|

市场调查报告书

商品编码

1773317

电动汽车电池健康诊断系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测EV Battery Health Diagnostics System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

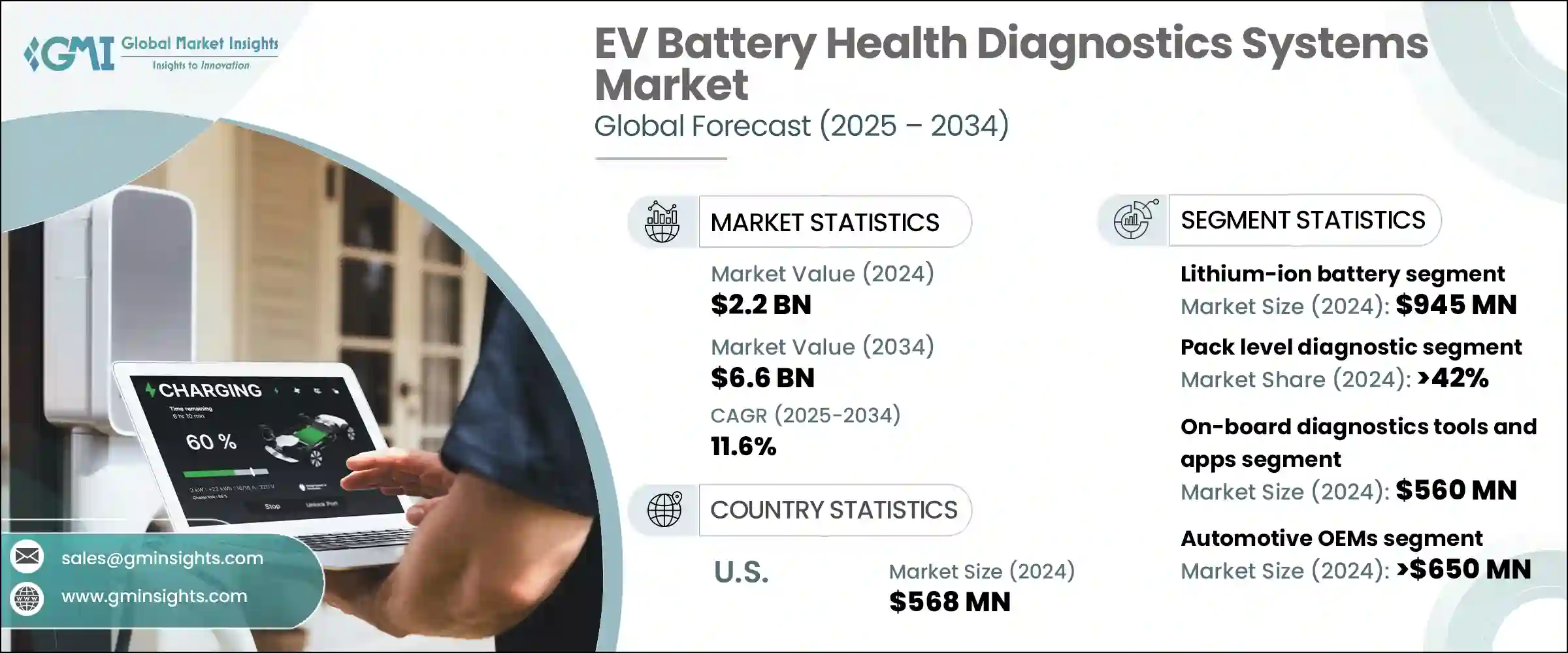

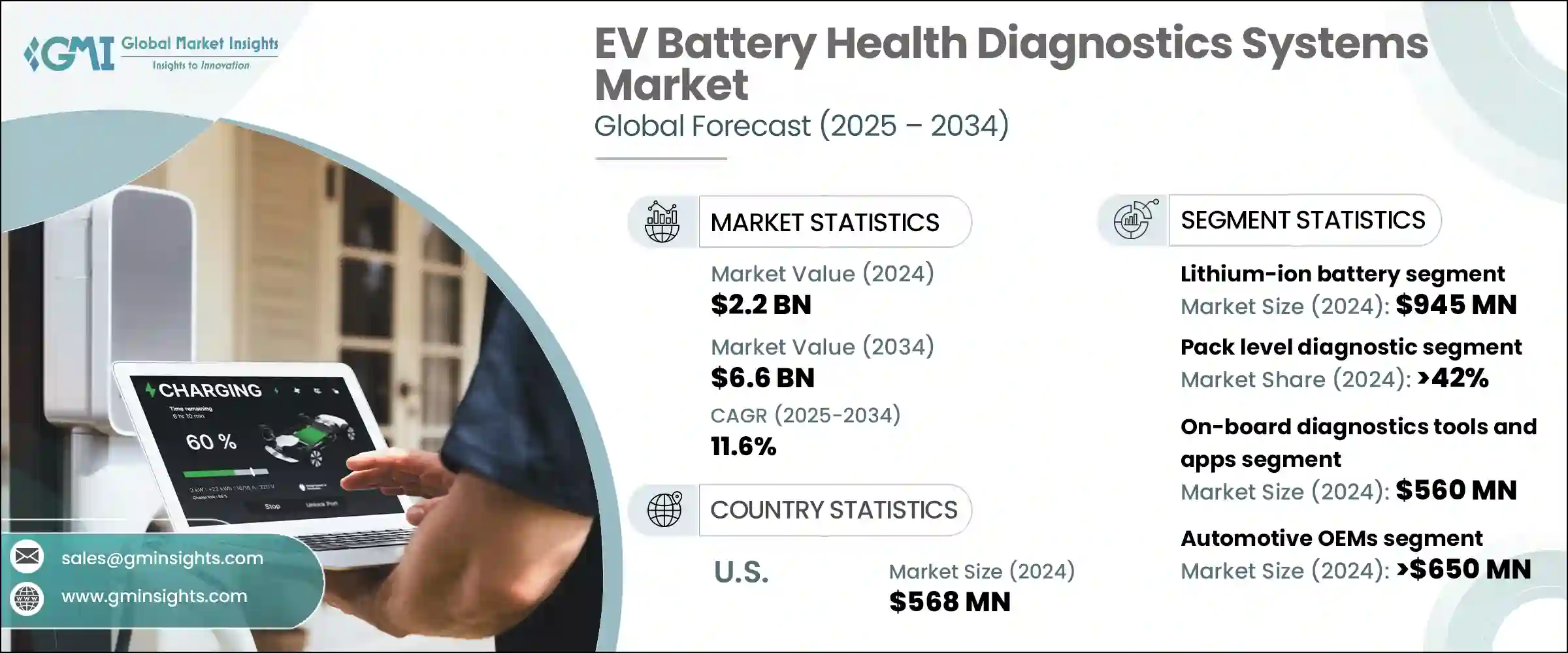

2024年,全球电动车电池健康诊断系统市场规模达22亿美元,预计2034年将以11.6%的复合年增长率成长,达到66亿美元。这一成长主要源于电动车在个人和商业运输领域的快速扩张,以及人们对电池安全性、性能和使用寿命日益增长的担忧。随着电动车的普及,确保电池健康对汽车製造商、车队营运商和消费者都至关重要。

由于电池成本高昂,对电动车来说是一笔不小的投资,因此即时诊断以监控电池的健康和性能至关重要。基于人工智慧和物联网技术的先进诊断系统在降低电动车 (EV) 的整体维护成本方面发挥关键作用。这些系统能够即时监控电池的健康状况、性能和效率,以便及时进行干预和预测性维护。透过在潜在问题升级为重大问题之前将其检测出来,这些诊断工具有助于优化电动车电池的使用寿命,从而减少昂贵的维修和更换费用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 22亿美元 |

