|

市场调查报告书

商品编码

1773265

沉淀二氧化硅市场机会、成长动力、产业趋势分析及2025-2034年预测Precipitated Silica Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

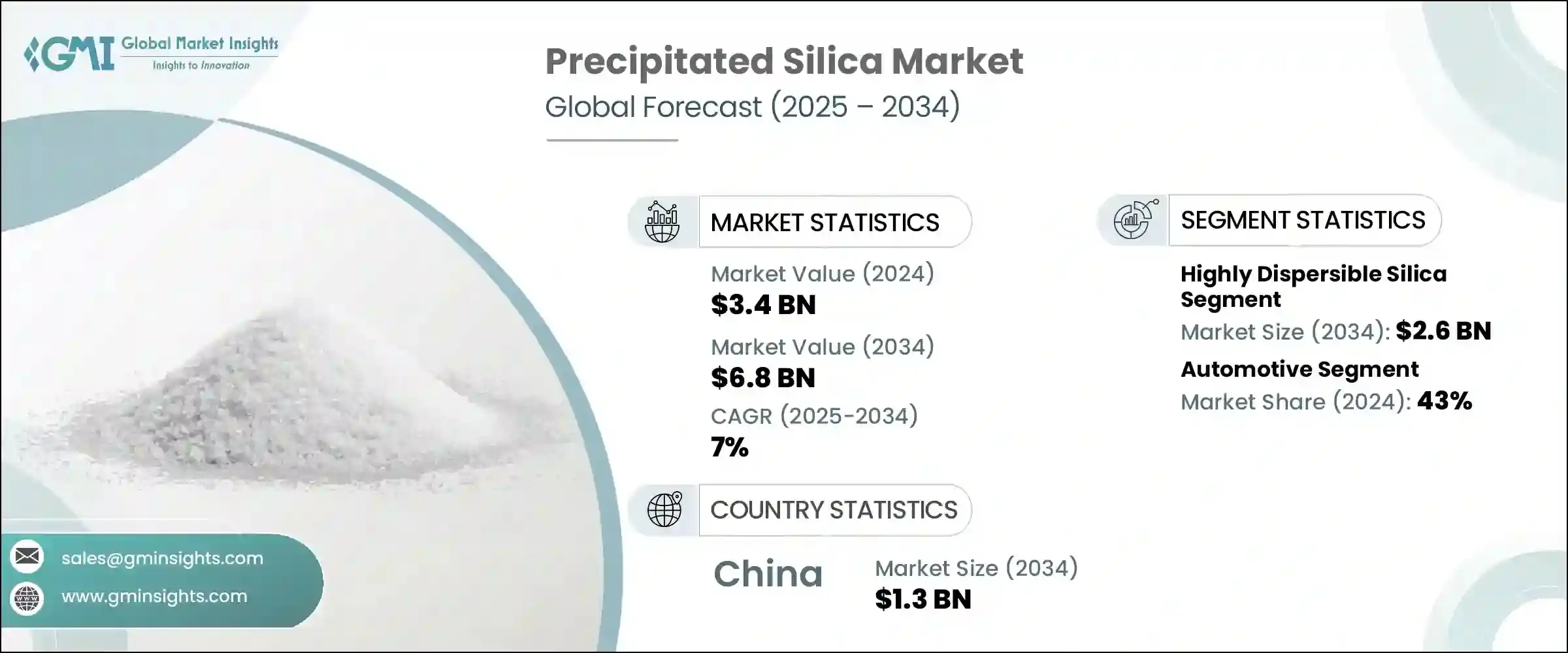

