|

市场调查报告书

商品编码

1773312

压制和吹製玻璃市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Pressed and Blown Glass Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

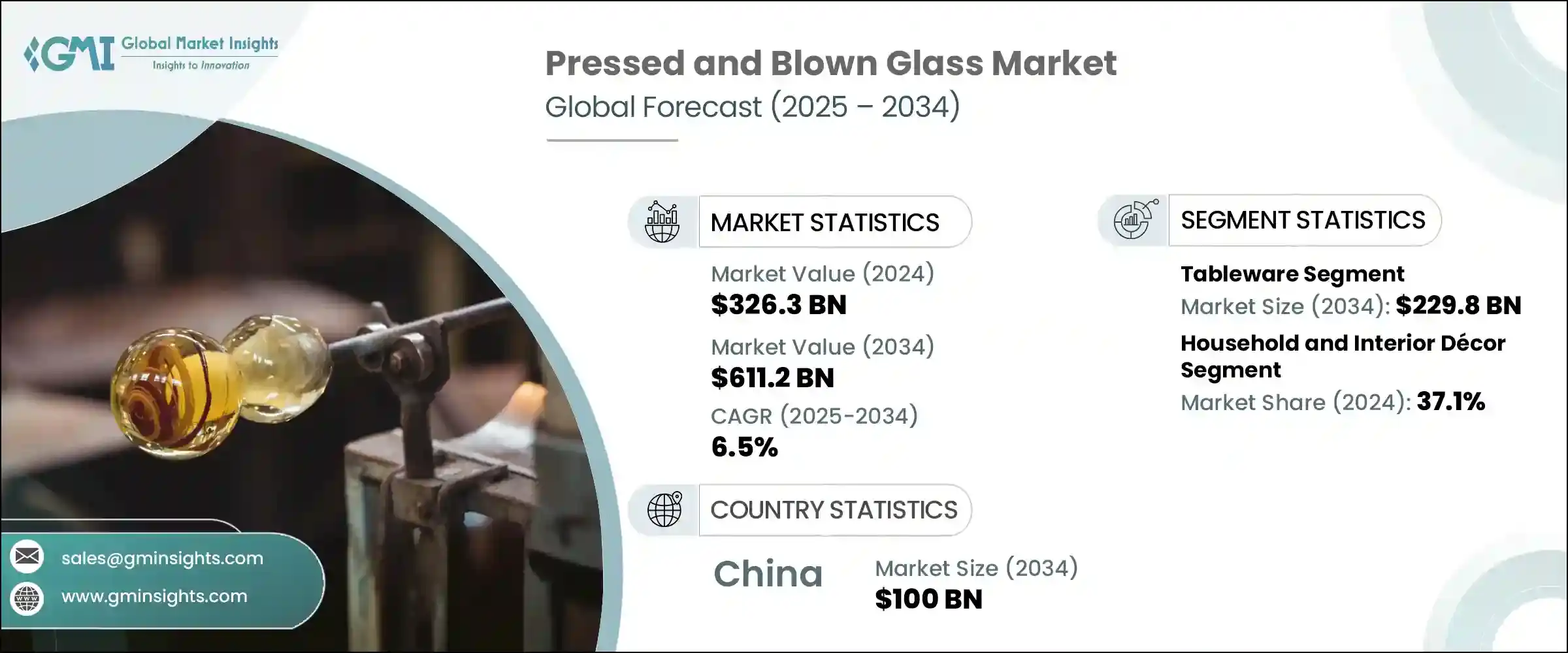

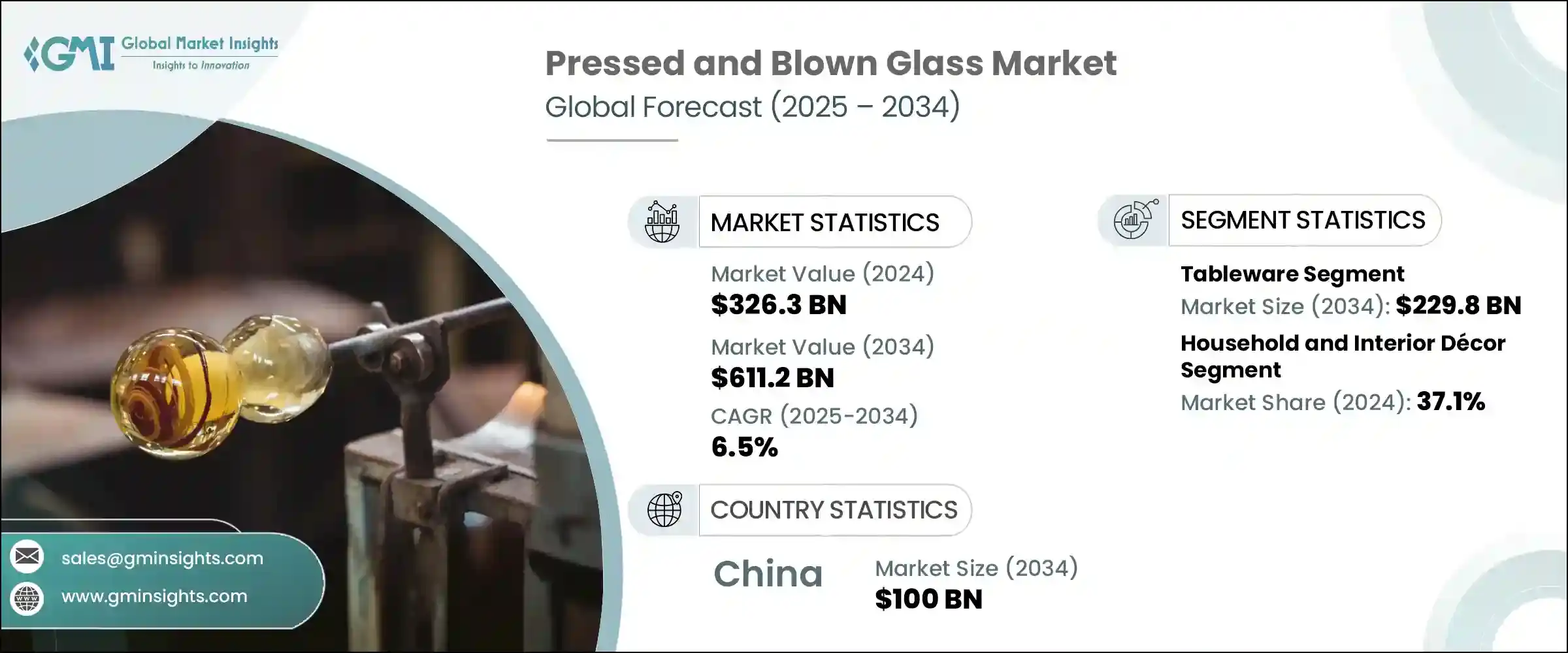

2024年,全球压制和吹製玻璃市场规模达3,263亿美元,预计到2034年将以6.5%的复合年增长率成长,达到6,112亿美元。成型技术的进步、建筑应用的不断扩展以及装饰和包装用途需求的不断增长,共同推动着该市场的发展。亚太市场正呈现出强劲成长势头,工业扩张和消费者日益富裕的消费群体正在推动玻璃产品在多个垂直领域的普及。

随着消费者偏好的转变,玻璃因其功能多样性和视觉吸引力在现代设计中日益受到青睐,并更加重视性能和美观。在包装和内饰等领域,耐用且可回收的玻璃材料正在取代可持续性较差的替代品。此外,自动化吹塑和压制製程的技术升级使製造商能够实现规模化生产,同时满足客製化需求。人工智慧整合监控和机器人成型等先进工具正日益受到青睐,从而改善了生产成果和品质控制。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3263亿美元 |

| 预测值 | 6112亿美元 |

| 复合年增长率 | 6.5% |

欧洲和北美的营运已开始采用自动化技术,提高速度和效率,并帮助企业满足日益增长的消费者期望。随着该产业与全球永续发展目标保持一致,对环保生产方法的持续投资也进一步支持了市场。随着个人化和高端装饰产品需求的不断增长,吹製玻璃正日益受到青睐。同时,压制玻璃仍然是容器製造的主要材料,在製药、美容和饮料等行业中发挥着至关重要的作用。

餐具领域在2024年占据了最大的市场份额,产值达到1,212亿美元,预计到2034年将达到2,298亿美元,复合年增长率为6.7%。玻璃餐具(包括饮具、盘子和盛装餐具)因其卫生、耐热和耐用性而持续受到热捧。环保用餐习惯的兴起正促使消费者逐渐远离塑胶和陶瓷。专注于手工工艺和简约透明餐具的设计趋势,推动了北美和欧洲等主要市场的玻璃餐具销售成长。

