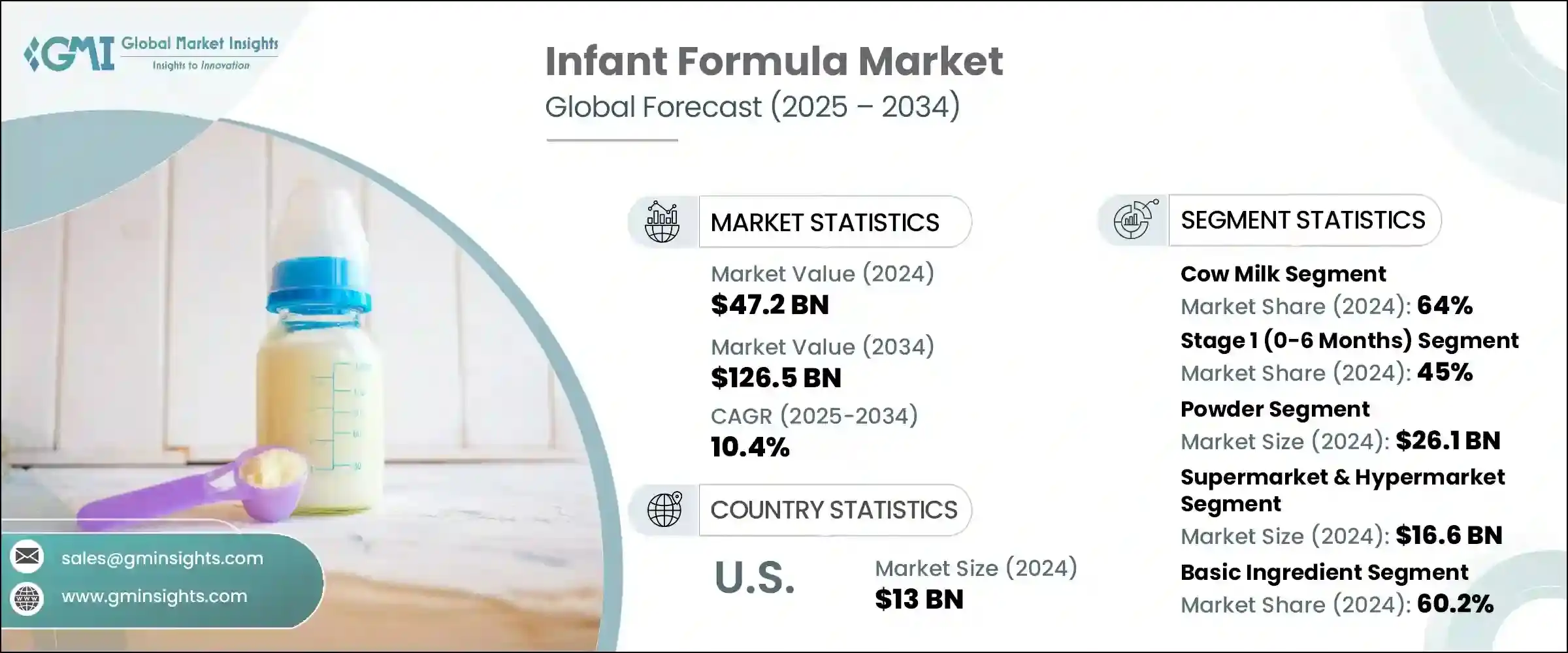

2024年,全球婴儿配方奶粉市场规模达472亿美元,预计到2034年将以10.4%的复合年增长率成长,达到1265亿美元。这一增长主要归因于人们对婴儿营养的认识不断提高、职业母亲人数不断增加以及出生率上升,尤其是在发展中国家。都市化、可支配所得的增加以及女性劳动参与率的提高也是市场扩张的因素。此外,家长们越来越关注产品的安全性、消化率和营养价值,这导致对高端配方奶粉的需求激增,包括有机、无乳糖和低过敏配方奶粉。

