|

市场调查报告书

商品编码

1773270

动态心电图市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Holter ECG Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

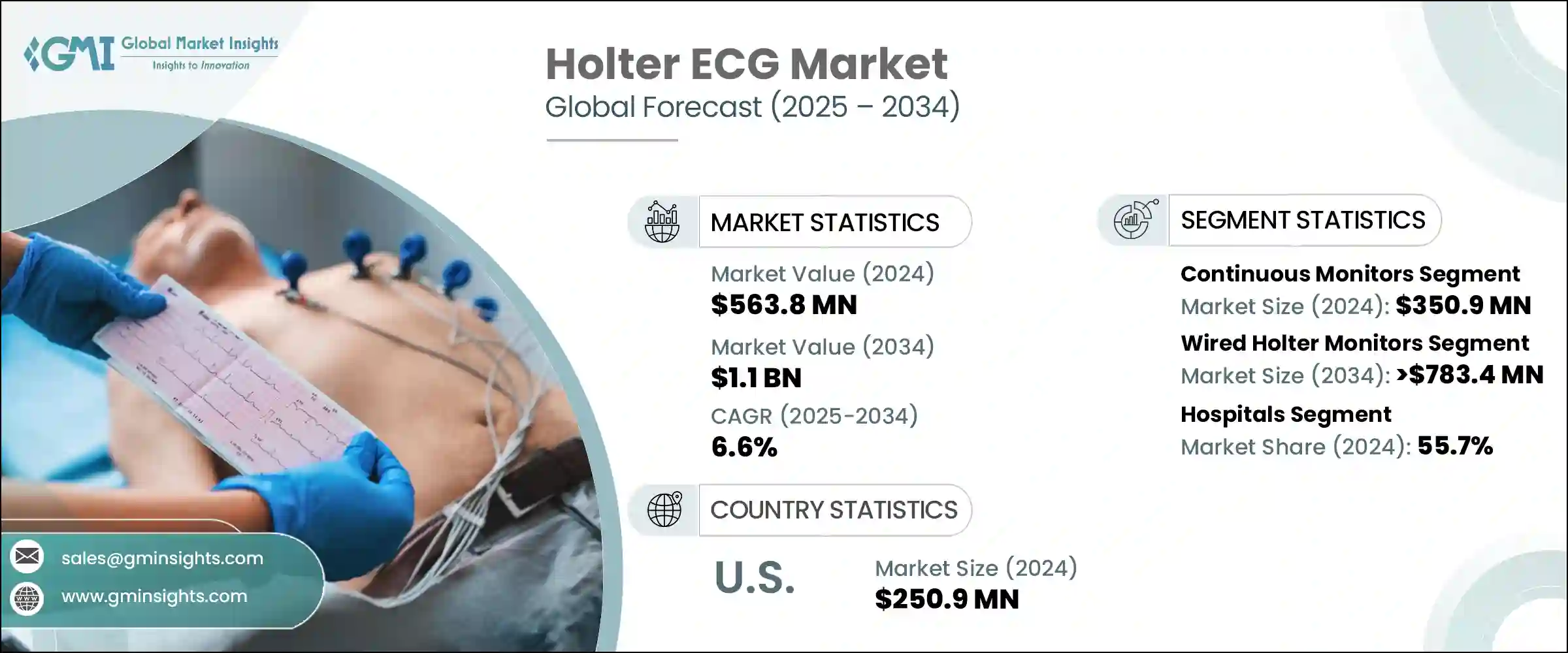

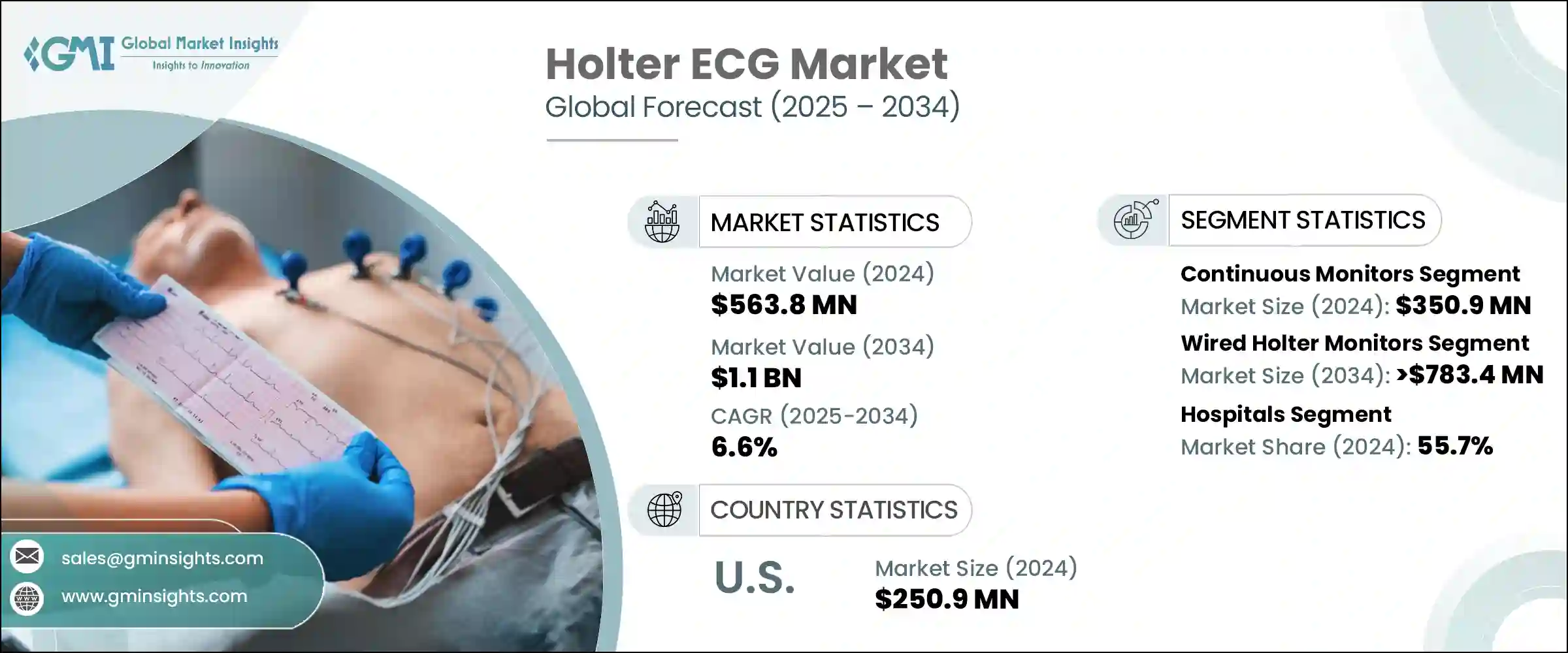

2024年,全球动态心电图(Holter)市场规模达5.638亿美元,预计到2034年将以6.6%的复合年增长率成长,达到11亿美元。这一增长主要得益于心臟相关疾病发病率的上升、微创监测技术的日益普及以及远端心臟诊断需求的不断增长。全球心血管疾病确诊人数的激增,持续推动先进诊断解决方案的需求。由于心臟病是全球死亡率的重要因素,早期精准诊断已成为医疗领域的关键重点。

由于动态心电图 (Holter ECG) 设备有助于在医院和家中识别心律不整,因此市场对此类设备的需求正在稳步增长。技术进步带来了体积更小、用户友好的设备,其电池寿命更长,并具备无线功能,从而提高了医护人员和患者的可用性。这些技术升级使得间歇性心律不整的检测变得更加容易,从而提高了其普及率。远端患者监护趋势以及更多可穿戴诊断设备的出现,为主动健康管理打开了新的大门。加之人们意识的提升和医疗保健支出的增加,这些因素持续加速了全球市场对动态心电图设备的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 5.638亿美元 |

