|

市场调查报告书

商品编码

1773247

牙科预防用品市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Dental Preventive Supplies Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

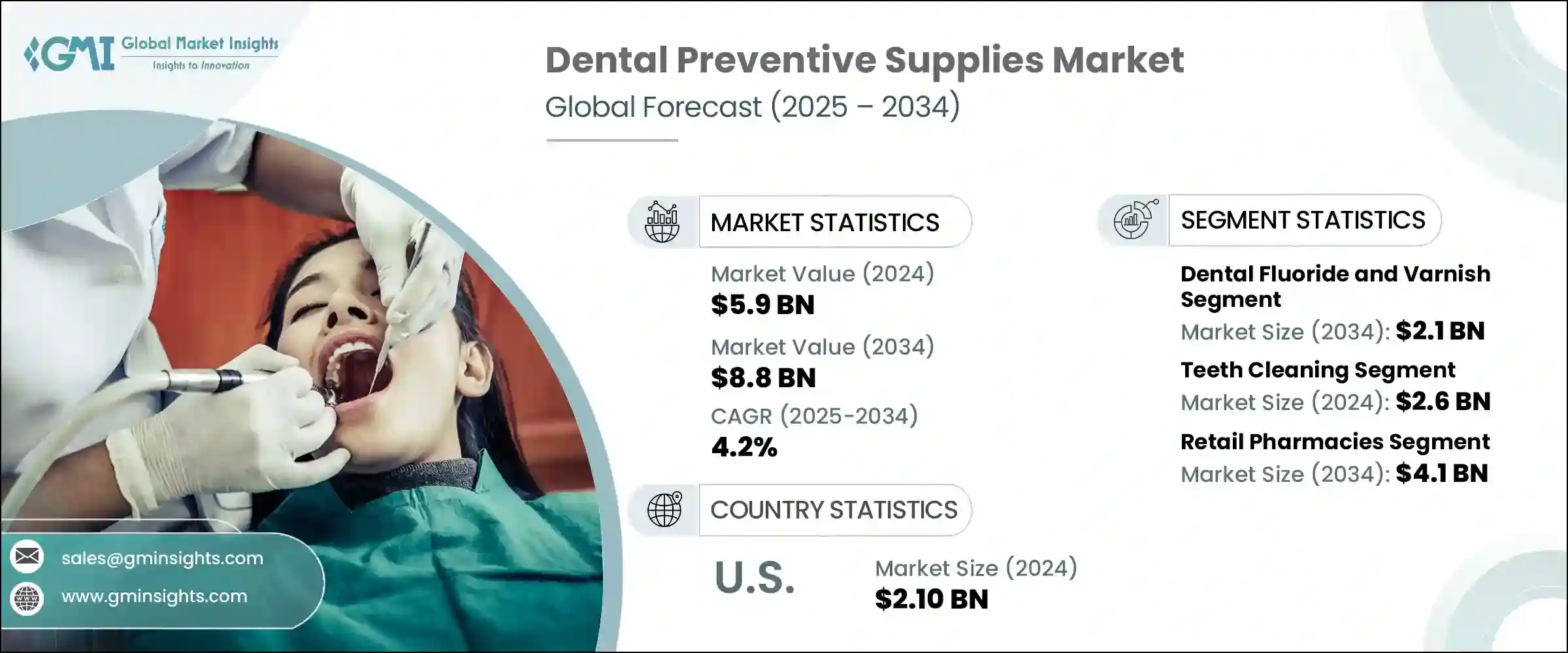

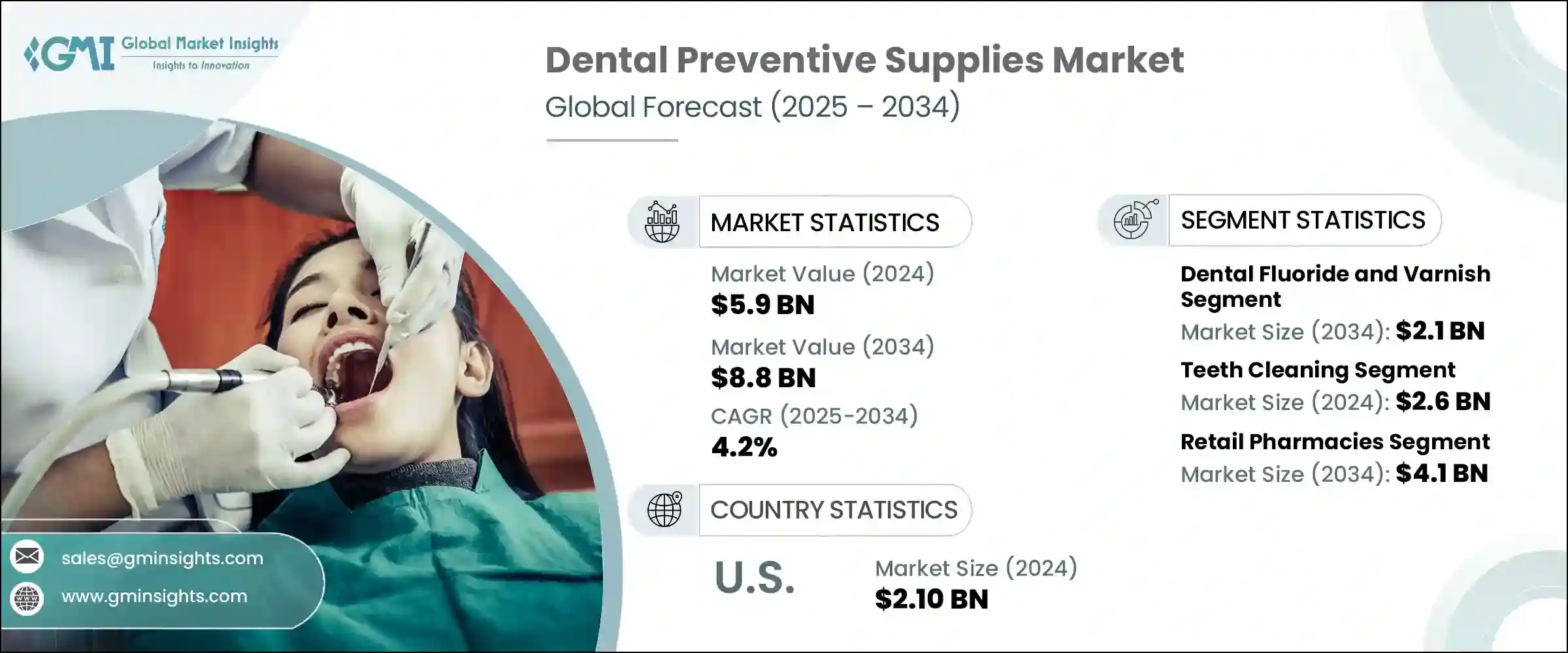

2024年,全球牙科预防用品市场规模达59亿美元,预计到2034年将以4.2%的复合年增长率成长,达到88亿美元。这一增长动力源于牙科疾病发病率的上升、公众口腔健康意识的增强以及牙科预防产品的持续技术创新。随着越来越多人意识到预防的重要性,牙膏、牙线和漱口水等产品正得到更广泛的普及。各国政府和卫生组织大力推广口腔卫生,尤其是透过学校计画和公众意识宣传活动,进一步鼓励了预防用品的使用。牙科预防工具的进步正在彻底改变专业人士和消费者的口腔护理方式,使日常护理更加有效,并更符合个人需求。

牙科预防用品涵盖了各种各样的产品,旨在降低蛀牙和牙龈炎等口腔疾病的风险。这些用品既服务于牙医,也服务于希望保持最佳口腔健康的个人。技术进步在市场扩张中发挥关键作用,创新产品提高了产品的可用性、准确性和便利性。例如,配备感测器、人工智慧和蓝牙连接的智慧牙刷,让使用者可以监测刷牙习惯,并透过即时回馈来改善刷牙技巧,从而将口腔护理转变为更个人化的体验。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 59亿美元 |

| 预测值 | 88亿美元 |

| 复合年增长率 | 4.2% |

预计到2034年,牙科氟化物和珐琅质市场规模将成长至21亿美元,主要得益于全球牙科问题发病率的上升,尤其是儿童和老年人的龋齿和龋齿。高糖摄取、吸烟和不良的口腔卫生习惯等因素显着导致了这些牙科疾病的发病率上升。这反过来又刺激了对氟化物治疗和珐琅质等预防措施的需求,这些措施有助于保护牙齿并减少蛀牙。

