|

市场调查报告书

商品编码

1773245

动物诊断市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Animal Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

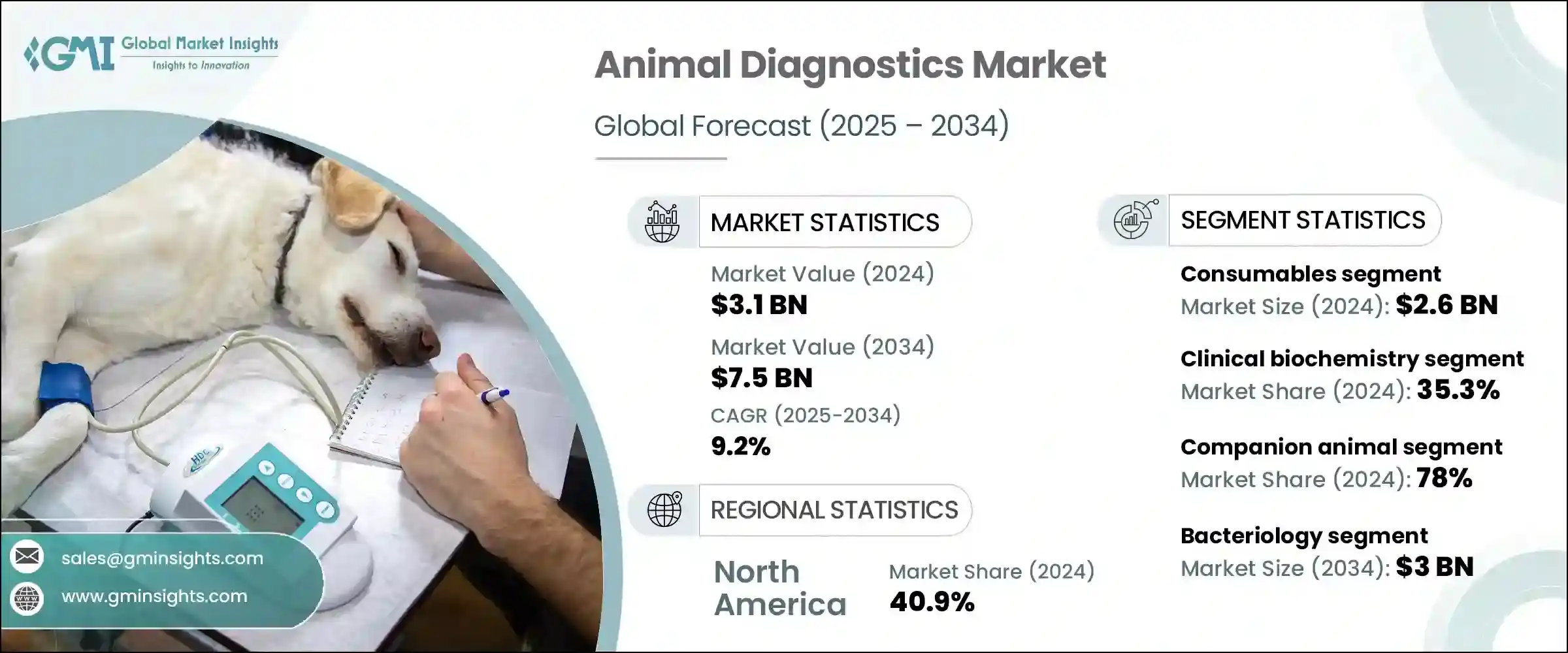

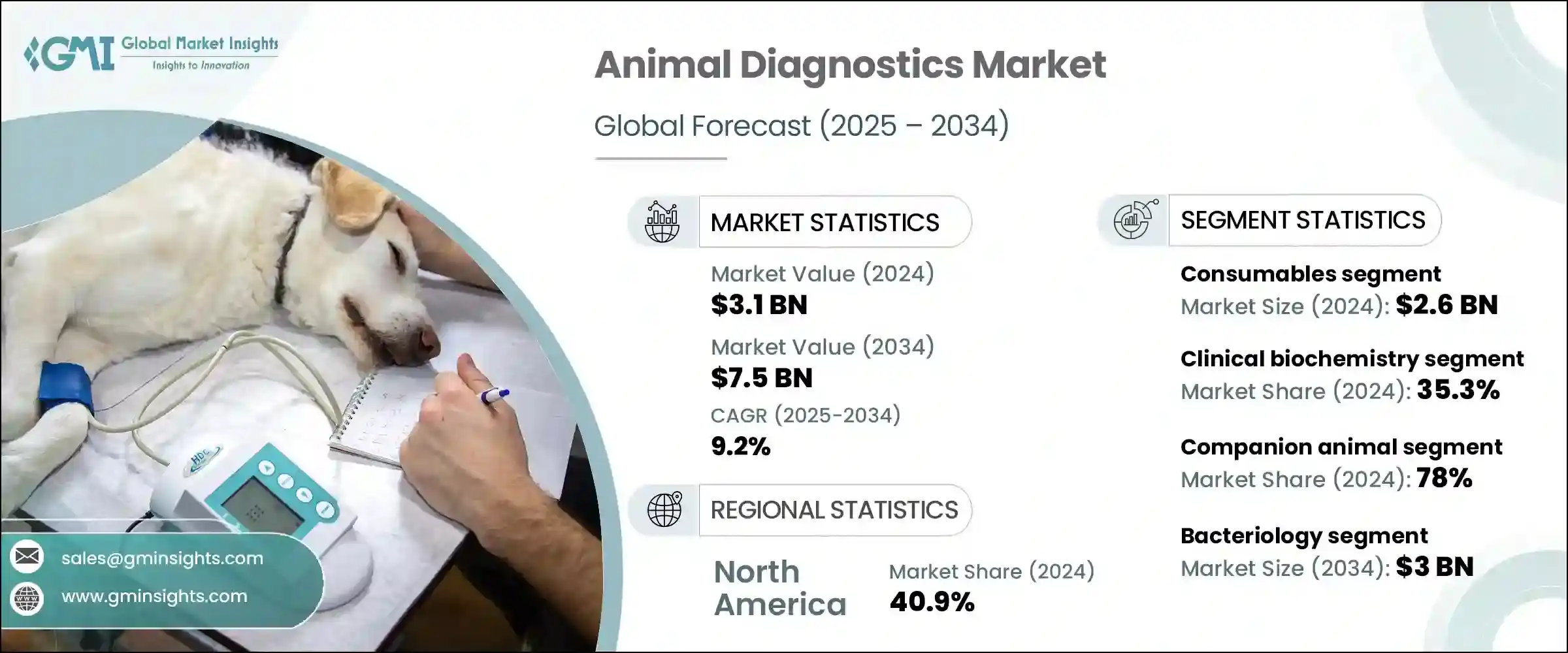

2024年,全球动物诊断市场规模达31亿美元,预计2034年将以9.2%的复合年增长率成长,达到75亿美元。这一增长主要源于伴侣动物和农场动物中传染病和慢性病发病率的上升。随着动物健康日益成为个别饲养者和农业部门的焦点,对可靠诊断解决方案的需求也持续增长。

公共和私营部门对动物卫生基础设施的投资,加上政府对疾病预防和管理的支持性政策,正在促进整个兽医领域对诊断技术的认识和应用。兽医诊所和诊断实验室之间的合作,以及主要机构在服务不足地区扩大服务覆盖范围,正在显着改善发展中国家获得检测服务的可近性。此外,宠物保险的日益普及减轻了宠物主人频繁诊断的经济负担,从而鼓励定期检测和早期疾病发现。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 31亿美元 |

| 预测值 | 75亿美元 |

| 复合年增长率 | 9.2% |

动物诊断涉及一系列用于检测和监测动物疾病或其他健康状况的检测方法。这些技术包括分子诊断、血清学检测、尿液分析和临床生物化学等。依产品类型,市场分为仪器和耗材两大类。其中,耗材占最大份额,2024 年价值 26 亿美元。此细分市场的主导地位源自于诊断试剂盒、试剂、玻片和采集管等物品的高使用频率和重复性需求。这些产品是兽医诊所和实验室日常运作不可或缺的一部分,有助于维持其持续的需求并占据整体市场领先地位。

