|

市场调查报告书

商品编码

1773256

垂直升降模组 (VLM) 市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Vertical Lift Module (VLM) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

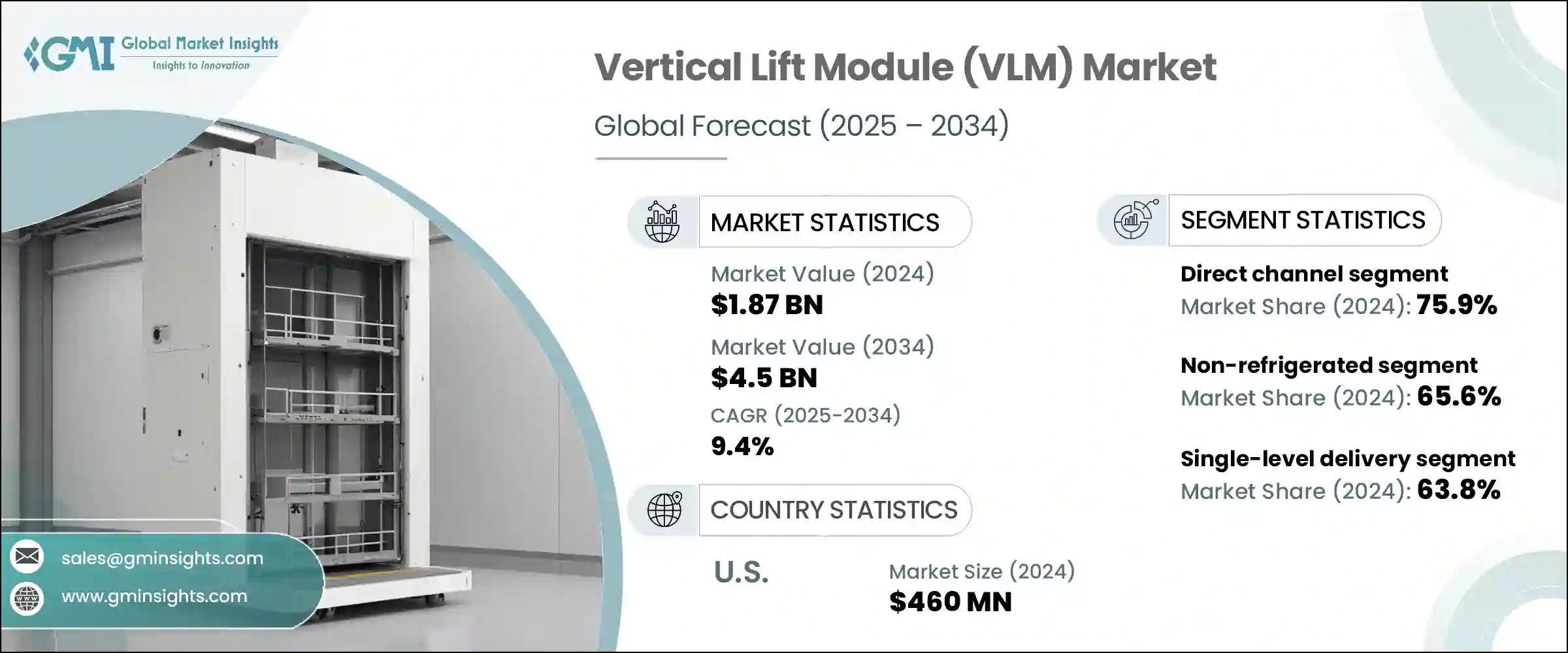

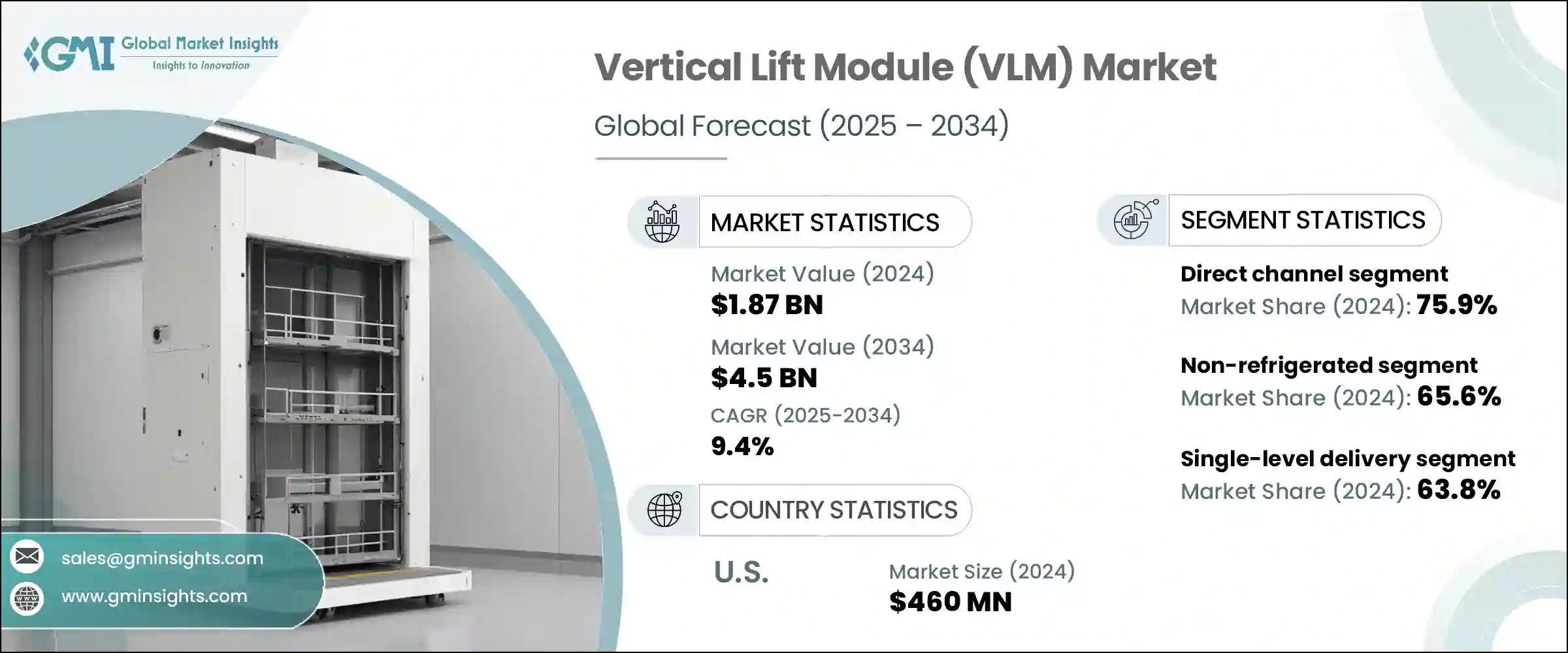

2024年,全球垂直升降模组 (VLM) 市场规模达18.7亿美元,预计到2034年将以9.4%的复合年增长率成长,达到45亿美元。随着各行各业日益寻求高效、节省空间的储存和检索解决方案,该市场正呈现强劲成长动能。汽车、製药和电子商务等行业正在迅速采用VLM来增强库存管理,简化拣选流程,并提高整体生产力。紧凑型高速储存的需求正在激增,尤其是在智慧仓储实践的兴起之下。 VLM有助于提高订单准确性,减少对人工的依赖,这与全球向自动化和精益製造转型的趋势相契合。

