|

市场调查报告书

商品编码

1773248

孕妇用品市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Maternity Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

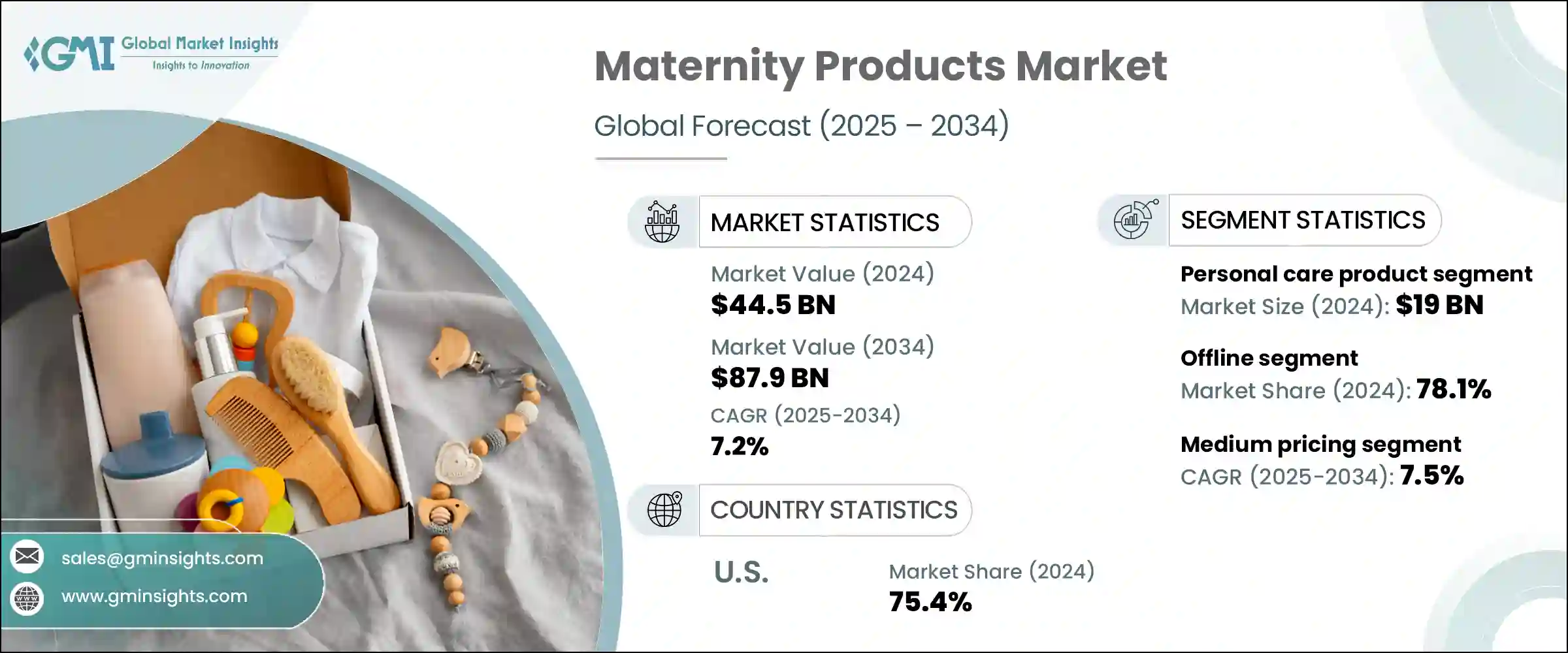

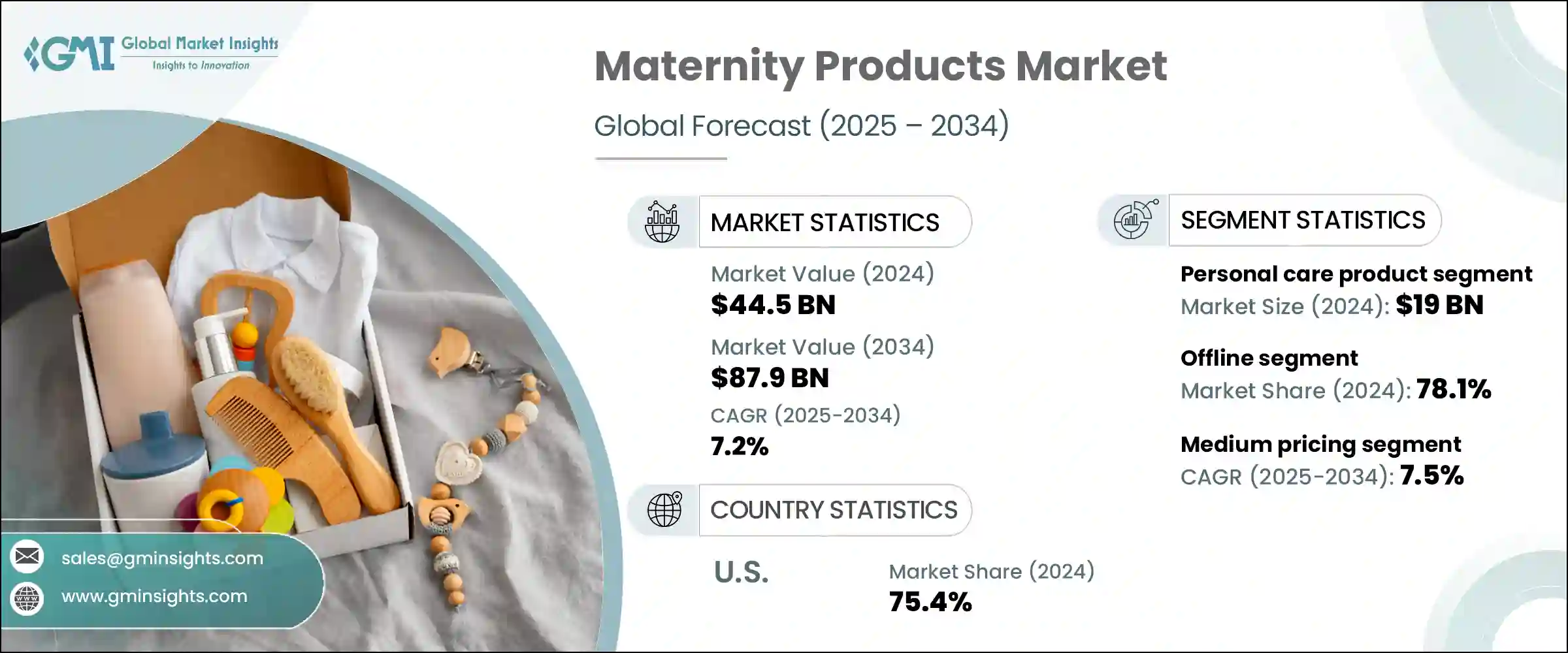

2024年,全球孕产妇用品市场规模达445亿美元,预计到2034年将以7.2%的复合年增长率成长,达到879亿美元。受家长对孕产妇健康意识不断提升的推动,该市场正呈现强劲成长动能。受医疗保健服务覆盖范围的扩大、消费者期望的不断变化以及政府扶持政策的影响,孕产妇保健方式正在发生显着转变。主要成长因素之一是消费者越来越关注怀孕及孕后身心健康。孕产妇护理领域的技术整合正在加速成长,数位工具可提供个人化的健康追踪、饮食计划和活动建议。

透过远距医疗服务进行的远距咨询也提高了孕产妇护理的可近性。各国政府和卫生组织正在推广数位化孕产妇解决方案,以弥补现有的护理缺口。随着全球可支配收入的成长,父母更倾向于投资先进、舒适、安全的孕产妇用品。线上零售平台的激增也改变了孕产妇护理的可近性和便利性。凭藉更高的隐私性、更广泛的产品选择以及货比三家的优势,电子商务持续吸引那些精通科技的现代父母,他们正在寻找高品质的解决方案来支持孕产之旅。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 445亿美元 |

| 预测值 | 879亿美元 |

| 复合年增长率 | 7.2% |

2024年,个人护理产品产值达190亿美元,预计到2034年复合年增长率将达到7.4%。这些产品在全球市场占据主导地位,这主要得益于怀孕和产后女性对护肤和健康的意识日益增强。皮肤刺激、色素沉淀和妊娠纹等问题促使人们对各种解决方案的需求不断增长,包括乳霜、凝胶和有机护肤品系列。女性劳动参与率的提高,以及对天然、安全和高性能产品的偏好,持续推动这一领域的成长。母亲们更注重便利性和有效性,这促使消费者转向值得信赖且注重环保的品牌。

