|

市场调查报告书

商品编码

1773329

汽车电动液压动力转向帮浦市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Electro-Hydraulic Power Steering Pumps Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

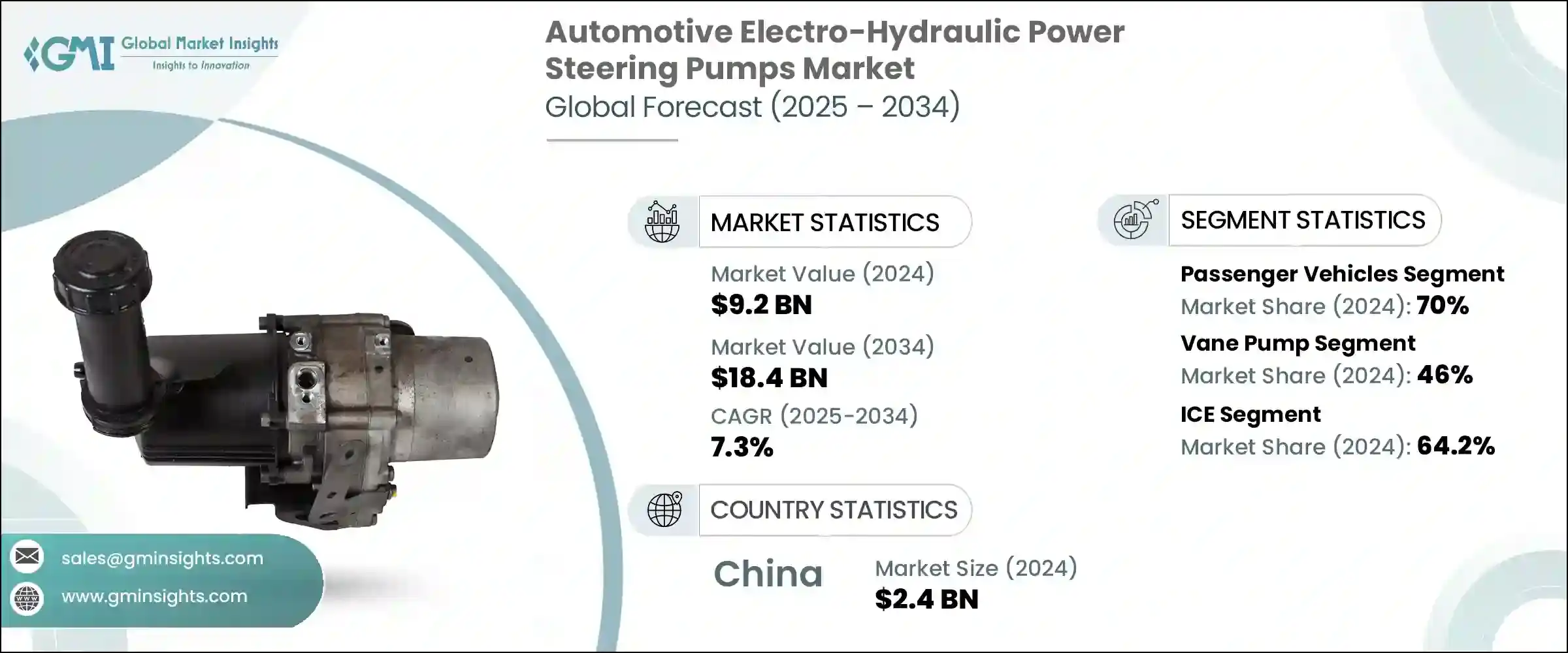

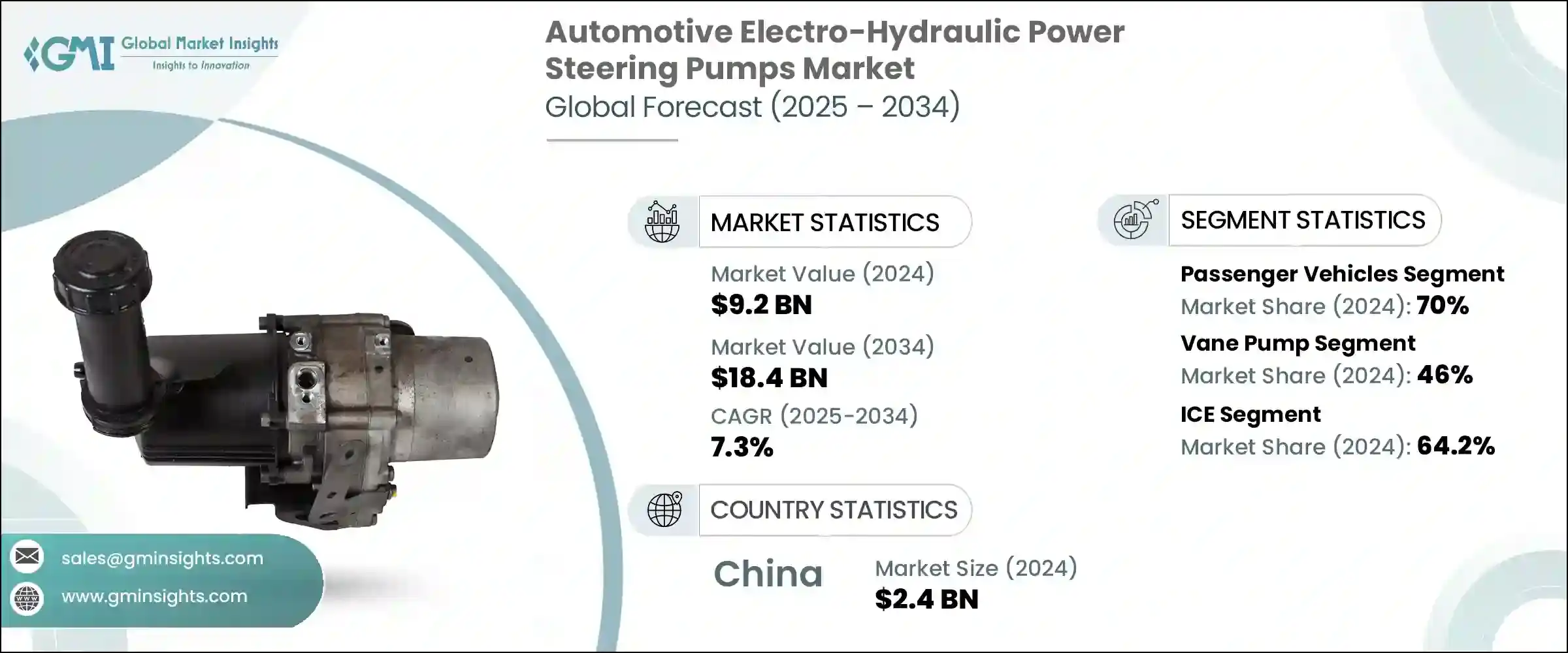

2024 年全球汽车电动液压辅助转向帮浦市场价值为 92 亿美元,预计到 2034 年将以 7.3% 的复合年增长率成长,达到 184 亿美元。这一强劲成长是由全球向节油和低排放汽车转变的推动力。随着汽车製造商力求满足北美、欧洲和中国等地区日益严格的环保要求,电动液压动力转向帮浦系统正变得越来越重要。与传统的液压转向系统不同,电动液压动力转向帮浦技术独立于引擎运行,仅在需要时启动。这显着降低了引擎阻力并降低了油耗。其适应性结构使其非常适合混合动力和轻度混合动力汽车。即使在内燃机关闭(混合动力运转中的常见情况)的情况下,该系统仍能保持完整的转向能力,使其成为全电动转向系统的经济高效的替代方案。