| 预测值 | 66亿美元 |

| 复合年增长率 | 11.6% |

此外,这些智慧诊断系统透过提供电池健康和性能的精确资料,简化了保固管理,使车队营运商和製造商能够更轻鬆地有效地管理保固索赔。远端追踪和诊断潜在问题的能力可确保更快的回应时间和更准确的索赔评估。

锂离子电池市场占40%的市场份额,2024年价值9.45亿美元。锂离子电池因其比其他化学电池更高的能量密度、更长的循环寿命和卓越的性能而得到了广泛的应用。这种普及推动了先进诊断技术的广泛应用,这些技术可以监测关键效能指标,例如充电状态(SOC)、健康状态(SOH)和热性能。此外,锂离子电池与基于人工智慧的云端平台和无线(OTA)诊断的兼容性,巩固了其在市场上的主导地位。

2024年,电池组级诊断市场占据42%的份额,预计在2025-2034年期间将以10.5%的复合年增长率增长,这得益于面向大众市场和商用电动车的经济高效且可扩展的诊断解决方案。电池组级诊断可追踪电压、温度和电流等关键参数,从而提供电池状态的全面视图。这种方法对于检测早期故障(例如热失控、电压不平衡和能量滥用)至关重要,而这些故障对于车辆安全、效率和续航里程至关重要。

