|

市场调查报告书

商品编码

1773323

轮胎平衡重市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Tire Balance Weight Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

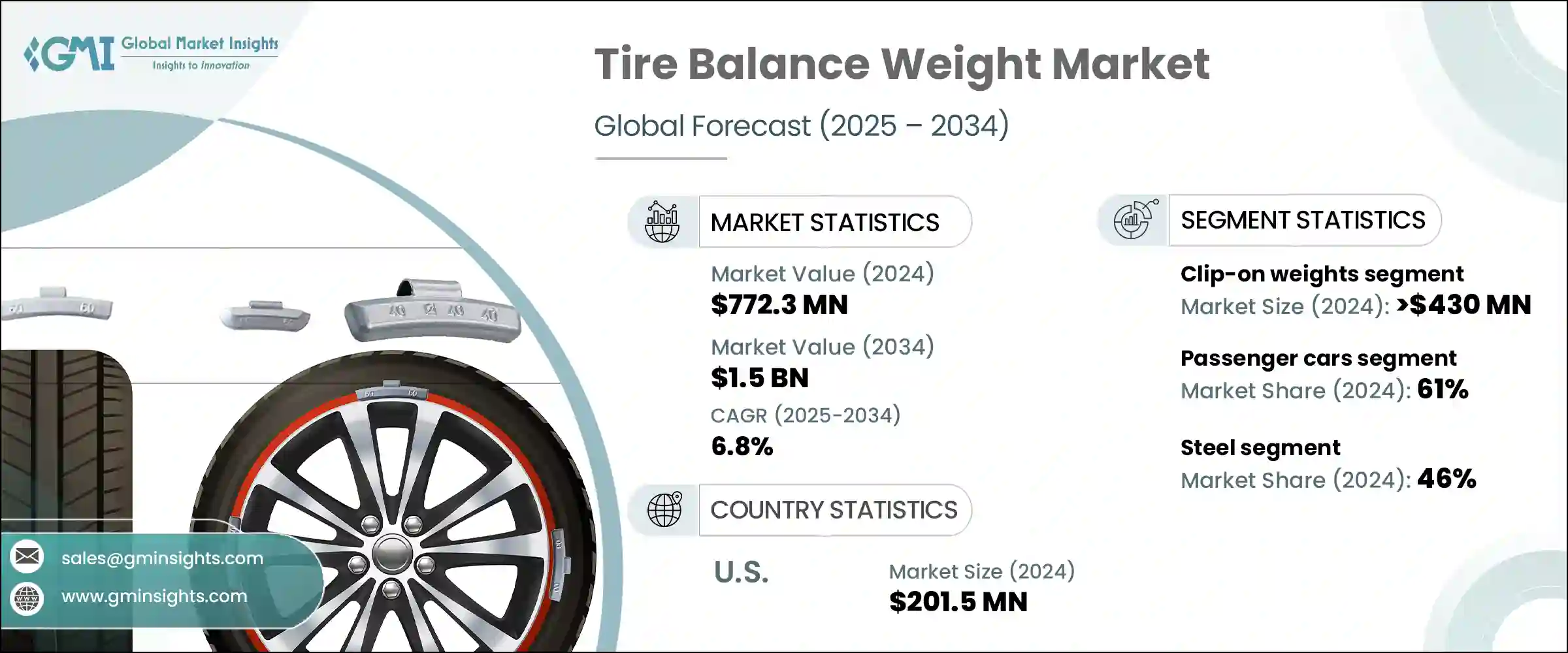

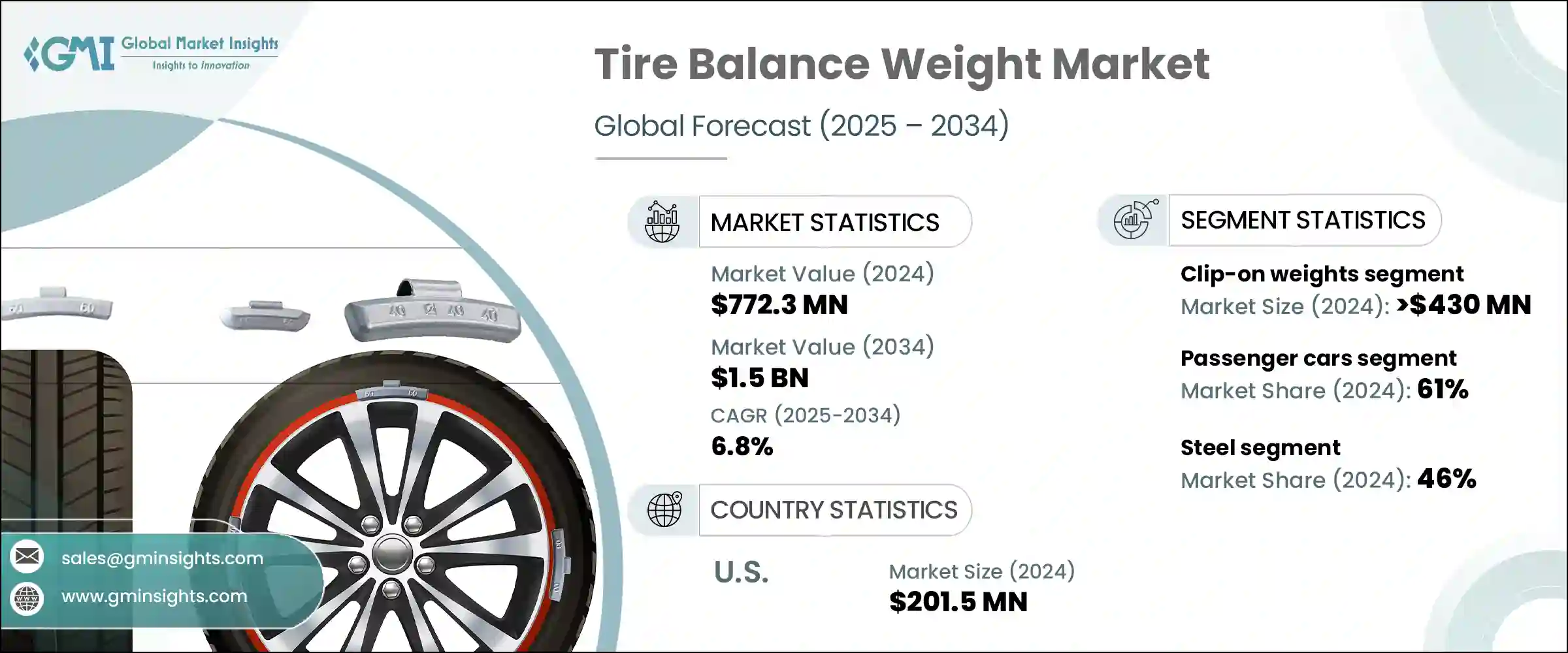

2024 年全球轮胎平衡块市场规模达 7.723 亿美元,预估年复合成长率为 6.8%,到 2034 年将达到 15 亿美元。这一成长主要得益于全球汽车产量的快速成长,尤其是在新兴市场。随着汽车保有量的增加和商用车数量的扩大,包括车轮平衡在内的定期轮胎保养需求激增,尤其是在交通需求旺盛的繁华城市。此外,公共部门对基础设施的投资不断增加,以及物流、客运和电子商务等行业推动的交通需求不断增长,也加剧了车队维护活动,从而对轮胎平衡块的需求强劲增长。由于这些零件在确保车辆安全和乘坐舒适性方面发挥关键作用,因此对它们的需求自然会随着全球汽车保有量的增加而增长。