随着汽车製造商越来越多地将高级驾驶辅助功能融入车辆,他们需要更灵敏、更电子控制的转向输入。 EHPS 系统满足了这项需求,即使在采用替代动力系统的车辆中也能确保安全性和精准性。其支援车道维持和防撞等自动化技术的能力,正推动其在各类车辆中的广泛应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 92亿美元 |

| 预测值 | 184亿美元 |

| 复合年增长率 | 7.3% |

乘用车市场占了70%的市场份额,预计到2034年将以7.5%的复合年增长率成长。该市场的产量和需求规模使其成为EHPS成长的主要贡献者。消费者对更佳操控性、更精緻的驾驶体验和安全驾驶体验的期望不断提高,这促使汽车製造商更广泛地整合EHPS系统。混合动力和电动乘用车尤其受益于该系统的兼容性和节能潜力,这鼓励製造商在各种车型中使用EHPS。

叶片泵浦技术领域在2024年占据46%的市场份额,预计到2034年将以8%的复合年增长率成长。这些泵浦因其能够维持稳定的液压油流量,从而确保稳定精准的转向回馈而备受青睐。其设计特点是滑动叶片与泵壳始终保持接触,从而提供平稳的性能和卓越的驾驶操控性。叶片泵浦也因其安静的运作和低脉动而备受推崇,使其成为注重座舱舒适性和声学优化的车辆设计的首选。

