|

市场调查报告书

商品编码

1773316

层式码垛机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Layer Palletizers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

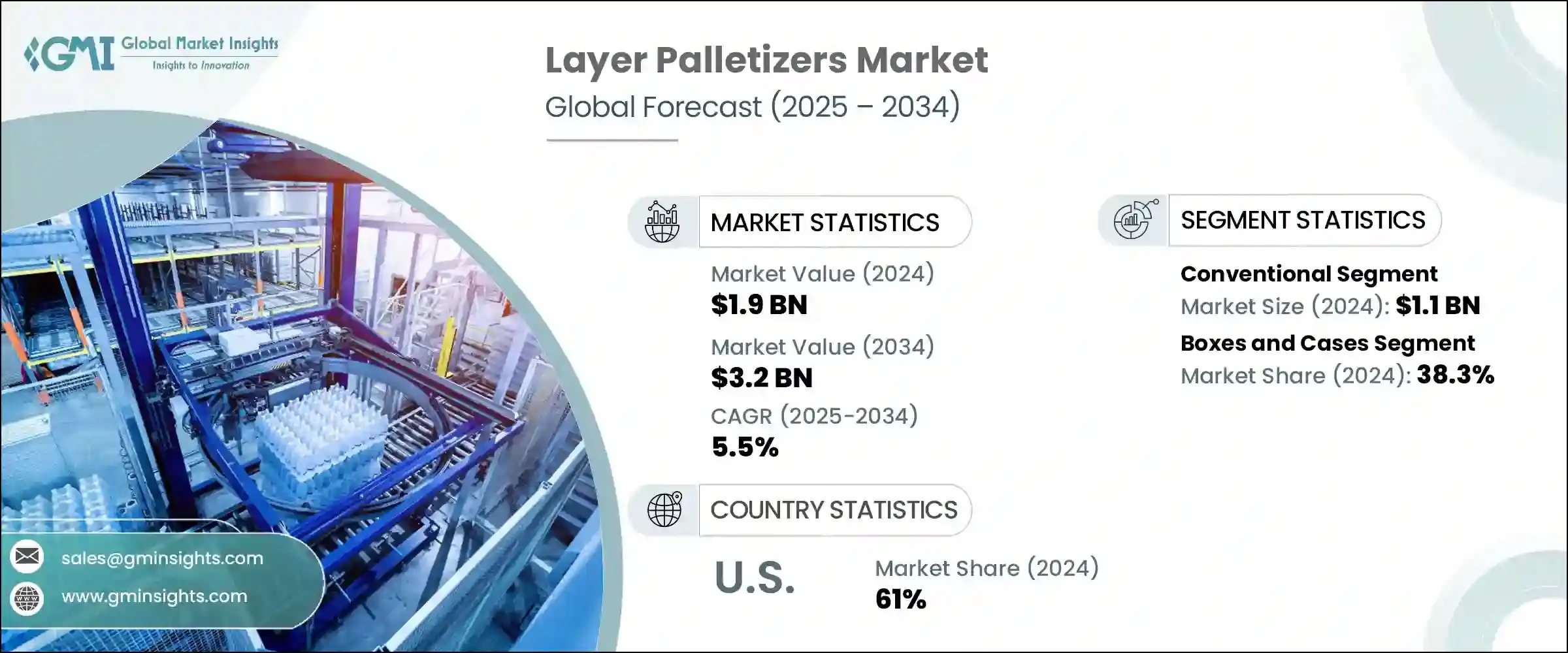

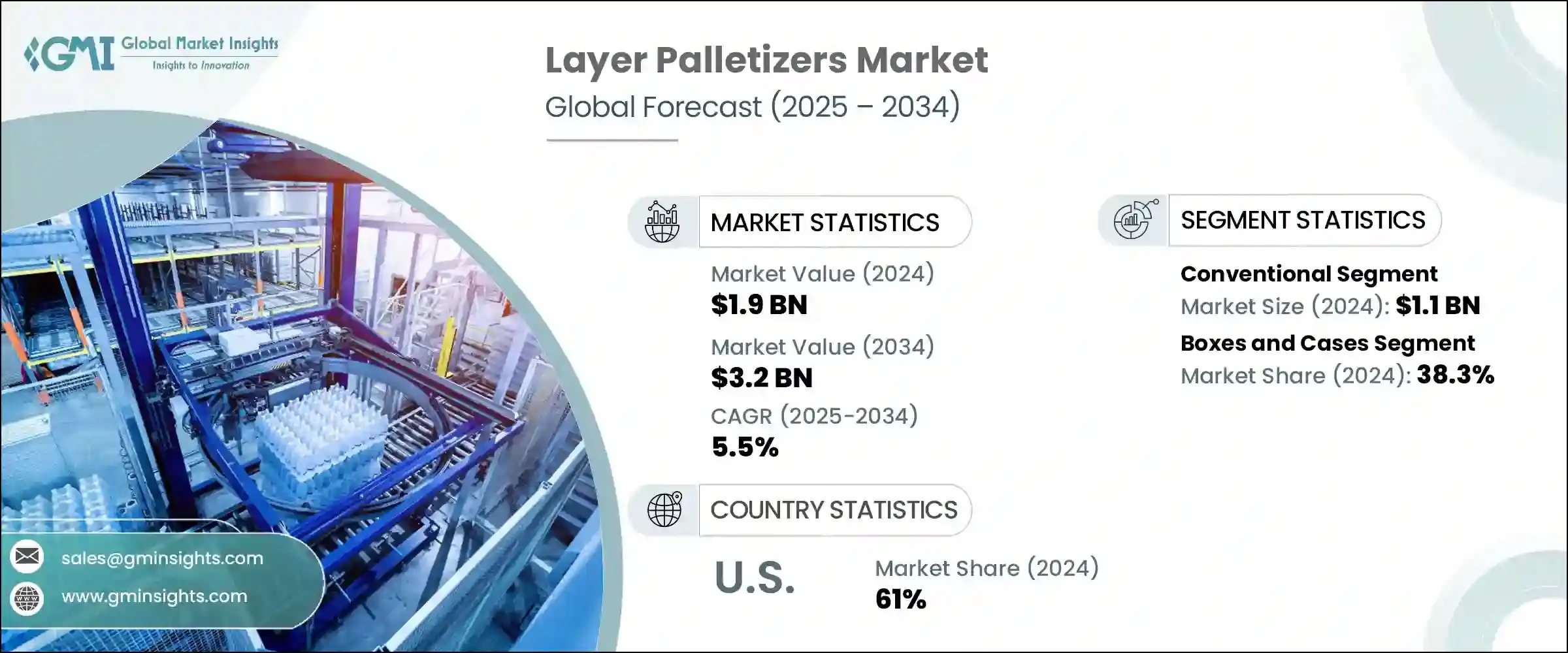

2024年,全球分层码垛机市场规模达19亿美元,预计到2034年将以5.5%的复合年增长率成长,达到32亿美元。分层码垛机在托盘上组织产品以实现高效运输方面发挥着至关重要的作用,广泛应用于物流、供应链和仓储营运。近年来,自动化堆迭系统越来越多地取代仓库和製造工厂中的手动堆迭方法,这得益于其能够提高效率、减少产品损坏并减轻工人的体力负担。

全球对自动化和营运效率日益增长的需求正推动着该市场的扩张。这些机器将箱子或袋子等物品小心地堆迭成整齐、稳定的层层结构,这对于简化多个行业的配送、仓储和运输流程至关重要。主要的市场驱动因素包括:劳动成本的上升、透过最大限度地减少人工操作来增强工作场所安全性,以及对生产线更高速度和更少错误的需求。製造商通常根据吞吐能力、对不同产品类型的适应性、设施布局以及与现有输送机和包装系统的兼容性来评估码垛机。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 19亿美元 |

| 预测值 | 32亿美元 |

| 复合年增长率 | 5.5% |

技术进步,尤其是机器人技术、人工智慧 (AI) 和工业物联网 (IIoT) 领域的技术进步,正在推动市场向前发展。现代分层码垛机拥有更高的灵活性,能够处理各种尺寸和形状的产品,并可无缝整合到现有生产线中。这种适应性确保製造商能够以更高的精度和更少的停机时间满足不断变化的需求。