2024年,家居及室内装潢类别的市占率将达到37.1%。城市发展、人们对现代生活美学日益增长的兴趣以及对多功能装饰品的客製化需求推动了这一增长。玻璃花瓶、灯具、艺术品和装饰面板等产品越来越受欢迎,尤其是手工製作或永续生产的。消费者对耐用、环保的室内装饰元素的偏好,推动了包括亚太地区、欧洲和北美在内的多个地区更多地使用压制和手工吹製的设计。

2024年,中国压制和吹製玻璃市场产值达527亿美元,预计复合年增长率将达到6.7%,到2034年将达到1000亿美元。这一成长与消费成长、机械化製造的改进以及向更智慧的生产系统转型息息相关。中国生产商越来越重视永续性,在生产过程中更多地使用回收碎玻璃,以降低成本并最大限度地减少对环境的影响。年轻一代正在引领客製化和数位玻璃器皿的潮流,推动对独特美学和实用优雅的需求。

市场领导者包括 Krosno Glass SA、Libbey Inc.、Arc Holdings、Bormioli Rocco 和 Sisecam 集团旗下的 Pasabahce。压制和吹製玻璃市场的主要公司正在优先考虑技术整合,以提高生产力并减少错误。机器人成型系统和人工智慧品质检测工具正在广泛部署,以提高一致性并缩短生产时间。为了满足日益增长的可持续解决方案需求,许多公司正在转向使用再生原材料并采用节能製程。对数位设计平台的投资使这些品牌能够快速製作原型并客製化产品,以满足工业客户和注重设计的消费者的需求。与设计师和零售分销商建立策略合作伙伴关係进一步使公司在风格和功能方面保持领先地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- Pestel 分析

- 价格趋势

- 按地区

- 按类型

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利格局

- 贸易统计(註:仅提供重点国家的贸易统计)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 餐具

- 饮水杯

- 不倒翁

- 高脚杯

- 马克杯和杯子

- 小酒杯

- 其他的

- 餐具

- 盘子

- 碗

- 上菜

- 其他的

- 餐具

- 水罐和醒酒器

- 托盘和大浅盘

- 其他的

- 饮水杯

- 容器

- 瓶子

- 饮料瓶

- 药用瓶

- 化妆品和香水瓶

- 其他的

- 罐子

- 食品罐

- 化妆品罐

- 其他的

- 小瓶和安瓿瓶

- 其他的

- 瓶子

- 装饰玻璃

- 小雕像和雕塑

- 花瓶和碗

- 装饰品

- 其他的

- 照明产品

- 灯罩

- 枝形吊灯和吊坠

- 其他的

- 技术和工业玻璃

- 实验室玻璃器皿

- 技术组件

- 其他的

- 其他的

第六章:市场估计与预测:按玻璃类型,2021 - 2034 年

- 主要趋势

- 钠钙玻璃

- 硼硅酸盐玻璃

- 水晶玻璃

- 铅水晶

- 无铅水晶

- 耐热玻璃

- 彩色玻璃

- 其他的

第七章:市场估计与预测:按製造工艺,2021 - 2034 年

- 主要趋势

- 压制过程

- 单料滴

- 双料

- 三重料

- 吹塑工艺

- 吹啊吹

- 按压并吹气

- 窄颈按压吹气(NNPB)

- 组合工艺

- 手工製作流程

- 其他的

第八章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 食品和饮料

- 酒精饮料

- 非酒精饮料

- 食品包装

- 其他的

- 製药

- 包装

- 实验室设备

- 其他的

- 化妆品和个人护理

- 香水和香料

- 保养产品

- 其他的

- 家居和室内装饰

- 餐具

- 装饰品

- 灯光

- 其他的

- 饭店及餐饮服务

- 饭店和餐厅

- 酒吧和酒馆

- 餐饮服务

- 其他的

- 其他的

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- B2B/直销

- 製造商到零售商

- 製造商到批发商

- 製造商最终使用

- 零售

- 大卖场/超市

- 专卖店

- 百货公司

- 其他的

- 网路零售

- 公司网站

- 电子商务平台

- 其他的

- 其他的

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第 11 章:公司简介

- Anchor Hocking LLC

- Arc International

- Ardagh Group SA

- Beatson Clark Ltd.

- Bormioli Rocco SpA

- Borosil Limited

- Garbo Glassware Co., Ltd.

- Gerresheimer AG

- Glass Dynamics LLC

- Kopp Glass, Inc.

