|

市场调查报告书

商品编码

1773268

中功率电动车母线市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Medium Power Electric Vehicle Busbar Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

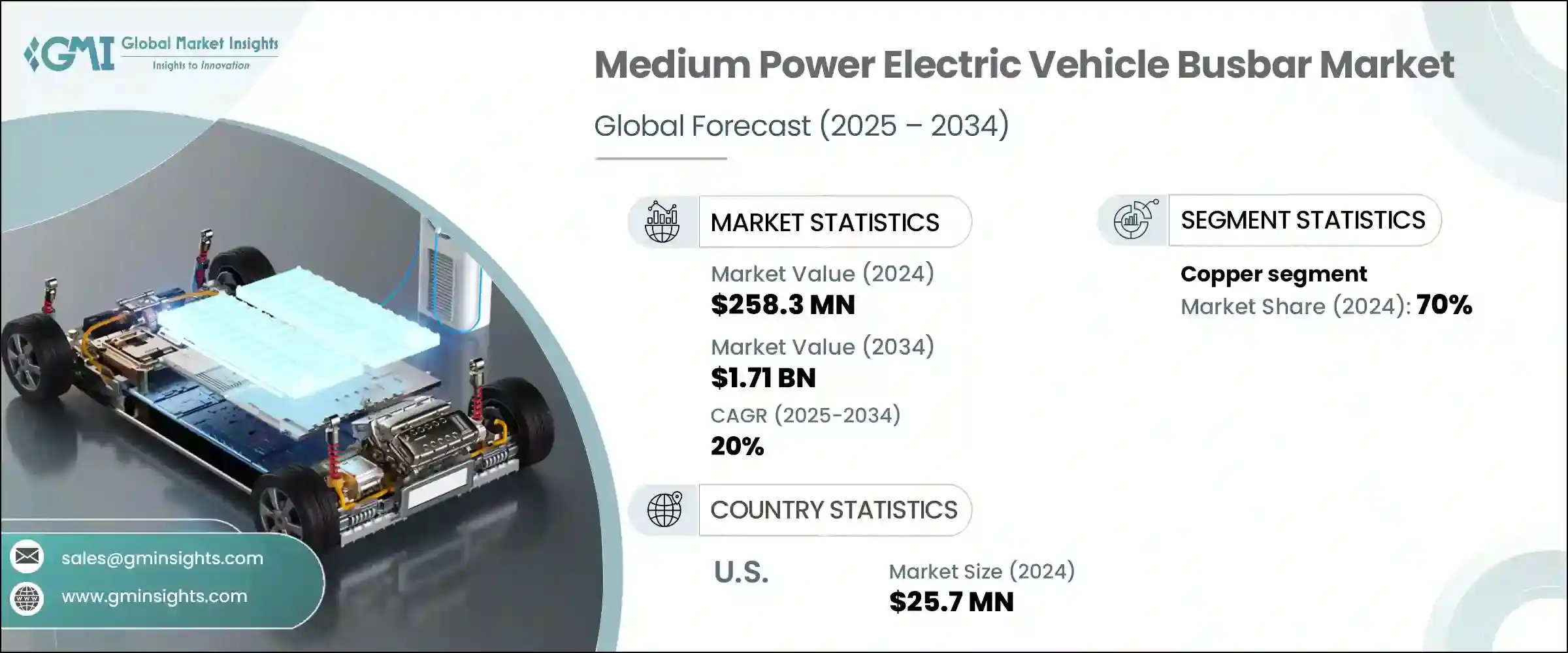

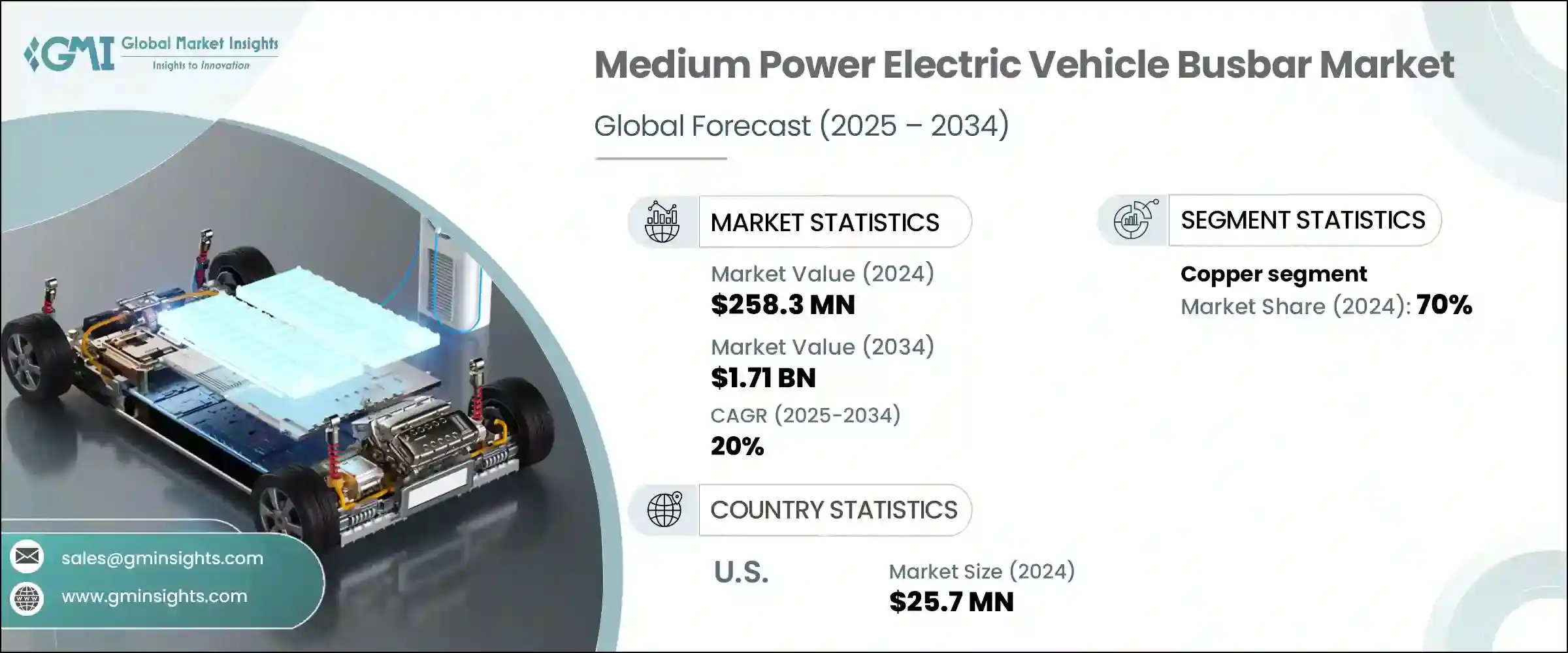

2024年,全球中功率电动车母线市场规模达2.583亿美元,预计2034年将以20%的复合年增长率成长,达到17.1亿美元。这一强劲的成长势头得益于电动车投资的不断增长、有利的监管环境以及配电技术的显着进步。随着电动车持续获得主流关注,策略合作、材料科学创新以及不断发展的生产技术正在重塑电动车内部的能量传输方式。市场发展势头与向轻量化、高效系统的转变日益紧密相关,该系统旨在优化车辆续航里程和性能。

材料革新是市场的关键驱动力。虽然铜凭藉其无与伦比的导电性仍然占据主导地位,但它也显着增加了车辆重量,促使製造商探索替代材料。如今,铝等更轻的材质正被整合,以降低成本并提高能源效率。采用先进复合材料的客製化工程解决方案因其卓越的热控制性能和机械耐久性而日益普及,并可在各种电动车应用中提升性能。此外,客製化的母线系统正在帮助製造商最大限度地减少材料浪费并优化车辆架构。智慧技术整合、新一代生产线以及不断发展的原始设备製造OEM)规范的融合,为整个价值链的市场拓展和创新打开了新的大门。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.583亿美元 |

| 预测值 | 17.1亿美元 |

| 复合年增长率 | 20% |

截至2024年,铜凭藉其卓越的导电性和热管理性能,在中功率电动车母线市场占据了70%的份额。铜能够最大限度地降低能量损失,这对于提升电动车电池性能、确保更长的续航里程和维护系统完整性至关重要。这些特性对于努力平衡车辆效率、安全性和电力传输的汽车製造商来说仍然至关重要。