传统层式码垛机市场在2024年创造了11亿美元的市场规模。这些系统透过逐层堆迭板条箱和纸箱等货物来建造托盘货物,并由上游的传送带系统在放置前对包裹进行对齐。传统码垛机尤其适用于中小型生产设施,并满足多通路市场的需求。透过利用这些先进的系统实现码垛流程的自动化,企业可以解决劳动力短缺问题,减少停机时间,并满足各行各业日益增长的需求。

2024年,纸箱和纸盒细分市场占据38.3%的市场。由于纸箱形状和硬度均匀,层式码垛机尤其适合处理标准化的矩形或方形纸箱。纸箱和纸盒可满足食品饮料、消费品、製药和电子商务等行业的众多包装需求。其一致的形状和可堆迭性使其能够快速、精确、稳定地形成托盘,这对于高效的供应链至关重要。

2024年,美国层式码垛机市场占有61%的份额。高昂的劳动成本加上码垛等重复性任务的劳动力短缺,是推动美国需求的主要因素。製造业、物流业和蓬勃发展的电子商务产业大力推动工业自动化,促进了自动码垛技术的广泛应用。美国公司大力投资这些系统,以提高效率、增加产量并维持一致的产品处理标准。此外,北美市场的成长得益于众多知名码垛机製造商和技术供应商的存在,他们不断创新并增强产品供应。

影响全球层码垛机市场的关键参与者包括 Korber AG、BW flexible Systems、Scott Automation、Premier Tech、PHS Innovate、Segbert Palletizing and Automation、COSMAPACK、TRAPO GmbH、Honeywell International Inc、SMB、Brolla、TMI、Mollers Packaging Technology GmbH、Concetti Sping Technology GmbH、ConcettiA 和 Rane。为了巩固市场地位,层码垛机产业的公司非常注重创新和客製化,开发针对不同产业需求和生产规模的解决方案。他们投资于整合尖端机器人技术、人工智慧和工业物联网 (IIoT) 功能,以提高系统灵活性和效率。与原始设备製造商 (OEM) 和包装解决方案提供商的合作使他们能够提供可无缝融入现有生产线的综合交钥匙系统。公司还优先透过策略合作伙伴关係、在地化製造和强大的服务网络扩大全球影响力,以满足全球客户的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 电子商务和物流的成长

- 食品和饮料行业的需求不断增长

- 各行各业采用自动化

- 产业陷阱与挑战

- 初期投资及维护成本高

- 产品变化的灵活性有限

- 机会

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 传统的

- 低/地板水平

- 进阶

- 机器人

第六章:市场估计与预测:按产能,2021 - 2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 盒子和箱子

- 袋子和麻袋

- 托盘和板条箱

- 其他的

第八章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 食品和饮料

- 製药

- 消费品

- 电子商务与物流

- 化学品和材料

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Brolla

- BW Flexible Systems

- Concetti SpA

- COSMAPACK

- Honeywell International Inc

- Korber AG

- KUKA AG

- Mollers Packaging Technology GmbH

- PHS Innovate

- Premier Tech

- Scott Automation

- Segbert Palletizing and Automation

- SMB

- TMI

- TRAPO GmbH

The Global Layer Palletizers Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 3.2 billion by 2034. Layer palletizers play a crucial role in organizing products on pallets for efficient transport, with widespread applications across logistics, supply chain, and storage operations. Over recent years, automated palletizing systems have increasingly replaced manual methods in warehouses and manufacturing facilities, driven by their ability to enhance efficiency, reduce product damage, and lessen physical strain on workers.

The growing global demand for automation and operational efficiency is fueling the expansion of this market. These machines carefully stack items such as boxes or bags into neat, stable layers, a process vital for streamlined distribution, storage, and transport across multiple industries. Key market drivers include rising labor expenses, an increased focus on workplace safety by minimizing manual handling, and the need for production lines to operate with greater speed and fewer errors. Manufacturers typically evaluate palletizers based on throughput capacity, adaptability to different product types, facility layout, and compatibility with existing conveyor and packaging systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $3.2 Billion |

| CAGR | 5.5% |

Technological advancements, especially in robotics, artificial intelligence (AI), and the Industrial Internet of Things (IIoT), are propelling the market forward. Modern layer palletizers boast enhanced flexibility, handling diverse product sizes and shapes while integrating seamlessly into existing production lines. This adaptability ensures manufacturers can meet evolving demands with greater precision and less downtime.