美国电动车电池健康诊断系统市场占75%的市场份额,2024年市场规模达5.68亿美元。随着电动车生态系统的快速发展以及联邦政府对电动车队的支持,美国市场有望进一步成长。消费者对电池效能透明度、安全性和可靠性的需求,推动了对准确及时诊断的需求。美国政府的激励措施,例如《通膨削减法案》,加上对电池生产和二次利用应用的资助,进一步推动了诊断系统创新,尤其是基于云端和人工智慧的技术。

电动车电池健康诊断系统市场的顶级公司包括 AVL、Mahle、Exide Technologies、Forvia Hella、Cox Automotive、LG Energy Solutions 和 Delphi。为了巩固其在电动车电池诊断市场的地位,各公司正专注于将人工智慧、物联网和云端平台等先进技术整合到其解决方案中。这有助于提供即时、精确的诊断,从而提高电池效能和使用寿命。各公司也在扩展其产品线,包括先进的电池组级和电池单元级诊断,以满足原始设备製造商 (OEM) 和车队营运商不断变化的需求。

与汽车製造商和车队管理公司合作,使这些企业能够根据特定客户需求开发客製化解决方案。此外,各公司正大力投资研发,以创新电池诊断技术,提升系统的准确性、可扩展性和效率。最后,提供全面的售后服务并透过直销管道建立稳固的客户关係已成为巩固市场地位的重要策略。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 成本结构

- 利润率

- 每个阶段的增值

- 影响供应链的因素

- 破坏者

- 对部队的影响

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 波特的分析

- PESTEL分析

- 技术与创新格局

- 现有技术

- 新兴技术

- 专利分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 生产统计

- 生产中心

- 消费中心

- 汇出和汇入

- 成本細項分析

- 可持续性分析

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按电池,2021 - 2034 年

- 主要趋势

- 锂离子电池

- 铅酸电池

- 镍氢电池

- 固态电池

- 其他的

第六章:市场估计与预测:按诊断,2021 - 2034 年

- 主要趋势

- 细胞水平诊断

- 模组级诊断

- 电池组级诊断

第七章:市场估计与预测:依服务模式,2021 - 2034 年

- 主要趋势

- 内部诊断系统

- 第三方实验室测试服务

- 基于云端的平台/API

- 其他的

第八章:市场估计与预测:依诊断方法,2021 - 2034 年

- 主要趋势

- 电化学阻抗谱

- 电压和电流监控

- 热成像/感测器

- 基于人工智慧的预测分析

- 车载诊断工具和应用程式

- 其他的

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 汽车OEM

- 电池製造商

- 车队营运商

- 电动车服务站

- 其他的

第十章:市场估计与预测:按地区,2021 - 2034 年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Accure Battery Intelligence

- Autel

- Aviloo

- AVL

- Battery OK Technologies

- Cellife Technologies

- Cox Automotive

- Delphi

- Exide Technologies

- Forvia Hella

- HEI Corporation

- Infinitev

- LG Energy Solutions

- Mahle

- Midtronics

- My Battery Health

- SG Software GmbH

- SK On

- Twaice

- Volytica Diagnostics

The Global EV Battery Health Diagnostics System Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 11.6% to reach USD 6.6 billion by 2034. This growth is primarily driven by the rapid expansion of electric vehicles (EVs) across personal and commercial transport sectors, alongside growing concerns about battery safety, performance, and longevity. As EV adoption accelerates, the importance of ensuring battery health has become critical for automotive manufacturers, fleet operators, and consumers alike.

With the high cost of batteries being a significant investment for EVs, real-time diagnostics to monitor battery health and performance is essential. Advanced diagnostic systems, powered by AI and IoT technologies, play a pivotal role in reducing the overall maintenance costs associated with electric vehicles (EVs). These systems enable real-time monitoring of battery health, performance, and efficiency, allowing for timely interventions and predictive maintenance. By detecting potential issues before they escalate into major problems, these diagnostic tools help optimize the longevity of EV batteries, thereby cutting down on expensive repairs and replacements.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $6.6 Billion |

| CAGR | 11.6% |

Moreover, these smart diagnostics systems streamline warranty management by providing precise data on battery health and performance, making it easier for fleet operators and manufacturers to manage warranty claims effectively. The ability to track and diagnose potential issues remotely ensures faster response times and more accurate claim assessments.

The lithium-ion battery segment held a 40% share and was valued at USD 945 million in 2024. Lithium-ion batteries have gained widespread use due to their superior energy density, longer cycle life, and exceptional performance compared to other battery chemistries. This popularity has led to the increased adoption of advanced diagnostics technologies that monitor key performance metrics like state of charge (SOC), state of health (SOH), and thermal performance. Additionally, their compatibility with AI-based cloud platforms and over-the-air (OTA) diagnostics has strengthened their dominance in the market.