| 预测值 | 11亿美元 |

| 复合年增长率 | 6.6% |

动态心电图 (Holter ECG) 是一种紧凑型穿戴式系统,可在特定时长追踪心律。电极连接到胸部和腹部的特定部位,并与携带式监测器相连,持续捕捉心臟的电活动。随着新技术重塑医疗保健服务,这些设备不仅在诊所中得到更快的普及,也越来越多地应用于家庭心臟监测系统。感测器设计和微电子技术的进步带来了隐形、可长时间佩戴的监测器,这些监测器可以隐藏在衣服下。这些特性显着提高了患者的舒适度和依从性,这对于有效的心律评估至关重要。这些创新也能帮助医生发现难以捕捉的心律不整,并更有效地进行治疗。长效设备的吸引力在于它们能够在提高易用性的同时保持高品质的资料,使其成为现代心臟护理的重要工具。

2024年,连续监测细分市场收入达3.509亿美元,占据动态心电图(Holter ECG)市场的主导地位。连续动态心电图设备能够提供24至48小时甚至更长的不间断资料,为医师观察心臟功能提供了更佳的窗口。其更长的记录时间提高了识别偶发性心律不整的可能性,而这些异常在短期评估中往往被忽略。因此,医疗保健专业人员通常更倾向于使用它们进行全面的动态心臟评估。这些设备通常被认为是对心律不整进行初步评估的首选。由于连续监测器在专科心臟诊所和普通内科的广泛应用,它已成为行业标准,为整体市场发展做出了巨大贡献。