美国中功率电动车母线市场规模预计2024年达到2,570万美元。联邦政府和各州政府推出的加速电动车普及的政策,加上对先进电网基础设施日益增长的需求,正在推动製造商扩大规模。中功率母线对于优化电动车配电网路、确保充电效率和负载平衡至关重要。随着电动车产量的扩大,对可靠、紧凑且热效率高的母线系统的需求也迅速增长。

全球中功率电动车母线市场的主要公司包括安费诺公司、英飞凌科技股份公司、Brar Elettromeccanica SpA、Littelfuse公司、Mersen SA、西门子、EMS集团、罗格朗、罗杰斯公司、三菱电机株式会社、泰科电子、施耐德电气、EAE集团、EG Electronics和魏德米勒介面有限公司。该领域的领导企业正透过材料创新、设计优化和全球製造扩张等方式扩大其市场占有率。许多公司正优先开发轻量化、高性能合金和复合材料,以满足下一代电动车不断发展的能源效率标准。与汽车製造商和电池製造商建立的策略合资企业有助于确保长期供应协议。各公司也正在增加对自动化和精密工具的投资,以实现复杂、车辆专用母线组件的可扩展且经济高效的生产。同时,他们正在加强对散热、智慧诊断和系统整合的研发力度,以提供满足汽车製造OEM需求的增值解决方案。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 战略仪表板

- 策略倡议

- 竞争基准测试

- 创新与技术格局

第五章:市场规模及预测:依资料,2021 - 2034 年

- 主要趋势

- 铜

- 铝

第六章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 挪威

- 德国

- 法国

- 荷兰

- 英国

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第七章:公司简介

- Amphenol Corporation

- Brar Elettromeccanica SpA

- EAE Group

- EG Electronics

- EMS Group

- Infineon Technologies AG

- Legrand

- Littelfuse, Inc.