2024年,中国汽车电控液压辅助转向帮浦市场规模达24亿美元,占67%的市占率。中国加速采用混合动力系统和节能汽车技术,推动了国内外汽车品牌对电控液压辅助转向帮浦系统的需求。随着48V混合动力平台的日益普及,电控液压辅助转向帮浦解决方案正广泛应用。全球一级供应商和本土企业在研发和区域化製造方面的大量投资,进一步巩固了中国作为关键生产和创新中心的地位。 ADAS应用和智慧转向技术的激增也推动了电控液压动力转向帮浦在高阶和中阶车型的应用。

积极参与全球汽车电动液压辅助转向帮浦市场的主要公司包括德尔福科技、采埃孚、罗伯特·博世、耐世特汽车、三菱电机、吉凯恩汽车、捷太格特、日本精工株式会社、现代摩比斯和天纳克。为增强在汽车电动液压辅助转向帮浦市场的竞争优势,各公司正在寻求以创新为主导的成长和策略伙伴关係。许多公司正在大力投资研发,以提高电动液压动力转向帮浦装置的能源效率、尺寸和整合灵活性,以满足原始设备製造OEM) 的要求。其他公司则与本地企业组成合资企业,以优化在快速成长的中国等经济体的市场覆盖率。简化製造流程以实现在地化生产并降低成本是另一个突出的策略。各公司也正在扩展其产品组合,推出支援 48V 平台等高压架构的系统。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 对节油转向系统的需求不断增长

- 动力总成架构电气化浪潮

- 与高级驾驶辅助系统 (ADAS) 的整合度不断提高

- 轻型商用车(LCV)销售成长

- 扩大新兴市场的汽车生产

- 产业陷阱与挑战

- 与传统液压泵相比系统成本较高

- 与全电动汽车架构的兼容性有限

- 市场机会

- 混合动力和轻度混合动力车的普及率不断上升

- 轻型商用车(LCV)领域的扩张

- 本地化製造和区域生产扩张

- 透过策略合作伙伴关係和合资企业实现成长

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 生产统计

- 生产中心

- 消费中心

- 汇出和汇入

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第六章:市场估计与预测:按泵浦分类,2021 - 2034 年

- 主要趋势

- 叶片泵

- 齿轮泵浦

- 活塞泵

- 其他的

第七章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- 原始设备製造商

- 售后市场

第八章:市场估计与预测:按推进方式,2021 - 2034 年

- 主要趋势

- 冰

- 电动车(EV)

- 杂交种

第九章:市场估计与预测:依组件,2021 - 2034

- 主要趋势

- 泵浦单元

- 水库

- 动力方向机油

- 控制单元

- 其他的

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- Alltech Automotive

- Cardone Industries

- Delphi Technologies

- GDST Auto Parts

- GKN Automotive

- Hitachi Astemo

- Hyundai Mobis

- JTEKT

- Kartek

- MAPCO Autotechnik

- Maval Manufacturing

- Mitsubishi Electric

- Nexteer Automotive

- NSK Ltd.

- Robert Bosch

- SEAT

- Sheppard Steering

- Tenneco

- Turn One Steering

- ZF Friedrichshafen

The Global Automotive Electro-Hydraulic Power Steering Pumps Market was valued at USD 9.2 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 18.4 billion by 2034. This strong growth is being propelled by the worldwide shift toward fuel-saving and low-emission vehicles. As vehicle manufacturers aim to meet increasingly strict environmental mandates in regions like North America, Europe, and China, EHPS systems are becoming essential. Unlike conventional hydraulic steering, EHPS technology operates independently from the engine, turning on only when needed. This significantly cuts engine drag and lowers fuel use. Its adaptable structure makes it a strong fit for hybrid and mild hybrid vehicles. The system retains full steering capability even when the internal combustion engine is turned off-a common condition in hybrid operations, making it a cost-effective alternative to full electric steering systems.

As automakers increasingly build advanced driver assistance features into vehicles, they require more responsive and electronically controlled steering inputs. EHPS systems meet this need while ensuring safety and precision, even in vehicles with alternative powertrains. Their ability to support automated technologies such as lane centering and collision avoidance is driving their widespread adoption across vehicle categories.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.2 Billion |

| Forecast Value | $18.4 Billion |

| CAGR | 7.3% |

The passenger vehicles segment held a 70% share and is expected to grow at a CAGR of 7.5% through 2034. The segment's scale in both production and demand makes it a major contributor to EHPS growth. Rising consumer expectations for better handling, refined ride quality, and safe driving experiences are motivating automakers to integrate EHPS systems more extensively. Hybrid and electric passenger vehicles, in particular, benefit from the system's compatibility and energy-saving potential, encouraging manufacturers to use EHPS across a wide spectrum of models.