各地区政府和监管机构正在加强安全和道路合规标准,这也推动了市场的发展。透过轮胎平衡块实现的正确车轮平衡可以消除不必要的振动,延长轮胎使用寿命,提高高速行驶安全性,并降低整体维护成本。尤其是在北美、欧洲和亚洲,对这些法规的严格遵守促使车辆营运商进行常规轮胎维护,从而刺激了需求。此外,法规合规性以及消费者和车队营运商对车辆性能和安全意识的不断提升,仍然是市场稳定扩张的根本驱动力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.723亿美元 |

| 预测值 | 15亿美元 |

| 复合年增长率 | 6.8% |

2024年,卡式平衡块市场产值达4.3亿美元,持续维持市场主导地位。传统平衡块由铅製成,但由于监管限制,许多地区已转向使用锌或钢作为替代品,这增加了与重新设计製造流程和采购新材料相关的生产成本。发展中经济体严重依赖商用车队和经济型汽车,仍主要使用卡式平衡块,尤其是在合金轮圈较不常见的地区,例如南美洲、东欧和亚洲部分地区。为了满足这些需求,製造商正专注于开发新材料,包括先进合金、聚合物涂层钢和镀锌钢。

乘用车市场在2024年占据了61%的市场份额,预计在预测期内将显着成长。合金轮圈在乘用车中的日益普及,带动了对创新平衡技术的需求成长,例如黏贴式平衡块,这种技术可以防止车轮表面损坏并提升车辆外观。这一趋势在城市地区和高端汽车领域尤其明显,因为这些地区的消费者兼顾性能和美观。随着乘用车的老化,其转售价值和维护价值的提升,也刺激了售后市场对平衡服务的需求持续成长。

