|

市场调查报告书

商品编码

1773321

棉花加工设备市场机会、成长动力、产业趋势分析及2025-2034年预测Cotton Processing Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

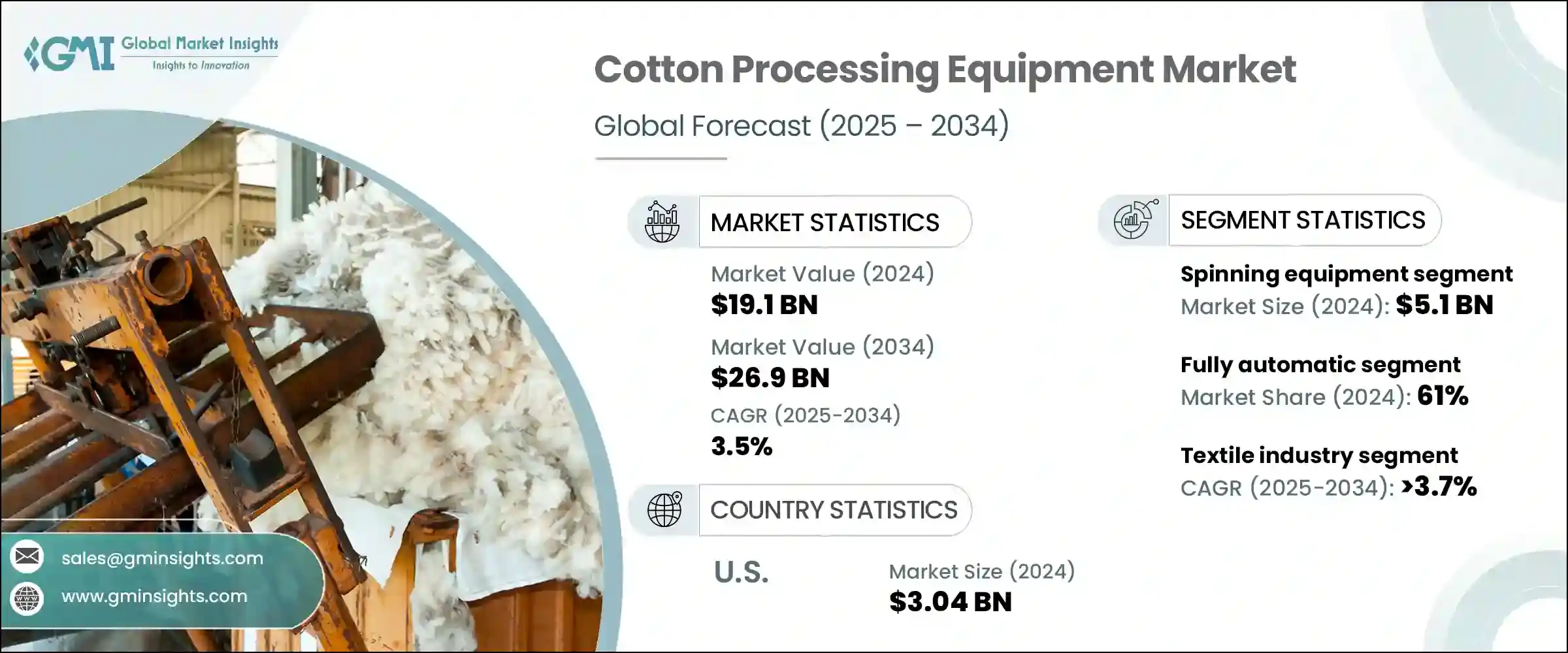

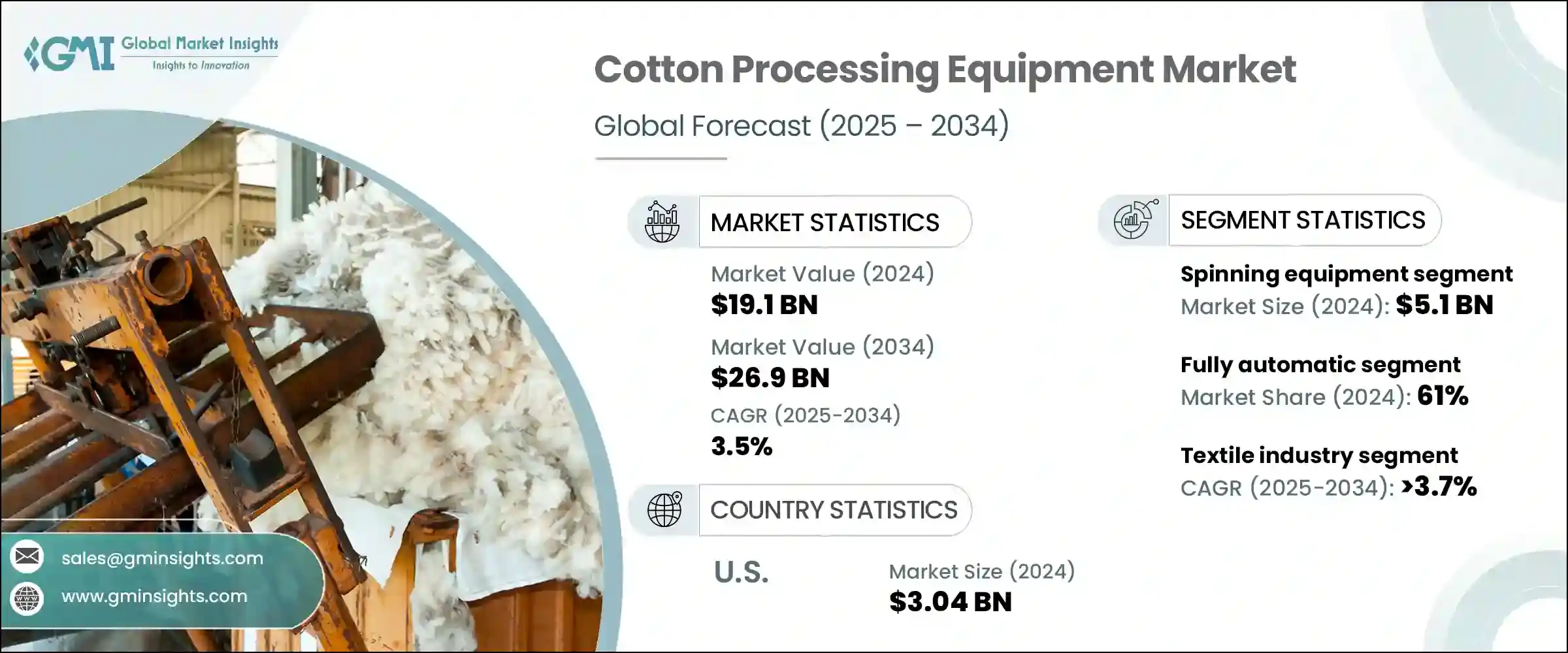

2024年,全球棉花加工设备市场规模达191亿美元,预计到2034年将以3.5%的复合年增长率成长,达到269亿美元。这一增长主要得益于对棉质服装和纺织品的需求不断增长,以及尖端加工技术的日益普及。棉花仍然是纺织业的重要原料,全球人口的成长以及可支配收入的提高,显着增加了对优质纺织品的需求。

这种日益增长的需求促使製造商透过部署先进的棉花加工设备来提升产能和效率。各公司正投入资源进行研发,以期为市场带来减少材料浪费、提高生产效率并确保加工棉花品质始终如一的解决方案。此外,向自动化和永续製造的转变正在塑造棉花加工业务的格局,推动对符合环境目标的智慧技术的投资。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 191亿美元 |

| 预测值 | 269亿美元 |

| 复合年增长率 | 3.5% |

在各类设备中,纺纱设备领域脱颖而出,2024 年市场价值将超过 51 亿美元。预计该领域在预测期内的复合年增长率将达到 4.1%。由于人们对自动化、高效和高速纺纱系统的关注度日益提高,该领域正经历着强劲的发展势头。製造商越来越多地整合高速纺杯、先进的环锭纺纱锭子和数位化工具等功能,以优化生产。

这些技术实现了即时监控、预测性维护和纱线产量的提高,从而减少了故障,并提高了营运效率。数位转型的重视,加上对永续性的需求,正在推动大型生产设施纺纱系统的变革。这种转变也重塑了劳动力模式,减少了对体力劳动的依赖,同时在技术支援和设备维护方面创造了新的职位。

从操作模式来看,全自动机械在2024年占据了约61%的市场份额,预计在2025年至2034年期间的复合年增长率将达到3.7%。全自动棉花加工系统的吸引力在于其能够提供高精度输出,同时显着降低操作失误。对于希望提高生产力并降低劳动成本的大型製造商而言,这些机器至关重要。

