|

市场调查报告书

商品编码

1773264

内视镜市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Endoscopy Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

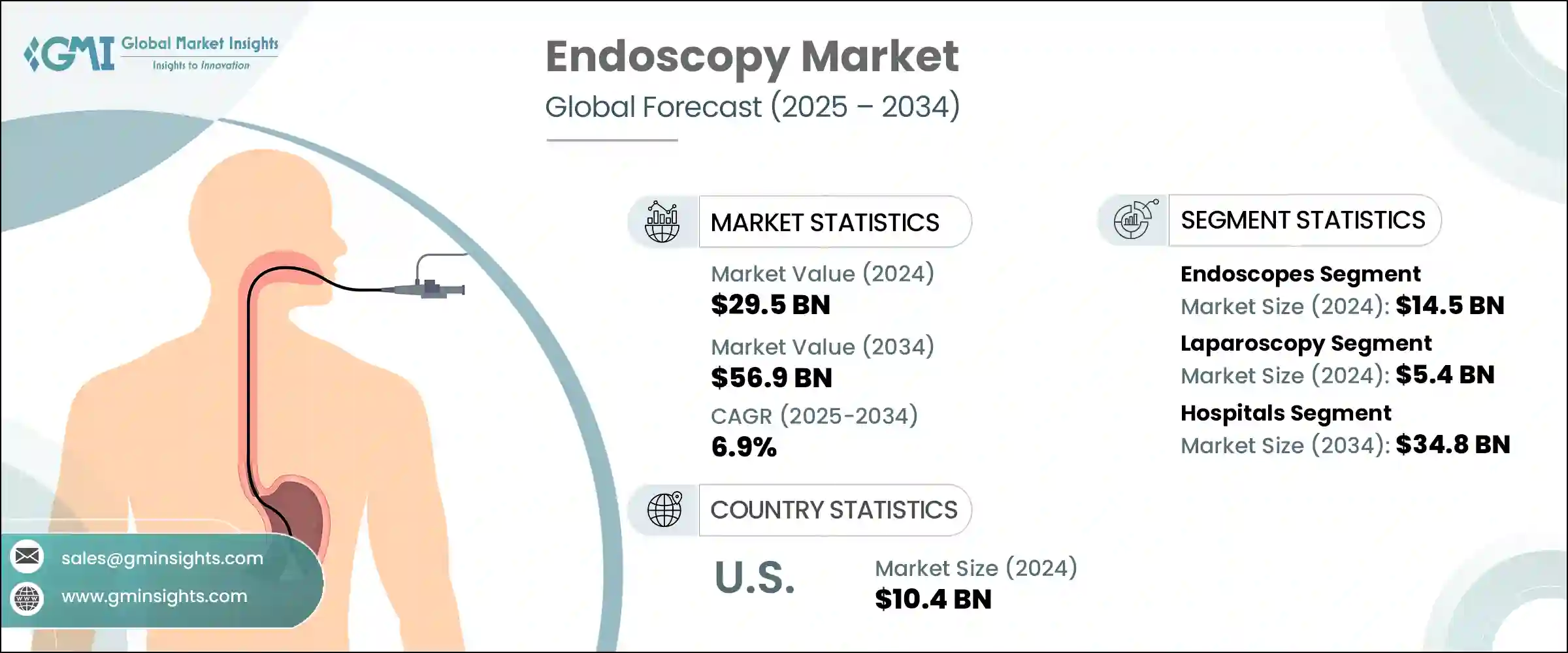

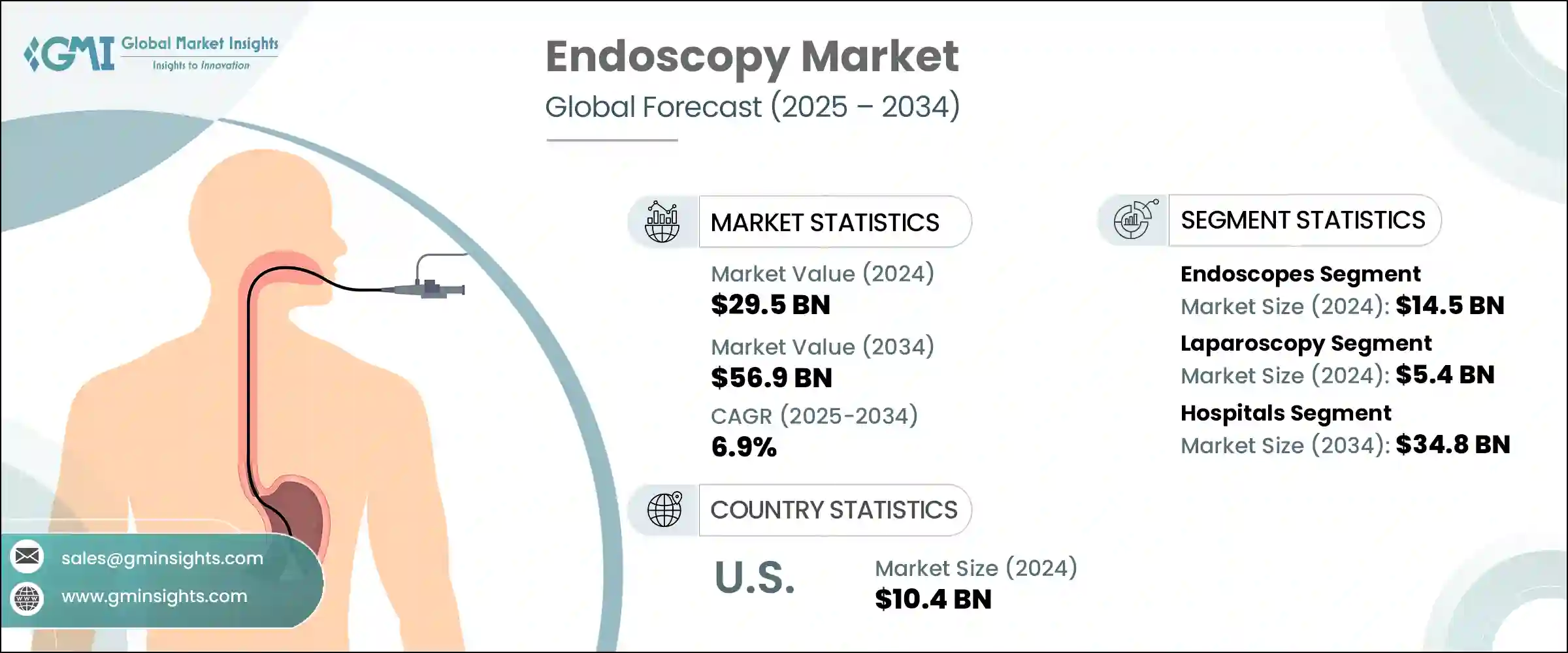

2024 年全球内视镜市场价值为 295 亿美元,预计到 2034 年将以 6.9% 的复合年增长率增长至 569 亿美元。市场成长受到医学进步、医疗保健重点变化和全球疾病负担增加等多种因素的影响。对微创治疗方案的需求不断增长,以及内视镜在诊断和治疗目的中的使用率增加,大大促进了市场扩张。由于医疗支出不断增长、人口老化以及全球慢性病和胃肠道疾病发病率上升,市场正呈现持续成长动能。此外,向早期诊断的转变和对预防保健的日益重视,导致公共和私人医疗机构都更多地采用内视镜检查程序。全球医疗保健系统都在投资先进的内视镜技术,以支持准确的诊断、更快的患者康復和降低住院费用。

2024年,内视镜市场占最高份额,收入达145亿美元。由于视觉清晰度、可操作性以及机器人和人工智慧等智慧功能的集成,对高性能成像和手术工具的需求持续增长。这些技术进步正在改变医生进行内部检查的方式,使诊断更快、更精准。如今,紧凑、灵活、轻便的内视镜更受专科医生的青睐,因为它们可以触及以前难以触及的解剖区域。