2024年,北美轮胎平衡重市场占30%的市场份额,其中美国贡献了2.015亿美元。该地区受益于自动化平衡机械的进步,这些机械融合了雷射测量、两点优化和数位诊断技术。这些创新不仅提高了服务的准确性和效率,还能与胎压监测系统集成,从而提升车辆的整体安全性和性能。 Hunter Engineering和CEMB等产业领导者处于市场数位转型的前沿,推动北美朝向更智慧、更精确的平衡技术迈进。此外,严格的环境法规已促使该地区全面淘汰铅基平衡重,从而加速了更安全、更环保的替代方案的采用。

主导全球轮胎平衡重市场的主要参与者包括宝龙汽车公司、3M 公司、亨特工程公司、轩尼诗工业公司(现为高士公司)、东邦工业公司、Plombco 和 WEGMANN 汽车公司。

轮胎平衡重领域的领导企业采用多种策略方法来巩固其市场地位并扩大市场影响力。材料和製造流程的创新是主要关注点,企业大力投资开发环保、轻巧且耐用的传统铅块替代品。这不仅符合不断变化的环境法规,还能满足客户对更高效能的需求。此外,企业正在将自动化和数位技术整合到生产和服务设备中,从而提高精度并缩短週转时间,对原始设备製造商和车队营运商都具有吸引力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 售后服务和轮胎更换业务的兴起

- 更严格的车辆安全法规

- 从铅到无毒材料的环保转变

- 轮胎和车轮设计的技术进步

- 产业陷阱与挑战

- 发展中地区缺乏意识

- 已开发经济体的市场饱和

- 市场机会

- 无铅环保材料需求激增

- 电动车和混合动力车的普及率不断上升

- 汽车后市场服务快速扩张的新趋势

- 智慧车间技术集成

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 生产统计

- 生产中心

- 消费中心

- 汇出和汇入

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 夹式砝码

- 黏性/黏贴式配重块

第六章:市场估计与预测:依资料,2021 - 2034 年

- 主要趋势

- 钢

- 锌

- 带领

- 其他的

第七章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- SUV(运动型多用途车)

- 商用车

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

- 两轮车

- 越野车

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 汽车修理厂

- 轮胎店

- 汽车製造商

- 车队营运商

第九章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- 原始设备製造商

- 售后市场

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 马来西亚

- 新加坡

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- 3M Company

- Alpha Autoparts

- Baolong Automotive Corp.

- Bharat Balancing Weights Pvt.

- Cangzhou Yaqiya Auto Parts (Yaqiya)

- Hatco / HARTEC sal

- HEBEI FANYA

- HEBEI XST

- Hennessy Industries (now Coats Company)

- Holman

- Hunter Engineering Company

- John Bean Technologies Corp.

- Micro-Poise Measurement Systems (AMETEK)

- Plombco Inc.

- Shengshi Weiye (Cangzhou Shengshiweiye)

- Snap-on Incorporated

- TOHO KOGYO Co.

- Trax JH

- WEGMANN Automotive

- Wurth USA

The Global Tire Balance Weight Market was valued at USD 772.3 million in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 1.5 billion by 2034. This growth is largely fueled by the rapid increase in automobile production worldwide, particularly in emerging markets. As car ownership rises and commercial vehicle fleets expand, the demand for regular tire maintenance, including wheel balancing, has surged, especially in bustling urban centers with high mobility needs. Furthermore, growing investments by public sectors in infrastructure and the rising transportation demands driven by logistics, passenger transit, and e-commerce sectors have intensified fleet servicing activities, creating a robust need for tire balance weights. Since these components play a critical role in ensuring vehicle safety and ride comfort, their demand naturally scales alongside the global vehicle population.

Governments and regulatory bodies across various regions are tightening safety and road compliance standards, which also drives the market. Proper wheel balancing-made possible through tire balance weights-eliminates unwanted vibrations, extends tire lifespan, improves driving safety at high speeds, and reduces overall maintenance costs. Enhanced adherence to these regulations, especially in North America, Europe, and Asia, is compelling vehicle operators to adopt routine tire maintenance, thereby bolstering demand. Moreover, the combination of regulatory compliance and rising consumer and fleet operator awareness about vehicle performance and safety continues to be a fundamental driver behind the market's steady expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $772.3 Million |

| Forecast Value | $1.5 Billion |

| CAGR | 6.8% |

In 2024, the clip-on weights segment generated USD 430 million in 2024, maintaining a dominant position in the market. Traditionally manufactured from lead, many regions have shifted toward zinc or steel alternatives due to regulatory restrictions, which have increased production costs related to redesigning manufacturing processes and sourcing new materials. Developing economies, which rely heavily on commercial fleets and budget vehicles, still predominantly use clip-on weights, especially where alloy wheels are less common, such as in South America, Eastern Europe, and parts of Asia. To meet these demands, manufacturers are focusing on developing new materials including advanced alloys, polymer-coated steel, and zinc-coated steel.