从技术面来看,临床生物化学领域在2024年引领全球动物诊断市场,占35.3%的份额。该领域凭藉其透过血液、尿液和其他体液评估重要生理指标的能力,持续获得发展,从而能够早期发现动物的肝肾疾病、代谢性疾病和激素失衡等疾病。随着人们对宠物预防保健意识的不断增强,对常规健康筛检(通常包含生物化学检测)的需求激增。宠物慢性病病例的增加也推动了临床化学工具在兽医领域的应用。

从应用角度来看,市场细分为细菌学、病理学、寄生虫学和其他诊断应用。细菌学领域占据了相当大的市场份额,预计到2034年将达到30亿美元。该领域对于识别导致多种动物疾病的细菌病原体仍然至关重要。细菌学检测使兽医能够准确诊断感染并及时实施治疗方案。检测方法的创新以及对人畜共患疾病控制和食品安全标准提高的日益重视,正推动该领域继续占据主导地位。

依动物类型细分,伴侣动物类别在2024年占据78%的市场份额,占据市场主导地位。这包括针对狗、猫、马和其他家养动物的诊断服务。宠物拥有量的激增,尤其是在城市地区,导致了对兽医服务(包括诊断)的需求增加。此外,随着宠物健康意识的增强以及动物癌症和糖尿病等疾病发生率的上升,宠物主人也开始寻求定期的健康检查和诊断支持。

依最终用途划分,诊断实验室在2024年成为领先细分市场,预计2025年至2034年的复合年增长率将达到9.3%。这些实验室提供全面的检测服务,配备先进的设备和熟练的技术人员,能够精确处理大量样本。它们能够进行即时PCR和基因定序等高级检测,成为寻求精准结果的兽医的首选。对集中式高通量检测的需求日益增长,使这些设施继续占据市场前沿。

从区域来看,北美在2024年继续保持其最大市场的地位,占据全球40.9%的份额。该地区受益于广泛的宠物饲养、先进的兽医保健基础设施以及日益增强的预防性动物护理意识。光是在美国,动物诊断市场在2024年就达到了11.4亿美元,并呈现持续的逐年成长。宠物保险普及率的提高以及动物保健支出的增加是该地区领先地位的支撑因素之一。

全球动物诊断市场的竞争格局由主要参与者主导,他们控制约65%至70%的市场份额。这些公司利用其广泛的产品组合和国际影响力,保持稳固的市场地位。在这个快速发展的市场中,收购、新产品发布和设施扩建等策略性倡议是推动成长和提升技术能力的常用策略。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 收养宠物的趋势日益增长

