|

市场调查报告书

商品编码

1773335

新能源汽车稳定器市场机会、成长动力、产业趋势分析及2025-2034年预测New Energy Vehicle Stabilizer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

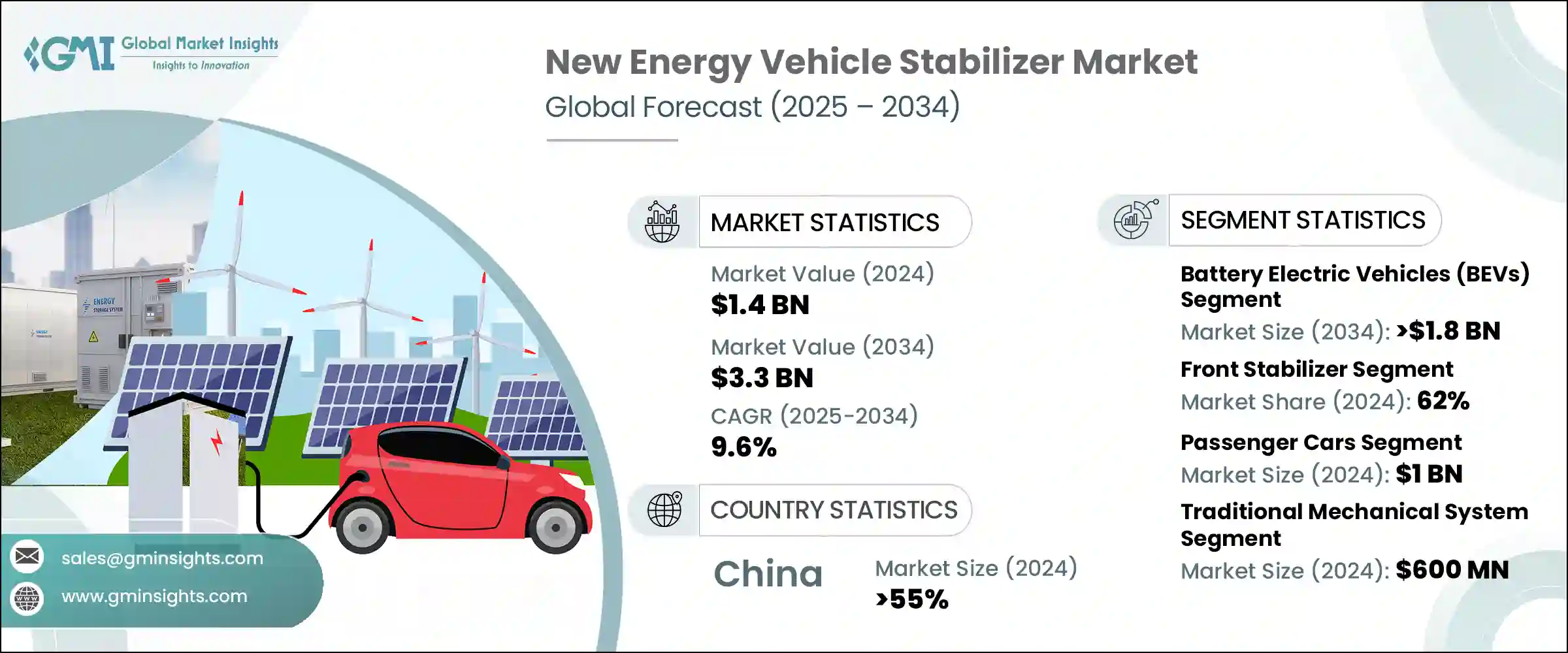

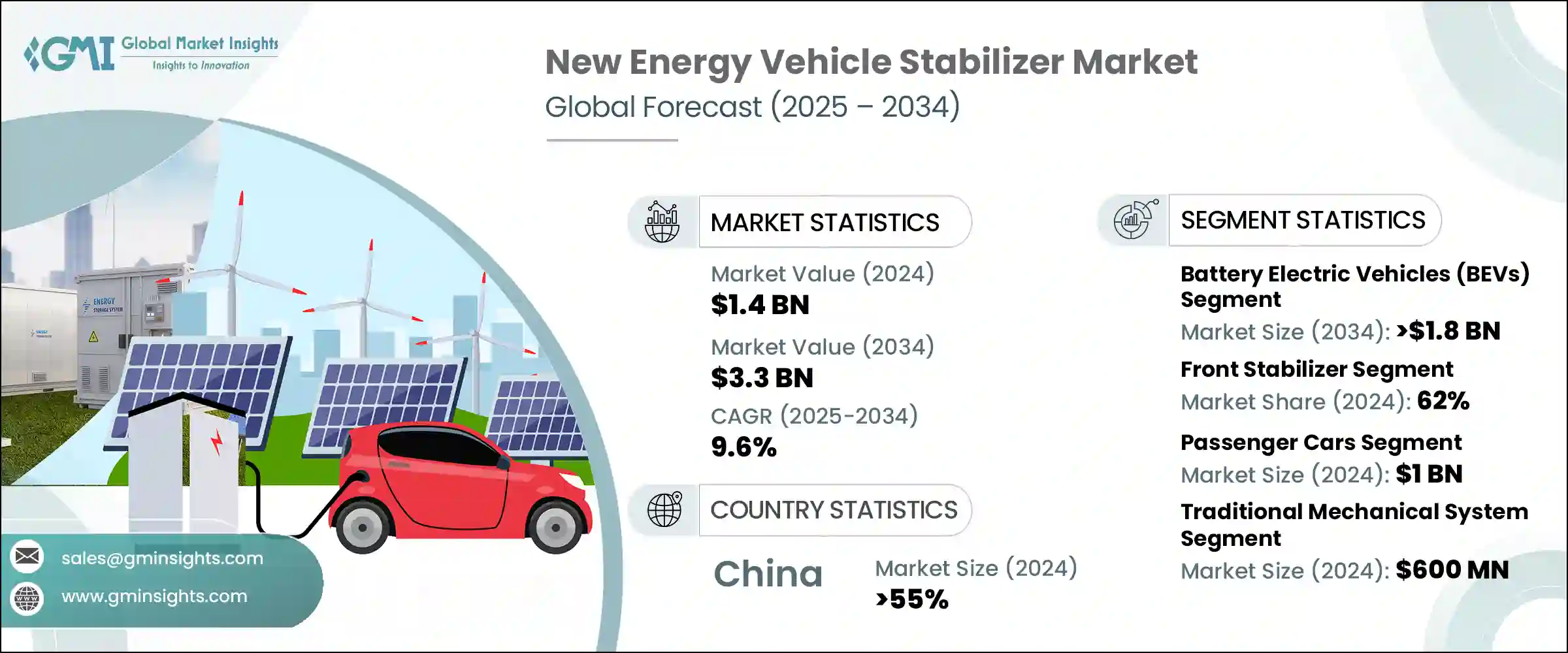

2024年,全球新能源汽车稳定器市场规模达14亿美元,预计2034年将以9.6%的复合年增长率成长,达到33亿美元。这一成长主要得益于全球主要市场对电动、混合动力和氢动力汽车的日益普及。随着製造商转向替代动力传动系统,车辆动力学和整体驾驶体验也日益受到重视,这直接推动了对先进稳定器技术的需求。机电式稳定器和主动式稳定器因其能够提升悬吊性能、减少车身侧倾并为乘客和驾驶员提供更平稳的操控性,正得到越来越广泛的应用。这反映了电动车产业追求高安全性和舒适性的普遍趋势。

稳定桿(通常称为防倾桿或防侧倾桿)在支撑新能源车的悬吊系统中发挥着至关重要的作用,尤其是在电池放置导致重量分布改变的情况下。与传统的内燃机 (ICE) 汽车不同,新能源汽车通常会将电池组安装在车辆地板上,这会导致重心偏移,需要重新设计稳定桿系统。这些系统旨在确保车辆的最佳性能和转弯稳定性,尤其是在高速操控或快速转向时。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 14亿美元 |