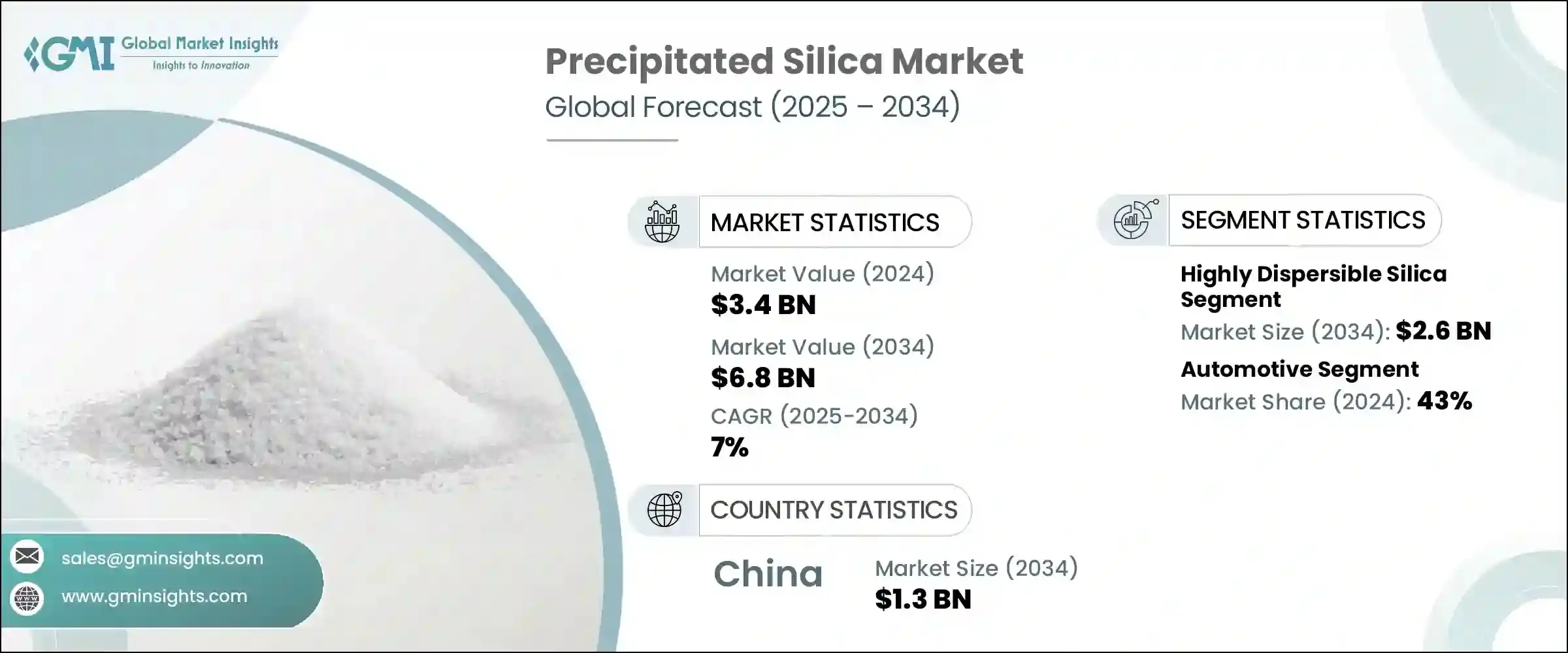

2024年,全球沉淀二氧化硅市场规模达34亿美元,预计2034年将以7%的复合年增长率成长,达到68亿美元。市场成长的动力源自于沉淀二氧化硅独特的物理和化学特性,使其成为各行各业用途广泛的成分。过去十年,其需求稳定成长,尤其作为橡胶、口腔护理产品和涂料的增效添加剂。快速城镇化、汽车产量成长以及对环保技术的日益重视等持续趋势,持续推动市场的发展。