增强的可用性、减少的患者不适感以及卓越的临床效果,正在巩固内视镜在常规诊疗中的地位。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 295亿美元 |

| 预测值 | 569亿美元 |

| 复合年增长率 | 6.9% |

另一个因素是,人们越来越倾向于使用一次性内视镜工具,这些工具在门诊和门诊环境中越来越受欢迎。这些设备有助于降低感染风险,并无需复杂的灭菌过程。尤其值得一提的是,一次性内视镜因其成本效益高,并且能够提高患者和医生的安全性,在支气管镜检查和泌尿外科领域越来越受欢迎。

全球癌症负担日益加重,尤其是胃肠道癌症和大肠癌,推动了对内视镜手术的需求,使其成为检测、监测和治疗的第一线解决方案。内视镜技术广泛用于肿瘤切除、切片采集和病情追踪。随着人们对早期癌症诊断益处的认识不断加深,对先进内视镜解决方案的需求持续激增。

在众多应用中,腹腔镜检查的市值在2024年达到54亿美元,预计在2025年至2034年期间的复合年增长率将达到6.5%。腹腔镜等微创技术因其住院时间短、手术创伤小、恢復期快等优势,正获得更广泛的认可。从胆囊切除术到减重手术,患者和外科医生都明显倾向于采用这些方法。随着全球肥胖率的上升,减重手术的数量也在增加,这进一步刺激了对腹腔镜器械的需求。随着越来越多的从业者透过模拟程序以及与设备製造商的合作接受腹腔镜培训,熟练专业人员的供应量正在提高,这进一步推动了全球范围内的腹腔镜应用。