- 食源性疾病和人畜共通传染病的发生率不断上升

- 有利的政府倡议

- 伴随诊断的进展

- 宠物保险的普及率不断提高

- 产业陷阱与挑战

- 动物试验成本过高

- 兽医护理自付费用低

- 市场机会

- 技术进步和即时诊断分子工具

- 畜牧业的扩张和对食品安全的需求

- 成长动力

- 成长潜力分析

- 定价分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 耗材

- 仪器

第六章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 临床生物化学

- 血糖监测

- 血气和电解质分析

- 其他临床生化检查

- 免疫诊断

- 横向流动试验

- 酵素连结免疫吸附试验

- 免疫分析仪

- 其他免疫诊断测试

- 分子诊断

- 聚合酶连锁反应

- 微阵列

- 其他分子诊断测试

- 血液学

- 尿液分析

- 其他技术

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 细菌学

- 病理

- 寄生虫学

- 其他应用

第八章:市场估计与预测:按动物类型,2021 - 2034 年

- 主要趋势

- 伴侣动物

- 狗

- 猫

- 马匹

- 其他伴侣动物

- 农场动物

- 牛

- 猪

- 家禽

- 其他农场动物

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 兽医医院和诊所

- 诊断实验室

- 居家照护环境

- 其他最终用途

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 波兰

- 荷兰

- 瑞典

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 菲律宾

- 泰国

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥伦比亚

- 秘鲁

- 智利

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

- 埃及

- 以色列

第 11 章:公司简介

- bioMerieux

- BioNote

- Bio-Rad Laboratories

- Boehringer Ingelheim International

- Heska Corporation

- Idexx laboratories

- KogeneBiotech

- Median Diagnostics

- Neogen Corporation

- Randox

- Thermo Fischer Scientific

- Virbac

- VetAll Laboratories

- Qiagen

- Zoetis

The Global Animal Diagnostics Market was valued at USD 3.1 billion in 2024 and is estimated to grow at a CAGR of 9.2% to reach USD 7.5 billion by 2034. This growth is primarily driven by the rising prevalence of both infectious and chronic diseases in companion and farm animals. As animal health becomes a growing concern for both individual owners and the agricultural sector, the demand for reliable diagnostic solutions continues to increase.

Public and private investments in animal health infrastructure, coupled with supportive government policies targeting disease prevention and management, are fostering greater awareness and adoption of diagnostics across the veterinary landscape. Collaborations between veterinary clinics and diagnostic labs, as well as expanded outreach by major players in underserved regions, are significantly improving access to testing services in developing countries. Moreover, the growing popularity of pet insurance is easing the financial burden of frequent diagnostics for pet owners, thereby encouraging regular testing and early disease detection.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.1 Billion |

| Forecast Value | $7.5 Billion |

| CAGR | 9.2% |

Animal diagnostics involves a range of testing methods used to detect and monitor diseases or other health conditions in animals. These techniques include molecular diagnostics, serological testing, urinalysis, and clinical biochemistry, among others. Based on product type, the market is divided into instruments and consumables. Among these, the consumables segment held the largest share, valued at USD 2.6 billion in 2024. The dominance of this segment is due to the high usage frequency and recurring need for items such as diagnostic kits, reagents, slides, and collection tubes. These products are integral to daily operations in veterinary clinics and labs, contributing to their consistent demand and overall market leadership.

By technology, the clinical biochemistry segment led the global animal diagnostics market in 2024 with a 35.3% share. This segment continues to gain traction due to its ability to assess vital physiological markers through blood, urine, and other bodily fluids, allowing for the early detection of conditions such as liver and kidney disorders, metabolic diseases, and hormonal imbalances in animals. As awareness about preventive care in pets grows, the demand for routine health screenings, which often include biochemistry panels, has surged. The increasing cases of chronic conditions in pets have also played a key role in boosting the use of clinical chemistry tools in veterinary settings.

In terms of application, the market is segmented into bacteriology, pathology, parasitology, and other diagnostic applications. The bacteriology segment accounted for a significant portion of the market and is projected to reach USD 3 billion by 2034. This segment remains crucial for identifying bacterial pathogens that are responsible for a wide range of animal diseases. Bacteriological testing enables veterinarians to diagnose infections accurately and implement timely treatment protocols. Innovations in testing methodologies and the growing emphasis on controlling zoonotic diseases and improving food safety standards are contributing to the segment's continued dominance.

When segmented by animal type, the companion animals category led the market with a substantial 78% share in 2024. This includes diagnostics for dogs, cats, horses, and other household animals. The surge in pet ownership, especially in urban areas, has led to higher demand for veterinary services, including diagnostics. Furthermore, rising awareness about pet health and the increasing incidence of diseases like cancer and diabetes in animals are pushing pet owners to seek regular health checkups and diagnostic support.

