|

市场调查报告书

商品编码

1773238

兽医皮肤病药物市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Veterinary Dermatology Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

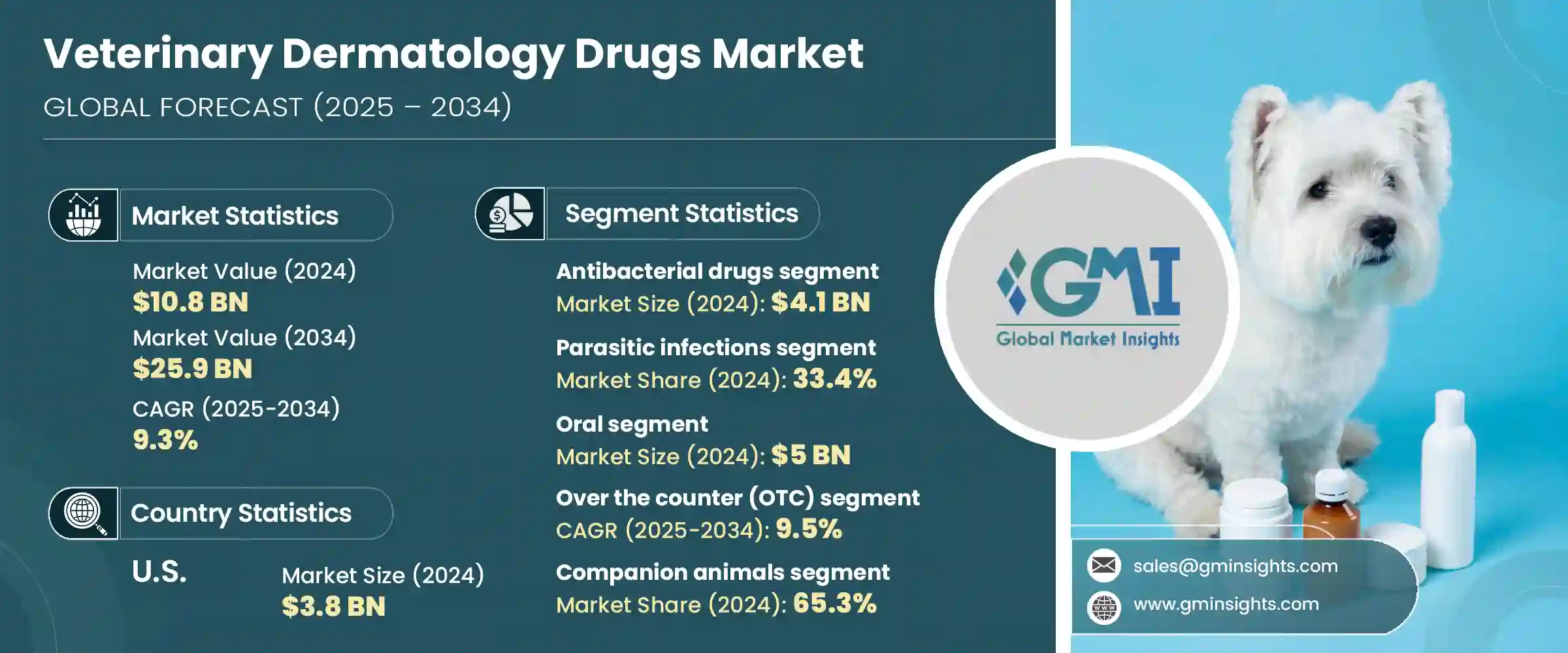

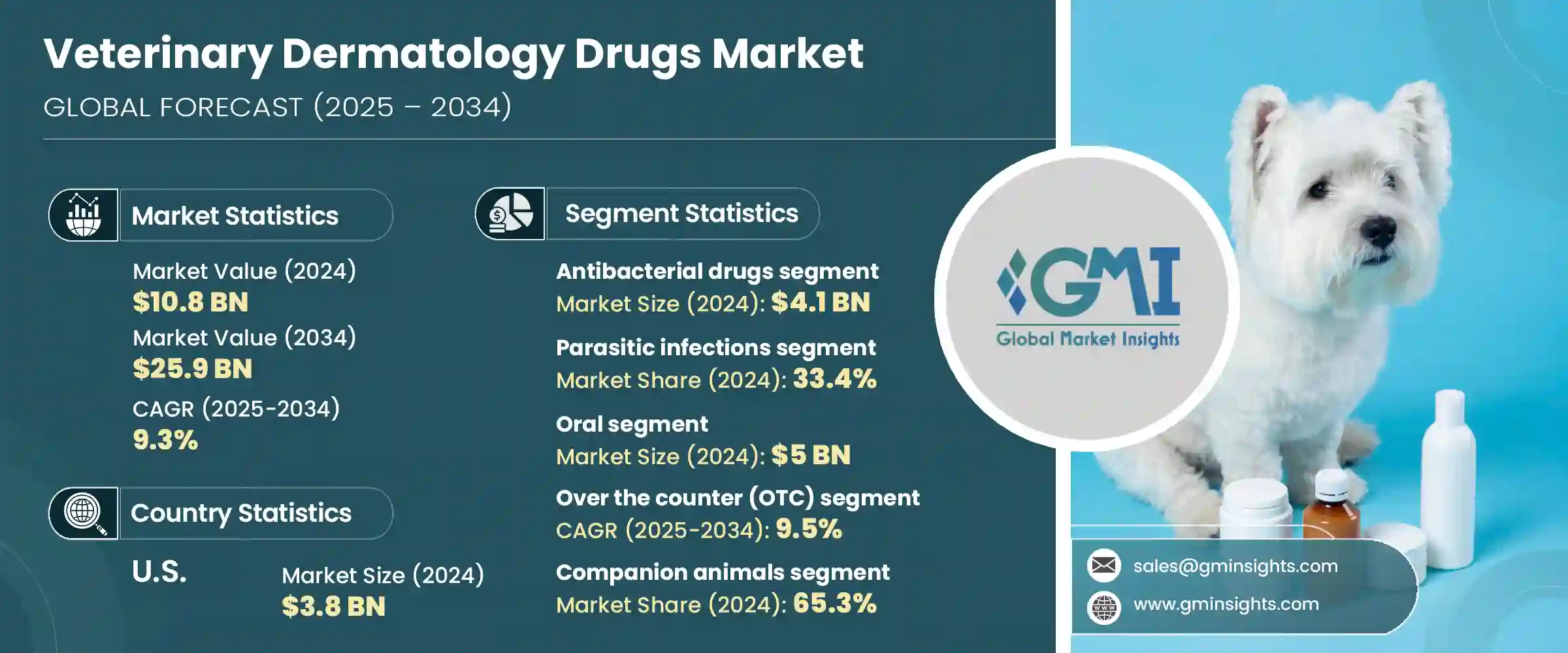

2024 年全球兽用皮肤病药物市场规模为 108 亿美元,预计到 2034 年将以 9.3% 的复合年增长率成长,达到 259 亿美元。推动这一增长的主要因素是动物皮肤病发病率的急剧上升,以及人们对宠物健康保健意识的不断提高。随着全球宠物拥有量的持续增长,用于治疗皮肤病的兽药需求激增。动物保健支出的增加和医疗化率的提高进一步扩大了这一需求,尤其是在伴侣动物更为普遍的城市地区。新兴经济体,尤其是亚太和拉丁美洲等地区,对动物保健基础设施的投资正在增强,这为市场扩张创造了有利条件。