就最终用户而言,医院在2024年占据主导地位,预计到2034年将达到348亿美元。医院越来越多地配备最先进的内视镜系统,以满足日益增长的诊断和外科手术需求。这些机构受益于政策激励和保险覆盖,这些政策和保险覆盖促进了内视镜在早期疾病检测中的应用,尤其是在胃肠道和癌症筛检中。医院不断升级其基础设施,以改善患者治疗效果,同时优化营运成本。内视镜检查可以减少长期住院的需求,这与此目标高度契合。对员工培训和技术更新的投资确保医院在适应内视镜检查最新发展的同时,保持高标准的护理。

美国内视镜市场持续成长,从2021年的92亿美元成长至2024年的104亿美元。预计2025年至2034年期间的复合年增长率将达到6.1%。慢性病的高发生率以及对精准诊断工具的需求是推动这一增长的主要动力。越来越多的患者被诊断出患有胃肠道疾病,这促使人们需要更先进、侵入性更低的解决方案。随着医疗保健提供者寻求在保持成本效益的同时改善手术效果,美国市场也在不断发展。

竞争格局由创新、合作伙伴关係和产品多元化决定。史赛克公司、奥林巴斯公司、波士顿科学公司、卡尔史托斯公司和美敦力公司等公司占了约42%-45%的市场。这些产业领导者正在积极投资整合人工智慧、机器人技术和先进影像技术的下一代内视镜平台,以提升临床表现。策略合作与收购仍然是扩大全球影响力、巩固其在不断发展的医疗器材领域地位的关键策略。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 全球老年人口不断增长

- 引进技术先进的内视镜

- 胃肠道疾病、癌症和其他慢性疾病发生率上升

- 微创手术的需求不断增加

- 产业陷阱与挑战

- 发展中国家缺乏熟练的医生和内视镜医师

- 市场机会

- 一次内视镜需求不断成长

- 整合人工智慧和资料分析激增

- 成长动力

- 成长潜力分析

- 监管格局

- 我们

- 欧洲

- 报销场景

- 波特的分析

- PESTEL分析

- 差距分析

- 价值链分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 消费者行为分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 按地区

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 内视镜

- 硬内视镜

- 柔性内视镜

- 胶囊内视镜

- 可视化系统

- 内视镜超音波

- 气腹机

- 其他产品

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 腹腔镜检查

- 胃肠内视镜检查

- 胃镜

- 大肠镜检查

- 乙状结肠镜检查

- 十二指肠镜检查

- 其他胃肠内视镜检查

- 关节镜检查

- 耳鼻喉内视镜检查

- 肺内视镜检查

- 妇产科

- 其他应用

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 其他最终用途

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- B Braun

- Boston Scientific

- CONMED

- COOK MEDICAL

- FUJIFILM

- HOYA

- INTUITIVE

- Johnson & Johnson

- KARL STORZ

- Medtronic

- OLYMPUS

- RICHARD WOLF

- Smith & Nephew

- Stryker

The Global Endoscopy Market was valued at USD 29.5 billion in 2024 and is estimated to grow at a CAGR of 6.9% to reach USD 56.9 billion by 2034. Market growth is being shaped by a combination of medical advancements, changing healthcare priorities, and rising disease burdens across the globe. The rising demand for less invasive treatment options and increased utilization of endoscopy for both diagnostic and therapeutic purposes are contributing significantly to market expansion. The market is witnessing consistent momentum due to growing healthcare spending, aging populations, and the rising incidence of chronic and gastrointestinal illnesses worldwide. Moreover, a shift toward early diagnosis and the growing focus on preventive care have led to higher adoption of endoscopic procedures in both public and private healthcare settings. Healthcare systems across the globe are investing in advanced endoscopic technologies that support accurate diagnostics, faster patient recovery, and lower hospitalization costs.

In 2024, the endoscopes segment accounted for the highest market share, generating USD 14.5 billion in revenue. The demand for high-performance imaging and procedural tools continues to accelerate, driven by improvements in visual clarity, maneuverability, and integration of smart features like robotics and AI. These technological advancements are transforming how physicians perform internal examinations, enabling quicker and more precise diagnoses. Compact, flexible, and lightweight endoscopes are now preferred by specialists for reaching anatomical areas that were previously inaccessible. Enhanced usability, reduced patient discomfort, and superior clinical outcomes are strengthening the position of endoscopes in routine practice.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.5 Billion |

| Forecast Value | $56.9 Billion |

| CAGR | 6.9% |

Another contributing factor is the growing preference for single-use and disposable endoscopic tools, which are becoming popular in outpatient and ambulatory settings. These devices help limit the risk of infection and eliminate the need for complex sterilization processes. Single-use endoscopes, in particular, are gaining traction in bronchoscopy and urology due to their cost-efficiency and ability to improve safety for both patients and practitioners.