The pack-level diagnostics segment held a 42% share in 2024 and is expected to grow at a CAGR of 10.5% during 2025-2034, driven by the cost-effective and scalable diagnostic solutions for both mass-market and commercial EVs. Pack-level diagnostics track critical parameters such as voltage, temperature, and current flow, offering an overall view of the battery's condition. This approach is vital for detecting early-stage failures, such as thermal runaway, voltage imbalances, and energy misuse, all of which are crucial for vehicle safety, efficiency, and range.

U.S. EV Battery Health Diagnostics System Market held a 75% share and generated USD 568 million in 2024. With rapid developments in the EV ecosystem and federal support aimed at electrifying fleets, the U.S. market is poised for further growth. Consumer demand for transparency in battery performance, as well as safety and reliability, is driving the need for accurate and timely diagnostics. The U.S. government's incentives, such as The Inflation Reduction Act, combined with funding for battery production and secondary use applications, have further fueled the push for innovation in diagnostics systems, especially cloud-based and AI-powered technologies.

The top companies in the EV Battery Health Diagnostics System Market include AVL, Mahle, Exide Technologies, Forvia Hella, Cox Automotive, LG Energy Solutions, and Delphi. To strengthen their position in the EV battery diagnostics market, companies are focusing on integrating advanced technologies such as AI, IoT, and cloud-based platforms into their solutions. This helps to provide real-time, precise diagnostics that enhance battery performance and lifespan. Companies are also expanding their product offerings, including advanced pack-level and cell-level diagnostics, to meet the evolving needs of OEMs and fleet operators.

Partnerships with automakers and fleet management companies allow these players to develop customized solutions tailored to specific customer needs. Furthermore, companies are investing heavily in R&D to innovate in battery diagnostics and improve system accuracy, scalability, and efficiency. Finally, offering comprehensive after-sales services and building strong customer relationships through direct sales channels have become essential strategies for strengthening the market foothold.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Battery type

- 2.2.3 Diagnostic type

- 2.2.4 Service model

- 2.2.5 Diagnostic model

- 2.2.6 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Market Opportunities

- 3.3 Growth potential analysis

- 3.4 Porter's analysis

- 3.5 PESTEL analysis

- 3.6 Technology & innovation landscape

- 3.6.1 Current technologies

- 3.6.2 Emerging technologies

- 3.7 Patent analysis

- 3.8 Regulatory landscape

- 3.8.1 North America

- 3.8.2 Europe

- 3.8.3 Asia Pacific

- 3.8.4 Latin America

- 3.8.5 Middle East & Africa

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Sustainability analysis

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New Product Launches

- 4.5.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Battery, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Lithium-ion battery

- 5.3 Lead-acid battery

- 5.4 Nickel-metal hydride battery

- 5.5 Solid-state battery

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Diagnostic, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Cell-level diagnostic

- 6.3 Module-level diagnostic

- 6.4 Pack-level diagnostic

Chapter 7 Market Estimates & Forecast, By Service Model, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 In-house diagnostic systems

- 7.3 Third-party lab testing services

- 7.4 Cloud-based platform/APIs

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Diagnostic Method, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Electrochemical impedance spectroscopy

- 8.3 Voltage and current monitoring

- 8.4 Thermal imaging/sensors

- 8.5 AI-based predictive analytics

- 8.6 On-board diagnostics tools and apps

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Automotive OEM

- 9.3 Battery manufacturers

- 9.4 Fleet operators

- 9.5 EV service stations

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 North America

- 10.1.1 U.S.

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Russia

- 10.2.7 Nordics

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 South Korea

- 10.3.5 Australia

- 10.3.6 Southeast Asia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.5 MEA

- 10.5.1 South Africa

- 10.5.2 Saudi Arabia

- 10.5.3 UAE

Chapter 11 Company Profiles

- 11.1 Accure Battery Intelligence

- 11.2 Autel

- 11.3 Aviloo

- 11.4 AVL

- 11.5 Battery OK Technologies

- 11.6 Cellife Technologies

- 11.7 Cox Automotive

- 11.8 Delphi

- 11.9 Exide Technologies

- 11.10 Forvia Hella

- 11.11 HEI Corporation

- 11.12 Infinitev

- 11.13 LG Energy Solutions

- 11.14 Mahle

- 11.15 Midtronics

- 11.16 My Battery Health

- 11.17 SG Software GmbH

- 11.18 SK On

- 11.19 Twaice

- 11.20 Volytica Diagnostics