物联网、机器学习和即时资料分析等智慧技术的融合正在增强这些系统的功能和输出品质。随着企业寻求实施智慧製造策略,预计主要製造中心对全自动系统的偏好将进一步增强。相较之下,手动机械在规模较小的本地化市场中仍然具有重要意义,尤其是在成本受限或先进基础设施获取管道有限的地区。

从应用角度来看,纺织业仍是棉花加工设备的主要消费产业,预计在预测期内复合年增长率将超过3.7%。全球服装和家居产业的持续成长,对棉质产品的需求强劲。消费者对环保和天然纤维的偏好显着提升,也推动了时尚和室内装潢市场对棉花的消费。

除了服装之外,医疗产业也正在成为高品质棉製品(包括纱布、绷带和外科用品)的稳定消费者。医疗机构对卫生和感染控制的日益重视,增强了对支持生产无菌耐用材料的先进棉花加工系统的需求。这一趋势促使製造商采用针对医疗领域需求的精密加工机械。

从区域来看,美国继续主导北美市场,占据该地区83%的份额,预计到2024年将达到30.4亿美元。美国是棉花及棉製品进出口的主要枢纽,受益于其作为重要枢纽的地位。随着对现代纺织解决方案的需求不断增长,以及技术升级机械的普及,美国棉花加工设备市场正在持续成长。美国企业正专注于投资先进的系统,以提高效率并适应不断变化的行业标准。致力于基础设施现代化和在最大程度降低环境影响的情况下提高产量,正在推动对智慧机械的需求。

该领域的主要参与者正在持续投资于技术升级和合作伙伴关係,以向客户推出更有效、更灵活的解决方案。这些策略不仅改善了产品供应,也提升了製造商在全球价值链中的竞争力。随着客户期望的不断变化以及对智慧环保解决方案的持续推动,棉花加工设备市场预计将在未来几年保持强劲成长势头。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依设备类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依设备类型,2021 - 2034 年

- 主要趋势

- 轧棉设备

- 刀辊杜松子酒

- 麦卡蒂杜松子酒

- 锯木厂

- 清洁设备

- 原棉清理机

- 棉绒清洁机

- 梳理设备

- 盖板梳理机

- 罗拉梳理机

- 高产量梳理机

- 纺纱设备

- 环锭纺纱

- 转杯纺

- 紧密纺

- 喷射纺纱

- 织造设备

- 整理机

- 其他(分类等)

第六章:市场估计与预测:依营运模式,2021 年至 2034 年

- 主要趋势

- 手动的

- 半自动

- 全自动

第七章:市场估计与预测:依产能,2021 - 2034

- 主要趋势

- 容量低

- 中等容量

- 高容量

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 纺织业

- 医疗和外科

- 其他的

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 直销

- 间接销售

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Abel

- Continental Eagle

- Giannitsa Ginning Mills

- Kimbell Gin Machinery

- Lummus

- Mitsun

- Multipro Machines

- Muratec

- Rieter

- Sando Tech

- Saurer

- Savio

- Suntech Textile Machinery

- Tongda Group

- Trutzschler

The Global Cotton Processing Equipment Market was valued at USD 19.1 billion in 2024 and is estimated to grow at a CAGR of 3.5% to reach USD 26.9 billion by 2034. This growth is primarily fueled by increasing demand for cotton-based apparel and textiles, along with the growing adoption of cutting-edge processing technologies. Cotton continues to be a vital raw material in the textile sector, and the growing global population, coupled with higher disposable incomes, has significantly increased the need for quality textiles.

This heightened demand is prompting manufacturers to enhance production capacity and efficiency through the deployment of advanced cotton processing equipment. Companies are channeling resources into R&D initiatives to bring to market solutions that reduce material waste, improve productivity, and ensure the consistent quality of processed cotton. Additionally, the rising shift toward automation and sustainable manufacturing is shaping the landscape of cotton processing operations, driving investments in smart technologies that align with environmental goals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $19.1 Billion |

| Forecast Value | $26.9 Billion |

| CAGR | 3.5% |

Among the various equipment types, the spinning equipment segment stood out with a market value exceeding USD 5.1 billion in 2024. It is anticipated to grow at a CAGR of 4.1% through the forecast period. This segment is experiencing strong momentum due to the rising focus on automated, efficient, and high-speed spinning systems. Manufacturers are increasingly integrating features like high-speed rotors, advanced ring spindles, and digital tools to optimize production.