2024年,牙齿清洁服务市场规模达26亿美元。这一增长主要得益于公众对预防蛀牙和牙龈炎等口腔疾病重要性的认识不断提高。全球老龄人口的不断增长也进一步推动了这个市场的发展,老龄化人口往往会面临更多的口腔健康问题。因此,对常规专业牙齿清洁服务的需求有所增长,这有助于维护口腔健康并预防进一步的併发症。

2024年,美国牙科预防用品市场规模达21亿美元。这一强劲的市场地位得益于许多训练有素、专注于预防保健的牙科专业人士的支持。此外,美国牙科技术和教育的持续进步也有助于维持市场成长。这些因素使美国成为全球牙科预防用品行业的重要参与者,持续的创新和专业知识不断推动需求和产品开发。

牙科预防用品市场的主要参与者包括高露洁棕榄公司、3M 公司、强生公司、宝洁公司、登士柏西诺德公司、Haleon、Ivoclar Vivadent、Henry Schein 公司、Sunstar Suisse SA、Kerr Corporation、Hu-Friedy Mfg. Co., LLC.、Ultradopd.牙科预防用品领域的领先公司专注于持续创新、扩大产品组合和策略合作伙伴关係,以巩固其市场地位。

研发投入使企业能够推出先进的解决方案,例如智慧牙科设备和基于天然成分的产品,以满足不断变化的消费者偏好。市场领导者也强调地理扩张,进军口腔健康意识快速提升的新兴市场。与牙科专业人士、教育机构和政府健康计画的合作有助于提升产品的采用率和品牌信誉。此外,企业还可以利用数位行销和电商平台直接接触更广泛的受众。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 口腔健康意识不断增强

- 牙齿疾病盛行率不断上升

- 牙科预防用品的技术进步

- 产业陷阱与挑战

- 牙科手术费用高昂

- 牙科保健服务的经济障碍

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 日本

- 中国

- 印度

- 技术格局

- 当前的技术趋势

- 新兴技术

- 未来市场趋势

- 定价分析

- 价值链分析

- 消费者行为分析

- 口腔卫生习惯的改变趋势

- 数位媒体对预防性牙科保健的影响

- 消费者对天然和有机产品的偏好

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 牙科氟化物和清漆

- 牙齿美白和脱敏剂

- 预防性糊剂和粉末

- 密封剂

- 牙线

- 口腔凝胶

- 其他产品类型

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 牙齿清洁

- 牙齿美白

- 牙齿涂层

第七章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 零售药局

- 药局

- 电子商务

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- 3M Company

- Church & Dwight Co.

- Colgate-Palmolive Company

- Dentsply Sirona

- GC International

- Haleon

- Henry Schein

- Hu-Friedy Mfg.

- Ivoclar Vivadent

- Johnson & Johnson

- Kerr Corporation

- Sunstar Suisse

- The Procter & Gamble Company

- Ultradent Products

- Young Innovations

The Global Dental Preventive Supplies Market was valued at USD 5.9 billion in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 8.8 billion by 2034. This growth is fueled by the rising incidence of dental conditions, increasing public awareness about oral health, and continuous technological innovations in dental preventive products. As more people recognize the importance of prevention, products like toothpaste, floss, and mouthwash are seeing broader adoption. Efforts by governments and health organizations promoting oral hygiene, especially through school programs and public awareness campaigns, are further encouraging the use of preventive supplies. Advancements in dental preventive tools are revolutionizing how both professionals and consumers approach oral care, making daily routines more effective and tailored to individual needs.

