|

市场调查报告书

商品编码

1773313

铝蜂窝板市场机会、成长动力、产业趋势分析及2025-2034年预测Aluminum Honeycomb Panels Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

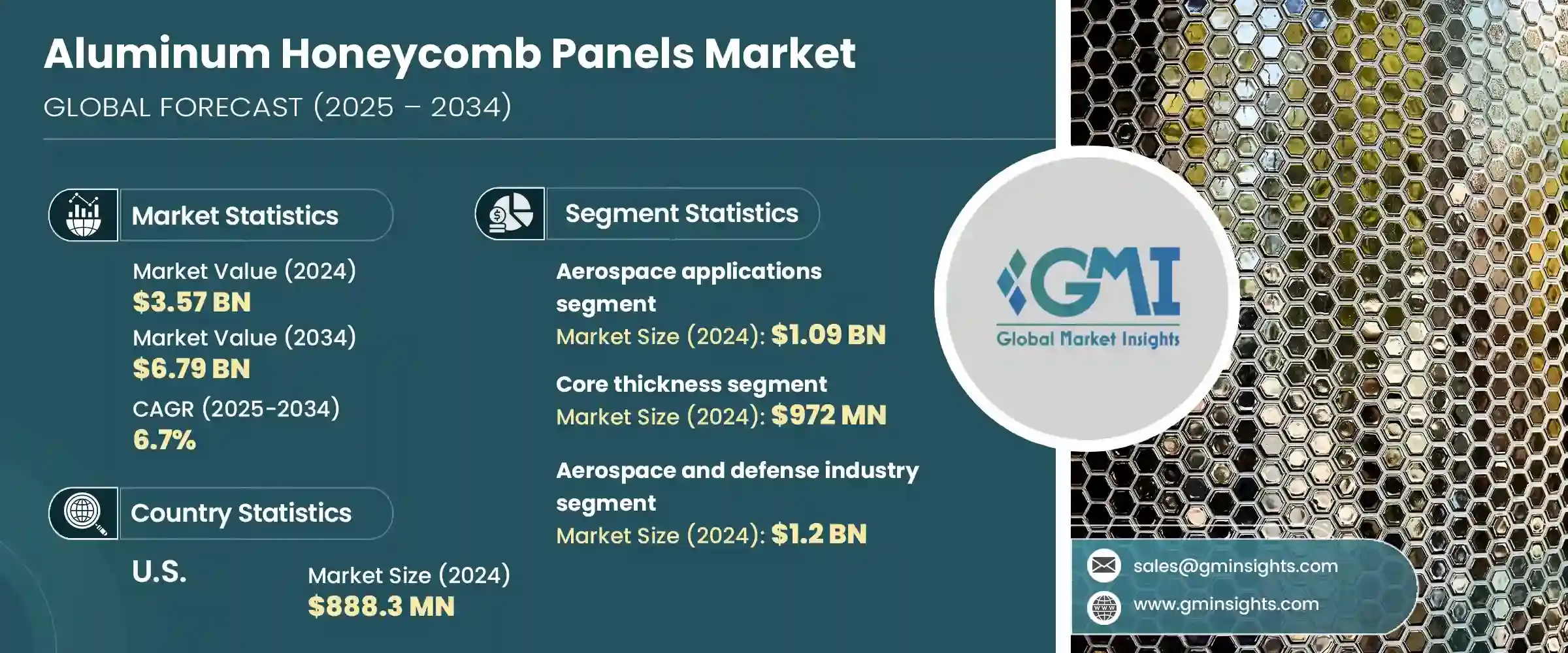

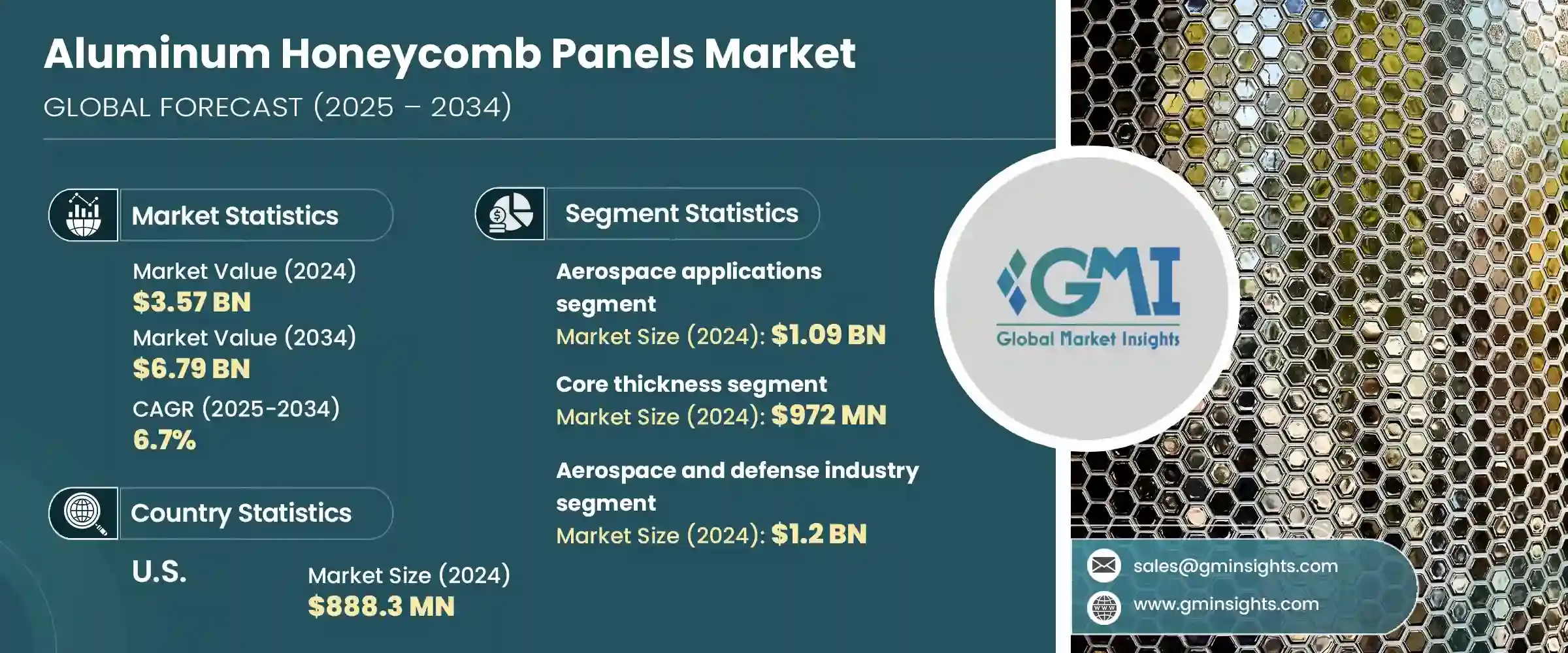

2024年,全球铝蜂窝板市场价值为35.7亿美元,预计到2034年将以6.7%的复合年增长率成长,达到67.9亿美元。这一成长主要源自于多个高性能产业日益增长的应用需求,这些产业需要兼具强度和轻量化的材料。在性能效率和结构完整性至关重要的行业,例如航太、汽车、建筑和工业製造,这种需求尤其突出。这些板材因其能够满足与能量吸收、耐久性和抗各种应力相关的严格要求,且不会显着增加结构重量而广受认可。

随着各行各业不断追求节能和永续发展的目标,对轻质且坚固耐用材料的需求日益增长,而铝蜂窝板正是理想的解决方案。这些材料在现代基础设施、交通运输系统和专用设备外壳中的应用日益增长,进一步巩固了其在全球市场中日益增长的重要性。其可回收性、防火性和隔热性能使其更具吸引力,适用于兼顾功能性和环保性的各类应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 35.7亿美元 |

| 预测值 | 67.9亿美元 |

| 复合年增长率 | 6.7% |

在航太领域,铝蜂窝板因其满足轻质、高强度等关键标准而迅速受到青睐。光是航太应用领域,其市场规模在2024年就已达10.9亿美元,预计2025年至2034年的复合年增长率将达到7.5%。这些面板有助于提高燃油效率并增强设计灵活性,这在航空製造中至关重要。它们的应用范围扩展到室内隔间、地板系统和结构构件,在这些领域,减轻重量至关重要,同时又不影响性能。随着飞机製造商越来越重视成本效益和省油技术,对铝蜂巢结构的偏好也日益增强。