沉淀二氧化硅能够提升产品性能,同时契合永续发展目标,使其具备持续应用的潜力。由于产业加速发展、汽车产业蓬勃发展以及消费品市场蓬勃发展,亚太地区新兴经济体正在大力推动这一成长。中国和印度等国家不仅是二氧化硅消费大国,而且正在发展成为重要的生产中心,进一步巩固了该地区在该领域的主导地位。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 34亿美元 |

| 预测值 | 68亿美元 |

| 复合年增长率 | 7% |

轮胎和橡胶产业仍然是沉淀二氧化硅应用的基石。它在增强牵引力、降低滚动阻力和提高燃油效率方面发挥着至关重要的作用,使其成为现代轮胎配方中不可或缺的一部分,尤其是在电动车和高性能汽车领域。除了轮胎之外,沉淀二氧化硅的用途正在扩展到製药、食品加工和个人护理产品领域,在这些领域中,它可用作抗结块剂、增稠剂和清洁剂。

高分散性二氧化硅 (HDS) 的市场规模在 2024 年达到 13 亿美元,预计到 2034 年将达到 26 亿美元,复合年增长率为 7.1%。该品种因其卓越的补强性能以及与轮胎橡胶配方的相容性而备受青睐。 HDS 显着提升了滚动阻力、湿地牵引力和燃油经济性,使其成为绿色高性能轮胎製造的关键材料,特别适用于混合动力和电动车。这与日益严格的全球环境法规以及原始设备製造商 (OEM) 对节油产品的需求相契合。低排放汽车和环保轮胎解决方案的转变正在推动 HDS 的普及,以巩固其作为未来轮胎技术关键材料的地位。

2024年,汽车领域占了43%的市场。这一领先地位归功于其在轮胎生产中的广泛应用,二氧化硅透过降低滚动阻力来提高轮胎的抓地力、耐磨性和燃油效率。随着全球节能低排放汽车的兴起,製造商越来越多地采用二氧化硅增强轮胎,以满足监管标准和客户偏好。电动车和混合动力车产量的激增推动了对高性能轮胎的需求,这些轮胎严重依赖沉淀二氧化硅来提供增强的牵引力和更长的续航里程。随着汽车製造商优先考虑可持续和高品质的轮胎材料,预计这一趋势将持续下去。

至2034年,美国沉淀二氧化硅市场将以6.7%的复合年增长率成长。这一成长主要得益于轮胎和橡胶应用,尤其是电动车专用轮胎销量的成长。此外,应用领域多元化,涵盖个人护理、医药、涂料和黏合剂等领域,也有助于拓宽市场基础。日益增长的环境问题以及推广环保材料的法规,正鼓励製造商采用可持续的二氧化硅生产技术。领先的公司正在大力投资产能扩张和研发,以创新更环保的材料和工艺,这凸显了美国市场对永续性和长期创新的行业关注。

沉淀二氧化硅产业的主要参与者包括PPG工业公司、赢创工业公司、东方二氧化硅公司、WR Grace & Co.和索尔维公司。为了巩固其在沉淀二氧化硅市场的立足点,领先的公司正致力于透过开发针对不同行业需求的专业化、可持续的二氧化硅等级来扩展其产品组合。对研发的大量投资推动了围绕环保生产方法和增强材料性能的创新,从而满足了对绿色高效解决方案日益增长的需求。各公司正在建立策略合作伙伴关係和合作关係,以进入新的地理市场并拓宽分销网络。公司还透过技术支援服务和客製化解决方案来增强客户参与度,从而建立更牢固的客户关係。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 依产品类型