The rising global burden of cancer, particularly gastrointestinal and colorectal cancers, is driving the need for endoscopic procedures as a frontline solution for detection, monitoring, and treatment. Endoscopic techniques are widely used for tumor removal, biopsy collection, and condition tracking. As awareness about the benefits of early cancer diagnosis grows, the demand for advanced endoscopy solutions continues to surge.

Among the various applications, laparoscopy held a market value of USD 5.4 billion in 2024 and is projected to grow at a CAGR of 6.5% between 2025 and 2034. Minimally invasive techniques like laparoscopy are gaining broader acceptance due to their association with shorter hospital stays, lower surgical trauma, and faster recovery periods. Patients and surgeons alike are showing a clear preference for these approaches in procedures ranging from gallbladder removal to bariatric surgeries. With the increasing rate of obesity worldwide, the number of weight-loss surgeries is rising, further supporting the demand for laparoscopic instruments. As more practitioners receive training in laparoscopy through simulation programs and partnerships with device manufacturers, the availability of skilled professionals is improving, which further drives adoption on a global scale.

In terms of end users, hospitals held the dominant position in 2024 and are projected to reach USD 34.8 billion by 2034. Hospitals are increasingly equipped with state-of-the-art endoscopic systems to meet the rising demand for diagnostics and surgical procedures. These institutions benefit from policy incentives and insurance coverage that promote the adoption of endoscopy for early disease detection, especially in cases of gastrointestinal and cancer screenings. Hospitals are continuously upgrading their infrastructure to enhance patient outcomes while optimizing operational costs. Endoscopy procedures, which reduce the need for extended hospital stays, align well with this objective. Investments in staff training and technology updates ensure that hospitals maintain high standards of care while adapting to the latest developments in endoscopic procedures.

The endoscopy market in the United States has shown consistent growth, rising from USD 9.2 billion in 2021 to USD 10.4 billion in 2024. It is expected to grow at a CAGR of 6.1% from 2025 to 2034. The high prevalence of chronic diseases and the need for precise diagnostic tools are major drivers behind this growth. An increasing number of patients are being diagnosed with gastrointestinal disorders, prompting the need for more advanced and less invasive solutions. The U.S. market continues to evolve as healthcare providers seek to improve procedural outcomes while maintaining cost efficiency.

The competitive landscape is defined by innovation, partnerships, and product diversification. Companies like Stryker Corporation, Olympus Corporation, Boston Scientific, Karl Storz, and Medtronic command approximately 42%-45% of the market share. These industry leaders are actively investing in next-gen endoscopic platforms that integrate AI, robotics, and advanced imaging to elevate clinical performance. Strategic collaborations and acquisitions remain key tactics for broadening global reach and strengthening their position in the evolving medical device landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing geriatric population globally

- 3.2.1.2 Introduction of technologically advanced endoscopes

- 3.2.1.3 Rising incidences of gastrointestinal disorders, cancer and other chronic conditions

- 3.2.1.4 Increasing demand for minimally invasive procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Dearth of skilled physicians and endoscopists in developing countries

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for disposable or single-use endoscopes

- 3.2.3.2 Surge in integrated AI and data analytics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Reimbursement scenario

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Gap analysis

- 3.9 Value chain analysis

- 3.10 Future market trends

- 3.11 Technology and innovation landscape

- 3.11.1 Current technological trends

- 3.11.2 Emerging technologies

- 3.12 Patent Landscape

- 3.13 Consumer behaviour analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 By Region

- 4.3.1.1 North America

- 4.3.1.2 Europe

- 4.3.1.3 Asia Pacific

- 4.3.1 By Region

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Endoscopes

- 5.2.1 Rigid endoscopes

- 5.2.2 Flexible endoscopes

- 5.2.3 Capsule endoscopes

- 5.3 Visualization systems

- 5.4 Endoscopic ultrasound

- 5.5 Insufflator

- 5.6 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Laparoscopy

- 6.3 GI endoscopy

- 6.3.1 Gastroscopy

- 6.3.2 Colonoscopy

- 6.3.3 Sigmoidoscopy

- 6.3.4 Duodenoscopy

- 6.3.5 Other GI endoscopies

- 6.4 Arthroscopy

- 6.5 ENT endoscopy

- 6.6 Pulmonary endoscopy

- 6.7 Obstetrics/Gynecology

- 6.8 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 B Braun

- 9.2 Boston Scientific

- 9.3 CONMED

- 9.4 COOK MEDICAL

- 9.5 FUJIFILM

- 9.6 HOYA

- 9.7 INTUITIVE

- 9.8 Johnson & Johnson

- 9.9 KARL STORZ

- 9.10 Medtronic

- 9.11 OLYMPUS

- 9.12 RICHARD WOLF

- 9.13 Smith & Nephew

- 9.14 Stryker