线下零售通路在2024年占据了78.1%的市场份额,预计在2025-2034年期间将维持7.1%的复合年增长率。实体零售店占据主导地位,因为它们提供亲手操作的产品评估。孕妇消费者更喜欢在购买前触摸、测试和评估商品,尤其是在舒适度、合身度、品质和尺寸方面。销售人员根据顾客的个人需求进行引导,从而提升了价值,从而改善了购物体验并建立了品牌信任。线下模式也支援更有针对性的产品比较,尤其是在购买穿戴式装置、健康设备或护肤品时。

2024年,美国孕产妇用品市场占据75.4%的市场份额,预计在2025-2034年期间将以7.1%的复合年增长率成长。美国消费者高度关注孕产妇健康,并将安全性和创新性放在首位。职业母亲数量的增加和收入水准的提高,促使消费者在优质孕产妇用品上的支出增加。此外,专注于永续和科技驱动创新的产品开发正日益受到消费者的青睐。市场的成熟和健康增强技术的快速普及,使美国继续在该领域保持领先地位。

全球孕妇用品市场的领先公司包括 Gap、Motherhood、H&M Mama、Seraphine、JoJo Maman Bebe、A Pea in the Pod、PinkBlush、HATCH、Old Navy、Cake、Frida、ASOS、Destination、Isabella Oliver 和 The Moms Co. 孕妇用品用品、行业的公司正专注于创新、产业品质和全企业战略,扩大其行业的公司正专注于创新、行业的企业和全企业战略,扩大其行业的公司正专注于创新、行业的企业和全企业战略,扩大其行业的公司正专注于创新、行业的企业和全企业战略,扩大其行业的公司正专注于创新、行业的企业和全企业战略,扩大其行业的公司正专注于创新、行业的企业和全企业战略,扩大其行业的公司正专注于创新、行业的企业和全企业战略。许多品牌正在增强其数位店面并优化电子商务管道,以满足对便利、谨慎购物体验日益增长的需求。产品组合正在多样化,包括有机、经皮肤病学测试和永续性认证的产品,以满足注重健康的消费者群体。与医疗保健专业人士和有影响力人士的合作有助于提升品牌信誉和消费者参与。透过个人化咨询服务和精心策划的展示,店内体验正在改善。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- MEA

- 拉丁美洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 孕妇服装

- 个人护理产品

- 营养补充品

- 孕妇配件

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 怀孕

- 产后

第七章:市场估计与预测:依定价,2021 年至 2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第八章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 网上销售

- 电子商务

- 公司网站

- 线下销售

- 批发/分销商

- 大卖场/超市

- 专卖店

- 其他(多品牌店等)

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十章:公司简介

- A Pea in the Pod

- ASOS

- Cake

- Destination

- Frida

- Gap

- H&M Mama

- Hatch

- Isabella Oliver

- JoJo Maman Bebe

- Motherhood

- Old Navy

- Pink Blush

- Seraphine

- The Moms Co.

The Global Maternity Products Market was valued at USD 44.5 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 87.9 billion by 2034. The market is experiencing strong momentum, driven by rising awareness among parents regarding maternal wellness. There's a notable shift in how maternal health is approached, influenced by better healthcare access, evolving consumer expectations, and supportive government policies. One of the primary growth factors is increased consumer focus on both mental and physical health during and after pregnancy. Technology integration in maternal care is accelerating growth, with digital tools providing personalized health tracking, diet planning, and activity recommendations.