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利格局

- 贸易统计数据

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 高分散性二氧化硅

- 常规沉淀二氧化硅

- 表面处理二氧化硅

- 特种沉淀二氧化硅

第六章:市场估计与预测:依等级,2021 - 2034 年

- 主要趋势

- 工业级

- 食品级

- 医药级

- 化妆品级

- 其他的

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 橡皮

- 轮胎应用

- 乘用车轮胎

- 商用车轮胎

- 越野轮胎

- 其他的

- 非轮胎橡胶应用

- 鞋类

- 工业橡胶製品

- 其他的

- 轮胎应用

- 口腔护理

- 牙膏

- 其他口腔护理产品

- 食品和饲料添加剂

- 抗结块剂

- 承运商

- 其他的

- 工业应用

- 油漆和涂料

- 塑胶

- 黏合剂和密封剂

- 其他的

- 个人护理和化妆品

- 保养产品

- 护髮产品

- 其他的

- 製药

- 片剂辅料

- 其他的

- 农业

- 其他的

第八章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 汽车

- 消费品

- 食品和饮料

- 医疗保健和製药

- 工业的

- 建造

- 农业

- 其他的

第九章:市场估计与预测:按製造工艺,2021 - 2034 年

- 主要趋势

- 湿式工艺

- 干法工艺

- 其他的

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第 11 章:公司简介

- Anten Chemical Co., Ltd.

- Evonik Industries AG

- Gujarat Multi Gas Base Chemicals Pvt. Ltd.

- Huber Engineered Materials

- Madhu Silica Pvt. Ltd.

- Oriental Silicas Corporation

- PPG Industries, Inc.

- PQ Corporation

- Quechen Silicon Chemical Co., Ltd.

- Shandong Link Silica Co., Ltd.

- Solvay SA

- Tata Chemicals Ltd.

- Tosoh Silica Corporation

- WR Grace & Co.

- Wacker Chemie AG

The Global Precipitated Silica Market was valued at USD 3.4 billion in 2024 and is estimated to grow at a CAGR of 7% to reach USD 6.8 billion by 2034. This market growth is driven by precipitated silica's unique physical and chemical properties, which make it a versatile ingredient across various industries. Over the past decade, its demand has steadily increased, particularly as a performance-enhancing additive in rubber, oral care products, and coatings. The ongoing trends of rapid urbanization, growing automotive production, and the increasing emphasis on environmentally friendly technologies continue to propel the market forward.

Precipitated silica's ability to improve product performance while aligning with sustainability goals positions it well for continued adoption. Emerging economies in the Asia Pacific region are fueling much of this growth, thanks to accelerated industrial development, expanding automotive sectors, and booming consumer goods markets. Countries such as China and India are not only large consumers but are also evolving as major production hubs, further solidifying the region's dominance in this sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.4 Billion |

| Forecast Value | $6.8 Billion |

| CAGR | 7% |

The tire and rubber industry remains the cornerstone of precipitated silica applications. Its vital role in enhancing traction, lowering rolling resistance, and boosting fuel efficiency has made it indispensable in modern tire formulations, especially for electric and high-performance vehicles. Beyond tires, precipitated silica's uses are broadening into pharmaceuticals, food processing, and personal care products, where it acts as an anti-caking agent, thickener, and detergent.

Highly dispersible silica (HDS) accounted for USD 1.3 billion in 2024 and is expected to reach USD 2.6 billion by 2034, growing at a CAGR of 7.1%. This variant is favored for its superior reinforcement capabilities and compatibility with tire rubber compounds. HDS significantly enhances rolling resistance, wet traction, and fuel economy, making it essential in the manufacture of green and high-performance tires, particularly for hybrid and electric vehicles. This aligns well with increasing global environmental regulations and original equipment manufacturers' (OEMs) demand for fuel-efficient products. The shift toward low-emission vehicles and eco-friendly tire solutions is boosting HDS adoption, reinforcing its position as a key material in future tire technologies.

In 2024, the automotive segment held a 43% share. This leadership is attributed to its widespread use in tire production, where silica improves tire grip, wear resistance, and fuel efficiency through reduced rolling resistance. With the global rise of energy-efficient, low-emission vehicles, manufacturers are increasingly incorporating silica-reinforced tires to meet regulatory standards and customer preferences. The surge in electric and hybrid vehicle production is driving demand for high-performance tires that depend heavily on precipitated silica to deliver enhanced traction and extended driving range. This trend is expected to continue as automotive manufacturers prioritize sustainable and high-quality tire materials.