These technologies are enabling real-time monitoring, predictive maintenance, and enhanced yarn output, leading to fewer breakdowns and better operational efficiency. The emphasis on digital transformation, coupled with the need for sustainability, is driving the evolution of spinning systems across large-scale production facilities. This transformation is also reshaping labor patterns, reducing the dependency on manual labor while simultaneously creating new roles in technical support and equipment maintenance.

In terms of operation mode, fully automatic machinery accounted for approximately 61% of the market share in 2024 and is forecast to grow at a CAGR of 3.7% between 2025 and 2034. The appeal of fully automatic cotton processing systems lies in their ability to deliver high-precision output while significantly lowering operational errors. These machines are proving essential for large-scale manufacturers aiming to enhance productivity while reducing labor costs.

The incorporation of intelligent technologies such as IoT, machine learning, and real-time data analytics is enhancing the functionality and output quality of these systems. As businesses seek to implement smart manufacturing strategies, the preference for fully automated systems is expected to intensify across key manufacturing hubs. In contrast, manual machinery continues to hold relevance in smaller, localized markets, particularly in regions where cost constraints or limited access to advanced infrastructure prevail.

On the basis of application, the textile industry remains the dominant consumer of cotton processing equipment and is expected to expand at a CAGR of over 3.7% during the forecast period. The continued growth of the global apparel and home furnishing sectors is generating strong demand for cotton-based products. A noticeable rise in consumer preference for eco-friendly and natural fibers is also propelling the consumption of cotton across both fashion and interior decor markets.

Beyond apparel, the medical sector is emerging as a consistent consumer of high-quality cotton products, including gauze, bandages, and surgical items. Increasing emphasis on hygiene and infection control in healthcare facilities has reinforced the need for advanced cotton processing systems that support the production of sterile and durable materials. This trend is encouraging manufacturers to adopt precision-based processing machinery tailored to the needs of the medical segment.

Regionally, the United States continues to dominate the North American market, holding 83% of the regional share and expected to reach USD 3.04 billion in 2024. The country benefits from being a major hub for both the import and export of cotton and cotton-related products. With growing demand for modern textile solutions and rising adoption of technologically upgraded machinery, the market for cotton processing equipment in the U.S. is experiencing consistent growth. Businesses in the country are focusing on investing in advanced systems that increase efficiency and align with shifting industry standards. Efforts to modernize infrastructure and boost output with minimal environmental impact are pushing demand for intelligent machinery.

Key players operating in this space are consistently investing in technological upgrades and collaborative partnerships to introduce more effective and adaptive solutions for customers. These strategies are not only improving product offerings but also enhancing the competitiveness of manufacturers across the global value chain. With evolving customer expectations and the steady push for smart, eco-conscious solutions, the cotton processing equipment market is poised to maintain a strong growth trajectory in the coming years.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 By regional

- 2.2.2 By equipment type

- 2.2.3 By mode of operation

- 2.2.4 By capacity

- 2.2.5 By application

- 2.2.6 By distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By equipment type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Equipment Type, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 Ginning equipment

- 5.2.1 Knife roller gin

- 5.2.2 Macarty gin

- 5.2.3 Saw gin

- 5.3 Cleaning equipment

- 5.3.1 Raw cotton cleaning machine

- 5.3.2 Cotton lint cleaner machines

- 5.4 Carding equipment

- 5.4.1 Flat carding machines

- 5.4.2 Roller carding machines

- 5.4.3 High-production carding machines

- 5.5 Spinning equipment

- 5.5.1 Ring spinning

- 5.5.2 Rotor spinning

- 5.5.3 Compact spinning

- 5.5.4 Air jet spinning

- 5.6 Weaving equipment

- 5.7 Finishing machines

- 5.8 Others (sorting etc.)

Chapter 6 Market Estimates & Forecast, By Mode of Operation, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automatic

- 6.4 Fully automatic

Chapter 7 Market Estimates & Forecast, By Capacity, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Low capacity

- 7.3 Medium capacity

- 7.4 High capacity

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Billion, Thousand Units)

- 8.1 Key trends

- 8.2 Textile industry

- 8.3 Medical & surgical

- 8.4 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Abel

- 11.2 Continental Eagle

- 11.3 Giannitsa Ginning Mills

- 11.4 Kimbell Gin Machinery

- 11.5 Lummus

- 11.6 Mitsun

- 11.7 Multipro Machines

- 11.8 Muratec

- 11.9 Rieter

- 11.10 Sando Tech

- 11.11 Saurer

- 11.12 Savio

- 11.13 Suntech Textile Machinery

- 11.14 Tongda Group

- 11.15 Trutzschler