- Libbey Inc.

- OI Glass, Inc. (Owens-Illinois)

- Piramal Glass Limited

- Rayotek Scientific Inc.

- Saverglass SAS

- SCHOTT AG

- Sisecam Group

- Steelite International

- Stoelzle Glass Group

- Verallia

- Vetropack Holding Ltd.

- Vidrala SA

- Vitro, SAB de CV

- Wiegand-Glas GmbH

- Zwiesel Kristallglas AG

The Global Pressed and Blown Glass Market was valued at USD 326.3 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 611.2 billion by 2034. The market is being propelled by the evolution of molding technologies, expanding architectural applications, and heightened demand for decorative and packaging uses. Significant momentum is being generated in Asia-Pacific markets, where industrial expansion and growing consumer affluence are supporting glass product adoption across multiple verticals.

Glass is increasingly favored for its functional versatility and visual appeal in modern design, with shifting consumer preferences emphasizing both performance and aesthetics. In sectors like packaging and interiors, durable and recyclable glass materials are replacing less sustainable alternatives. Additionally, technological upgrades in automated blowing and pressing processes allow manufacturers to produce at scale while meeting custom requirements. Advanced tools like AI-integrated monitoring and robotic forming are gaining traction, improving production outcomes and quality control.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $326.3 Billion |

| Forecast Value | $611.2 Billion |

| CAGR | 6.5% |

European and North American operations have embraced automation, enhanced speed and efficiency, and helping companies meet rising consumer expectations. The market is further supported by ongoing investments in eco-conscious production methods, as the industry aligns itself with global sustainability goals. Blown glass is gaining traction due to rising demand for personalized and high-end decorative products. Meanwhile, pressed glass remains a dominant material in container manufacturing, playing a crucial role in industries such as pharmaceuticals, beauty, and beverages.

The tableware segment held the largest market share in 2024, generating USD 121.2 billion, and is projected to hit USD 229.8 billion by 2034, growing at a CAGR of 6.7%. Glass tableware-including drinkware, plates, and serving items-continues to be in high demand for its hygiene, thermal resistance, and long-term usability. The movement toward environmentally friendly dining habits is steering consumers away from plastics and ceramics. Design trends favoring artisan craftsmanship and minimal, transparent serveware have helped accelerate glass tableware sales in key markets such as North America and Europe.

The household and interior decor category captured a 37.1% share in 2024. This growth is being fueled by urban development, increased interest in modern living aesthetics, and custom orders for multifunctional decorative pieces. Items like glass vases, lighting fixtures, art pieces, and accent panels are seeing a rise in popularity, especially those that are handcrafted or sustainably produced. Consumer preference for long-lasting, eco-friendly interior elements is promoting greater use of both pressed and hand-blown designs across several regions including parts of Asia-Pacific, Europe, and North America.

China Pressed and Blown Glass Market generated USD 52.7 billion in 2024 and is expected to grow at a CAGR of 6.7%, reaching USD 100 billion by 2034. This expansion is tied to rising consumption, improvements in mechanized manufacturing, and a transition to more intelligent production systems. Chinese producers are placing greater emphasis on sustainability, integrating more recycled cullet into production to cut costs and minimize environmental impact. Younger generations are shaping trends in custom and digital glassware, fostering demand for unique aesthetics and functional elegance.

Leading players in the market include Krosno Glass S.A., Libbey Inc., Arc Holdings, Bormioli Rocco, and Pasabahce under the Sisecam Group. Major companies in the pressed and blown glass market are prioritizing technological integration to enhance productivity and reduce errors. Robotic forming systems and AI-powered quality inspection tools are being widely deployed to improve consistency and cut production time. To meet the growing demand for sustainable solutions, many firms are shifting toward using recycled raw materials and adopting energy-efficient processes. Investments in digital design platforms allow these brands to quickly prototype and customize products, catering to both industrial clients and design-conscious consumers. Strategic partnerships with designers and retail distributors further enable companies to stay ahead in style and function.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By type

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics(Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 LATAM

- 4.2.6 MEA

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.7 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 Tableware