| 预测值 | 33亿美元 |

| 复合年增长率 | 9.6% |

2024年,纯电动车 (BEV) 占据了46%的市场份额,预计到2034年该细分市场将创造18亿美元的市场价值。纯电动车在稳定器市场占据稳固地位,得益于产量激增以及消费者对纯电动平台的需求。这一增长得益于政策支援、充电基础设施的扩展以及现代、大众、特斯拉和比亚迪等全球汽车製造商的大力投资。由于纯电动车电池重量增加,需要专门设计的悬吊系统,这进一步增加了对先进稳定器组件的依赖。

2024年,前稳定桿市场占据全球新能源汽车稳定桿市场62%的份额,并预计到2034年将以8.2%的复合年增长率成长。这种主导地位源于其在管理前轴稳定性和维持车辆平衡方面的关键作用。由于电动车通常采用前轮驱动配置,并将电池重量集中在前轴上,前稳定桿已成为确保即时驾驶条件下精准操控和减少车身晃动的不可或缺的部件。

亚太地区新能源汽车稳定器市场占55%的市场份额,2024年市场规模达3亿美元。新能源汽车製造业的快速发展、持续的监管支持以及不断增长的国内需求是推动这一增长的关键因素。中国已成为全球最大的新能源汽车市场,而积极的国家战略和投资进一步巩固了这一地位。蔚来、小鹏、比亚迪和吉利等本土品牌,以及特斯拉和大众等全球汽车製造商,都在持续扩大其在该地区的生产布局,以满足日益增长的需求。