配方奶粉成分的技术进步,例如益生元、益生菌、HMO(母乳寡糖)和DHA/ARA的加入,进一步提升了这些产品的接受度。然而,挑战依然存在,包括这些产品高昂的成本、复杂的法规以及强烈的母乳哺育文化偏好,尤其是在公共卫生运动盛行的地区。由于担心假冒配方奶粉,一些市场消费者缺乏信任,这也限制了市场的成长。由于家长们对不含合成添加剂、基因改造生物和人工甜味剂的产品的需求,消费者明显转向清洁标籤、有机和植物性配方奶粉。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 472亿美元 |

| 预测值 | 1265亿美元 |

| 复合年增长率 | 10.4% |

2024年,牛奶配方奶粉市场占据64%的市场份额,预计到2034年将保持稳定成长,复合年增长率为10.4%。由于其营养成分与母乳相似,尤其是在添加了DHA、ARA和铁元素后,这种配方奶粉仍然最受欢迎。标准牛奶配方奶粉通常适用于非母乳哺育的健康足月婴儿。製造商还开发了部分水解和高度水解等配方奶粉,以满足有消化问题或轻度牛奶不耐受婴儿的需求。

在各个阶段中,第一阶段(0-6个月大的婴儿)占据最大份额,到2024年将达到45%。预计该阶段将快速成长,到2034年复合年增长率将达到10.6%。在婴儿期这个关键阶段,由于消化系统仍在发育成熟,婴儿完全依赖母乳或配方奶粉来获取营养。第一阶段配方奶粉对肠胃温和,富含DHA、ARA、益生元和铁等必需营养素,有助于促进认知、免疫和消化健康。监管机构确保这些产品符合严格的安全性和功效标准,进而增强消费者信心。

美国婴儿配方奶粉市场在2024年创收130亿美元,预计2034年将以8.4%的复合年增长率成长。美国凭藉其高出生率、先进的医疗保健系统、广泛的婴儿配方奶粉供应以及强大的品牌忠诚度,占据领先地位。美国市场的特点是高端和特色配方奶粉日益流行,包括有机、非基因改造和植物性配方,以及富含HMO和DHA/ARA的配方奶粉。

该领域的领先公司包括雀巢、雅培营养、Arla Food、贝拉米有机和Bubs Australia,它们都在争夺更大的市场份额。婴儿配方奶粉公司一直在采取多项策略性倡议,以巩固其市场地位并扩大影响力。他们高度重视创新,尤其是在配方成分方面,透过添加与母乳成分非常相似的营养素,例如HMO、DHA、ARA和益生元。这些改进旨在增强婴儿的认知发展、免疫力和消化健康。此外,这些公司正在大幅增加研发投入,以打造更新、更先进的产品,以满足市场对无乳糖、有机和低过敏性等特殊配方奶粉日益增长的需求。

为了满足注重健康的父母的偏好,清洁标籤、非基因改造和植物性配方奶粉也正受到欢迎。此外,各公司正在增强分销网络,加强零售合作伙伴关係,并在新兴市场扩张,以确保其产品能够更广泛地供应。领先品牌也专注于透过遵守最高安全标准和提供透明的产品标籤来建立消费者信任,这在当今市场日益重要。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计资料(HS 编码)(註:仅提供主要国家的贸易统计数据

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 营养科学与产品开发

- 婴儿的营养需求

- 宏量营养素需求

- 蛋白质需求

- 碳水化合物需求

- 脂肪需求

- 微量营养素需求

- 维生素需求

- 矿物质需求

- 特定年龄的营养需求

- 特殊饮食要求

- 宏量营养素需求

- 配方组成及标准

- 国际标准

- 区域差异

- 品质规格

- 安全参数

- 功能性原料创新

- 母乳寡糖(HMO)