推动市场发展的另一个因素是先进皮肤科药物的开发,这些药物旨在最大限度地减少副作用,同时提高疗效。製药公司正专注于开发新的剂型,尤其是外用和口服药物,以提高给药的便利性和疗效。随着人们对皮肤病对动物健康影响的认识不断提高,市场对皮肤科专用药物的接受度也越来越高。此外,牲畜和伴侣动物皮肤感染的增加也推动了早期诊断和治疗的需求,从而促进了皮肤科药物在兽医实践中的广泛使用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 108亿美元 |

| 预测值 | 259亿美元 |

| 复合年增长率 | 9.3% |

兽用皮肤科药物涵盖了用于治疗动物皮肤疾病的广泛领域,涵盖从感染、发炎到自体免疫性皮肤病的各种疾病。这些药物通常分为几类,包括抗菌药、抗真菌药、抗寄生虫药和抗发炎药物。这些药物可透过多种途径给药,例如口服、外用和注射,这取决于动物的病情和对治疗的反应。

就药物类别而言,抗菌药物占据最大的市场份额,2024 年价值达到 41 亿美元。细菌性皮肤感染(尤其是在伴侣动物中)的发生率不断上升,这在很大程度上推动了对抗菌兽药的需求。随着这些感染日益普遍,兽医开始寻求更先进的抗菌製剂和联合疗法,以获得更有效的治疗效果。抗药性菌株的出现也加速了对更强效、更有针对性的抗菌产品的需求。此外,人们对这些疾病的认识不断提高,诊断能力也不断提升,使得早期发现成为可能,从而推动了抗菌兽药领域持续占据主导地位。