- Mersen SA

- Mitsubishi Electric Corporation

- Rogers Corporation

- Schneider Electric

- Siemens

- TE Connectivity

- Weidmuller Interface GmbH & Co. KG

The Global Medium Power Electric Vehicle Busbar Market was valued at USD 258.3 million in 2024 and is estimated to grow at a CAGR of 20% to reach USD 1.71 billion by 2034. This impressive growth trajectory is being fueled by rising investments in electric mobility, favorable regulatory landscapes, and significant advancements in power distribution technologies. As electric vehicles continue gaining mainstream traction, strategic collaborations, innovations in material sciences, and evolving production technologies are reshaping how energy is routed within these vehicles. Market momentum is increasingly tied to the shift toward lightweight, high-efficiency systems tailored to optimize vehicle range and performance.

Material evolution is a key market driver. While copper remains dominant due to its unmatched electrical conductivity, it adds considerable weight-leading manufacturers to explore alternative materials. Lighter options like aluminum are now being integrated to reduce cost and improve energy efficiency. Custom-engineered solutions using advanced composites are gaining popularity for their superior thermal control and mechanical durability, offering a performance boost across various EV applications. Additionally, tailored busbar systems are helping manufacturers minimize material waste and optimize vehicle architecture. The convergence of smart technology integration, next-gen production lines, and evolving OEM specifications is opening new doors for market expansion and innovation across the value chain.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $258.3 Million |

| Forecast Value | $1.71 Billion |

| CAGR | 20% |

As of 2024, the copper segment in the medium-power electric vehicle busbar market held a 70% share due to its superior conductivity and thermal management. Its ability to minimize energy loss makes it vital for enhancing EV battery performance, ensuring better range, and maintaining system integrity. These characteristics remain critical for automakers striving to balance vehicle efficiency, safety, and power delivery.

United States Medium Power Electric Vehicle Busbar Market USD 25.7 million in 2024. Federal and state-led policies to accelerate EV adoption, coupled with rising demand for advanced grid infrastructure, are pushing manufacturers to scale up. Medium power busbars are essential in optimizing EV power distribution networks, ensuring both charging efficiency and load balancing. As EV production scales, the demand for reliable, compact, and heat-efficient busbar systems is increasing rapidly.

Key companies in the Global Medium Power Electric Vehicle Busbar Market include Amphenol Corporation, Infineon Technologies AG, Brar Elettromeccanica SpA, Littelfuse, Inc., Mersen SA, Siemens, EMS Group, Legrand, Rogers Corporation, Mitsubishi Electric Corporation, TE Connectivity, Schneider Electric, EAE Group, EG Electronics, and Weidmuller Interface GmbH & Co. KG. Leading players in this space are advancing their market footprint through a combination of material innovation, design optimization, and global manufacturing expansion. Many are prioritizing the development of lightweight, high-performance alloys and composites to meet the evolving efficiency standards of next-generation EVs. Strategic joint ventures with automakers and battery manufacturers are helping secure long-term supply agreements. Companies are also boosting investments in automation and precision tooling to enable scalable, cost-effective production of complex, vehicle-specific busbar assemblies. In parallel, they are expanding R&D efforts focused on heat dissipation, smart diagnostics, and system integration to deliver value-added solutions tailored to OEM requirements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Material, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Copper

- 5.3 Aluminum

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.3 Europe

- 6.3.1 Norway

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Netherlands

- 6.3.5 UK

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 South Korea

- 6.4.5 Australia

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 South Africa

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

Chapter 7 Company Profiles

- 7.1 Amphenol Corporation

- 7.2 Brar Elettromeccanica SpA

- 7.3 EAE Group

- 7.4 EG Electronics

- 7.5 EMS Group

- 7.6 Infineon Technologies AG

- 7.7 Legrand

- 7.8 Littelfuse, Inc.

- 7.9 Mersen SA

- 7.10 Mitsubishi Electric Corporation

- 7.11 Rogers Corporation

- 7.12 Schneider Electric

- 7.13 Siemens

- 7.14 TE Connectivity

- 7.15 Weidmuller Interface GmbH & Co. KG