企业正致力于建构配备先进软体、即时追踪和非接触式介面的系统,使其适用于工业4.0环境。日益增长的城市化和有限的仓库空间也推动了对垂直储存系统的需求。垂直升降模组 (VLM) 技术的最新进展更加重视环境责任。製造商正在引入节能马达和再生驱动系统,以便在运行过程中回收能量,从而降低整体功耗。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 18.7亿美元 |

| 预测值 | 45亿美元 |

| 复合年增长率 | 9.4% |

采用模组化结构可实现可扩充安装,最大程度减少浪费,同时使用轻质可回收材料也符合循环经济原则。许多 VLM 现在整合了智慧电源管理系统,可根据需求自动调整能源使用,进一步提升永续性。这些创新不仅有助于企业实现绿色目标,也符合全球减少工业碳足迹的目标,使 VLM 成为追求营运和生态效率的现代仓库和智慧製造环境的首选。

2024年,非冷藏型VLM市场占65.6%的市场份额,预计到2034年将以8.7%的复合年增长率成长。这类系统之所以占据主导地位,是因为其在汽车、电子和工业製造等无需气候控制环境的产业中得到了广泛的应用。由于配置更简单且无需冷却装置,这类系统更易于部署和维护。它们也对基础设施预算有限的公司具有吸引力,同时营运和能源成本也更低。