- 益生菌和益生元

- 长链多元不饱和脂肪酸

- 核苷酸和生长因子

- 产品开发流程

- 研究与开发

- 临床研究和试验

- 监管审批流程

- 商业发布

- 营养声明与定位

- 健康声明法规

- 科学证实

- 行销传播

- 消费者教育

- 未来营养趋势

- 个人化营养

- 微生物组研究

- 认知发展支持

- 增强免疫系统

- 婴儿的营养需求

- 製造和品质控制

- 製造过程

- 原料准备

- 混合与搅拌

- 热处理

- 喷雾干燥

- 包装和密封

- 品质控制系统

- 良好生产规范(GMP)

- 危害分析关键控制点(HACCP)

- 品质保证测试

- 大量测试协议

- 安全与污染控制

- 微生物安全

- 化学污染物控制

- 物理危害预防

- 过敏原管理

- 设备与技术

- 加工设备

- 测试分析设备

- 包装机械

- 自动化与控制系统

- 供应链管理

- 原物料采购

- 供应商资格

- 库存管理

- 冷链管理

- 监理合规性

- 製造标准

- 设施检查

- 文件要求

- 召回程序

- 製造过程

- 消费者行为与市场动态

- 消费者人口统计

- 父母年龄组

- 收入水平

- 教育水平

- 地理分布

- 购买决策因素

- 营养益处

- 品牌信任与声誉

- 价格敏感度

- 医疗保健提供者的建议

- 便利因素

- 餵食模式和偏好

- 纯配方奶餵养

- 混合餵食(母乳+配方奶)

- 过渡餵食

- 文化餵养实践

- 资讯来源和影响

- 医疗保健专业人员

- 线上资源

- 家人和朋友

- 社群媒体影响力

- 品牌忠诚度与转换行为

- 品牌忠诚度因素

- 切换触发器

- 试用和采用模式

- 推荐行为

- 区域消费者差异

- 北美洲消费者

- 欧洲消费者

- 亚太消费者

- 其他区域模式

- 消费者人口统计

- 行销和分销策略

- 行销策略

- 品牌定位

- 高端定位

- 价值定位

- 专业定位

- 目标受众细分

- 行销管道

- 医疗保健专业人员参与

- 数位行销

- 传统媒体

- 教育项目

- 品牌定位

- 分销策略

- 多通路分销

- 通路伙伴管理

- 地理扩张

- 市场渗透策略

- 定价策略

- 进阶定价

- 有竞争力的价格

- 基于价值的定价

- 区域定价差异

- 促销活动

- 医疗保健专业计划

- 消费者教育活动

- 采样程式

- 忠诚度计划

- 数位转型

- 电子商务策略

- 数位化客户参与

- 数据分析与洞察

- 全通路整合

- 监管行销考虑

- 遵守世卫组织准则

- 广告限制

- 健康声明法规

- 道德行销实践

- 行销策略

- 创新与未来趋势

- 当前的创新趋势

- 功能性成分

- 有机和清洁标籤

- 个人化营养

- 永续包装

- 新兴技术

- 精准营养

- 微胶囊化

- 新颖的加工技术

- 智慧包装

- 研发重点

- 肠道微生物组研究

- 认知发展

- 免疫系统支持

- 预防过敏

- 永续发展倡议

- 永续采购

- 减少碳足迹

- 循环经济原则

- 减轻环境影响

- 数位创新

- 智慧餵食解决方案

- 行动应用程式

- 物联网集成

- 人工智慧推荐

- 未来市场趋势

- 市场整合

- 高端市场成长

- 新兴市场扩张

- 监理演变

- 当前的创新趋势

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 牛奶配方奶粉

- 标准牛奶配方

- 部分水解配方

- 深度水解配方

- 大豆配方

- 蛋白质水解物配方

- 特殊配方

- 早产儿配方奶粉

- 抗逆流配方

- 无乳糖配方

- 胺基酸配方

- 其他特殊配方

- 有机配方

- 山羊奶配方奶粉

第六章:市场估计与预测:依阶段,2021-2034

- 主要趋势

- 第 1 阶段(0-6 个月)

- 第 2 阶段(6-12 个月)

- 第 3 阶段(12-24 个月)

- 第 4 阶段(24 个月以上)