以适应症划分,寄生虫感染占据最大市场份额,2024年占总市场份额的33.4%。寄生虫引起的皮肤病是动物最常见的皮肤病之一。环境和气候条件的变化是导致寄生虫疾病传播加剧的原因之一,尤其是在热带地区。为此,製药公司正在推出外用和口服两种形式的长效抗寄生虫药物。这些新剂型着重简化治疗程序,同时提供持久保护。抗寄生虫药物研发领域的持续研究和创新,加上有利的监管条件,正在支持该领域的成长。透过扩大分销网络来提升可及性,也促进了该领域的强劲表现。

在各种给药途径中,口服药物在2024年占据了50亿美元的市场,预计到2034年将以9%的复合年增长率成长。口服给药因其係统性给药方式而广受青睐,该方式允许药物在血液中循环,从而解决皮肤问题的根本原因。由于动物通常更容易接受口服药物,因此口服药物也能确保更好的依从性。高依从性有助于获得一致的治疗效果,从而推动该领域的需求。

从区域来看,北美引领全球兽用皮肤病药物市场,2024 年占 38.6% 的份额。光是美国市场当年的规模就达到 38 亿美元,高于 2023 年的 35 亿美元。该地区的成长得益于其强大的研发能力和不断改进的药物配方。伴侣动物数量众多以及对宠物照顾的文化重视是该地区主导的关键。随着宠物主人不断为他们的宠物投资高端医疗保健解决方案,对皮肤病药物的需求也随之增长。

市场竞争依然激烈,众多参与者透过精准研发、药物配方创新、地理扩张以及遵守不断变化的监管标准等方式争相抢占市场份额。各公司越来越注重研发满足动物独特皮肤病学需求的专用产品,并在这个快速成长的领域中确立策略性定位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 皮肤病发生率上升

- 技术进步

- 兽医皮肤科医师数量不断增加

- 增加动物保健支出

- 产业陷阱与挑战

- 不良副作用和安全问题

- 治疗费用高昂

- 市场机会

- 宠物拥有量和支出不断增加

- 拓展电子商务与零售通路

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 技术格局

- 当前的技术趋势

- 新兴技术

- 未来市场趋势

- 定价分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

第五章:市场估计与预测:按药物类别,2021 年至 2034 年

- 主要趋势

- 抗菌药物

- 抗真菌药物

- 抗寄生虫药物

- 其他药物类别

第六章:市场估计与预测:按适应症,2021 年至 2034 年

- 主要趋势

- 寄生虫感染

- 过敏性感染

- 自体免疫性皮肤病

- 皮肤癌

- 其他适应症

第七章:市场估计与预测:依管理路线,2021 年至 2034 年

- 主要趋势

- 口服

- 外用

- 注射剂

第八章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 处方

- 场外交易(OTC)

第九章:市场估计与预测:按动物类型,2021 年至 2034 年

- 主要趋势

- 伴侣动物

- 狗

- 猫

- 马匹

- 其他伴侣动物

- 牲畜

- 牛

- 猪

- 其他牲畜

第 10 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 兽医院药房

- 零售药局

- 网路药局

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- Bimeda

- Bioiberica

- Boehringer Ingelheim

- Ceva Sante Animale

- Dechra Pharmaceuticals

- Elanco Animal Health

- Indian Immunologicals

- Merck & Co.

- Vee Remedies

- Virbac

- Vetoquinol

- Vivaldis

- Zoetis

The Global Veterinary Dermatology Drugs Market was valued at USD 10.8 billion in 2024 and is estimated to grow at a CAGR of 9.3% to reach USD 25.9 billion by 2034. This growth is being driven by a sharp increase in the incidence of skin disorders among animals, coupled with rising awareness around pet health and wellness. As pet ownership continues to rise worldwide, demand for veterinary drugs designed to treat dermatological issues has surged. This demand is further amplified by an uptick in animal healthcare spending and an increasing medicalization rate, particularly in urban areas where companion animals are more prevalent. Investment in animal healthcare infrastructure is gaining momentum across emerging economies, especially in regions such as Asia-Pacific and Latin America, creating favorable conditions for market expansion.

Another factor contributing to the market's progress is the development of advanced dermatological drugs aimed at minimizing side effects while enhancing therapeutic outcomes. Pharmaceutical companies are focusing on new formulations, particularly topical and oral options, that improve ease of administration and efficacy. As awareness continues to grow about the impact of skin diseases on animal health, the market is witnessing greater acceptance of dermatology-specific medications. Additionally, the rise in skin infections among livestock and companion animals is pushing the need for early diagnosis and treatment, encouraging the widespread use of dermatology drugs across veterinary practices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.8 Billion |

| Forecast Value | $25.9 Billion |

| CAGR | 9.3% |

Veterinary dermatology drugs encompass a broad spectrum of treatments used to manage and cure skin disorders in animals, ranging from infections and inflammations to autoimmune skin conditions. These medications are typically categorized into several drug classes, including antibacterial, antifungal, antiparasitic, and anti-inflammatory drugs. These drugs are administered through multiple routes, such as oral, topical, and injectable, depending on the condition and the animal's response to treatment.