Remote consultations through telehealth services are also improving maternity care accessibility. Governments and health organizations are promoting digital maternal solutions to address existing care gaps. As disposable incomes rise globally, parents are more inclined to invest in advanced, comfortable, and safe maternity products. The surge in online retail platforms has also transformed accessibility and convenience. With greater privacy, wider product choices, and the ability to compare offerings, e-commerce continues to attract modern, tech-savvy parents who are looking for quality solutions to support the motherhood journey.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $44.5 Billion |

| Forecast Value | $87.9 Billion |

| CAGR | 7.2% |

In 2024, personal care products generated USD 19 billion and are forecasted to grow at a CAGR of 7.4% by 2034. These items dominate the global market, largely due to growing awareness of skincare and wellness among pregnant and postpartum women. Concerns such as skin irritation, pigmentation, and stretch marks are prompting demand for a broad spectrum of solutions, including creams, gels, and organic skincare lines. Increasing participation of women in the workforce, along with a preference for natural, safe, and high-performing products, continues to fuel growth in this segment. Mothers are prioritizing both convenience and effectiveness, supporting a shift toward trusted and eco-conscious brands.

The offline retail channels segment accounted for 78.1% share in 2024 and is projected to maintain a CAGR of 7.1% during 2025-2034. Physical retail stores hold a dominant position because they offer hands-on product assessment. Pregnant consumers prefer the opportunity to touch, test, and evaluate items before making a purchase-particularly when it comes to comfort, fit, quality, and size. Sales personnel add value by guiding customers based on their individual needs, which improves the shopping experience and builds brand trust. Offline formats also support a more curated product comparison, especially when purchasing wearables, health devices, or skin care solutions.

United States Maternity Products Market held 75.4% share in 2024 and is on track to grow at a CAGR of 7.1% during 2025-2034. Consumers in the US are highly attuned to maternal health and prioritize both safety and innovation. An increase in working mothers and rising income levels are contributing to greater spending on premium-quality maternity products. Additionally, product development focused on sustainable and tech-driven innovations is gaining strong consumer interest. The market's maturity and fast adoption of health-enhancing technologies continue to position the US as a leader in this space.

Leading companies in the Global Maternity Products Market include Gap, Motherhood, H&M Mama, Seraphine, JoJo Maman Bebe, A Pea in the Pod, PinkBlush, HATCH, Old Navy, Cake, Frida, ASOS, Destination, Isabella Oliver, and The Moms Co. Companies in the maternity products industry are focusing on innovation, quality, and omnichannel retail strategies to expand their presence. Many brands are enhancing their digital storefronts and optimizing e-commerce channels to meet rising demand for convenient, discreet shopping experiences. Product portfolios are being diversified with organic, dermatologically tested, and sustainability-certified offerings to cater to the health-conscious consumer base. Collaborations with healthcare professionals and influencers help boost brand credibility and consumer engagement. In-store experiences are being improved through personalized consultation services and curated displays.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.2.4 Pricing

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behaviour analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behaviour

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 – 2034, (USD Billion)(Thousand Units)

- 5.1 Key trends

- 5.2 Maternal apparel

- 5.3 Personal care products

- 5.4 Nutritional supplements

- 5.5 Maternity accessories

Chapter 6 Market Estimates & Forecast, By Application, 2021 – 2034, (USD Billion)(Thousand Units)

- 6.1 Key trends

- 6.2 Pregnancy

- 6.3 Postnatal

Chapter 7 Market Estimates & Forecast, By Pricing, 2021 – 2034, (USD Billion)(Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion)(Thousand Units)

- 8.1 Key trends

- 8.2 Online sales

- 8.2.1 E-commerce

- 8.2.2 Company website

- 8.3 Offline sales

- 8.3.1 Wholesales/distributors

- 8.3.2 Hypermarkets/supermarkets

- 8.3.3 Specialty stores

- 8.3.4 Others(multi-brand stores, etc.)

Chapter 9 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion)(Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 A Pea in the Pod

- 10.2 ASOS

- 10.3 Cake

- 10.4 Destination

- 10.5 Frida

- 10.6 Gap

- 10.7 H&M Mama

- 10.8 Hatch

- 10.9 Isabella Oliver

- 10.10 JoJo Maman Bebe

- 10.11 Motherhood

- 10.12 Old Navy

- 10.13 Pink Blush

- 10.14 Seraphine

- 10.15 The Moms Co.