第七章:市场估计与预测:依形式,2021-2034

- 主要趋势

- 粉末

- 浓缩液

- 即食

第八章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 超市和大卖场

- 药局和药局

- 网路零售

- 电子商务平台

- 直接面向消费者的网站

- 婴儿用品专卖店

- 医院和诊所

- 便利商店

- 其他的

第九章:市场估计与预测:依成分,2021-2034

- 主要趋势

- 基本成分

- 蛋白质

- 乳清蛋白

- 酪蛋白

- 大豆蛋白

- 碳水化合物

- 乳糖

- 玉米糖浆固体

- 其他碳水化合物

- 脂肪和油

- 植物油

- DHA和ARA

- 蛋白质

- 功能性成分

- 益生元

- 益生菌

- 母乳寡糖(HMO)

- 核苷酸

- 维生素和矿物质

- 维生素

- 矿物质

第十章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第 11 章:公司简介

- Abbott Nutrition

- Arla Food

- Bellamy's Organic

- BUBS Australia

- Hero Group

- Mead Johnson Nutrition

- Nestle

- Nutricia

- The Kraft Heinz Company

- Danone SA

- Reckitt Benckiser Group plc (Mead Johnson)

- Perrigo Company plc

The Global Infant Formula Market was valued at USD 47.2 billion in 2024 and is estimated to grow at a CAGR of 10.4% to reach USD 126.5 billion by 2034. The growth is largely attributed to rising awareness around infant nutrition, the increasing number of working mothers, and higher birth rates, especially in developing nations. Urbanization, an increase in disposable income, and higher female workforce participation are also contributing factors to the market expansion. Additionally, parents are becoming more concerned with product safety, digestibility, and nutritional value, leading to a surge in demand for premium formulas, including organic, lactose-free, and hypoallergenic options.

Technological advancements in formula composition, like incorporating prebiotics, probiotics, HMOs (human milk oligosaccharides), and DHA/ARA, are further boosting the acceptance of these products. However, challenges remain, including the high cost of these products, complex regulations, and strong cultural preferences for breastfeeding, particularly in regions where public health campaigns are prevalent. Market growth is also limited by a lack of consumer trust in some markets due to fears about counterfeit formulas. There is a noticeable shift towards clean-label, organic, and plant-based formulas, as parents demand products free of synthetic additives, GMOs, and artificial sweeteners.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $47.2 Billion |

| Forecast Value | $126.5 Billion |

| CAGR | 10.4% |

In 2024, the cow milk-based formula segment commanded a 64% share and is expected to maintain steady growth with a CAGR of 10.4% through 2034. This formula remains the most preferred due to its nutritional profile, which is like breast milk, especially when fortified with DHA, ARA, and iron. Standard cow's milk formula is typically chosen for healthy, full-term infants who are not breastfed. Manufacturers have also developed varieties like partially and extensively hydrolyzed formulas to cater to infants with digestive issues or mild cow's milk intolerance.

Among different stages, the Stage 1 (for infants aged 0-6 months) segment holds the largest share, accounting for 45% in 2024. This segment is expected to see rapid growth, driven by a CAGR of 10.6% through 2034. At this critical stage of infancy, babies rely solely on breast milk or formula for nourishment as their digestive systems are still maturing. Stage 1 formulas are designed to be gentle on the stomach, containing essential nutrients like DHA, ARA, prebiotics, and iron to promote cognitive, immune, and digestive health. Regulatory bodies ensure that strict safety and efficacy standards are met for these products, thereby enhancing consumer confidence.

U.S. Infant Formula Market generated USD 13 billion in 2024 and is set to grow at a CAGR of 8.4% by 2034. The U.S. leads due to its high birth rates, advanced healthcare systems, widespread availability of infant formula, and strong brand loyalty. The market here is characterized by the increasing popularity of premium and speciality formulas, including organic, non-GMO, and plant-based options, as well as formulas enriched with HMOs and DHA/ARA.