单层配送式VLM在2024年占63.8%的市场份额,预计2025年至2034年的复合年增长率将达到8.9%。各行各业的企业都青睐这种设计,因为它符合人体工学设计,而且操作简单。操作员受益于以恆定高度配送物品,从而减轻身体负担并提高工作流程效率。这些设备几乎不需要培训,是员工流动频繁的设施的理想选择。中小企业尤其重视其经济实惠和可扩展性,这使得它们非常适合快节奏、高吞吐量且需要可靠性的环境。

美国垂直升降模组 (VLM) 市场占 87.3% 的市场份额,2024 年市场规模达 4.6 亿美元。美国凭藉其先进的工业基础设施以及在製造和仓储领域大力推行自动化,在该领域占据主导地位。空间优化和营运效率是该地区企业关注的重点,尤其是在劳动成本不断上涨的背景下。自动化投资、政府对智慧製造的激励措施以及成熟的解决方案提供商网络,都有助于该地区在 VLM 应用方面占据领先地位。

推动全球垂直升降模组 (VLM) 市场发展的公司包括 AutoCrib、卡迪斯 (Kardex)、Vidmar、Modula GROUP、Weland Solutions、Vidir Solutions, Inc.、ICAM SpA、SSI SCHAFER、Rabatex Group、ELF Automation、Hanel Buro、Ferret SplingA、Conveyor Handto Company、LISTA 和 LISTA、LIA、Convey领先的 VLM 製造商正在实施一系列策略性倡议,以扩大其市场影响力。他们透过整合基于人工智慧的库存优化、非接触式操作和基于云端的系统诊断,不断创新产品线。

企业也正在与电商和物流企业合作,开发客製化的仓储解决方案。研发投资优先用于提升系统模组化、降低能耗和提高吞吐量。许多企业正在透过在关键市场建立在地化生产和支援设施来扩大其全球影响力。客製化服务和灵活的租赁模式有助于满足中小企业的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 仓库自动化需求不断成长

- 工业环境中的空间优化

- 与工业4.0技术的融合

- 产业陷阱与挑战

- 初期投资及维护成本高

- 技术复杂性和客製化问题

- 机会

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依储存类型

- 监理框架

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 贸易统计数据

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按储存类型,2021 - 2034 年(百万美元)

- 温控/冷藏

- 非冷藏

第六章:市场估计与预测:按交付类型,2021 - 2034 年(百万美元)

- 单级交付

- 双层交付

第七章:市场估计与预测:按装载量,2021 - 2034 年(百万美元)

- 每托盘最多 500 公斤

- 每托盘500至700公斤

- 每托盘700公斤以上

第八章:市场估计与预测:按最终用途,2021 - 2034 年(百万美元)

- 汽车

- 食品和饮料

- 零售、仓储和物流

- 金属和机械

- 化学

- 其他(医疗保健、航空等)

第九章:市场估计与预测:按配销通路,2021 - 2034 年(百万美元)

- 直销

- 间接销售

第 10 章:市场估计与预测:按地区,2021 年至 2034 年(百万美元)

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- AutoCrib

- Conveyor Handling Company

- ELF Automation

- Ferretto SpA

- Hanel Buro

- ICAM SpA

- Kardex

- LISTA

- Mecalux, SA

- Modula GROUP

- Rabatex Group

- SSI SCHAFER

- Vidir Solutions, Inc.

- Vidmar

- Weland Solutions

The Global Vertical Lift Module (VLM) Market was valued at USD 1.87 billion in 2024 and is estimated to grow at a CAGR of 9.4% to reach USD 4.5 billion by 2034. The market is seeing robust growth as industries increasingly seek efficient, space-saving storage and retrieval solutions. Sectors such as automotive, pharmaceuticals, and e-commerce are rapidly embracing VLMs to enhance inventory management, streamline picking operations, and boost overall productivity. The demand for compact and high-speed storage is surging, particularly with the rise of smart warehousing practices. VLMs contribute to improved order accuracy and reduced reliance on manual labor, aligning with global shifts toward automation and lean manufacturing.

Companies are focusing on building systems equipped with advanced software, real-time tracking, and contactless interfaces, making them suitable for Industry 4.0 environments. Growing urbanization and limited warehouse space are also driving demand for vertical storage systems. Recent advancements in vertical lift module (VLM) technology are placing a strong emphasis on environmental responsibility. Manufacturers are introducing energy-efficient motors and regenerative drive systems that recover energy during operation, reducing overall power consumption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.87 Billion |

| Forecast Value | $4.5 Billion |

| CAGR | 9.4% |

The adoption of modular construction allows for scalable installations with minimal waste, while the use of lightweight, recyclable materials supports circular economy principles. Many VLMs now integrate intelligent power management systems that automatically adjust energy usage based on demand, further improving sustainability. These innovations not only help businesses meet their green targets but also align with global goals for reducing industrial carbon footprints, making VLMs a preferred choice in modern warehouses and smart manufacturing environments aiming for operational and ecological efficiency.