这些材料在建筑业也越来越受欢迎。它们兼具轻量和高刚度,安装更便捷、使用寿命更长,并在结构性能方面表现出色。此外,它们的防火隔音特性也使其在覆层系统、天花板和隔间中的应用日益广泛,尤其是在商业和机构建筑中。绿色建筑规范和永续建筑的转变,使得铝蜂窝板在建筑实践中的应用越来越广泛,尤其是在已开发经济体中。

从产品规格的角度来看,市场正透过芯材厚度、合金类型和单元配置方面的创新不断发展。芯材厚度细分市场在2024年的市值为9.72亿美元,预计在预测期内将以7%的复合年增长率成长。不同的芯材尺寸可为各种应用提供客製化的承重能力,而特定的合金则可增强耐腐蚀性并优化结构性能。製造商也在开发客製化的面板形状和尺寸,以满足特定的设计或技术要求。这些创新使铝蜂窝板能够更好地适应多个行业的复杂环境。

就最终用途而言,航太和国防工业在2024年占据了最大的市场份额,价值12亿美元,占32.4%的市场份额。预计到2034年,该领域的复合年增长率将达到7.2%。这一成长主要得益于国防项目投资的增加,以及先进国防系统对轻质材料的日益重视。在汽车产业,尤其是电动车领域,太阳能板透过减轻车辆总重量,有助于延长续航里程并提高性能。

此外,由于耐腐蚀性、热稳定性和易于製造等需求,其在船舶、铁路和物流等领域的应用也日益广泛。这些特性使板材非常适合用于船舶内部、火车车厢和货运系统。工业製造商也依赖这些板材来建造敏感设备的结构框架和外壳,这凸显了其多功能性和性能的一致性。

在美国,2024年铝蜂窝板市场规模达8.883亿美元,预计2025年至2034年期间的复合年增长率将达到6.5%。美国作为全球飞机生产中心的地位,以及对电动车和军事升级的投资不断增加,为市场扩张创造了有利条件。商业建筑对环保建筑实践和能源效率的重视,进一步支撑了国内需求。

在竞争格局中,主要的复合材料和材料生产商凭藉先进的製造流程、多样化的产品组合以及跨供应链的策略合作伙伴关係占据市场主导地位。这些公司持续投资研发,以提高产品强度、耐火性和适应性,以满足不断发展的行业标准。透过使生产符合全球监管规范和永续发展目标,这些公司保持了竞争优势,并满足了大批量和高规格的市场需求。他们与原始设备製造商和承包商建立的良好关係确保了长期的业务连续性,而他们对自动化和品质控制的承诺则巩固了他们在关键终端应用领域的领先地位。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测、应用,2021-2034

- 主要趋势

- 航太应用

- 商业航空

- 飞机地板系统

- 内装面板和零件

- 结构应用

- 军事和国防航空

- 太空和卫星应用

- 商业航空

- 汽车应用

- 电动汽车零件

- 碰撞吸收系统

- 结构加固

- 内部和外部面板

- 建筑与建筑

- 帷幕墙系统

- 外墙覆层

- 室内设计应用

- 屋顶和结构构件

- 船舶应用

- 造船和海军应用

- 游艇和休閒船製造

- 海上平台建造

- 工业应用

- 机械设备製造业

- 工装和夹具

- 无尘室与实验室应用

- 交通运输及铁路

- 高铁应用

- 城市交通系统

- 商用车应用

- 其他的

- 家具与设计

- 再生能源应用

- 体育和娱乐设备

第六章:市场估计与预测:依核心类型和规格,2021-2034

- 主要趋势

- 芯材厚度

- 超薄(5mm-10mm)

- 标准(11毫米-25毫米)

- 中号(26毫米-50毫米)

- 厚(51毫米-100毫米)

- 重型(100mm以上)

- 铝合金型

- 3003合金(商业级)

- 5052合金(航太级)

- 5056合金(高性能应用)