Leading companies in this space include Nestle, Abbott Nutrition, Arla Food, Bellamy's Organic, and Bubs Australia, each vying for a stronger market presence. Infant formula companies have been adopting several strategic initiatives to strengthen their market position and expand their influence. They are focusing heavily on innovation, particularly in formula composition, by incorporating nutrients that closely mimic those found in breast milk, such as HMOs, DHA, ARA, and prebiotics. These improvements aim to enhance cognitive development, immunity, and digestive health for infants. Moreover, these companies are significantly increasing their investments in research and development to create new, more advanced products that cater to the growing demand for speciality formulas, such as lactose-free, organic, and hypoallergenic varieties.

The shift toward clean-label, non-GMO, and plant-based formulas is also being embraced to meet the preferences of health-conscious parents. Additionally, companies are enhancing their distribution networks, strengthening retail partnerships, and expanding in emerging markets to ensure the wider availability of their products. Leading brands are also focusing on building consumer trust by adhering to the highest safety standards and offering transparent product labeling, which is increasingly important in today's market.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Stage

- 2.2.4 Form

- 2.2.5 Distribution channel

- 2.2.6 Ingredient

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Nutritional Science & product development

- 3.13.1 Nutritional Requirements for Infants

- 3.13.1.1 Macronutrient requirements

- 3.13.1.1.1 Protein requirements

- 3.13.1.1.2 Carbohydrate requirements

- 3.13.1.1.3 Fat requirements

- 3.13.1.2 Micronutrient requirements

- 3.13.1.2.1 Vitamin requirements

- 3.13.1.2.2 Mineral requirements

- 3.13.1.3 Age-Specific nutritional needs

- 3.13.1.4 Special dietary requirements

- 3.13.1.1 Macronutrient requirements

- 3.13.2 Formula composition & standards

- 3.13.2.1 International standards

- 3.13.2.2 Regional variations

- 3.13.2.3 Quality specifications

- 3.13.2.4 Safety parameters

- 3.13.3 Functional ingredients innovation

- 3.13.3.1 Human Milk Oligosaccharides (HMO)

- 3.13.3.2 Probiotics & prebiotics

- 3.13.3.3 Long-Chain Polyunsaturated Fatty Acids

- 3.13.3.4 Nucleotides & growth factors

- 3.13.4 Product development process

- 3.13.4.1 Research & development

- 3.13.4.2 Clinical studies & trials

- 3.13.4.3 Regulatory approval process

- 3.13.4.4 Commercial launch

- 3.13.5 Nutritional claims & positioning

- 3.13.5.1 Health claims regulations

- 3.13.5.2 Scientific substantiation

- 3.13.5.3 Marketing communications

- 3.13.5.4 Consumer education

- 3.13.6 Future nutritional trends

- 3.13.6.1 Personalized nutrition

- 3.13.6.2 Microbiome research

- 3.13.6.3 Cognitive development support

- 3.13.6.4 Immune system enhancement

- 3.13.1 Nutritional Requirements for Infants

- 3.14 Manufacturing & quality control

- 3.14.1 Manufacturing process

- 3.14.1.1 Raw material preparation

- 3.14.1.2 Blending & mixing

- 3.14.1.3 Heat treatment

- 3.14.1.4 Spray drying

- 3.14.1.5 Packaging & sealing

- 3.14.2 Quality control systems

- 3.14.2.1 Good Manufacturing Practices (GMP)

- 3.14.2.2 Hazard Analysis Critical Control Points (HACCP)