The vane pump technology segment accounted for 46% share in 2024 and is projected to grow at a CAGR of 8% through 2034. These pumps are preferred for their ability to maintain a consistent flow of hydraulic fluid, ensuring steady and precise steering feedback. Their design features sliding vanes that stay in constant contact with the pump housing, delivering smooth performance and superior driver control. Vane pumps are also valued for their quiet operation and low pulsation, making them a preferred choice in vehicle designs that emphasize cabin comfort and acoustic refinement.

China Automotive Electro-Hydraulic Power Steering Pumps Market generated USD 2.4 billion in 2024 and held a 67% share. The country's accelerated adoption of hybrid systems and energy-conscious automotive technologies has pushed demand for EHPS systems across both domestic and international car brands. With a growing push for 48V hybrid platforms, EHPS solutions are seeing widespread integration. China's position as a key production and innovation hub is further reinforced by heavy investments from both global Tier-1 suppliers and local companies in research, development, and regionalized manufacturing. The surge in ADAS adoption and intelligent steering technologies is also bolstering EHPS implementation across premium and mid-tier vehicle categories.

Major companies actively participating in the Global Automotive Electro-Hydraulic Power Steering Pumps Market include Delphi Technologies, ZF Friedrichshafen, Robert Bosch, Nexteer Automotive, Mitsubishi Electric, GKN Automotive, JTEKT, NSK Ltd., Hyundai Mobis, and Tenneco. To strengthen their competitive edge in the automotive EHPS market, companies are pursuing innovation-led growth and strategic partnerships. Many are investing heavily in R&D to enhance the energy efficiency, size, and integration flexibility of EHPS units meeting OEM requirements. Others are forming joint ventures with local players to optimize market reach in fast-growing economies like China. Streamlining manufacturing processes to localize production and reduce costs is another prominent strategy. Companies are also expanding their product portfolios with systems that support higher-voltage architectures like 48V platforms.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Technology

- 2.2.4 Suspension

- 2.2.5 Sales channel

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for fuel-efficient steering systems

- 3.2.1.2 Surge in electrification of powertrain architectures

- 3.2.1.3 Rising integration with advanced driver-assistance systems (ADAS)

- 3.2.1.4 Increasing sales of light commercial vehicles (LCVs)

- 3.2.1.5 Expansion of vehicle production in emerging markets

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High system cost compared to traditional hydraulic pumps

- 3.2.2.2 Limited compatibility with fully electric vehicle architectures

- 3.2.3 Market opportunities

- 3.2.3.1 Rising adoption of hybrid and mild-hybrid vehicles

- 3.2.3.2 Expansion of the light commercial vehicle (LCV) segment

- 3.2.3.3 Localized manufacturing and regional production expansion

- 3.2.3.4 Growth through strategic partnerships and joint ventures

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, units)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchbacks

- 5.2.2 Sedans

- 5.2.3 SUV

- 5.3 Commercial vehicles

- 5.3.1 Light commercial vehicles (LCV)

- 5.3.2 Medium commercial vehicles (MCV)

- 5.3.3 Heavy commercial vehicles (HCV)

Chapter 6 Market Estimates & Forecast, By Pump, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Vane pump

- 6.3 Gear pump

- 6.4 Piston pump

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Sales channel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 OEMs

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Propulsions, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 ICE

- 8.3 Electric Vehicles (EVs)

- 8.4 Hybrid

Chapter 9 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Pump unit

- 9.3 Reservoir

- 9.4 Power steering fluid

- 9.5 Control unit

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Alltech Automotive

- 11.2 Cardone Industries

- 11.3 Delphi Technologies

- 11.4 GDST Auto Parts

- 11.5 GKN Automotive

- 11.6 Hitachi Astemo

- 11.7 Hyundai Mobis

- 11.8 JTEKT

- 11.9 Kartek

- 11.10 MAPCO Autotechnik

- 11.11 Maval Manufacturing

- 11.12 Mitsubishi Electric

- 11.13 Nexteer Automotive

- 11.14 NSK Ltd.

- 11.15 Robert Bosch

- 11.16 SEAT

- 11.17 Sheppard Steering

- 11.18 Tenneco

- 11.19 Turn One Steering

- 11.20 ZF Friedrichshafen