- 其他特种合金

- 单元尺寸和配置

- 标准六角形细胞

- 微蜂巢配置

- 客製化电池几何形状

- 面板材质

- 铝面板

- 复合面板

- 混合配置

- 面板尺寸和尺寸

- 标准面板

- 大尺寸面板

- 客製尺寸的应用程式

第七章:市场估计与预测:按最终用途产业,2021-2034 年

- 主要趋势

- 航太和国防工业

- 汽车产业

- 建筑业

- 商业建筑

- 住宅应用

- 基础建设发展

- 海洋和造船业

- 商业运输

- 海军和国防应用

- 休閒海洋市场

- 海上能源领域

- 运输和物流

- 轨道交通

- 商用车

- 大众运输系统

- 工业製造

- 机械设备

- 洁净室应用

- 专业工业用途

- 其他的

- 能源和发电

- 体育和娱乐

- 家具和室内设计

第八章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- 3A Composites Holding AG

- Hexcel Corporation

- Plascore Inc.

- Alcoa Corporation

- Novelis Inc.

- Hunter Douglas NV

- Toray Advanced Composites

- Euro-Composites SA

- Collins Aerospace (Raytheon Technologies)

- Argosy International Inc.

- Alucoil SL

- Pacific Panels Inc.

- Benecor Inc.

- Liming Honeycomb Composites Co., Ltd.

- KUMZ (Kamensk-Uralsky Metallurgical Works)

- Eco Earth Solutions

- Renoxbell Group

- Foshan Alucrown Building Materials Co., Ltd.

- Mass Transit Equipment LLP

- UACJ Corporation

- Schweiter Technologies AG

- Shinko-North Co., Ltd.

- Guangzhou Aloya Renoxbell Aluminum Co., Ltd.

- Advanced Custom Manufacturing

- Zodiac Aerospace (Safran)

- B/E Aerospace

- Triumph Group Inc.

- The NORDAM Group LLC

- Flatiron Panel Products

- Corex-Honeycomb

- 3M Company

- Armacell International SA

- MC Gill Corporation

- TenCate Advanced Composites

- Oerlikon Metco

- Boeing Encore Interiors LLC

- Safran SA

- Rockwell Collins (Collins Aerospace)

- Avcorp Industries Inc.

- Yamaton Corporation

- Shuangdie Group

- SPEE3D

- Zimmermann Group

- BoDo Plastics

- Duramax

- LIDA PLASTIC INDUSTRY

- Gayatri Corporation

- Viva Composite Panel Pvt Ltd

- Go Alubuild Pvt Ltd

- Kukreja Brothers

- Uniwell International Enterprises Corp.

- Prance Building Materials

- DJ Aluminum

- Alumetal

- TOPCOMB

- Chaluminium

- Jixiang Aluminum

The Global Aluminum Honeycomb Panels Market was valued at USD 3.57 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 6.79 billion by 2034. This growth is primarily driven by increasing applications across multiple high-performance industries that require materials combining strength with low weight. The demand is particularly pronounced in sectors where performance efficiency and structural integrity are key, such as aerospace, automotive, construction, and industrial manufacturing. These panels are widely recognized for their ability to meet stringent requirements related to energy absorption, durability, and resistance to various stresses without significantly increasing the weight of structures.

As industries continue to pursue energy-saving and sustainability goals, the demand for lightweight yet robust materials is rising, which makes aluminum honeycomb panels an ideal solution. The rising trend of using these materials in modern infrastructure, transportation systems, and specialized equipment housing further supports their growing relevance in global markets. Their appeal is enhanced by their recyclability, fire resistance, and thermal insulation properties, making them suitable for a wide range of applications that require both functionality and environmental responsibility.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.57 billion |

| Forecast Value | $6.79 billion |

| CAGR | 6.7% |

In the aerospace segment, aluminum honeycomb panels are gaining rapid traction as they fulfill essential criteria such as lightweight and high strength. The aerospace applications segment alone was valued at USD 1.09 billion in 2024 and is projected to register a CAGR of 7.5% from 2025 to 2034. These panels help enhance fuel efficiency and enable improved design flexibility, which is critical in aviation manufacturing. Their usage extends to interior partitions, flooring systems, and structural elements, where weight reduction is crucial without compromising performance. As aircraft manufacturers increase focus on cost-efficient and fuel-saving technologies, the preference for aluminum honeycomb structures continues to strengthen.

These materials are also finding growing acceptance in the building and construction industry. Their combination of low weight and high rigidity allows for easier installation, longer lifespan, and superior performance in structural roles. Their fire-resistant and sound-insulating features further contribute to their use in cladding systems, ceilings, and partitions, particularly in commercial and institutional buildings. The shift toward green building codes and sustainable architecture has led to higher adoption of aluminum honeycomb panels in construction practices, especially in developed economies.