- 5.2.1 Drinking glasses

- 5.2.1.1 Tumblers

- 5.2.1.2 Stemware

- 5.2.1.3 Mugs and cups

- 5.2.1.4 Shot glasses

- 5.2.1.5 Others

- 5.2.2 Dinnerware

- 5.2.2.1 Plates

- 5.2.2.2 Bowls

- 5.2.2.3 Serving dishes

- 5.2.2.4 Others

- 5.2.3 Serveware

- 5.2.3.1 Pitchers and decanters

- 5.2.3.2 Trays and platters

- 5.2.3.3 Others

- 5.2.1 Drinking glasses

- 5.3 Containers

- 5.3.1 Bottles

- 5.3.1.1 Beverage bottles

- 5.3.1.2 Pharmaceutical bottles

- 5.3.1.3 Cosmetic and perfume bottles

- 5.3.1.4 Others

- 5.3.2 Jars

- 5.3.2.1 Food jars

- 5.3.2.2 Cosmetic jars

- 5.3.2.3 Others

- 5.3.3 Vials and ampoules

- 5.3.4 Others

- 5.3.1 Bottles

- 5.4 Decorative glass

- 5.4.1 Figurines and sculptures

- 5.4.2 Vases and bowls

- 5.4.3 Ornaments

- 5.4.4 Others

- 5.5 Lighting products

- 5.5.1 Lamp shades

- 5.5.2 Chandeliers and pendants

- 5.5.3 Others

- 5.6 Technical and industrial glass

- 5.6.1 Laboratory glassware

- 5.6.2 Technical components

- 5.6.3 Others

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Glass Type, 2021 - 2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Soda-lime glass

- 6.3 Borosilicate glass

- 6.4 Crystal glass

- 6.4.1 Lead crystal

- 6.4.2 Lead-free crystal

- 6.5 Heat-resistant glass

- 6.6 Colored glass

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Manufacturing Process, 2021 - 2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Press process

- 7.2.1 Single gob

- 7.2.2 Double gob

- 7.2.3 Triple gob

- 7.3 Blow process

- 7.3.1 Blow and blow

- 7.3.2 Press and blow

- 7.3.3 Narrow neck press and blow (NNPB)

- 7.4 Combined processes

- 7.5 Hand-crafted processes

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.2 Food and beverage

- 8.2.1 Alcoholic beverages

- 8.2.2 Non-alcoholic beverages

- 8.2.3 Food packaging

- 8.2.4 Others

- 8.3 Pharmaceutical

- 8.3.1 Packaging

- 8.3.2 Laboratory equipment

- 8.3.3 Others

- 8.4 Cosmetics and personal care

- 8.4.1 Perfumes and fragrances

- 8.4.2 Skincare products

- 8.4.3 Others

- 8.5 Household and interior decor

- 8.5.1 Tableware

- 8.5.2 Decorative items

- 8.5.3 Lighting

- 8.5.4 Others

- 8.6 Hospitality and foodservice

- 8.6.1 Hotels and restaurants

- 8.6.2 Bars and pubs

- 8.6.3 Catering services

- 8.6.4 Others

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Tons)

- 9.1 Key trends

- 9.2 B2b/direct sales

- 9.2.1 Manufacturers to retailers

- 9.2.2 Manufacturers to wholesalers

- 9.2.3 Manufacturers to end use

- 9.3 Retail

- 9.3.1 Hypermarkets/supermarkets

- 9.3.2 Specialty stores

- 9.3.3 Department stores

- 9.3.4 Others

- 9.4 Online retail

- 9.4.1 Company websites

- 9.4.2 E-commerce platforms

- 9.4.3 Others

- 9.5 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Anchor Hocking LLC

- 11.2 Arc International

- 11.3 Ardagh Group S.A.

- 11.4 Beatson Clark Ltd.

- 11.5 Bormioli Rocco S.p.A.

- 11.6 Borosil Limited

- 11.7 Garbo Glassware Co., Ltd.

- 11.8 Gerresheimer AG

- 11.9 Glass Dynamics LLC

- 11.10 Kopp Glass, Inc.

- 11.11 Libbey Inc.

- 11.12 O-I Glass, Inc. (Owens-Illinois)

- 11.13 Piramal Glass Limited

- 11.14 Rayotek Scientific Inc.

- 11.15 Saverglass SAS

- 11.16 SCHOTT AG

- 11.17 Sisecam Group

- 11.18 Steelite International

- 11.19 Stoelzle Glass Group

- 11.20 Verallia

- 11.21 Vetropack Holding Ltd.

- 11.22 Vidrala S.A.

- 11.23 Vitro, S.A.B. de C.V.

- 11.24 Wiegand-Glas GmbH

- 11.25 Zwiesel Kristallglas AG