The passenger car segment held a 61% share in 2024 and is expected to experience considerable growth over the forecast period. The rising popularity of alloy wheels in passenger vehicles has led to increased demand for innovative balancing techniques such as stick-on weights, which prevent damage to the wheel surface and enhance vehicle appearance. This trend is strong in urban areas and higher-end vehicle segments, where consumers prioritize both performance and aesthetics. As passenger cars age, their resale and maintenance values encourage sustained aftermarket demand for balancing services.

North America Tire Balance Weight Market held a 30% share in 2024, with the United States contributing USD 201.5 million. The region benefits from advancements in automated balancing machinery that incorporate laser measurement, two-point optimization, and digital diagnostics. These innovations not only improve service accuracy and efficiency but also enable integration with tire pressure monitoring systems, enhancing overall vehicle safety and performance. Industry leaders like Hunter Engineering and CEMB are at the forefront of digital transformation in the market, pushing North America toward smarter, more precise balancing technologies. Additionally, strict environmental regulations have led to a complete phase-out of lead-based weights in the region, accelerating the adoption of safer, eco-friendly alternatives.

Key players dominating the Global Tire Balance Weight Market include Baolong Automotive Corp., 3M Company, Hunter Engineering Company, Hennessy Industries (now Coats Company), TOHO KOGYO Co., Plombco, and WEGMANN Automotive.

Leading companies in the tire balance weight sector employ several strategic approaches to strengthen their market presence and expand their foothold. Innovation in materials and manufacturing processes is a primary focus, with firms investing heavily in developing eco-friendly, lightweight, and durable alternatives to traditional lead weights. This enables compliance with evolving environmental regulations while meeting customer demand for higher performance. Additionally, companies are embracing automation and digital technology integration in production and service equipment, which enhances precision and reduces turnaround times, appealing to OEMs and fleet operators alike.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Material

- 2.2.4 Vehicle

- 2.2.5 End use

- 2.2.6 Sales channel

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in aftermarket services & tire replacement

- 3.2.1.2 Stricter regulations for vehicle safety

- 3.2.1.3 Environmental shift from lead to non-toxic materials

- 3.2.1.4 Technological advancements in tire & wheel design

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of awareness in developing regions

- 3.2.2.2 Market saturation in developed economies

- 3.2.3 Market opportunities

- 3.2.3.1 Surging demand for lead-free and eco-friendly materials

- 3.2.3.2 Rising EV and hybrid vehicle adoption

- 3.2.3.3 Emerging trends of rapid expansion in automotive aftermarket services

- 3.2.3.4 Integration of smart workshop technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 (USD Million, Units)

- 5.1 Key trends

- 5.2 Clip-on weights

- 5.3 Adhesive/Stick-on weights

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 (USD Million, Units)

- 6.1 Key trends

- 6.2 Steel

- 6.3 Zinc

- 6.4 Lead

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD Million, Units)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.2.1 Hatchbacks

- 7.2.2 Sedans

- 7.2.3 SUVs (Sport utility vehicles)

- 7.3 Commercial vehicles

- 7.3.1 Light commercial vehicles (LCVs)

- 7.3.2 Medium commercial vehicles (MCVs)

- 7.3.3 Heavy commercial vehicles (HCVs)

- 7.4 Two-wheelers

- 7.5 Off-road vehicles

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Million, Units)

- 8.1 Key trends

- 8.2 Automotive workshops

- 8.3 Tire shops

- 8.4 Vehicle manufacturers

- 8.5 Fleet operators

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 (USD Million, Units)

- 9.1 Key trends

- 9.2 OEMs

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Malaysia

- 10.4.7 Singapore

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 3M Company

- 11.2 Alpha Autoparts

- 11.3 Baolong Automotive Corp.

- 11.4 Bharat Balancing Weights Pvt.

- 11.5 Cangzhou Yaqiya Auto Parts (Yaqiya)

- 11.6 Hatco / HARTEC s.a.l.

- 11.7 HEBEI FANYA

- 11.8 HEBEI XST

- 11.9 Hennessy Industries (now Coats Company)

- 11.10 Holman

- 11.11 Hunter Engineering Company

- 11.12 John Bean Technologies Corp.

- 11.13 Micro-Poise Measurement Systems (AMETEK)

- 11.14 Plombco Inc.

- 11.15 Shengshi Weiye (Cangzhou Shengshiweiye)

- 11.16 Snap-on Incorporated

- 11.17 TOHO KOGYO Co.

- 11.18 Trax JH

- 11.19 WEGMANN Automotive

- 11.20 Wurth USA