|

市场调查报告书

商品编码

1773333

家禽养殖设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Poultry Farming Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

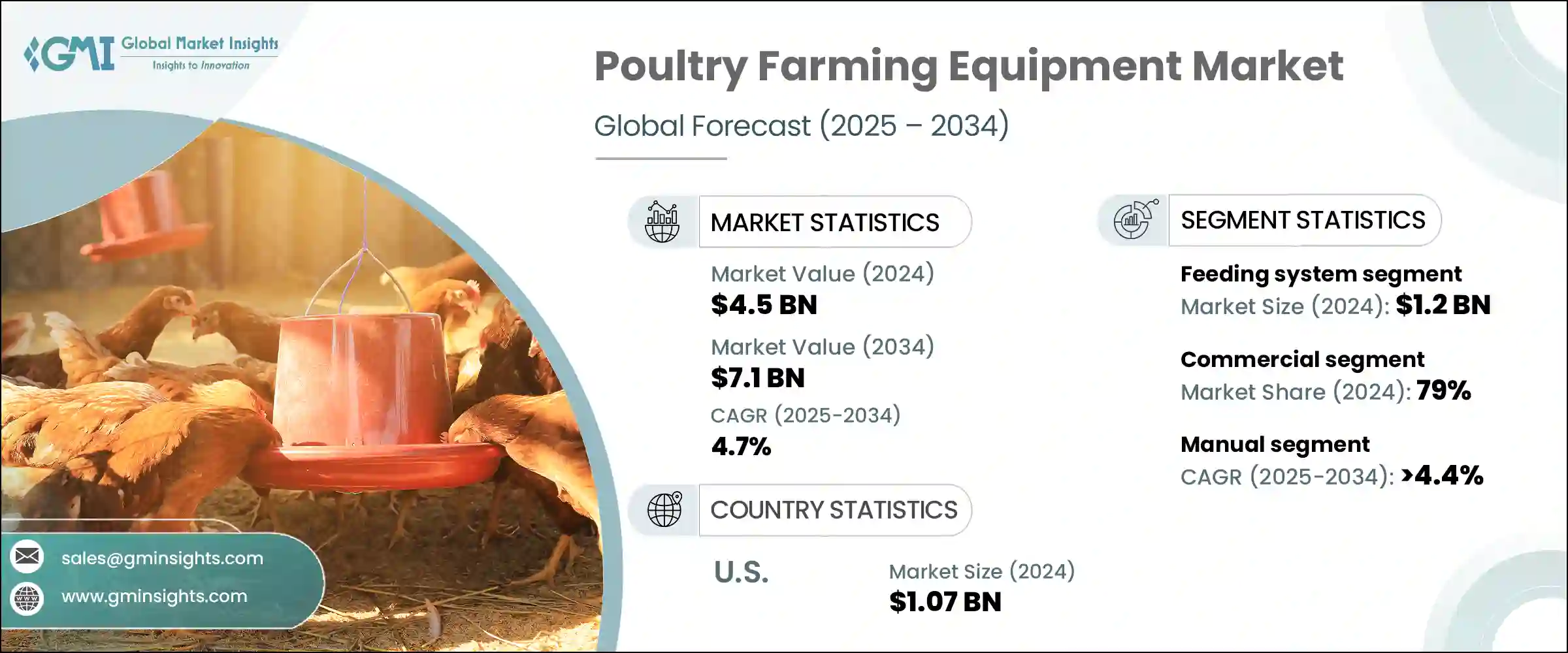

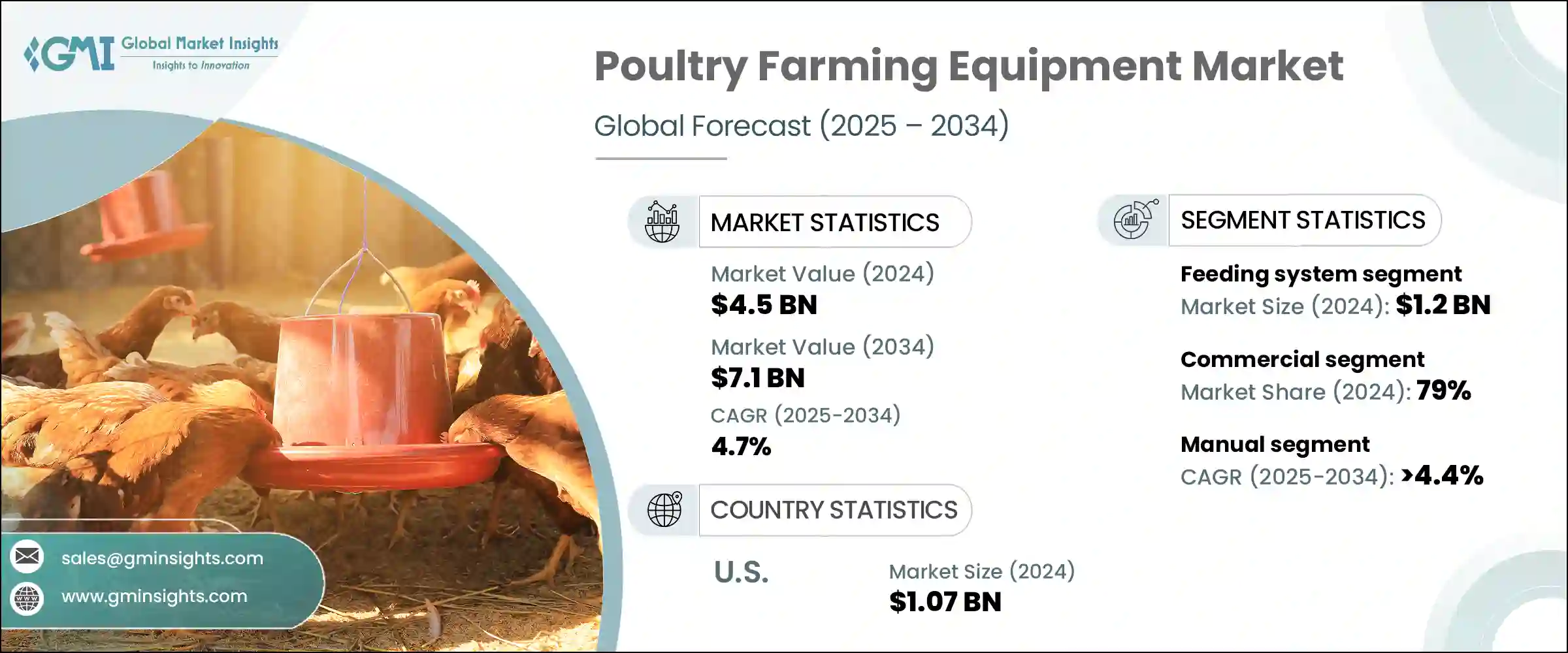

2024年,全球家禽养殖设备市场规模达45亿美元,预计2034年将以4.7%的复合年增长率成长,达到71亿美元。随着消费者日益转向高蛋白饮食,全球对鸡蛋和肉类等家禽产品的需求持续成长。这种需求激增在发展中国家尤其突出,这些国家的收入成长和快速的城市化推动了家禽产品的消费。快餐连锁店的影响力日益增强,以及即食家禽产品的供应日益丰富,促使生产商投资高效的养殖设备。