By end use, diagnostic laboratories emerged as the leading segment in 2024 and are projected to grow at a CAGR of 9.3% from 2025 to 2034. These labs offer comprehensive testing services, supported by sophisticated equipment and skilled technicians capable of processing large sample volumes with precision. Their ability to perform advanced testing, such as real-time PCR and genetic sequencing, has made them the preferred choice for veterinarians seeking accurate results. Growing demand for centralized, high-throughput testing continues to position these facilities at the forefront of the market.

Regionally, North America maintained its position as the largest market in 2024, commanding 40.9% of the global share. The region benefits from widespread pet ownership, advanced veterinary healthcare infrastructure, and growing awareness of preventive animal care. The animal diagnostics market in the United States alone reached USD 1.14 billion in 2024, showing consistent year-over-year growth. Increased adoption of pet insurance and high spending on animal health are among the factors supporting this regional leadership.

The competitive landscape of the global animal diagnostics market is dominated by key players that control around 65% to 70% of the industry. These companies leverage their expansive product portfolios and international presence to maintain a strong foothold. Strategic initiatives, including acquisitions, new product launches, and facility expansions, are common tactics used to drive growth and enhance technological capabilities in this rapidly evolving market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Technology

- 2.2.4 Application

- 2.2.5 Animal type

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing trend of adopting pet animals

- 3.2.1.2 Rising prevalence of foodborne and zoonotic diseases

- 3.2.1.3 Favorable government initiatives

- 3.2.1.4 Advancements in companion diagnostics

- 3.2.1.5 Increasing adoption of pet insurance

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Prohibitive cost associated with animal tests

- 3.2.2.2 Low out of pocket expenditure on veterinary care

- 3.2.3 Market opportunities

- 3.2.3.1 Technological advancements and point-of-care molecular tools

- 3.2.3.2 Expanding livestock industry and demand for food safety

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pricing analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Consumables

- 5.3 Instruments

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Clinical biochemistry

- 6.2.1 Glucose monitoring

- 6.2.2 Blood gas and electrolyte analysis

- 6.2.3 Other clinical biochemistry tests

- 6.3 Immunodiagnostics

- 6.3.1 Lateral flow assays

- 6.3.2 ELISA

- 6.3.3 Immunoassay analyzers

- 6.3.4 Other immunodiagnostic tests

- 6.4 Molecular diagnostics

- 6.4.1 PCR

- 6.4.2 Microarrays

- 6.4.3 Other molecular diagnostic tests

- 6.5 Hematology

- 6.6 Urinalysis

- 6.7 Other technologies

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Bacteriology

- 7.3 Pathology

- 7.4 Parasitology

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Companion animals

- 8.2.1 Dogs

- 8.2.2 Cats

- 8.2.3 Horses

- 8.2.4 Other companion animals

- 8.3 Farm animals

- 8.3.1 Cattle

- 8.3.2 Swine

- 8.3.3 Poultry

- 8.3.4 Other farm animals

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Veterinary hospitals and clinics

- 9.3 Diagnostic labs

- 9.4 Home care settings

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Poland

- 10.3.7 Netherlands

- 10.3.8 Sweden

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Philippines

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Columbia

- 10.5.5 Peru

- 10.5.6 Chile

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Turkey

- 10.6.5 Egypt

- 10.6.6 Israel

Chapter 11 Company Profiles

- 11.1 bioMerieux

- 11.2 BioNote

- 11.3 Bio-Rad Laboratories

- 11.4 Boehringer Ingelheim International

- 11.5 Heska Corporation

- 11.6 Idexx laboratories

- 11.7 KogeneBiotech

- 11.8 Median Diagnostics

- 11.9 Neogen Corporation

- 11.10 Randox

- 11.11 Thermo Fischer Scientific

- 11.12 Virbac

- 11.13 VetAll Laboratories

- 11.14 Qiagen

- 11.15 Zoetis