预计到2034年,有线动态心电图 (Holter) 监测领域的复合年增长率将达到6%,市场估值将达到7.834亿美元。这些系统长期以来因其强大的性能和始终如一的资料准确性而备受心臟病学领域的信赖。其维护成本低,且与数位化医院基础设施相容,使其成为许多医疗机构的必备设备。这些设备可与心电图软体、PACS(医学影像归檔与通讯系统)和归檔网路等患者资料系统无缝集成,从而简化诊断工作流程。医生信赖其久经考验的可靠性,这最大限度地减少了资料缺口的可能性,并确保对心律问题进行更清晰的诊断。虽然新的无线方案正在涌现,但有线解决方案由于其可靠的输出和易于整合到现有医院IT环境中,仍然保持着强劲的市场需求。

2024年,美国动态心电图 (Holter ECG) 市场规模达2.509亿美元,预计2025年至2034年的复合年增长率将达到5.5%。老年人族群和慢性心臟病患者的应用尤其强劲。云端平台和人工智慧 (AI) 增强型资料解读工具彻底改变了远端监测心臟状况的方式。这些数位化增强功能有助于更好地管理患者资料并改善临床疗效。此外,优惠的报销结构和本土公司不断推出的创新产品,也促进了美国动态心电图市场的成长。预防保健倡议,尤其是那些专注于心血管健康的倡议,正在进一步巩固市场地位。

在 Holter 心电图市场竞争的主要公司包括 GE HealthCare、SPACELABS HEALTHCARE、ScottCare、VIVALINK、PHILIPS、SCHILLER、iRHYTHM、FUKUDA、Bittium 和 Baxter。为了巩固其在 Holter 心电图产业的地位,主要参与者正在实施广泛的产品创新、有针对性的收购和技术整合等策略。许多公司正在投资人工智慧心电图解释工具,以提高诊断准确性并支援远端分析。公司还透过与医疗保健提供者建立策略伙伴关係和合作来扩大其地理覆盖范围。产品组合正在多样化,包括长时间和无线穿戴式监视器,旨在满足消费者对舒适性和可用性日益增长的期望。此外,製造商正在努力简化与医院 IT 生态系统的兼容性,确保无缝的资料共享和解释。这些方法正在帮助品牌保持竞争力并在这个快速发展的市场中占据更大的份额。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 心臟病盛行率不断上升

- 技术进步

- 微创设备的采用日益增多

- 远端心臟监测需求激增

- 产业陷阱与挑战

- 严格的监理政策

- 动态心电图成本高

- 市场机会

- 远距病人监护 (RPM) 和远距心臟病学的扩展

- 成长动力

- 成长潜力分析

- 监管格局

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 定价分析

- 差距分析

- 波特的分析

- 报销场景

- PESTEL分析

- 价值链分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 按地区

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 连续监测

- 间歇性监测器

第六章:市场估计与预测:按方式,2021 - 2034 年

- 主要趋势

- 有线动态心电图监测仪

- 3导程动态心电图监测仪

- 12导程动态心电图监测仪

- 其他有线动态心电图监测仪

- 无线动态心电图监测仪

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 其他最终用途

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Baxter

- Bittium

- FUKUDA

- GE HealthCare

- iRHYTHM

- PHILIPS

- SCHILLER

- ScottCare

- SPACELABS HEALTHCARE

- VIVALINK

The Global Holter ECG Market was valued at USD 563.8 million in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 1.1 billion by 2034. This growth is largely fueled by the rising incidence of heart-related conditions, the increasing acceptance of less invasive monitoring technologies, and the growing demand for remote cardiac diagnostics. The surging number of individuals diagnosed with cardiovascular diseases worldwide continues to drive the need for sophisticated diagnostic solutions. With heart ailments contributing significantly to global mortality rates, early and accurate diagnosis has become a critical medical priority.

Demand for Holter ECGs is rising steadily as these devices help identify cardiac irregularities in both hospital and at-home settings. Technological progress has led to smaller, user-friendly devices with improved battery life and wireless features, enhancing usability for both healthcare providers and patients. These technological upgrades have made it easier to detect intermittent arrhythmia, increasing adoption. Remote patient monitoring trends and the availability of more wearable diagnostic devices have opened new doors for proactive health management. Combined with broader awareness and healthcare spending, these factors continue to accelerate the demand for Holter ECG devices across global markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $563.8 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 6.6% |

Holter ECGs are compact wearable systems that track heart rhythms for a defined duration. Electrodes are attached to specific parts of the chest and abdomen, linked to a portable monitor that continuously captures the heart's electrical activity. As newer technologies reshape healthcare delivery, these devices are seeing faster adoption not just in clinics but also in home-based cardiac monitoring setups. Advances in sensor design and microelectronics have led to discreet, long-wear monitors that remain hidden under clothing. These features significantly increase patient comfort and compliance, which are essential for effective cardiac rhythm assessment. These innovations also support physicians in detecting hard-to-catch arrhythmias and managing treatment more effectively. The appeal of extended-use devices lies in their ability to maintain high data quality while improving ease of use, making them an essential tool in modern cardiac care.