数位商务平台的扩张也简化了供应链,间接推动了对自动化、可扩展家禽养殖工具的需求。旨在提高营运效率和动物福利的现代技术正日益受到关注。创新解决方案正在实施,以平衡空间效率和自动化程度,支援更健康的禽类饲养条件和最佳化的饲餵系统。精准农业的趋势和对更高生产力的追求,正在推动人们转向更先进的设备解决方案。农场设施内更舒适的环境、更卫生的设施和更自动化的设施如今已成为成功家禽养殖的关键要素,并支持更永续、更有效率的家禽养殖生态系统。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 45亿美元 |

| 预测值 | 71亿美元 |

| 复合年增长率 | 4.7% |

2024年,饲餵系统细分市场产值达12亿美元,预计到2034年将以4.7%的复合年增长率成长。自动化饲餵解决方案正迅速被寻求简化操作流程和减少人工的家禽生产商所采用。定时分配系统和精密设计的料斗的使用有助于农民控制饲料用量并优化生长结果。精准饲餵技术的发展正在促进这一类别的进一步需求。消费者对符合伦理饲养的家禽日益增长的关注,以及动物福利监管标准的不断提高,正在推动现代笼养系统的普及。这些系统,加上对禽舍内高品质环境管理日益增长的需求,正在推动先进气候控制技术的发展。