In terms of drug class, antibacterial medications held the largest market share, reaching a value of USD 4.1 billion in 2024. The demand for antibacterial veterinary drugs is largely fueled by the increasing frequency of bacterial skin infections, particularly among companion animals. As these infections become more common, veterinarians are turning to more advanced antibacterial formulations and combination therapies to deliver effective results. The emergence of drug-resistant strains has also accelerated the need for stronger and more targeted antibacterial products. Furthermore, the rising awareness of these conditions and improvements in diagnostic capabilities have enabled early detection, contributing to the consistent dominance of this segment.

By indication, parasitic infections accounted for the largest market share, capturing 33.4% of the total in 2024. Skin conditions caused by parasites are among the most common dermatological issues in animals. Changes in environmental and climatic conditions are playing a role in the increased spread of parasitic diseases, particularly in tropical climates. In response, pharmaceutical companies are introducing long-acting antiparasitic drugs in both topical and oral forms. These new formulations focus on simplifying treatment routines while delivering lasting protection. Ongoing research and innovation in antiparasitic drug development, combined with favorable regulatory conditions, are supporting segment growth. Enhanced access through expanded distribution networks has also contributed to the segment's strong performance.

Among the various routes of administration, oral drugs accounted for USD 5 billion in 2024 and are forecast to grow at a CAGR of 9% through 2034. Oral administration is widely preferred due to its systemic approach, which allows the drug to circulate through the bloodstream and tackle the root cause of skin issues. It also ensures better compliance, as animals tend to accept oral medications more readily than external applications. This high compliance rate contributes to consistent treatment results, which in turn drives demand in this segment.

Regionally, North America led the global veterinary dermatology drugs market, holding a 38.6% share in 2024. The market in the United States alone was valued at USD 3.8 billion that year, up from USD 3.5 billion in 2023. Growth in this region can be attributed to the presence of robust R&D capabilities and the steady introduction of improved drug formulations. The high volume of companion animals and the cultural emphasis on pet care are central to the region's dominant market position. As pet owners continue to invest in premium healthcare solutions for their animals, the demand for dermatology drugs has followed suit.

Competition within the market remains strong, with numerous players striving to gain market share through targeted R&D, innovation in drug formulations, geographic expansion, and compliance with evolving regulatory standards. Companies are increasingly focusing on creating specialized products that meet the unique dermatological needs of animals, positioning themselves strategically within this rapidly growing sector.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Drug class

- 2.2.3 Indication

- 2.2.4 Route of administration

- 2.2.5 Type

- 2.2.6 Animal type

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of dermatological diseases

- 3.2.1.2 Technological advancements

- 3.2.1.3 Increasing number of veterinary dermatology practitioners

- 3.2.1.4 Increased spending on animal healthcare

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adverse side effects and safety concerns

- 3.2.2.2 High cost of treatment

- 3.2.3 Market opportunities

- 3.2.3.1 Rising pet ownership and spending

- 3.2.3.2 Expansion of e-commerce and retail channels

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Antibacterial drugs

- 5.3 Antifungal drugs

- 5.4 Antiparasitic drugs

- 5.5 Other drug classes

Chapter 6 Market Estimates and Forecast, By Indication, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Parasitic infections

- 6.3 Allergic infections

- 6.4 Autoimmune skin diseases

- 6.5 Skin cancer

- 6.6 Other indications

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Topical

- 7.4 Injectable

Chapter 8 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Prescription

- 8.3 Over the counter (OTC)

Chapter 9 Market Estimates and Forecast, By Animal Type, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Companion animals

- 9.2.1 Dogs

- 9.2.2 Cats

- 9.2.3 Horses

- 9.2.4 Other companion animals

- 9.3 Livestock animals

- 9.3.1 Bovine

- 9.3.2 Swine

- 9.3.3 Other livestock animals

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Veterinary hospital pharmacies

- 10.3 Retail pharmacies

- 10.4 Online pharmacies

Chapter 11 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Bimeda

- 12.2 Bioiberica

- 12.3 Boehringer Ingelheim

- 12.4 Ceva Sante Animale

- 12.5 Dechra Pharmaceuticals

- 12.6 Elanco Animal Health

- 12.7 Indian Immunologicals

- 12.8 Merck & Co.

- 12.9 Vee Remedies

- 12.10 Virbac

- 12.11 Vetoquinol

- 12.12 Vivaldis

- 12.13 Zoetis