In 2024, the continuous monitoring segment brought in USD 350.9 million, dominating the Holter ECG landscape. Continuous Holter ECG devices deliver uninterrupted data for 24 to 48 hours or even longer, giving doctors an enhanced window to observe heart function. Their extended recording duration increases the likelihood of identifying sporadic rhythm disorders that would often go unnoticed in shorter evaluations. As a result, healthcare professionals often prefer them for thorough ambulatory cardiac assessment. These devices are often considered the primary option for initial evaluations of irregular heartbeat conditions. Due to their consistent use across both specialized cardiac practices and general medicine, continuous monitors have become an industry standard, contributing substantially to overall market development.

The wired Holter monitors segment is anticipated to witness a CAGR of 6% through 2034, reaching a market valuation of USD 783.4 million. These systems have long been trusted in cardiology for their robust performance and consistent data accuracy. Their low maintenance requirements and compatibility with digital hospital infrastructure make them a staple in many healthcare settings. These devices seamlessly integrate with patient data systems like ECG software, PACS, and archiving networks, which streamlines diagnostic workflows. Physicians rely on their proven reliability, which minimizes the chance of data gaps and ensures a clearer diagnosis of heart rhythm issues. While newer wireless options are emerging, wired solutions still retain strong market demand due to their dependable output and ease of integration into current hospital IT environments.

United States Holter ECG Market was worth USD 250.9 million in 2024 and is set to grow at a CAGR of 5.5% from 2025 to 2034. Adoption is especially robust among elderly populations and individuals living with chronic heart disease. Cloud-based platforms and AI-enhanced data interpretation tools have revolutionized the way cardiac conditions are monitored remotely. These digital enhancements allow for better management of patient data and improved clinical outcomes. Additionally, favorable reimbursement structures and the continuous launch of innovative products by local companies are contributing to the growth of Holter ECGs in the country. Preventive care initiatives, particularly those focusing on cardiovascular wellness, are further strengthening the market's position.

Major companies competing in the Holter ECG Market include GE HealthCare, SPACELABS HEALTHCARE, ScottCare, VIVALINK, PHILIPS, SCHILLER, iRHYTHM, FUKUDA, Bittium, and Baxter. To reinforce their position in the Holter ECG industry, key players are implementing strategies such as extensive product innovation, targeted acquisitions, and technology integration. Many are investing in AI-powered ECG interpretation tools to enhance diagnostic accuracy and support remote analysis. Companies are also expanding their geographic reach through strategic partnerships and collaborations with healthcare providers. Product portfolios are being diversified to include long-duration and wireless wearable monitors, tailored to meet rising consumer expectations for comfort and usability. Additionally, manufacturers are working to streamline compatibility with hospital IT ecosystems, ensuring seamless data sharing and interpretation. These approaches are helping brands to stay competitive and capture a larger share of this rapidly evolving market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Modality

- 2.2.4 End use

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of cardiac diseases

- 3.2.1.2 Technological advancements

- 3.2.1.3 Growing adoption of minimally invasive devices

- 3.2.1.4 Surging preference for remote patient cardiac monitoring

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory policies

- 3.2.2.2 High cost of the Holter ECG

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of remote patient monitoring (RPM) and telecardiology

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pricing analysis

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 Reimbursement scenario

- 3.10 PESTEL analysis

- 3.11 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 By region

- 4.3.1.1 North America

- 4.3.1.2 Europe

- 4.3.1.3 Asia Pacific

- 4.3.1 By region

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Continuous monitors

- 5.3 Intermittent monitors

Chapter 6 Market Estimates and Forecast, By Modality, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Wired Holter monitors

- 6.2.1 3 lead Holter monitors

- 6.2.2 12 lead Holter monitors

- 6.2.3 Other wired Holter monitors

- 6.3 Wireless Holter monitors

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Baxter

- 9.2 Bittium

- 9.3 FUKUDA

- 9.4 GE HealthCare

- 9.5 iRHYTHM

- 9.6 PHILIPS

- 9.7 SCHILLER

- 9.8 ScottCare

- 9.9 SPACELABS HEALTHCARE

- 9.10 VIVALINK