- 3.14.2.3 Quality assurance testing

- 3.14.2.4 Batch testing protocols

- 3.14.3 Safety & contamination control

- 3.14.3.1 Microbiological safety

- 3.14.3.2 Chemical contaminant control

- 3.14.3.3 Physical hazard prevention

- 3.14.3.4 Allergen management

- 3.14.4 Equipment & technology

- 3.14.4.1 Processing equipment

- 3.14.4.2 Testing & analysis equipment

- 3.14.4.3 Packaging machinery

- 3.14.4.4 Automation & control systems

- 3.14.5 Supply chain management

- 3.14.5.1 Raw material sourcing

- 3.14.5.2 Supplier qualification

- 3.14.5.3 Inventory management

- 3.14.5.4 Cold chain management

- 3.14.6 Regulatory compliance

- 3.14.6.1 Manufacturing standards

- 3.14.6.2 Facility inspections

- 3.14.6.3 Documentation requirements

- 3.14.6.4 Recall procedures

- 3.14.1 Manufacturing process

- 3.15 Consumer behavior & market dynamics

- 3.15.1 Consumer demographics

- 3.15.1.1 Parental age groups

- 3.15.1.2 Income levels

- 3.15.1.3 Education levels

- 3.15.1.4 Geographic distribution

- 3.15.2 Purchase decision factors

- 3.15.2.1 Nutritional benefits

- 3.15.2.2 Brand trust & reputation

- 3.15.2.3 Price sensitivity

- 3.15.2.4 Healthcare provider recommendations

- 3.15.2.5 Convenience factors

- 3.15.3 Feeding patterns & preferences

- 3.15.3.1 Exclusive formula feeding

- 3.15.3.2 Mixed feeding (breast + formula)