The conventional layer palletizers segment generated USD 1.1 billion in 2024. These systems build pallet loads by stacking goods such as crates and boxes layer by layer, with an upstream conveyor system aligning packages before placement. Conventional palletizers are particularly well-suited to small and medium-sized production facilities and meet the requirements of multi-channel markets. By automating the palletizing process with these advanced systems, businesses can address labor shortages, reduce downtime, and satisfy rising demand across sectors.

In 2024, the boxes and cases segment held a 38.3% share. Layer palletizers are especially effective for handling standardized rectangular or square cartons due to their uniform shape and rigidity. Boxes and cases serve numerous packaging needs across industries such as food and beverages, consumer goods, pharmaceuticals, and e-commerce. Their consistent shape and stackability enable fast, precise, and stable pallet formation, which is essential for efficient supply chains.

U.S. Layer Palletizers Market held a 61% share in 2024. High labor costs combined with workforce shortages for repetitive tasks such as palletizing are major factors driving demand in the U.S. A strong push towards industrial automation across manufacturing, logistics, and the booming e-commerce sector has encouraged widespread adoption of automated palletizing technologies. Companies in the U.S. invest heavily in these systems to boost efficiency, increase output, and maintain consistent product handling standards. Moreover, North America's market growth benefits from the presence of numerous established palletizer manufacturers and technology providers who continuously innovate and enhance product offerings.

Key players shaping the Global Layer Palletizers Market include Korber AG, BW Flexible Systems, Scott Automation, Premier Tech, PHS Innovate, Segbert Palletizing and Automation, COSMAPACK, TRAPO GmbH, Honeywell International Inc, SMB, Brolla, TMI, Mollers Packaging Technology GmbH, Concetti SpA, and Rane. To solidify their market positions, companies in the layer palletizers industry focus heavily on innovation and customization, developing solutions tailored to diverse industry needs and production scales. They invest in integrating cutting-edge robotics, AI, and IIoT capabilities to enhance system flexibility and efficiency. Collaborations with original equipment manufacturers (OEMs) and packaging solution providers allow them to offer comprehensive turnkey systems that seamlessly fit into existing lines. Firms also prioritize expanding their global footprint through strategic partnerships, localized manufacturing, and robust service networks to support customer requirements worldwide.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Capacity

- 2.2.4 Application

- 2.2.5 End Use Industry

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth of e-commerce and logistics

- 3.2.1.2 Rising demand from the food and beverages industry

- 3.2.1.3 Adoption of automation in various industries

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and maintenance costs

- 3.2.2.2 Limited flexibility for product variation

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Units)

- 5.1 Key trends

- 5.2 Conventional

- 5.2.1 Low/Floor level

- 5.2.2 High level

- 5.3 Robotic

Chapter 6 Market Estimates and Forecast, By Capacity, 2021 - 2034 (USD Billion) (Units)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Units)

- 7.1 Key trends

- 7.2 Boxes and cases

- 7.3 Bags and sacks

- 7.4 Trays and crates

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Units)

- 8.1 Key trends

- 8.2 Food and beverages

- 8.3 Pharmaceuticals

- 8.4 Consumer goods

- 8.5 E-commerce and logistics

- 8.6 Chemicals and materials

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Brolla

- 10.2 BW Flexible Systems

- 10.3 Concetti SpA

- 10.4 COSMAPACK

- 10.5 Honeywell International Inc

- 10.6 Korber AG

- 10.7 KUKA AG

- 10.8 Mollers Packaging Technology GmbH

- 10.9 PHS Innovate

- 10.10 Premier Tech

- 10.11 Scott Automation

- 10.12 Segbert Palletizing and Automation

- 10.13 SMB

- 10.14 TMI

- 10.15 TRAPO GmbH