Dental preventive supplies encompass a wide array of products designed to reduce the risk of oral diseases such as tooth decay and gum inflammation. These supplies serve both dental practitioners and individuals who want to maintain optimal oral health. Technological progress plays a key role in market expansion, with innovative products enhancing usability, accuracy, and convenience. For instance, smart toothbrushes equipped with sensors, artificial intelligence, and Bluetooth connectivity allow users to monitor brushing habits and improve techniques through real-time feedback, transforming oral care into a more personalized experience.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.9 Billion |

| Forecast Value | $8.8 Billion |

| CAGR | 4.2% |

The dental fluoride and varnish segment is projected to grow to USD 2.1 billion by 2034, driven largely by the increasing global incidence of dental issues, especially dental caries and tooth decay among children and older adults. Factors such as high sugar intake, tobacco consumption, and poor oral hygiene habits significantly contribute to the rising prevalence of these dental diseases. This, in turn, fuels the demand for preventive measures like fluoride treatments and varnishes, which help protect teeth and reduce decay.

In 2024, the teeth cleaning services segment generated USD 2.6 billion. This growth is largely due to greater public awareness about the importance of preventing dental conditions such as cavities and gingivitis. The segment is further supported by the expanding aging population worldwide, which tends to experience more oral health problems. As a result, the demand for routine professional teeth cleaning services has increased, helping maintain oral health and prevent further complications.

U.S. Dental Preventive Supplies Market was valued at USD 2.10 billion in 2024. This strong market position is supported by many highly trained dental professionals specializing in preventive care. Additionally, continuous advancements in dental technologies and education across the country help sustain market growth. These factors make the U.S. a vital player in the global dental preventive supplies industry, with ongoing innovation and expertise fueling demand and product development.

Major players operating in the Dental Preventive Supplies Market include Colgate-Palmolive Company, 3M Company, Johnson & Johnson, The Procter & Gamble Company, Dentsply Sirona Inc., Haleon, Ivoclar Vivadent, Henry Schein, Inc., Sunstar Suisse S.A., Kerr Corporation, Hu-Friedy Mfg. Co., LLC., Ultradent Products Inc., Church & Dwight Co., and Young Innovations, Inc. Leading companies in the dental preventive supplies sector focus on continuous innovation, expanding product portfolios, and strategic partnerships to strengthen their market position.

Investment in R&D allows firms to introduce advanced solutions like smart dental devices and natural ingredient-based products that meet evolving consumer preferences. Market leaders also emphasize geographic expansion by entering emerging markets where oral health awareness is growing rapidly. Collaborations with dental professionals, educational institutions, and government health programs help boost product adoption and brand credibility. Additionally, companies leverage digital marketing and e-commerce platforms to reach a wider audience directly.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.2.4 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing oral health awareness

- 3.2.1.2 Increasing prevalence of dental disorders

- 3.2.1.3 Technological advancements in dental preventive supplies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with dental procedures

- 3.2.2.2 Economic barriers to dental care access

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.3.1 Japan

- 3.4.3.2 China

- 3.4.3.3 India

- 3.5 Technological landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Value chain analysis

- 3.9 Consumer behaviour analysis

- 3.9.1 Shifting trends in oral hygiene practices

- 3.9.2 Influence of digital media on preventive dental care

- 3.9.3 Consumer preferences for natural and organic products

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Dental fluorides and varnish

- 5.3 Tooth whitening and desensitizers

- 5.4 Prophylactic pastes and powders

- 5.5 Sealants

- 5.6 Dental floss

- 5.7 Mouth gels

- 5.8 Other product types

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Teeth cleaning

- 6.3 Teeth whitening

- 6.4 Teeth coating

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Retail pharmacies

- 7.3 Drug stores

- 7.4 E-commerce

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3M Company

- 9.2 Church & Dwight Co.

- 9.3 Colgate-Palmolive Company

- 9.4 Dentsply Sirona

- 9.5 GC International

- 9.6 Haleon

- 9.7 Henry Schein

- 9.8 Hu-Friedy Mfg.

- 9.9 Ivoclar Vivadent

- 9.10 Johnson & Johnson

- 9.11 Kerr Corporation

- 9.12 Sunstar Suisse

- 9.13 The Procter & Gamble Company

- 9.14 Ultradent Products

- 9.15 Young Innovations