U.S. Precipitated Silica Market will grow at a CAGR of 6.7% through 2034. This growth is primarily fueled by tire and rubber applications, especially with the rising sales of tires tailored for electric vehicles. Additionally, the diversification of applications into personal care, pharmaceuticals, coatings, and adhesives is helping broaden the market base. Increasing environmental concerns and regulations promoting eco-friendly materials are encouraging manufacturers to adopt sustainable silica production techniques. Leading companies are investing heavily in capacity expansion and research & development to innovate greener materials and processes, highlighting a clear industry focus on sustainability and long-term innovation in the U.S. market.

Key players in the Precipitated Silica Industry include PPG Industries, Evonik Industries, Oriental Silicas Corporation, W.R. Grace & Co., and Solvay S.A. To strengthen their foothold in the precipitated silica market, leading companies are focusing on expanding their product portfolios by developing specialized and sustainable silica grades tailored to diverse industry needs. Heavy investment in R&D is enabling innovation around eco-friendly production methods and enhanced material performance, which meets the growing demand for green and efficient solutions. Strategic partnerships and collaborations are being formed to access new geographic markets and broaden distribution networks. Companies are also enhancing customer engagement through technical support services and customized solutions, fostering stronger client relationships.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 End use industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1.1 Mergers & acquisitions

- 4.6.1.2 Partnerships & collaborations

- 4.6.1.3 New Product Launches

- 4.7 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 Highly dispersible silica

- 5.3 Conventional precipitated silica

- 5.4 Surface-treated silica

- 5.5 Specialty precipitated silica

Chapter 6 Market Estimates and Forecast, By Grade, 2021 - 2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Industrial grade

- 6.3 Food Grade

- 6.4 Pharmaceutical grade

- 6.5 Cosmetic grade

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Rubber

- 7.2.1 Tire applications

- 7.2.1.1 Passenger car tires

- 7.2.1.2 Commercial vehicle tires

- 7.2.1.3 Off-road tires

- 7.2.1.4 Others

- 7.2.2 Non-tire rubber applications

- 7.2.2.1 Footwear

- 7.2.2.2 Industrial rubber products

- 7.2.2.3 Others

- 7.2.1 Tire applications

- 7.3 Oral care

- 7.3.1 Toothpaste

- 7.3.2 Other oral care products

- 7.4 Food and feed additives

- 7.4.1 Anti-caking agents

- 7.4.2 Carriers

- 7.4.3 Others

- 7.5 Industrial applications

- 7.5.1 Paints and coatings

- 7.5.2 Plastics

- 7.5.3 Adhesives and sealants

- 7.5.4 Others

- 7.6 Personal care and cosmetics

- 7.6.1 Skin care products

- 7.6.2 Hair care products

- 7.6.3 Others

- 7.7 Pharmaceuticals

- 7.7.1 Tablet excipients

- 7.7.2 Others

- 7.8 Agriculture

- 7.9 Others

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Consumer goods

- 8.4 Food and beverage

- 8.5 Healthcare and pharmaceuticals

- 8.6 Industrial

- 8.7 Construction

- 8.8 Agriculture

- 8.9 Others

Chapter 9 Market Estimates and Forecast, By Manufacturing Process, 2021 - 2034 (USD Billion) (Tons)

- 9.1 Key trends

- 9.2 Wet process

- 9.3 Dry process

- 9.4 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Anten Chemical Co., Ltd.

- 11.2 Evonik Industries AG

- 11.3 Gujarat Multi Gas Base Chemicals Pvt. Ltd.

- 11.4 Huber Engineered Materials

- 11.5 Madhu Silica Pvt. Ltd.

- 11.6 Oriental Silicas Corporation

- 11.7 PPG Industries, Inc.

- 11.8 PQ Corporation

- 11.9 Quechen Silicon Chemical Co., Ltd.

- 11.10 Shandong Link Silica Co., Ltd.

- 11.11 Solvay S.A.

- 11.12 Tata Chemicals Ltd.

- 11.13 Tosoh Silica Corporation

- 11.14 W. R. Grace & Co.

- 11.15 Wacker Chemie AG