From a product specification standpoint, the market is advancing through innovations in core thickness, alloy types, and cell configurations. The core thickness segment, which was valued at USD 972 million in 2024, is expected to grow at a CAGR of 7% over the forecast period. Varying core dimensions offer customized load-bearing capabilities across applications, while specific alloys enhance corrosion resistance and optimize structural performance. Manufacturers are also developing tailored panel shapes and sizes to cater to specific design or technical requirements. These innovations are making aluminum honeycomb panels more adaptable to complex environments across multiple industries.

In terms of end-use, the aerospace and defense industry accounted for the largest share of the market in 2024, valued at USD 1.2 billion and holding a 32.4% market share. This segment is expected to expand at a CAGR of 7.2% through 2034. The growth is fueled by increased investment in national defense programs and a growing emphasis on lightweight materials for advanced defense systems. In the automotive industry, particularly in the electric vehicle segment, the panels contribute to extended range and better performance by reducing overall vehicle weight.

Additionally, their growing usage in sectors like marine, rail, and logistics is driven by the need for corrosion resistance, thermal stability, and ease of fabrication. These characteristics make the panels well-suited for use in ship interiors, train compartments, and cargo systems. Industrial manufacturers also rely on these panels to build structural frames and enclosures for sensitive equipment, which highlights their versatility and performance consistency.

In the United States, the aluminum honeycomb panels market was valued at USD 888.3 million in 2024 and is projected to grow at a CAGR of 6.5% from 2025 to 2034. The country's position as a global hub for aircraft production, along with rising investments in electric vehicles and military upgrades, is creating favorable conditions for market expansion. The emphasis on environmentally friendly construction practices and energy efficiency in commercial buildings further supports domestic demand.

The competitive landscape features major composite and material producers who dominate the market through a combination of advanced manufacturing, diverse product portfolios, and strategic partnerships across supply chains. These companies continuously invest in research and development to improve product strength, fire resistance, and adaptability to meet evolving industrial standards. By aligning production with global regulatory norms and sustainability targets, these firms maintain their competitive edge and cater to both high-volume and high-specification market demands. Their established relationships with OEMs and contractors ensure long-term business continuity, while their commitment to automation and quality control reinforces their leadership in critical end-use segments.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Application

- 2.2.3 Core Type and Specifications

- 2.2.4 End use Industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, Application, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Aerospace applications

- 5.2.1 Commercial aviation

- 5.2.1.1 Aircraft flooring systems

- 5.2.1.2 Interior panels and components

- 5.2.1.3 Structural applications

- 5.2.2 Military and defense aviation

- 5.2.3 Space and satellite applications

- 5.2.1 Commercial aviation

- 5.3 Automotive applications

- 5.3.1 Electric vehicle components

- 5.3.2 Crash absorption systems

- 5.3.3 Structural reinforcements

- 5.3.4 Interior and exterior panels

- 5.4 Construction and architecture

- 5.4.1 Curtain wall systems

- 5.4.2 Facade cladding

- 5.4.3 Interior design applications

- 5.4.4 Roofing and structural elements

- 5.5 Marine applications

- 5.5.1 Ship building and naval applications

- 5.5.2 Yacht and recreational boat manufacturing

- 5.5.3 Offshore platform construction

- 5.6 Industrial applications

- 5.6.1 Machinery and equipment manufacturing

- 5.6.2 Tooling and fixtures

- 5.6.3 Clean room and laboratory applications

- 5.7 Transportation and rail

- 5.7.1 High-speed rail applications

- 5.7.2 Urban transit systems

- 5.7.3 Commercial vehicle applications

- 5.8 Others

- 5.8.1 Furniture and design

- 5.8.2 Renewable energy applications

- 5.8.3 Sports and recreation equipment

Chapter 6 Market Estimates & Forecast, By Core Type and Specifications, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Core thickness

- 6.2.1 Ultra-thin (5mm-10mm)

- 6.2.2 Standard (11mm-25mm)

- 6.2.3 Medium (26mm-50mm)

- 6.2.4 Thick (51mm-100mm)