In 2024, the non-refrigerated VLMs segment accounted for a 65.6% share and is anticipated to grow at a CAGR of 8.7% through 2034. Their dominance stems from widespread use in sectors like automotive, electronics, and industrial manufacturing, where climate-controlled environments are not required. These systems are easier to deploy and maintain due to their simpler configuration and absence of cooling units. They also appeal to companies with limited infrastructure budgets while offering lower operating and energy costs.

The single-level delivery VLM segment held a 63.8% share in 2024 and is expected to grow at a CAGR of 8.9% from 2025 to 2034. Businesses across industries prefer this design for its ergonomic design and ease of use. Operators benefit from items being delivered at a consistent height, reducing physical strain and improving workflow efficiency. These units require minimal training and are ideal for facilities with frequent staff turnover. Small and mid-size enterprises are especially drawn to their affordability and scalability, making them suitable for fast-paced, high-throughput environments that demand reliability.

United States Vertical Lift Module (VLM) Market held an 87.3% share, generating USD 460 million in 2024. The U.S. dominates the space due to its advanced industrial infrastructure and strong embrace of automation in manufacturing and warehousing. Space optimization and operational efficiency are top priorities for regional players, especially given rising labor costs. Investments in automation, government incentives for smart manufacturing, and a mature network of solution providers all contribute to the region's leadership in VLM adoption.

Companies driving the Global Vertical Lift Module (VLM) Market include AutoCrib, Kardex, Vidmar, Modula GROUP, Weland Solutions, Vidir Solutions, Inc., ICAM S.p.A., SSI SCHAFER, Rabatex Group, ELF Automation, Hanel Buro, Ferretto SpA, Conveyor Handling Company, LISTA, and Mecalux, S.A. Leading VLM manufacturers are implementing a range of strategic actions to expand their market footprint. They are consistently innovating product lines by integrating AI-based inventory optimization, touchless operations, and cloud-based system diagnostics.

Companies are also forming collaborations with e-commerce and logistics players to develop tailored storage solutions. R&D investments are being prioritized to improve system modularity, reduce energy consumption, and boost throughput. Many players are expanding their global footprint by establishing localized production and support facilities in key markets. Customization offerings and flexible leasing models help address the needs of small and medium-sized businesses.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collections methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 By storage type

- 2.2.2 By delivery type

- 2.2.3 By loading capacity

- 2.2.4 By End use

- 2.2.5 By Distribution channel

- 2.2.6 By region

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for warehouse automation

- 3.2.1.2 Space optimization in industrial settings

- 3.2.1.3 Integration with Industry 4.0 technologies

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and maintenance costs

- 3.2.2.2 Technical complexity and customization issues

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By storage type

- 3.7 Regulatory framework

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger & acquisitions

- 4.6.2 Partnership & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Storage Type, 2021 - 2034 ($Mn) (Thousand Units)

- 5.1 Temperature controlled/refrigerated

- 5.2 Non-refrigerated

Chapter 6 Market Estimates & Forecast, By Delivery Type, 2021 - 2034 ($Mn) (Thousand Units)

- 6.1 Single-level delivery

- 6.2 Dual-level delivery

Chapter 7 Market Estimates & Forecast, By Loading Capacity, 2021 - 2034 ($Mn) (Thousand Units)

- 7.1 Up to 500 kg per tray

- 7.2 500 to 700 kg per tray

- 7.3 Above 700 kg per tray

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn) (Thousand Units)

- 8.1 Automotive

- 8.2 Food & beverage

- 8.3 Retail, warehouse & logistics

- 8.4 Metals & machinery

- 8.5 Chemical

- 8.6 Others (healthcare, aviation, etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Mn) (Thousand Units)

- 9.1 Direct sales

- 9.2 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 AutoCrib

- 11.2 Conveyor Handling Company

- 11.3 ELF Automation

- 11.4 Ferretto SpA

- 11.5 Hanel Buro

- 11.6 ICAM S.p.A.

- 11.7 Kardex

- 11.8 LISTA

- 11.9 Mecalux, S.A.

- 11.10 Modula GROUP

- 11.11 Rabatex Group

- 11.12 SSI SCHAFER

- 11.13 Vidir Solutions, Inc.

- 11.14 Vidmar

- 11.15 Weland Solutions