新能源汽车稳定器市场的领导者包括索格菲集团、蒂森克虏伯、大元、采埃孚、东风、日本国际、SwayTec、瀚瑞森、康斯博格汽车和慕贝尔。新能源汽车稳定器领域的公司正在积极追求创新并与下一代电动车平台整合。大多数公司都在投资研发,以开发更轻、强度更高的稳定器零件,以适应电动传动系统不断变化的动态。与电动车製造商合作进行早期设计参与,可以实现客製化悬吊系统。该公司还采用了自适应和机电技术,与车载感测器和控制单元配合使用,以实现即时性能。透过在地化生产中心和与原始设备製造商签订的长期供应商协议进行全球扩张,有助于这些公司扩大其市场覆盖范围。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 零件製造商

- 技术提供者

- 售后市场供应商

- 系统整合商

- 成本结构

- 利润率

- 每个阶段的增值

- 影响供应链的因素

- 破坏者

- 供应商格局

- 对部队的影响

- 成长动力

- 政府法规和消费者对电动和混合动力汽车的需求不断增加

- 对新能源汽车增强行驶控制和操控性能的需求

- 从机械稳定器转向智慧感测器整合稳定器

- 对自适应和断开稳定器系统的需求增加

- 产业陷阱与挑战

- 特别是机电和主动系统

- 空间限制导致的包装挑战

- 市场机会

- 电动越野车性能部件和客製化的成长

- 为无线 (OTA) 稳定器调整和控制解决方案打开大门

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

- 技术与创新格局

- 现有技术

- 新兴技术

- 专利分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 生产统计

- 生产中心

- 消费中心

- 汇出和汇入

- 成本細項分析

- 可持续性分析

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 纯电动车(BEV)

- 插电式混合动力电动车(PHEV)

- 混合动力电动车(HEV)

- 燃料电池电动车(FCEV)

第六章:市场估计与预测:按稳定器,2021 - 2034 年

- 主要趋势

- 前稳定器

- 后稳定器

第七章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 液压稳定器系统

- 机电稳定器系统

- 电子控制稳定桿

- 传统机械系统

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 轿车

- 掀背车

- 越野车

- 中紫外线

- 商用车

- 轻型商用车

- 中型商用车

- 重型商用车

第九章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第十章:市场估计与预测:按地区,2021 - 2034 年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 乌克兰

- 俄罗斯

- 北欧的

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 智利

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- AAM

- ADDCO

- Chuo Spring

- DAEWON

- Dongfeng

- JAMNA AUTO INDUSTRIES LIMITED

- Sogefi Group

- Kongsberg Automotive

- Mubea

- NHK International

- Hendrickson

- Sogefi

- SwayTec

- Tata

- Thyssenkrupp

- Tinsley Bridge

- TMT(CSR)

- Tower

- Wanxiang

- Yangzhou Dongsheng

- ZF

The Global New Energy Vehicle Stabilizer Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 9.6% to reach USD 3.3 billion by 2034. This growth is largely fueled by the increasing adoption of electric, hybrid, and hydrogen-powered vehicles across major global markets. As manufacturers shift to alternative drivetrains, there is a rising emphasis on vehicle dynamics and overall ride quality, which directly boosts the demand for advanced stabilizer technologies. Electromechanical and active stabilizers are becoming more widely adopted due to their ability to enhance suspension performance, reduce body roll, and provide smoother handling for both passengers and drivers. This reflects a broader trend in the EV sector to deliver high levels of safety and comfort.

Stabilizers-often called sway or anti-roll bars-play a crucial role in supporting the suspension systems of NEVs, especially given the altered weight distribution brought on by battery placement. Unlike conventional internal combustion engine (ICE) vehicles, NEVs tend to house battery packs on the vehicle floor, shifting the center of gravity and requiring reimagined stabilizer systems. These systems are designed to ensure optimal performance and cornering stability, particularly during high-speed maneuvers or rapid direction changes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $3.3 Billion |

| CAGR | 9.6% |

Battery Electric Vehicles (BEVs) commanded a 46% share in 2024, and the segment is anticipated to generate USD 1.8 billion by 2034. The strong foothold of BEVs in the stabilizer market is backed by surging production and consumer demand for all-electric platforms. This increase is due to supportive policy environments, expanded charging infrastructure, and significant investment from global OEMs like Hyundai, Volkswagen, Tesla, and BYD. Heavier battery weights in BEVs necessitate specially engineered suspension systems, increasing the reliance on advanced stabilizer components.

In 2024, the front stabilizer bars segment led the global new energy vehicle stabilizer market, accounting for 62% share, and is forecasted to grow at a CAGR of 8.2% through 2034. This dominance stems from their critical role in managing front-axle stability and maintaining vehicle balance. As electric vehicles frequently adopt front-wheel drive configurations and concentrate battery mass on the front axle, front stabilizers have become indispensable in ensuring precise handling and reduced body movement in real-time driving conditions.