- 6.2.5 Heavy-duty (above 100mm)

- 6.3 Aluminum alloy type

- 6.3.1 3003 alloy (commercial grade)

- 6.3.2 5052 alloy (aerospace grade)

- 6.3.3 5056 alloy (high-performance applications)

- 6.3.4 Other specialized alloys

- 6.4 Cell size and configuration

- 6.4.1 Standard hexagonal cells

- 6.4.2 Micro-cell configurations

- 6.4.3 Custom cell geometries

- 6.5 Face sheet material

- 6.5.1 Aluminum face sheets

- 6.5.2 Composite face sheets

- 6.5.3 Hybrid configurations

- 6.6 Panel size and dimensions

- 6.6.1 Standard panels

- 6.6.2 Large format panels

- 6.6.3 Custom-sized applications

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Aerospace and defense industry

- 7.3 Automotive industry

- 7.4 Building and construction industry

- 7.4.1 Commercial construction

- 7.4.2 Residential applications

- 7.4.3 Infrastructure development

- 7.5 Marine and shipbuilding industry

- 7.5.1 Commercial shipping

- 7.5.2 Naval and defense applications

- 7.5.3 Recreational marine market

- 7.5.4 Offshore energy sector

- 7.6 Transportation and logistics

- 7.6.1 Rail transportation

- 7.6.2 Commercial vehicles

- 7.6.3 Public transportation systems

- 7.7 Industrial manufacturing

- 7.7.1 Machinery and equipment

- 7.7.2 Clean room applications

- 7.7.3 Specialized industrial uses

- 7.8 Others

- 7.8.1 Energy and power generation

- 7.8.2 Sports and recreation

- 7.9 Furniture and interior design

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 3A Composites Holding AG

- 9.2 Hexcel Corporation

- 9.3 Plascore Inc.

- 9.4 Alcoa Corporation

- 9.5 Novelis Inc.

- 9.6 Hunter Douglas N.V.

- 9.7 Toray Advanced Composites

- 9.8 Euro-Composites S.A.

- 9.9 Collins Aerospace (Raytheon Technologies)

- 9.10 Argosy International Inc.

- 9.11 Alucoil S.L.

- 9.12 Pacific Panels Inc.

- 9.13 Benecor Inc.

- 9.14 Liming Honeycomb Composites Co., Ltd.

- 9.15 KUMZ (Kamensk-Uralsky Metallurgical Works)

- 9.16 Eco Earth Solutions

- 9.17 Renoxbell Group

- 9.18 Foshan Alucrown Building Materials Co., Ltd.

- 9.19 Mass Transit Equipment LLP

- 9.20 UACJ Corporation

- 9.21 Schweiter Technologies AG

- 9.22 Shinko-North Co., Ltd.

- 9.23 Guangzhou Aloya Renoxbell Aluminum Co., Ltd.

- 9.24 Advanced Custom Manufacturing

- 9.25 Zodiac Aerospace (Safran)

- 9.26 B/E Aerospace

- 9.27 Triumph Group Inc.

- 9.28 The NORDAM Group LLC

- 9.29 Flatiron Panel Products

- 9.30 Corex-Honeycomb

- 9.31 3M Company

- 9.32 Armacell International S.A.

- 9.33 MC Gill Corporation

- 9.34 TenCate Advanced Composites

- 9.35 Oerlikon Metco

- 9.36 Boeing Encore Interiors LLC

- 9.37 Safran S.A.

- 9.38 Rockwell Collins (Collins Aerospace)

- 9.39 Avcorp Industries Inc.

- 9.40 Yamaton Corporation

- 9.41 Shuangdie Group

- 9.42 SPEE3D

- 9.43 Zimmermann Group

- 9.44 BoDo Plastics

- 9.45 Duramax

- 9.46 LIDA PLASTIC INDUSTRY

- 9.47 Gayatri Corporation

- 9.48 Viva Composite Panel Pvt Ltd

- 9.49 Go Alubuild Pvt Ltd

- 9.50 Kukreja Brothers

- 9.51 Uniwell International Enterprises Corp.

- 9.52 Prance Building Materials

- 9.53 DJ Aluminum

- 9.54 Alumetal

- 9.55 TOPCOMB

- 9.56 Chaluminium

- 9.57 Jixiang Aluminum