- 3.15.3.3 Transitional feeding

- 3.15.3.4 Cultural feeding practices

- 3.15.4 Information sources & influences

- 3.15.4.1 Healthcare professionals

- 3.15.4.2 Online resources

- 3.15.4.3 Family & friends

- 3.15.4.4 Social media influence

- 3.15.5 Brand loyalty & switching behavior

- 3.15.5.1 Brand loyalty factors

- 3.15.5.2 Switching triggers

- 3.15.5.3 Trial & adoption patterns

- 3.15.5.4 Recommendation behavior

- 3.15.6 Regional consumer variations

- 3.15.6.1 North American consumers

- 3.15.6.2 European consumers

- 3.15.6.3 Asia-Pacific consumers

- 3.15.6.4 Other regional patterns

- 3.15.1 Consumer demographics

- 3.16 Marketing & distribution strategies

- 3.16.1 Marketing strategies

- 3.16.1.1 Brand positioning

- 3.16.1.1.1 Premium positioning

- 3.16.1.1.2 Value positioning

- 3.16.1.1.3 Specialty positioning

- 3.16.1.2 Target audience segmentation

- 3.16.1.3 Marketing channels

- 3.16.1.3.1 Healthcare professional engagement

- 3.16.1.3.2 Digital marketing

- 3.16.1.3.3 Traditional media

- 3.16.1.3.4 Educational programs

- 3.16.1.1 Brand positioning

- 3.16.2 Distribution strategies

- 3.16.2.1 Multi-channel distribution

- 3.16.2.2 Channel partner management

- 3.16.2.3 Geographic expansion

- 3.16.2.4 Market penetration strategies

- 3.16.3 Pricing strategies

- 3.16.3.1 Premium pricing

- 3.16.3.2 Competitive pricing

- 3.16.3.3 Value-based pricing

- 3.16.3.4 Regional pricing variations

- 3.16.4 Promotional activities

- 3.16.4.1 Healthcare professional programs

- 3.16.4.2 Consumer education campaigns

- 3.16.4.3 Sampling programs

- 3.16.4.4 Loyalty programs

- 3.16.5 Digital transformation

- 3.16.5.1 E-commerce strategies

- 3.16.5.2 Digital customer engagement

- 3.16.5.3 Data analytics & insights

- 3.16.5.4 Omnichannel integration

- 3.16.6 Regulatory marketing considerations

- 3.16.6.1 WHO code compliance

- 3.16.6.2 Advertising restrictions

- 3.16.6.3 Health claims regulations

- 3.16.6.4 Ethical marketing practices

- 3.16.1 Marketing strategies

- 3.17 Innovation & future trends

- 3.17.1 Current innovation trends

- 3.17.1.1 Functional ingredients

- 3.17.1.2 Organic & clean label

- 3.17.1.3 Personalized nutrition

- 3.17.1.4 Sustainable packaging

- 3.17.2 Emerging technologies

- 3.17.2.1 Precision nutrition

- 3.17.2.2 Microencapsulation

- 3.17.2.3 Novel processing technologies

- 3.17.2.4 Smart packaging

- 3.17.3 Research & development focus

- 3.17.3.1 Gut microbiome research

- 3.17.3.2 Cognitive development

- 3.17.3.3 Immune system support

- 3.17.3.4 Allergy prevention

- 3.17.4 Sustainability initiatives

- 3.17.4.1 Sustainable sourcing

- 3.17.4.2 Carbon footprint reduction

- 3.17.4.3 Circular economy principles

- 3.17.4.4 Environmental impact mitigation

- 3.17.5 Digital innovation

- 3.17.5.1 Smart feeding solutions

- 3.17.5.2 Mobile applications

- 3.17.5.3 IoT integration

- 3.17.5.4 AI-Powered recommendations

- 3.17.6 Future market trends

- 3.17.6.1 Market consolidation

- 3.17.6.2 Premium segment growth

- 3.17.6.3 Emerging market expansion

- 3.17.6.4 Regulatory evolution

- 3.17.1 Current innovation trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trend

- 5.2 Cow's milk-based formula

- 5.2.1 Standard cow's milk formula

- 5.2.2 Partially hydrolyzed formula

- 5.2.3 Extensively hydrolyzed formula

- 5.3 Soy-based formula

- 5.4 Protein hydrolysate formula

- 5.5 Specialty formula

- 5.5.1 Premature infant formula

- 5.5.2 Anti-reflux formula

- 5.5.3 Lactose-free formula

- 5.5.4 Amino acid-based formula

- 5.5.5 Other specialty formulas

- 5.6 Organic formula

- 5.7 Goat milk-based formula

Chapter 6 Market Estimates & Forecast, By Stage, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trend

- 6.2 Stage 1 (0–6 months)

- 6.3 Stage 2 (6–12 months)

- 6.4 Stage 3 (12–24 months)

- 6.5 Stage 4 (24+ months)

Chapter 7 Market Estimates & Forecast, By Form, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trend

- 7.2 Powder

- 7.3 Liquid concentrate

- 7.4 Ready-to-feed

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trend

- 8.2 Supermarkets & Hypermarkets

- 8.3 Pharmacies & Drug Stores

- 8.4 Online Retail

- 8.4.1 E-commerce Platforms

- 8.4.2 Direct-to-Consumer Websites

- 8.5 Specialty Baby Stores

- 8.6 Hospitals & Clinics

- 8.7 Convenience Stores

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Ingredient, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trend

- 9.2 Basic Ingredients

- 9.2.1 Proteins

- 9.2.1.1 Whey Protein

- 9.2.1.2 Casein

- 9.2.1.3 Soy Protein

- 9.2.2 Carbohydrates

- 9.2.2.1 Lactose

- 9.2.2.2 Corn Syrup Solids

- 9.2.2.3 Other Carbohydrates

- 9.2.3 Fats & Oils

- 9.2.3.1 Vegetable Oils

- 9.2.3.2 DHA & ARA

- 9.2.1 Proteins

- 9.3 Functional Ingredients

- 9.3.1 Prebiotics

- 9.3.2 Probiotics

- 9.3.3 Human Milk Oligosaccharides (HMO)

- 9.3.4 Nucleotides

- 9.4 Vitamins & Minerals

- 9.4.1 Vitamins

- 9.4.2 Minerals

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East & Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East & Africa

Chapter 11 Company Profiles

- 11.1 Abbott Nutrition

- 11.2 Arla Food

- 11.3 Bellamy's Organic

- 11.4 BUBS Australia

- 11.5 Hero Group

- 11.6 Mead Johnson Nutrition

- 11.7 Nestle

- 11.8 Nutricia

- 11.9 The Kraft Heinz Company

- 11.10 Danone S.A.

- 11.11 Reckitt Benckiser Group plc (Mead Johnson)

- 11.12 Perrigo Company plc