商业化养殖业在2024年占据了79%的市场份额,预计2025年至2034年的复合年增长率将达到4.9%。全球对家禽产品的大量需求促使商业业者大力投资自动化养殖设备。这些先进的机器有助于降低劳动力成本,并使生产商能够更有效率地满足需求。随着家禽成为各地区重要的蛋白质来源,商业化农场将生产力、一致性和卫生放在首位,从而持续依赖智慧且可扩展的解决方案。

欧洲家禽养殖设备市场在2024年创收8亿美元,预计2034年将以4.2%的复合年增长率成长。该地区商业农场的扩张加速了对耐用、高容量的大规模设备管理营运的需求。政府的支持计画和推动创新农业技术应用的政策措施也促进了市场扩张。这些激励措施鼓励生产商采用尖端机械来提高产量和效率,使他们能够满足家禽业不断变化的需求。

引领产业发展的领导者包括SKA、青岛华博、Hellmann Poultry、Potters Poultry、Valco Industries、Zucami Poultry Equipment、Texha、Officine Facco、PEP Poultry Equipment Plus、AGICO、Roxell、Big Dutchman、Hightop、Tecnotry Equipment Plus、AGICO、Roxell、Big Dutchman、Hightop、Tecnotry、Tecno。这些关键企业透过产品创新和策略成长,在推动市场发展方面发挥重要作用。为了巩固其在家禽养殖设备行业的地位,顶级製造商正在积极扩展产品线,将自动化、节能和动物福利功能融入其设备中。与商业家禽农场的合作使企业能够根据特定的营运需求客製化解决方案。研发投入促进了使用者友善和精准型技术的开发,从而改善了农场管理。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依设备类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 贸易统计(HS编码-84369100)

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依设备类型,2021 - 2034 年

- 主要趋势

- 进料系统

- 浇水系统

- 笼养系统

- 蛋鸡笼

- 肉鸡笼

- 饲养笼

- 气候控制系统

- 通风系统

- 暖气系统

- 冷却系统

- 孵化设备

- 鸡蛋处理设备

- 其他(照明系统等)

第六章:市场估计与预测:依营运模式,2021 年至 2034 年

- 主要趋势

- 手动的

- 半自动

- 全自动

第七章:市场估计与预测:依家禽类型,2021 - 2034 年

- 主要趋势

- 鸡

- 鸭子

- 土耳其

- 其他(鹅、兔子等)

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 家庭

- 商业的

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 直销

- 间接销售

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- AGICO

- Big Dutchman

- Hellmann Poultry

- Hightop

- Officine Facco

- PEP Poultry Equipment Plus

- Potters Poultry

- Qingdao Huabo

- Roxell

- SKA

- Tavsan

- Tecno Poultry Equipment

- Texha

- Valco Industries

- Zucami Poultry Equipment

The Global Poultry Farming Equipment Market was valued at USD 4.5 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 7.1 billion by 2034. Demand for poultry products like eggs and meat continues to rise worldwide as consumers increasingly shift toward protein-rich diets. This surge in demand is notably prominent in developing countries, where rising incomes and rapid urbanization are driving the consumption of poultry products. The growing influence of fast-food chains and increased availability of ready-to-eat poultry items are compelling producers to invest in high-efficiency farming equipment.