Asia Pacific New Energy Vehicle Stabilizer Market held a 55% share and generated USD 300 million in 2024. The rapid acceleration of NEV manufacturing sustained regulatory support, and increasing domestic demand are key drivers of this growth. China has established itself as the largest NEV market worldwide, a position reinforced by aggressive national strategies and investment. Local brands like NIO, XPeng, BYD, and Geely, as well as global automakers such as Tesla and Volkswagen, have continued to expand their production footprints in the region to meet this surging demand.

Leading players operating in the New Energy Vehicle Stabilizer Market include Sogefi Group, Thyssenkrupp, DAEWON, ZF, Dongfeng, NHK International, SwayTec, Hendrickson, Kongsberg Automotive, and Mubea. Companies in the NEV stabilizer segment are aggressively pursuing innovation and integration with next-gen EV platforms. Most are investing in R&D to develop lighter, high-strength stabilizer components that match the evolving dynamics of electric drivetrains. Collaborations with EV manufacturers for early-stage design involvement allow for customized suspension systems. Firms are also incorporating adaptive and electromechanical technologies that work with onboard sensors and control units for real-time performance. Global expansion through localized production hubs and long-term supplier agreements with OEMs helps these players strengthen their market reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Stabilizer

- 2.2.4 Technology

- 2.2.5 Application

- 2.2.6 Sales Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material suppliers

- 3.1.1.2 Component manufacturers

- 3.1.1.3 Technology providers

- 3.1.1.4 Aftermarket suppliers

- 3.1.1.5 System integrators

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing government mandates and consumer demand for electric and hybrid vehicles

- 3.2.1.2 Demand for enhanced ride control and handling performance in NEVs

- 3.2.1.3 Shift from mechanical to intelligent, sensor-integrated stabilizers

- 3.2.1.4 Increased need for adaptive and disconnecting stabilizer systems

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Especially electromechanical and active systems

- 3.2.2.2 Packaging challenges due to space constraints

- 3.2.3 Market Opportunities

- 3.2.3.1 Growth in performance parts and customization in electric off-road vehicles

- 3.2.3.2 Opens door for over-the-air (OTA) stabilizer tuning and control solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Porter's analysis

- 3.5 PESTEL analysis

- 3.6 Technology & innovation landscape

- 3.6.1 Current technologies

- 3.6.2 Emerging technologies

- 3.7 Patent analysis

- 3.8 Regulatory landscape

- 3.8.1 North America

- 3.8.2 Europe

- 3.8.3 Asia Pacific

- 3.8.4 Latin America

- 3.8.5 Middle East & Africa

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Sustainability analysis

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New Product Launches

- 4.5.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Battery Electric Vehicles (BEVs)

- 5.3 Plug-in Hybrid Electric Vehicles (PHEVs)

- 5.4 Hybrid Electric Vehicles (HEVs)

- 5.5 Fuel Cell Electric Vehicles (FCEVs)

Chapter 6 Market Estimates & Forecast, By Stabilizer, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Front Stabilizer

- 6.3 Rear Stabilizer

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Hydraulic stabilizer system

- 7.3 Electromechanical stabilizer system

- 7.4 Electronically controlled stabilizer bar

- 7.5 Traditional mechanical system

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.1.1 Passenger Car

- 8.1.2 Sedan

- 8.1.3 Hatchback

- 8.1.4 SUV

- 8.1.5 MUV

- 8.2 Commercial Vehicle

- 8.2.1 Light Commercial Vehicle

- 8.2.2 Medium Commercial Vehicle

- 8.2.3 Heavy Commercial Vehicle

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 North America

- 10.1.1 U.S.

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Ukraine

- 10.2.7 Russia

- 10.2.8 Nordic

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 Australia

- 10.3.5 South Korea

- 10.3.6 Southeast Asia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.4.4 Chile

- 10.5 MEA

- 10.5.1 South Africa

- 10.5.2 Saudi Arabia

- 10.5.3 UAE

Chapter 11 Company Profiles

- 11.1 AAM

- 11.2 ADDCO

- 11.3 Chuo Spring

- 11.4 DAEWON

- 11.5 Dongfeng

- 11.6 JAMNA AUTO INDUSTRIES LIMITED

- 11.7 Sogefi Group

- 11.8 Kongsberg Automotive

- 11.9 Mubea

- 11.10 NHK International

- 11.11 Hendrickson

- 11.12 Sogefi

- 11.13 SwayTec

- 11.14 Tata

- 11.15 Thyssenkrupp

- 11.16 Tinsley Bridge

- 11.17 TMT(CSR)

- 11.18 Tower

- 11.19 Wanxiang

- 11.20 Yangzhou Dongsheng

- 11.21 ZF