The expansion of digital commerce platforms is also simplifying the supply chain, indirectly pushing the demand for automated, scalable poultry farming tools. Modern technologies designed to improve operational efficiency and animal welfare are gaining traction. Innovative solutions are being implemented to balance space efficiency and automation, supporting healthier bird-rearing conditions and optimized feeding systems. The trend toward precision farming and the push for higher productivity is reinforcing the shift toward more advanced equipment solutions. Enhanced comfort, sanitation, and automation within farming facilities are now becoming essential components of successful poultry operations, supporting a more sustainable and efficient poultry farming ecosystem.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.5 Billion |

| Forecast Value | $7.1 Billion |

| CAGR | 4.7% |

In 2024, the feeding system segment generated USD 1.2 billion in 2024 and is anticipated to grow at a 4.7% CAGR throughout 2034. Automatic feeding solutions are rapidly being adopted by poultry producers looking to streamline operations and reduce manual labor. The use of timed distribution systems and precision-engineered hoppers is helping farmers control feed portions and optimize growth outcomes. Developments in precision feeding technologies are fostering further demand in this category. Increasing consumer concern for ethically raised poultry and growing regulatory standards around animal welfare are pushing the adoption of modern cage systems. These systems, combined with the increasing demand for high-quality environmental management within poultry houses, are driving the growth of advanced climate control technologies.

The commercial farming sector held a 79% share in 2024 and is expected to grow at a CAGR of 4.9% from 2025 to 2034. The global appetite for poultry products in large volumes pushes commercial operators to invest heavily in automated farming equipment. These advanced machines help reduce labor expenses and allow producers to meet demand more efficiently. As poultry becomes a key protein source across regions, commercial farms are prioritizing productivity, consistency, and hygiene, driving the continued reliance on smart and scalable solutions.

Europe Poultry Farming Equipment Market generated USD 0.8 billion in 2024 and is projected to grow at a CAGR of 4.2% through 2034. The expansion of commercial farms across the region is accelerating demand for durable and high-capacity equipment management operations at scale. Government support programs and policy initiatives promoting the adoption of innovative agricultural technology are also contributing to market expansion. These incentives are encouraging producers to embrace cutting-edge machinery to improve yield and efficiency, enabling them to cater to the evolving demands of the poultry sector.

Leading companies shaping the industry include SKA, Qingdao Huabo, Hellmann Poultry, Potters Poultry, Valco Industries, Zucami Poultry Equipment, Texha, Officine Facco, PEP Poultry Equipment Plus, AGICO, Roxell, Big Dutchman, Hightop, Tecno Poultry Equipment, and Tavsan. These key players are playing an instrumental role in pushing the market forward through product innovation and strategic growth. To enhance their position in the poultry farming equipment industry, top manufacturers are actively expanding product lines by integrating automation, energy efficiency, and animal welfare features into their equipment. Partnerships and collaborations with commercial poultry farms allow companies to tailor solutions to specific operational needs. Investment in R&D enables the development of user-friendly and precision-based technologies to improve farm management.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 By regional

- 2.2.2 By equipment type

- 2.2.3 By mode of operation

- 2.2.4 By poultry type

- 2.2.5 By end use

- 2.2.6 By distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By equipment type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code-84369100)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Equipment Type, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 Feeding system

- 5.3 Watering system

- 5.4 Cage system

- 5.4.1 Layer cage

- 5.4.2 Broiler cage

- 5.4.3 Breeder cage

- 5.5 Climate control system

- 5.5.1 Ventilation system

- 5.5.2 Heating system

- 5.5.3 Cooling system

- 5.6 Incubation equipment

- 5.7 Egg handling equipment

- 5.8 Others (lighting system etc.)

Chapter 6 Market Estimates & Forecast, By Mode of Operation, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automatic

- 6.4 Fully automatic

Chapter 7 Market Estimates & Forecast, By Poultry Type, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Chicken

- 7.3 Duck

- 7.4 Turkey

- 7.5 Others (geese, rabbit etc.)

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Billion, Thousand Units)

- 8.1 Key trends

- 8.2 Household

- 8.3 Commercial

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AGICO

- 11.2 Big Dutchman

- 11.3 Hellmann Poultry

- 11.4 Hightop

- 11.5 Officine Facco

- 11.6 PEP Poultry Equipment Plus

- 11.7 Potters Poultry

- 11.8 Qingdao Huabo

- 11.9 Roxell

- 11.10 SKA

- 11.11 Tavsan

- 11.12 Tecno Poultry Equipment

- 11.13 Texha

- 11.14 Valco Industries

- 11.15 Zucami Poultry Equipment